This article provides an overview of the topics and cases presented and discussed by the expert...

The traditional budgeting process is short-term focused, causes unnecessary control and bureaucracy and results in a conflict of interest. For most present-day organisations, Traditional Budgeting is no longer fit for the task.

The Digital Nordic FP&A Circle looked at alternatives to Traditional Budgeting and shared practical experiences of moving away from it.

This article provides an overview of the topics and cases presented and discussed by the expert panellists at the webinar “From Traditional to Better and Beyond Budgeting”, as well as the results of our polling questions.

What the Beyond Budgeting Is

Knut Fahlén, Certified Management Consultant (CMC) at Ekan Management and Beyond Budgeting expert, outlined the main external factors and internal prerequisites needed to make this transition from Traditional Budgeting to Beyond Budgeting:

External:

Complex market conditions

Increased competition and uncertainty

Need for Customer knowledge and expectations

Living in the VUCA world

Internal:

Need for Fast decisions

Cooperation and teamwork

Lack of talents

For organisations working with modern operating systems (agile or lean), Beyond Budgeting is a natural fit, as those ideas are part of the Beyond Budgeting principles.

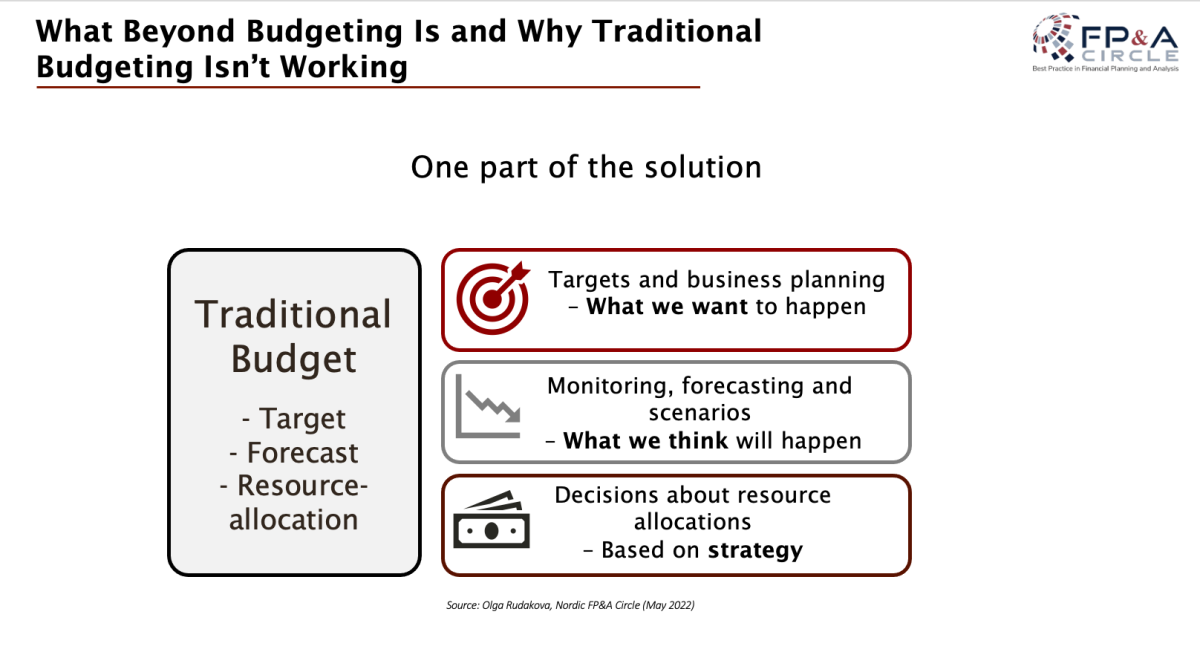

Most organisations in the Beyond Budgeting network are questioning the benefits of traditional budgets, as traditional budgets attempt to serve three purposes: target setting, forecasting and resource allocation. While these three processes should be separated, which will give people the freedom to act based on shared values and sound judgement.

Figure 1

Dr Fahlén has finished with quite a powerful transition in FP&A and the whole organisation mindset, that transition Beyond budgeting brings: from “Do I have a budget for this?” to ”Is this the right thing to do?”

