In this video, Sebastian Poduch, Head of FP&A at Royal Schiphol Group, shares his experiences utilising...

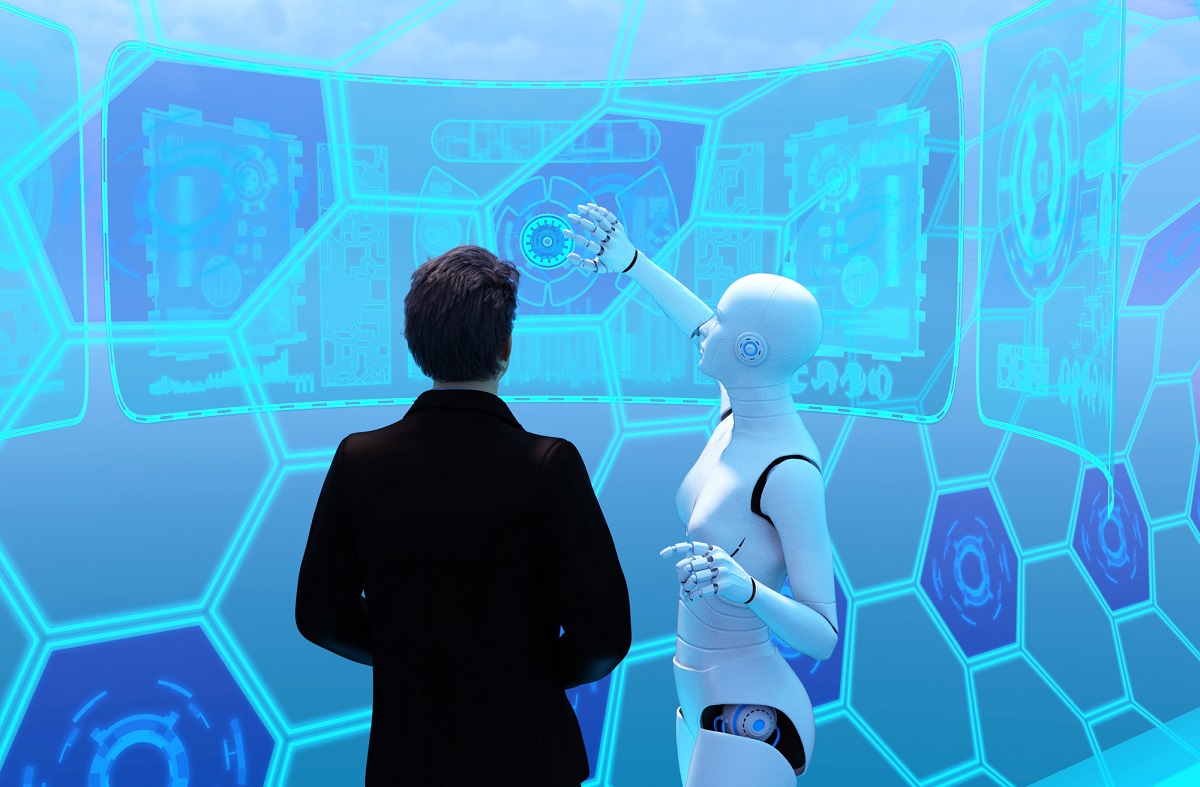

Even in times of unusual volatility, it remains possible to prepare for future outcomes and base the decision-making process around different scenarios. Predictive technology is viewed as a vital management tool for making sense of past performance and providing guidance into the future.

However, there are still many questions and misconceptions regarding this approach. Many finance leaders express their concerns about the costs, data and system requirements, effectiveness and efficiency of this process.

To shed light on these concerns, we hosted the FP&A Trends Webinar on the 28th of March, 2023. Here, we are summarising the key takeaways from this session.

Unlocking the Power of Predictive Analytics: A Journey through Experience and Insights

In his illuminating presentation, Sebastian Poduch, Head of FP&A at The Royal Schiphol Group, shared rich experiences and insights garnered over years of delving into Predictive Analytics. The core aim was to elevate finance to a value-adding function by optimising performance management. From revenue forecasting to market size predictions, cash management, fraud prevention, and process quality assessment, impactful use cases were explored.

The presentation delved into two standout examples: short-term revenue forecasting and operating working capital optimisation. Success stories emphasised superior forecasting accuracy and enhanced operational efficiency, showcasing the tangible benefits of Predictive Analytics.

