FP&A teams all over the world are undergoing a major transformation via the Integrated FP&A model...

Introduction

We have recently seen an upheaval in setting up Shared Service Centres/Centres of Excellence by many companies operating in low-cost locations and dealing with labour arbitrage. This article provides a working model for businesses eager to transform a typical volume-intensive, cost-focused Shared Service Centre into a value-oriented COE. It also provides the reader with a detailed overview of the differences between these notions, a practical example of such a project and critical factors to consider before driving this transformation. Based on the Juniper Network’s case study, we will explore the key lessons learnt and success components.

About Juniper

Juniper Networks (JNPR) is a networking industry company with $ 5.3 billion in annual revenue (FY’22) spanning enterprise, service provider and cloud segments. Juniper Global Business Service (Juniper GBS) was set up in 2005 as a Shared Service Centre. Over 18 years, it has transformed into a Centre of Excellence across multiple areas. At the time of writing, Juniper GBS is operating predominantly within locations in India and the USA, providing service offerings related to accounting and reporting, Financial Planning and Analysis (FP&A), operational analytics, Quote to Cash (Q2C), order management, master data management, service delivery, Accounts Payable (AP) and so on.

Shared Services Centre vs. Centre of Excellence (CoE)

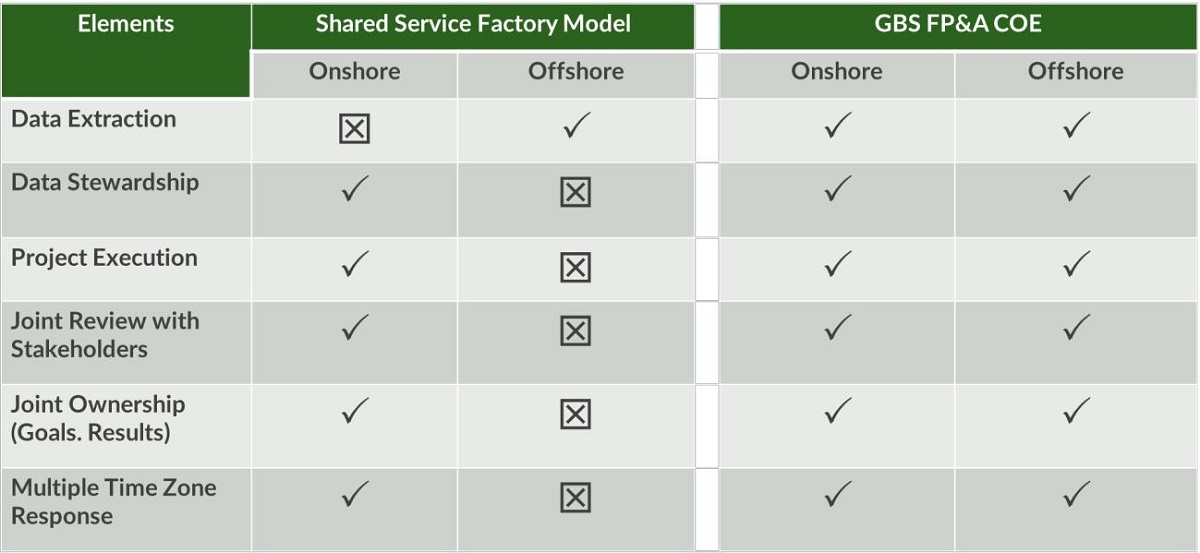

Before setting up a Shared Service Centre or a Centre of Excellence, companies and their top management stakeholders should understand the fundamental difference between these concepts. First and foremost, we should not forget that Shared Service Centres are cost-focused and usually have limited ownership. On the contrary, the COEs are value-focused and offer joint ownership. The following table illustrates the difference between these two models within the FP&A context.

Figure 1: The Key Differences between Shared Service Centres and FP&A Centres of Excellence

- Data Extraction

In Shared Service Centres, volume-intensive, transaction-focused and low-end work is provided to offshore teams. For instance, we mean a task like generating 100 reports in Excel or any other tool without understanding the end state. Contrary to this, the Centre of Excellence offers joint ownership between offshore and onshore teams.

- Data Stewardship

In the case of a Shared Service Centre, it has “no say” in Data Stewardship, and it’s owned by an onshore team. However, Data Stewardship is critical in driving reporting and analytics in a progressive FP&A COE with joint ownership. It’s akin to creating a foundation of a building. If the foundation is fragile, then the entire building may collapse.