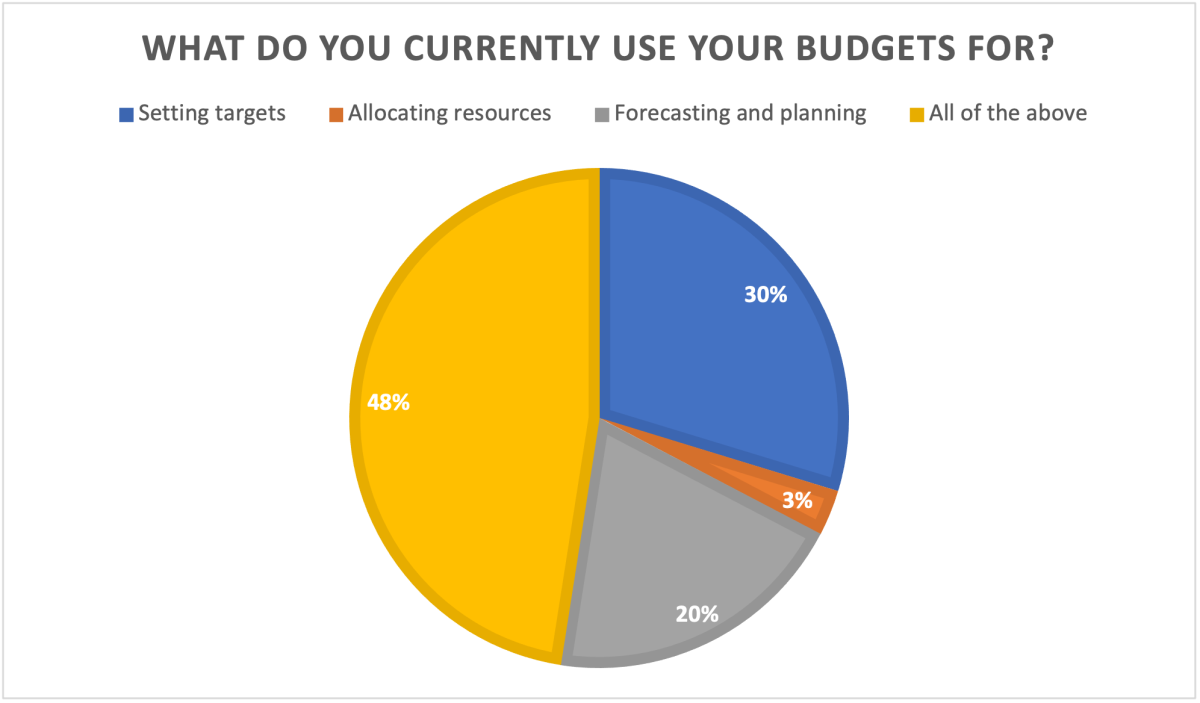

What are we currently using our budgets for?

During the webinar, attendees from the FP&A industry took part in the poll and stated which purpose their budgets are serving. 48% of the organisations are still using their budgets for all three purposes: target setting, forecasting and resource allocation, while the remaining 52% are using budgets for just one of them, primarily target setting or forecasting.

