Budgets were invented in the Industrial Age as an efficient management tool. So why in this...

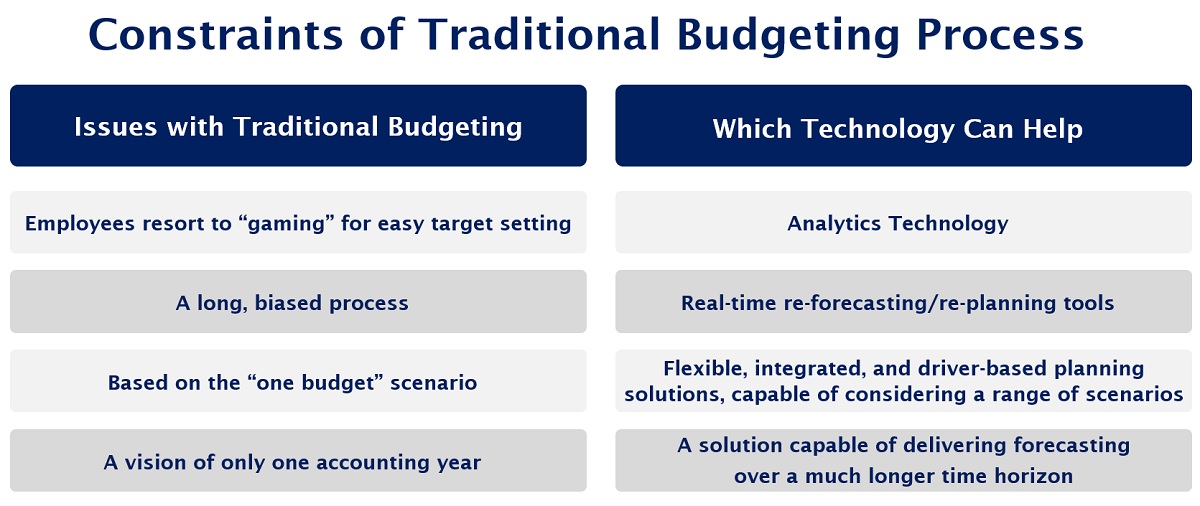

Increasingly, organisations are dissatisfied with their traditional budgeting (TB) processes that suffer from multiple constraints.

Figure 1

Beyond Budgeting (BB) aims to establish a highly decentralised forecasting system and completely abandon TB processes. BB is disruptive but also helps the company to be more agile and adaptable, eliminates bureaucracy and rigid control mechanisms, empowers people, and promotes transparency.

However, successfully implementing BB requires the entire transformation of the organisation, from its culture to its systems and processes.

Let's examine seven technological and information enablers that help drive the success of a Beyond Budgeting framework.

1. Activity-Based Management (ABM)

Beyond Budgeting is all about decentralisation. Thus, to have effective oversight, data from activities must be captured in real-time. This is where ABM systems come into play. Not only do they enable real-time data capture, but they also allow companies to use that data effectively in decision-making processes. ABM systems help organisations ensure that the actual costs of customers/channels/products are computed accurately and eliminate activities that do not add value.

2. Database of Actionable Customer Analytics

Along with ABM, an actionable customer relationship management (CRM) system is essential. Any customer-facing team should have the necessary data at its fingertips. CRM systems reveal the profitability matrices of each customer, aid with contract management, and help the team understand future business pipelines.

3. Warehousing of up-to-date Benchmarking Data

In Beyond Budgeting, performance is not measured against a fixed contract decided before the start of the year. Instead, it is measured in relative terms: performance is compared with data from peers, industry, or the organisation's figures from previous years. It requires a system that can continuously refresh dynamic data from the market or a paid source and then produce reports showing relative performance. It allows the organisation to make accurate assessments and plan improvement.

4. Rolling Forecasts and Use of Economic Profit in Decision-Making

Traditional budgets are disseminated only on a 'need to know' basis. BB, on the other hand, believes in a culture of 'sharing for success'. In the long run, BB can only succeed if it delivers superior returns to the shareholder. This means that each decision made at a local level must be evaluated through the prism of economic profit. Therefore, providing those on the organisation's frontline with a ready-to-use, simple and real-time data analysis model is critical. While making decisions, front-liners need to ensure that the returns deliver an economic profit that is more than the incremental cost of capital of the company.

5. Collaborative Planning Tools

BB encourages synergistic cooperation across borders, time zones and teams. It, therefore, relies on modern technology, which facilitates this kind of collaboration.

6. Integrated Planning Process

For perfect strategy execution, all organisational planning processes must be harmonised through models and drivers. This Extended Planning and Analysis (xP&A)-based integration also facilitates another essential part of BB via culture Change Management.

7. Detailed Analytics

In traditional budgeting, people tend to 'play the system' to achieve lower targets, maximise bonuses, and more. In contrast, the detailed analytics delivered through modern tools and processes expose these practices and provide clear, transparent guidelines for the budgeting process.

Conclusion

Successfully transitioning to Beyond Budgeting requires more than just cultural changes within an organisation. It is also essential to have the support of all 7 of the above technology levers. With investments in these technologies, BB implementation can yield impressive gains. As a finance leader for your organisation, are you adopting these?

This article was first published on the SAP Blog.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.