Join the FP&A Trends Webinar on March 26th at 1:00 PM CET to explore the Four...

If we are to believe both the CFOs who use modern planning techniques and the software companies that provide the relevant tools, planning becomes so much more efficient and accurate compared to traditional planning with Excel. They also say that modern planning gives other benefits such as enhanced agility, analytical insights, and informed decisions.

Some look down on traditional planning with comments such as:

“We need to recognise that traditional planning no longer works.”

“Dynamic developments in recent years have shown that traditional planning has its limits.”

Others go further and claim that Excel-based systems and PowerPoint are outdated, reactive, and static.

And yet the 2025 FP&A Trends Survey found that 45% of companies still use Excel as the dominant planning tool. Only 21% use modern cloud-based planning platforms. In addition, only 17% of businesses have a single source of planning data that is easy to analyse, and 58% have multiple data sources that need time and effort to collate.

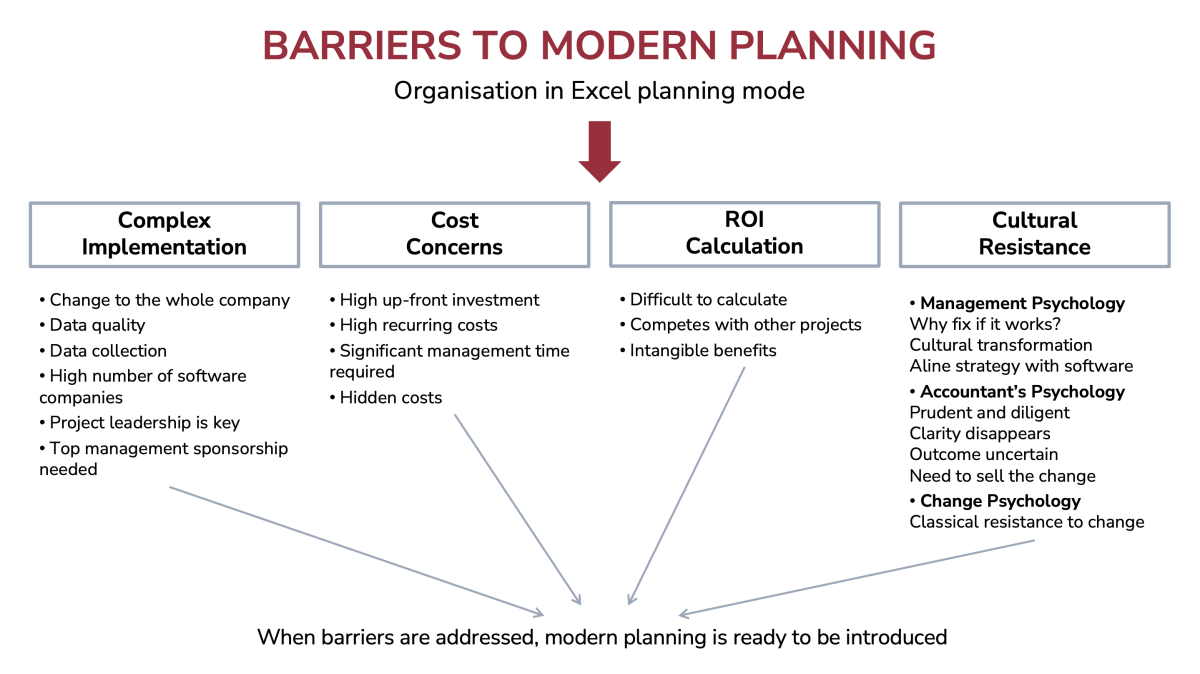

I find it surprising that so many companies still use Excel and so few take advantage of modern planning techniques. What holds them back?

Complexity of Implementation

Traditional planning stays exclusively within the planning department, whereas modern planning systems involve the whole organisation. This shift requires coordination across business functions, which adds time and effort. They are as complex to install as a new ERP system (Enterprise Resource Planning). IT departments need to take on new software. Manufacturing and marketing become an integral part of the new process, often with an attitude of ‘more work with no immediate reward’.

One of the key elements is data. In new planning systems, everyone uses the same database. This means that each department has to give up its own data collection process and adapt and learn a new one. This can feel like a loss of autonomy for departments that have built their own models and templates. Management needs to show that the new database reduces time spent on the low-value task of data collection and validation for it to be accepted.

The sheer number of software companies makes the choice difficult, each claiming to offer the best solution. Organisations often struggle to determine which corresponds to their needs. Even selecting a system requires a cross-functional team to define the scope of the project and the exact planning needs, a team that often has not had prior experience introducing planning software. Finally, without strong project leadership and sponsorship from top management, the project can fail and not produce the required results.

Cost and Competition

Not only can the upfront investment discourage large and mid-sized companies, but recurring costs, management time, licensing fees, outside consultants, user training, IT infrastructure upgrades, and maintenance costs also contribute to the total cost of the project. Hidden costs also exist. Users, for instance, need to learn and test the system while they continue with day-to-day tasks without disrupting their departments.