- Project Execution

The Shared Service Centre model does not offer any ownership, while the project execution may benefit from it within the COE model. Early-stage involvement within a project is a key success factor for both onshore and offshore teams.

- Joint Review with Stakeholders

Shared Service Centres can only supply information for critical stakeholder reviews, such as quarterly business reviews (QBRs). However, stakeholders may access even monthly business reviews (MBRs) with the help of mature onshore teams in COEs. In the latter case, a COE ensures the involvement of onshore and offshore teams.

- Joint Ownership

In a COE model, the organisation benefits from the joint ownership related to goals and results. But, on the other side of the coin, in the Shared Service Model, the ownership solely lies on the onshore team.

- Multiple Time Zones

A mature COE can respond in various time zones since maturity and ownership lie with both onshore and offshore team members. As a result, it truly enables us to provide service and engage with business stakeholders around the clock without delays.

We have already implemented all the abovementioned principles of a mature COE in Juniper GBS. It has been instrumental in Juniper GBS’ success.

An Ideal FP&A COE Organisational Structure Model

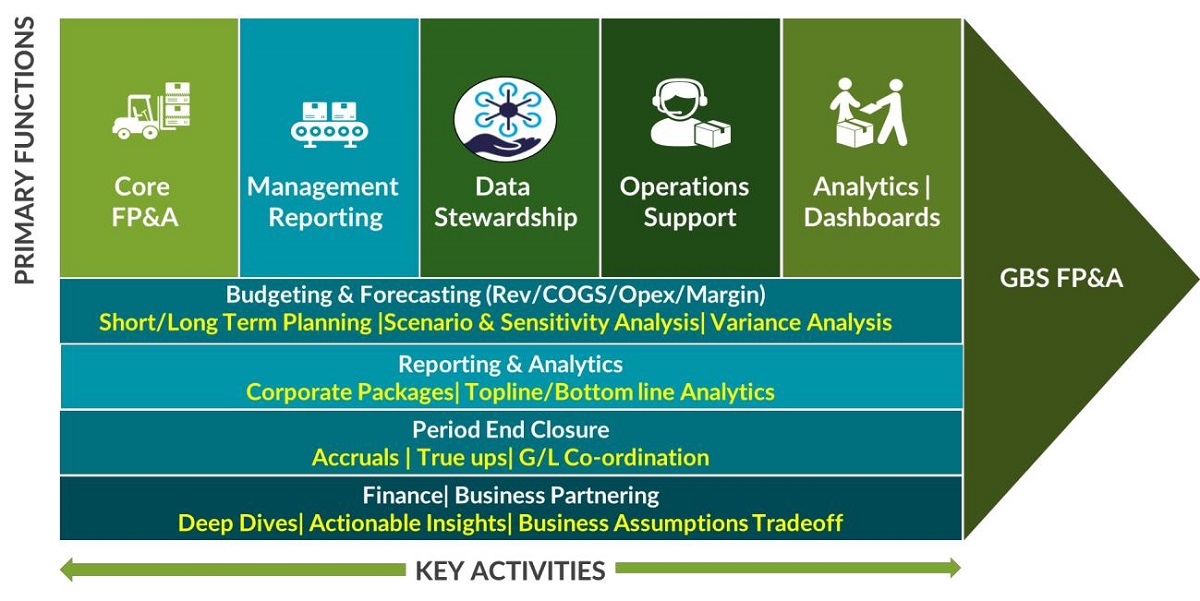

Once we have identified the key differences between the Shared Service Model and the Centre of Excellence, we will have to consider an ideal FP&A COE organisational structure. The following figure illustrates a Juniper GBS’ FP&A COE with a well-rounded portfolio of Core FP&A, Reporting, Data Stewardship, Operations and Analytics with deep expertise. The additional details related to the typical organisational structure are also outlined below.

Figure 2: Juniper GBS’ FP&A COE Organisational Structure

- Core FP&A

Any good FP&A COE will have Core FP&A as its central function. It will concentrate on activities related to short- and long-term planning, forecasting, period-end closure, finance and Business Partnering. Many companies think the FP&A COE should only comprise Core FP&A, but this idea is wrong. Ideally, 50% of an FP&A COE team should handle Core FP&A activities.