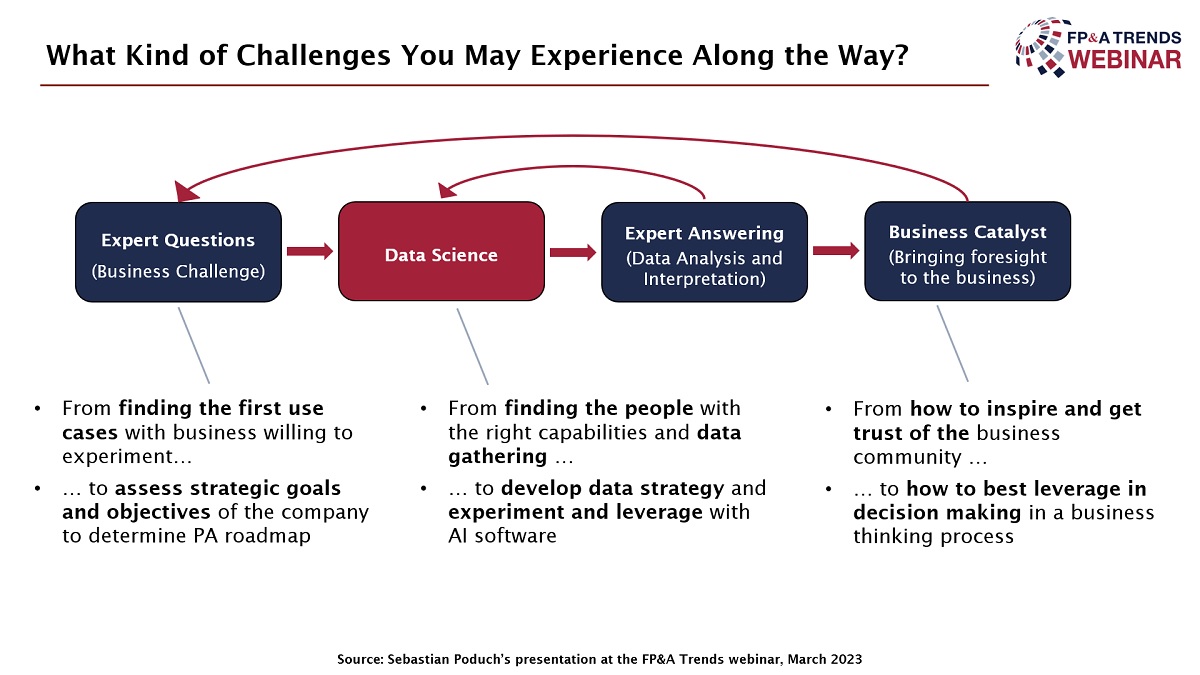

Sebastian also introduced a crucial success framework, highlighting key components like data, training, tools, and, most importantly, people. The evolution of the data science component within Financial Planning & Analysis (FP&A) underscored the importance of having a detailed data strategy and the increasing necessity of hiring skilled talent.

The journey to successful implementation involved building trust through initial use cases, leading to an exponential increase in an organisational appetite for Predictive Analytics. As teams matured, Predictive Analytics transitioned from experimentation to a strategic tool, significantly contributing to decision-making processes and business planning.

Figure 1

In conclusion, Sebastian underscored the transformative potential of Predictive Analytics in revolutionising finance functions and optimising operational efficiency. His presentation served as an inspirational guide for organisations leveraging data-driven approaches for a competitive edge.

How Many Organisations Have Already Deployed Predictive Analytics for FP&A?