Figure 2

Weekly Rolling Forecasts as Risk Mitigation Enabler

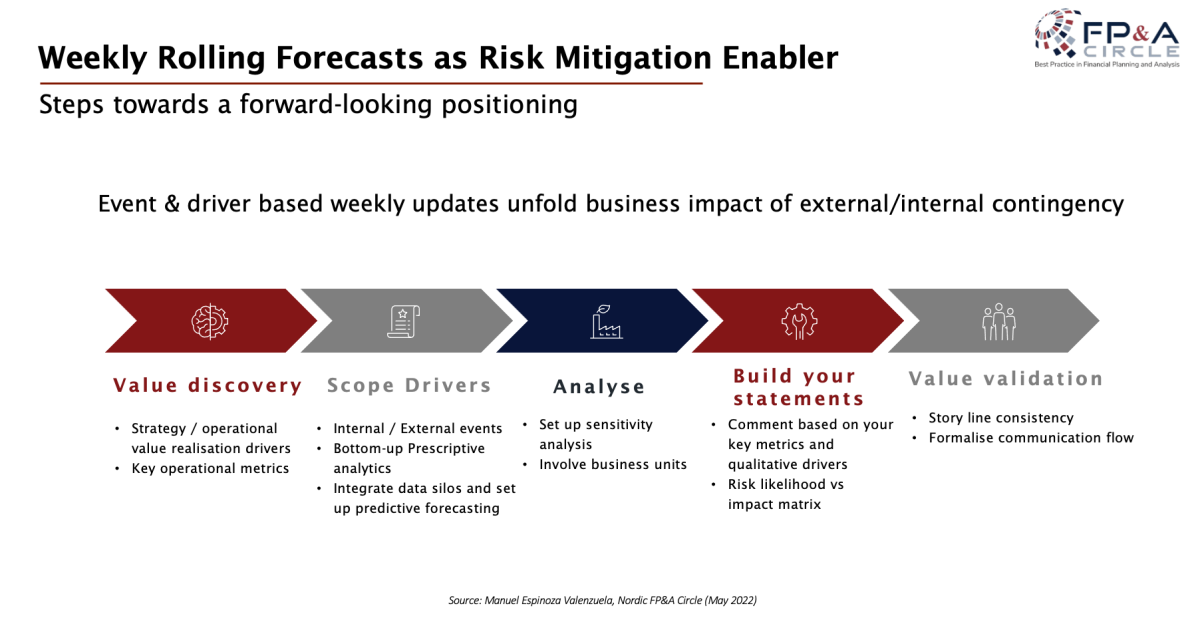

Manuel Espinoza Valenzuela, Head of Performance Analytics at Nilfisk showed us a framework he has successfully implemented in FMCG companies and at Nilfisk. The outcome of the process is up-to-date weekly P&L positioning of the organisation, which allows timely data-driven decision making.

The process begins with taking the time to discover what creates value in the organisation and what the key drivers of profit and growth are. At the initial stage, it is important to translate the operating business model into financial performance metrics, that is, to establish relationships between business drivers and financial KPIs.

The analytical stage requires advanced tools to enable quality data integration, predictive forecasting, and prescriptive analytics. Those tools help us understand price/volume relationships and sensitivity. Building your financial statements involves creating a Risk likelihood vs impact matrix, which helps to quantify events and react to them.

The last part is to engage the business, build trust, and formalise the flow of communication to promote business partnership attributes that any organisation would benefit from.