- Data Stewardship

Data Stewardship has recently emerged as the most critical function of FP&A COEs. It encompasses data definitions, hierarchies, structure, data validation rules, and data flow across upstream and downstream processes. Historically, this function used to be part of the IT domain, but with the evolution of FP&A teams and their structure, it has become a pivotal function for FP&A COE success. The team responsible for Data Stewardship should comprise good techno-functional experts proficient in technology and business processes. A good Data Stewardship team enables the organisation to benefit from flexible reporting and using scalable systems.

- Reporting

With a solid Data Stewardship team in place, one can have robust reporting focusing on standardisation, insight generation, analyses and flexibility. The reporting team should also be a good proponent of self-service tools via dashboards and so on.

- Operations

Once an FP&A COE is stabilised, an ideal organisation may also take joint ownership of business operations and ensure synergistic collaboration with the FP&A team. For example, Juniper GBS’ FP&A COE includes CRM Support (quotas, sales hierarchies, territory assignment), Global Sales Compensation (sales incentive payout, query resolution, commissions), supply chain (Integrated Business Planning) and legal operation support. It contributes to a natural progression of this sub-function as the FP&A COE matures.

- Analytics

Analytics is a pivotal sub-function of a mature FP&A COE. An analytics team with a well-diversified skill set is needed to translate data into actionable insights and create dashboards that may drive better business outcomes or enable self-service. Then, the “A” part of the FP&A means moving towards “Analytics”. A good Analytics team will have a good mix of subject matter experts, data scientists, and certified system experts who can operate with different planning systems. When Juniper GBS started its journey, we had only 3 members in our Analytics team. But in 2022, it has grown to 11 team members who can work with different software solutions.

Business Partnering

A customer-centric mindset and the ability to make a difference are critical to Business Partnering. The FP&A team needs to invest in understanding the business and processes and become a part of the major business/strategic discussions in order to provide actionable insights. A Business Partner should also be an effective storyteller with excellent communication skills. They should be able to influence decisions and act as a trusted advisor to the business.