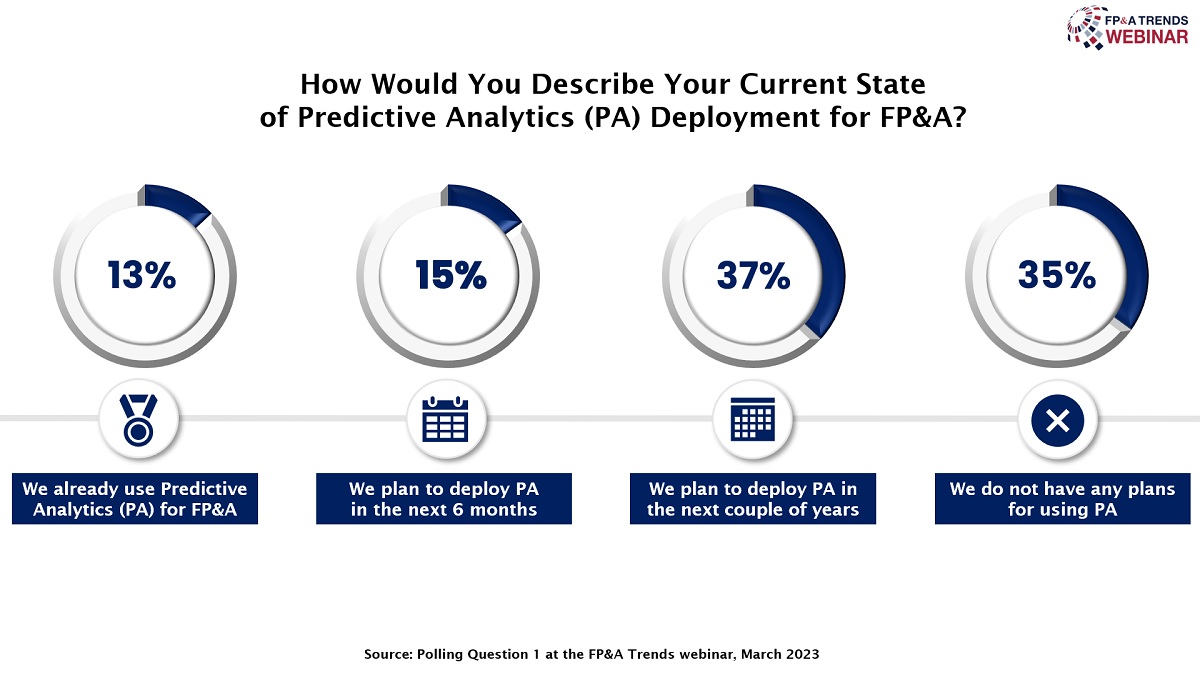

We have also asked the webinar audience to determine how many companies leverage Predictive Analytics (PA) for their FP&A activities. Only 13% of the respondents have already been using PA, while 35% of the audience do not plan to use it. 15% of the webinar attendees plan to deploy PA within the next six months, and 37% plan to do so in the following years.

Figure 2

Navigating Financial Transformation through Predictive Planning: Novartis Case Study

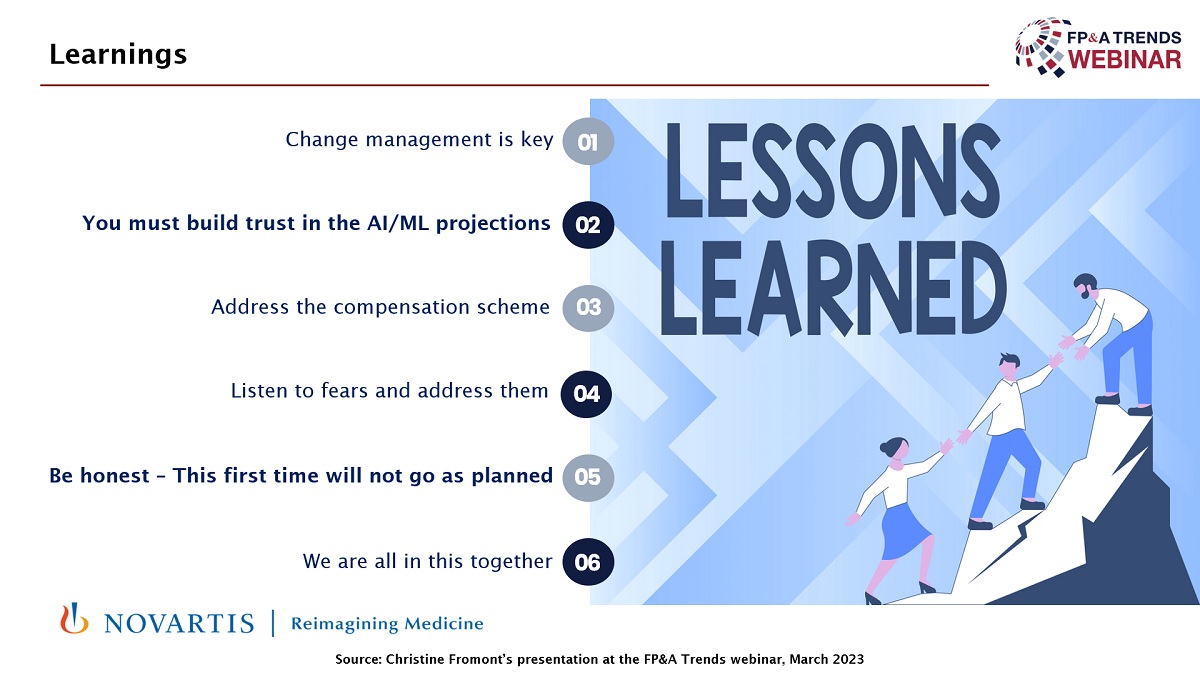

Christine Fromont, a former Neuroscience CFO at Novartis, presented its transformative journey in an engaging case study. Her presentation kicked off with Richard Branson's quote, focusing on the commercial aspect and emphasising the need to overcome fears for success—a guiding principle throughout the transformative process.