Figure 3

The Learnings from Moving to No Budgets

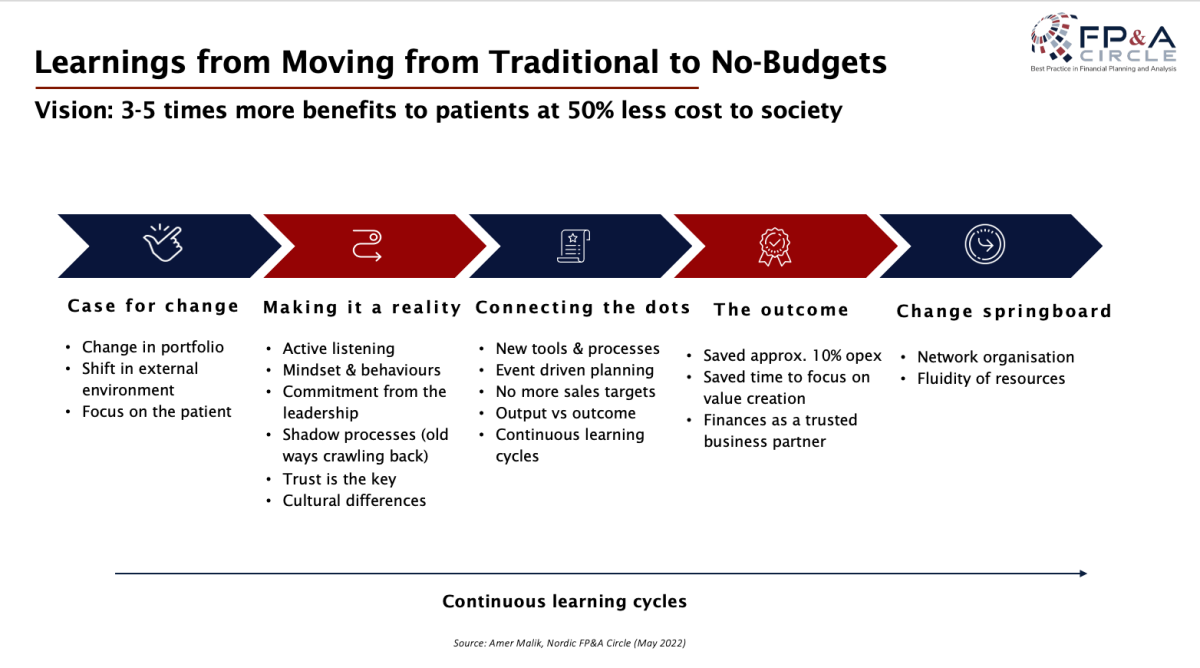

Amer Malik, CFO UAE at Roche, shared his transformation journey and the role finance played in it. Amer's personal journey with Beyond Budgeting (or NO Budgets, as it was later called at Roche) began in Sweden and continued in the United Arab Emirates.

The main reason for the transition was expanding the drug portfolio at Roche from being primarily focused on oncology to a fairly broad spectrum of diseases and shifting to personalised healthcare.

The main challenges of colleagues to make Beyond Budgeting a reality can be summarised in three questions:

Do I need approval every time I need extra money?

Is it a cost-saving exercise?

What if we end up overspending?

But introducing Beyond Budgeting principles, commitment from the leadership and not allowing shadow processes to crawl back in resolved all the concerns.

Practical implementation required new tools, team changes, understanding of value drivers (not just cost drivers) and a shift to event-driven planning. Roche also removed sales targets and replaced its sales force with patient journey partners.

Feedback from the business on the whole change was very positive, more time could be dedicated to patients rather than building forecasts. Stakeholders also see a finance team playing a more central role as a business partner.

The Beyond Budgeting transition enabled Roche to begin a new phase of transformation toward a network organisation.

Figure 4

Technology for Better and Beyond Budgeting

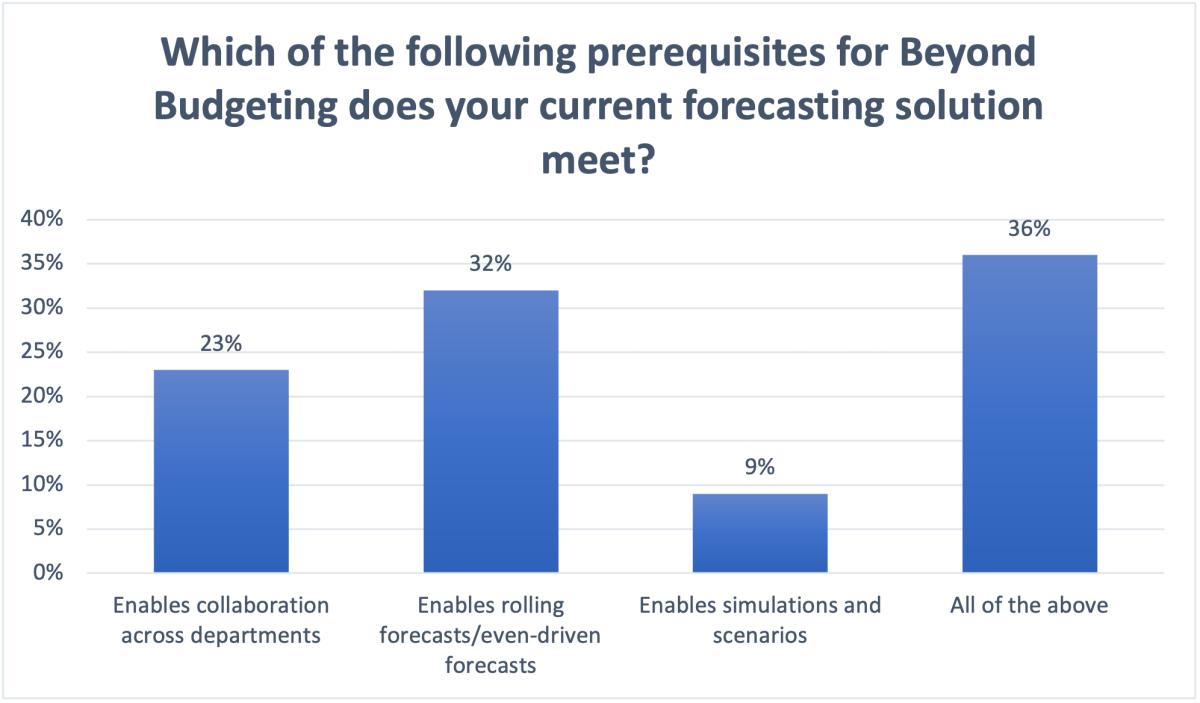

During the webinar, attendees from the FP&A industry took part in the technology-related poll with quite a remarkable result: 36% of the respondents claimed that their current forecasting solution meets all of the following prerequisites for Beyond Budgeting:

Enables collaboration across departments

Enables rolling forecasts/even-driven forecasts

Enables simulations and scenarios

Figure 5

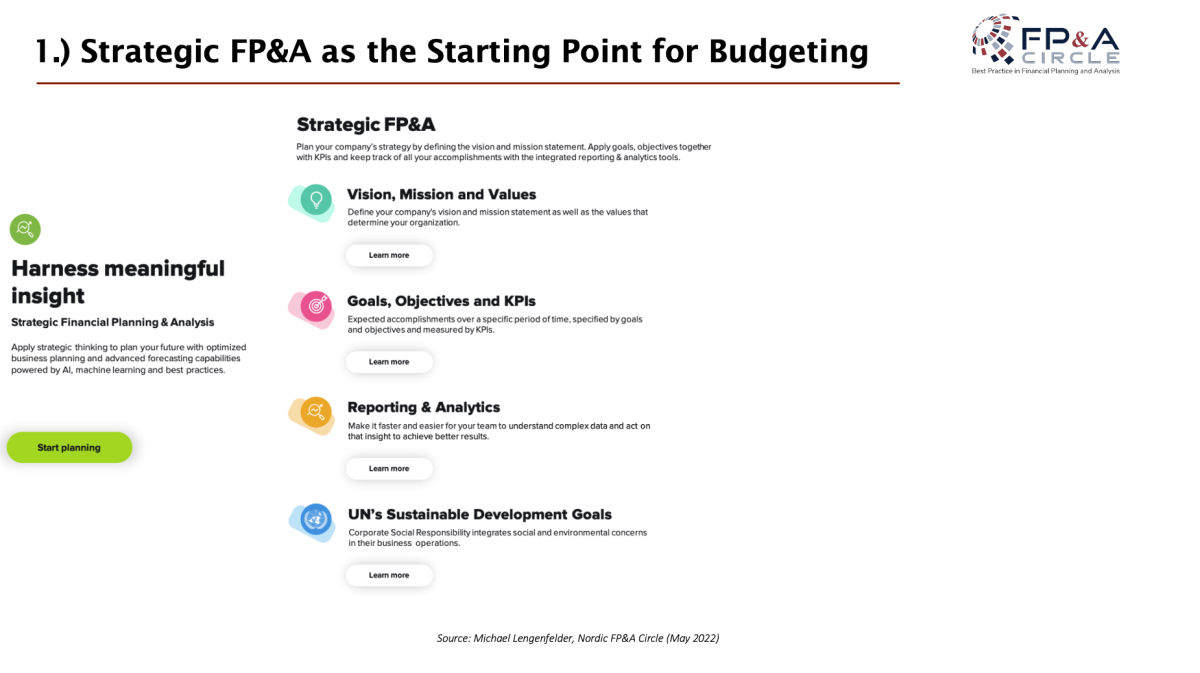

Michael Lengenfelder, Head of FP&A Product Management at Unit4, explained how Technology can enable Beyond Budgeting and arranged his presentation along three main processes: Target setting, Resource allocation and Forecasting.

In terms of Target setting, modern software can be very helpful in defining a company’s vision/mission and breaking them down into goals, objectives and measurable KPIs.

Figure 6

Fully Integrated Financial Planning allows us to make resource allocation decisions using Value Drivers and AI forecasting, which in modern software work in conjunction.

Modern software allows us to generate Rolling Forecasting not attached to the fiscal year relatively effortlessly, thanks to build in allocation rules and data inputs available at any time.

Michael has finished with examples of modern reporting, which is getting closer to reading a newspaper in the form of an easy-to-consume story.

Conclusions

Beyond Budgeting is more than a set of principles. It is a philosophy, a management model and an organisational mindset. Step-by-step changes to our FP&A processes, decoupling goal setting, forecasting, and resource allocation will ultimately lead to changes in other facets of our business, allowing us to govern organisations based on shared values and what is simply the right thing to do.

We would like to thank our global sponsor, Unit4, for their great support with this Digital FP&A Circle.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.