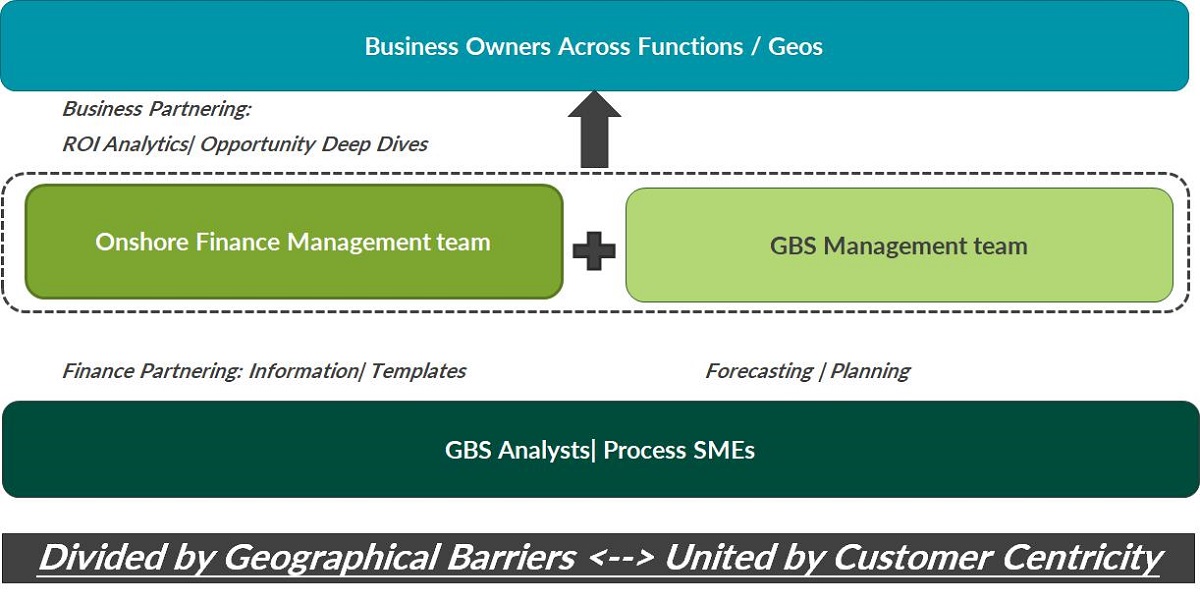

GBS FP&A COE Operating Model

Once we set up an FP&A organisational structure with a healthy mix of Core FP&A, Reporting, Data Stewardship, Operations and Analytics, the next step would be to define a working model that could add value and lead the transformation. We need to start with a solid foundation of a core group of subject matter experts in their domains. Once we have a good team, these experts could be managed by both onshore and GBS FP&A COE leadership groups and drive results, actions and insights. The one FP&A team would be responsible for external stakeholders’ engagement. Let us showcase these models employed by Juniper GBS FP&A COE.

Figure 3: Juniper GBS FP&A COE Operating Model

- Process Analyst/Subject Matter Experts

Juniper GBS FP&A COE operating model is based on a group of Process Analysts/SMEs with deep functional expertise who provide solid insights and analysis within their specific domain. Their key activities include finance partnering, period closure, variance analysis, insights, forecasting and planning.

- Management Layer (Joint Ownership)

Once SMEs complete their work, the next review is carried out by the management. Both onshore and offshore leadership teams have to review what has been done. As mentioned, a mature FP&A COE will have joint ownership with equitable representation from both onshore/offshore parties.

- Joint Review with Stakeholders

This team thoroughly reviews the SME-related work. The next step is to review work/analyses and the insights jointly provided to stakeholders. That said, we can ensure successful communication with stakeholders via an alias. They benefit from prompt, high-quality deliverables related to actionable insights and analyses.

Let us consider an example to understand this model better. If the CFO has some urgent query related to financials in the US late hours, we have to remember that in a typical Shared Service Model, only data is supplied to an onshore team. It means that the requested information will be provided to CXO only the next day, and it may lead to stakeholder discontentment. Compare it with Juniper’s model: in Juniper GBS FP&A COE model, Indian team members (offshore team) process the request, which is worked upon immediately. It enables us to provide insights, reviews and analyses in a maximum of 1-2 hours. In Juniper GBS FP&A COE, the illustrated model has yielded excellent results. It also drives an important aspect of the COE delivery model: we are “Divided by Geographical barriers and United by Customer Centricity.”

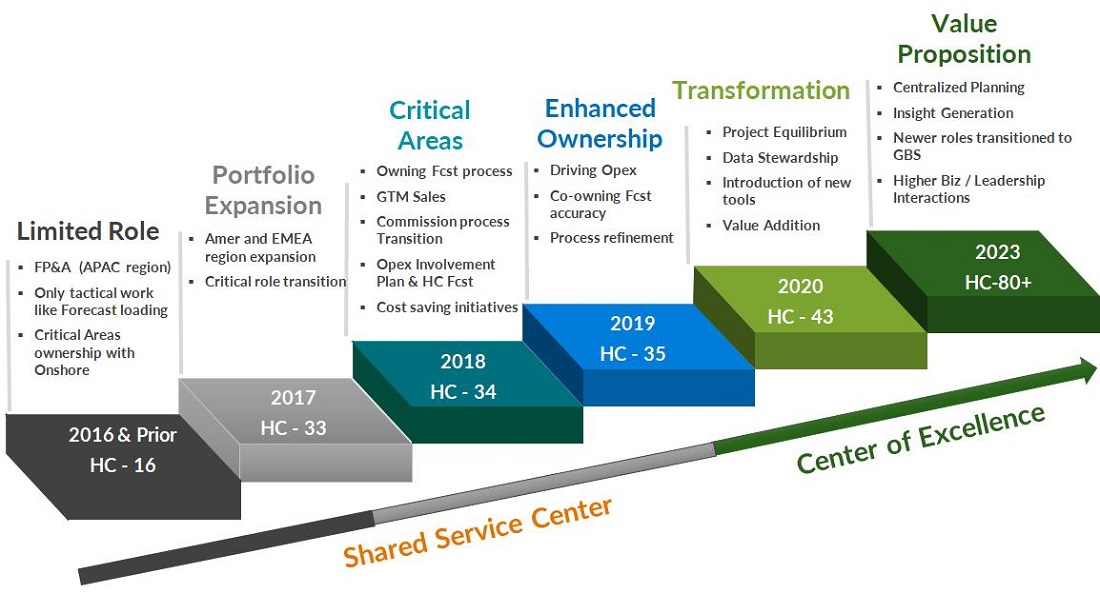

Juniper GBS FP&A COE Team Evolution

Based on the above COE operating model, Juniper’s GBS FP&A team increased 5 times from 16 members in 2016 to 84 people in 2023. Any Shared Service Model starts with cost arbitrage and is viewed as a transaction eliminator for a huge number of reports. Once operations are stable, the Shared Service Model can expand to multiple geographies and new areas, such as forecasting, planning and insight generation. The shift from the Shared Service Model to the Centre of Excellence happens at this point.