The return on investment (ROI) of modern planning is difficult to quantify, unlike projects that lead to easily calculated cost savings or direct revenue gains. Software literature only explains qualitative benefits such as improved decision-making, efficiency, and collaboration between departments, making these improvements difficult to convert into concrete financial amounts for an ROI calculation.

Planning software also competes with other investment projects that offer immediate and more tangible returns. These projects tend to receive priority because they directly impact revenue or operations and are aligned with business goals. Managers may consider planning software ‘nice to have’ rather than essential, in opposition to CFOs who remain under pressure to deliver short-term performance.

Psychology of Top Management

Management’s initial reaction to the proposal of a new planning process is often:

“Why fix something that works. Our planning process gives us what we need to run the business.”

Whereas they can decide more easily if traditional planning has begun to break down. This may arise from missed forecasts which have lead to serious business consequences or when the planning process has become too complex to manage with manual systems. Often traditional planning doesn’t break but erodes over time when plans take too long to prepare or deadlines are missed. Only then does management step in to request a new system.

Further, the change brings a whole new cultural transformation, and management often wonders whether the disruption now is worth the supposed future benefits. Finally, top management must integrate their business strategy into the new planning system to be effective. Without this alignment, the new system often becomes a technical tool disconnected from strategic priorities. Also, this requires intellectual effort and commitment, sometimes difficult to obtain.

Psychology of Accountants

Accountants do not oppose progress, but they approach it with prudence and due diligence. In traditional planning, they control the whole process; in modern planning, they share it with their colleagues, yet keep accountability. Clarity disappears into a sort of black box of new procedures, unfamiliar software, and untried data collection. Mistakes are difficult to detect. The system needs to be tried and tested, yet there is never time to keep the traditional plan in parallel, so they feel like jumping out of a plane with a new, untested parachute.

Besides, accountants can only assess whether the complexity of the new process brings value once it has been installed and is working. Before then, it existed as the opinion of the software consultants and the system promoters.

Finally, accountants need to sell the changes to the whole organisation. They do not necessarily excel in selling. As an accountant, I always say that if I had the abilities and the character of a salesman, I would not have chosen accounting.

Figure 1

An Example of Difficulties

Beta Alfa Medical, a mid-sized medical appliance company with operations across Europe, decided to modernise its planning system. They relied on Excel for forecasts, budgets, and plans in each subsidiary, with a consolidation at headquarters.

Six months before ‘going live,’ they set up a small cross-functional implementation team with consultants from the software providers and opted for a “big bang” rollout over one weekend in all subsidiaries and all functions at the same time.

Although reporting from subsidiaries had a standard format, the Excel spreadsheets and data collection to produce the figures were different in each subsidiary. The rollout in headquarters was a success, but the subsidiaries found the process too rigid and slower than their well-known Excel. Managers in the subsidiaries ended up spending more time on planning and forecasting than before.

Integrating data from the old system revealed significant inconsistencies. Some data was missing, some had been misinterpreted, and they discovered that conventions among subsidiaries were not consistent. A few subsidiaries reverted back to Excel for part of the process, to get forecasts to headquarters in time, bypassing the new system.

Headquarters personnel had to jump in after the go-live and spend weeks in the subsidiaries to clean and collect data and convince managers to work the new system. Luckily, through massive overtime and additional consulting, forecasts and plans in the first few months after the go-live were accurate and only sometimes late.

Conclusion

Even taking into account natural resistance to change, there are no quick fixes to speed up the modernisation of planning processes. For it to succeed, the classical steps of any project have to be in place: planning the transformation as an organisational change (not a software implementation), selecting a competent cross-functional implementation team with executive sponsorship and a precise scope and the many other steps which are discussed in FP&A Trends.

To overcome some of the barriers to modern planning systems, FP&A leaders should:

Include ‘reduce the risk’ into all parts of the project, especially in the three critical steps: design, selection of software and setting up parameters. And in the ‘go live’, start small and introduce gradually: department by department or task by task.

Address the users' fears. If, for instance, FP&A fear loss of control in planning, build their control into the new system. If sales fear loss of autonomy over data, let them keep control in the new system.

Share ROI in terms of intangibles: speed of decision-making, accuracy of forecasting, ease of use, speed of planning revisions, and less time spent on mundane tasks, not on cost alone.

Excel is not the enemy it is the starting point. Use the Excel process as a source for parameters in the new system and choose the software that can best follow these procedures.

Data quality is critical. Clean, control, and harmonise data before go-live, but, above all, use current databases as far as possible and then improve them.

Software providers and CFOs must lead the way. Software companies must move beyond technical features and focus on the advantages of their solutions to the users. CFOs who have implemented modern planning systems should share their experiences, as some already do with FP&A Trends. Real-world stories offer the most compelling argument for others to follow.

Based on the experiences of the author, the name of the company changed.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.