Initiating the ambitious transformation in 2021, Novartis aimed to revolutionise its lengthy nine-month financial planning process with "One Financial Plan," condensing the timeline to six weeks and heavily relying on Artificial Intelligence (AI)/Machine Learning (ML) integration. AI played a pivotal role in predictive planning, forecasting patient numbers, optimising marketing mixes, and centralising plans for operationalisation by individual countries based on market insights.

The case study highlighted three key focus areas: fundamental process change, mindset shift, and the increased role of automation. Top management support was crucial, and a significant mindset shift was achieved by decoupling remuneration processes from target setting, reducing internal conflicts. Heavy investments in enhancing AI and Machine Learning maturity, supported by digital tools, streamlined financial performance evaluation.

A crucial lesson was the importance of building trust in AI. Initially hesitant about bottom-up approaches, Novartis shifted toward transparency, allowing different organisation branches to contribute to AI models and challenge them. Regardless of the hurdles, Novartis triumphed in implementing its transformative plan within six weeks, reaffirming its commitment to innovative predictive planning.

Figure 3

In conclusion, this case study stands as a testament to the power of embracing change, leveraging AI, and fostering a culture of trust to navigate financial transformation successfully.

What Are the Roadblocks for Starting Predictive Analytics and ML-Based Forecasting?

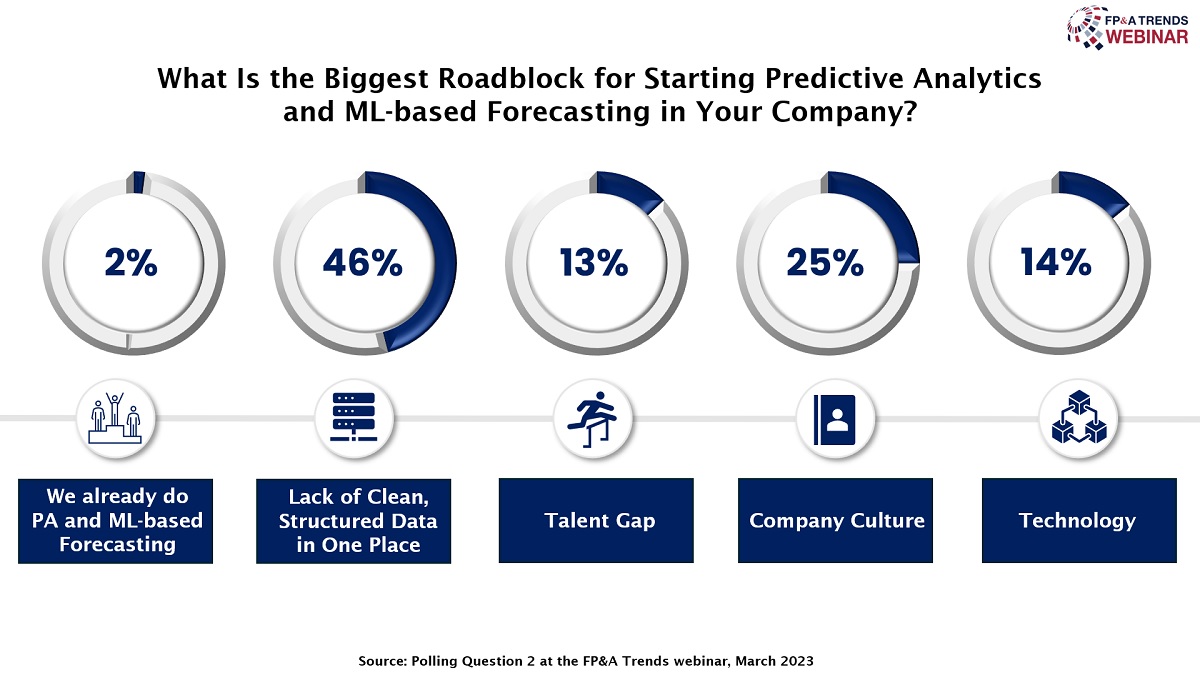

We have also explored the obstacles that prevent organisations from leveraging PA and ML-based forecasting. Only 2% of the respondents have already leveraged Predictive Analytics within their companies. 13% of the audience believes the talent gap is the most complex obstacle, and 14% named technology a hurdle. However, the absolute leader is a lack of clean and structured data in one place – 46% of the respondents voted for this option. The remaining 25% are sure that the company culture prevents them from using PA.