Figure 4: Juniper GBS FP&A COE Transformation Journey

During the FP&A Transformation process, Juniper Networks celebrated the following milestones:

- 2016 – Beginning of our FP&A Transformation Journey

There was only finance partnering and no business interaction back then. Juniper’s GBS FP&A started to support the APAC organisation with basic reporting and forecast loading activities, and then we ensured the rock-solid execution within this region. We saw only a minimal ownership level during this stage. Ownership levels were minimal during this stage.

- 2017 – Portfolio Expansion

Our headcount (HC) was increased from 16 to 33 people. It was mainly due to the expansion of our operations to the EMEA and Americas, based on our previous success in APAC. Some critical activities like centralised planning, FP&A, OpEx and Topline reporting were transitioned during this stage.

- 2018 – Stabilisation of Critical Areas

We focused on transition stabilisation and ensured flawless execution. The primary focus then was to invest time in understanding the business processes and operations and develop communication skills. We managed to leverage time zones for effective analysis and showcased it to our onshore stakeholders.

- 2019 – Enhanced Ownership Level

The ownership level between onshore and offshore has started increasing since 2019. The GBS FP&A team owned several areas, such as OpEx, commissions, HC and Topline reporting. In addition, we also ensured that all data structures, master data management and hierarchies were being centrally managed by the GBS FP&A team.

- 2020 – COE Transformation

In 2020, COE transformation began within GBS FP&A by interacting with business stakeholders, understanding their problems, and providing real-time solutions to their needs. It led to the establishment of completely shared ownership between onshore and offshore teams.

- 2021-23 – Value Proposition

During these years, we have expanded the FP&A COE to other areas, such as business operations, including demand planning, legal, quality, pricing and Analytics. At the time of writing, 25% of GBS FP&A organisational structure is Analytics. We have become a trusted advisor to businesses. Now, we provide options to attain their financial and operational goals.

The ownership level moves from onshore to joint ownership as FP&A becomes a trusted business advisor. We learned that investing in the right kind of people is crucial during the journey. Those people have deep process knowledge, customer-centric behaviour, and a willingness to change. Furthermore, we can use the difference in time zones to our advantage and invest in understanding business processes and downstream and upstream impact.

The critical success factors for this transformation were as follows:

- Creating an enabling culture and getting top management support. Both are extremely important to drive COE transformation, as the process involves Change Management.

- Building an ecosystem of related processes and activities. The FP&A team influences various parts of the organisation, so creating an ecosystem of related processes is a must.

- Standardise operations: simplify your operations to the next level and scale them up.

- Moving up the value chain from volume to value delivery.

- Remembering and focusing on the three key considerations: ease of use, speed and agility.

- Providing real-time support. Understanding customer needs to serve clients better becomes a critical aspect of the COE model. Always follow up with stakeholders/customers to find out whether the analyses drove meaningful actions.

- Making your customers productive and efficient.

What Have We Learnt?

- Leadership support and willingness to invest in the COE are crucial.

- FP&A Transformation is only possible when you invest in the right people, processes and technology. We would not have completed our journey without the right people. Hire employees keeping in mind their technical skills, business acumen, and Business Partnering skills. Develop a customer-centric attitude.

- We have explored that many organisations would like to hire people from organisations with Shared Service Models in place. However, people with good Business Partnering and onshore experience can provide an edge in driving the COE transformation journey.

- FP&A team members should also have a good understanding of the upstream and downstream impact of changes within multiple processes. They also need to be competent in modern technologies, as such a skilled workforce can make it the key enabler of the organisational success instead of dependence on the IT department.

- Make processes agile and robust.

- Eliminate non-value-added, redundant activities, and invest that time in understanding business processes and technologies.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.