Figure 4

Transforming Finance with AI Technology

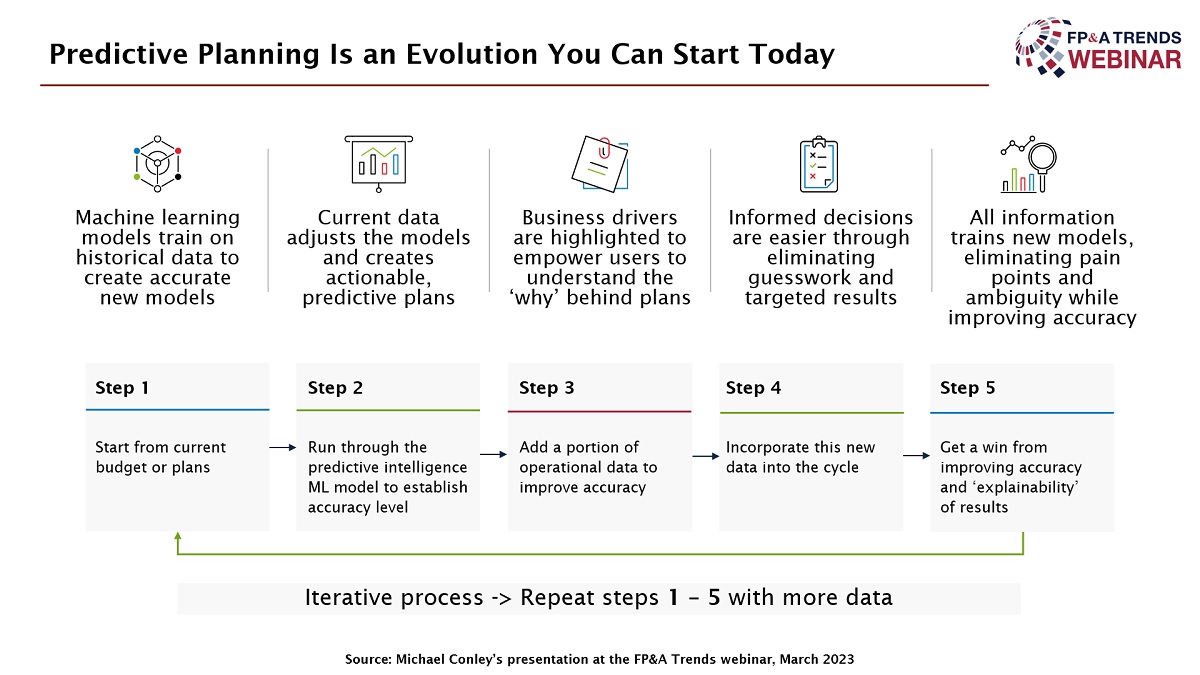

In the ever-evolving business landscape, technology plays an increasingly pivotal role. The quest to build trust through technological advancements took centre stage in this presentation by Michael Conley, Associate Director at Wolters Kluwer. We delved into current technological capabilities and encouraged thoughtful reflection on integration.

Acknowledging buzzwords like Artificial Intelligence, Machine Learning, Predictive Analytics, and robotics, Michael aimed to demystify these concepts, making them more accessible. The heart of the presentation affirmed that AI is a tangible reality unfolding in the present. Michael's presentation discussed whether big data enables AI deployment or vice versa. With the emphasis on finding tailored solutions, Michael underscored the importance of differentiating basic statistical calculations from advanced technologies which can internally leverage real neural networks and deep learning. He also pointed out that autonomy from specific cloud platforms ensures a model's explainability.

Figure 5

His discussion also underscored the necessity of using AI/ML, especially with extensive data. Historical data creates accurate models, providing better insights into business drivers. Advocating for an Open Library of Statistical Modelling, the presentation promoted leveraging existing technology.

According to Michael, the ideal solution involves using multiple models, cross-validating predictions, and seeking the highest-scoring combination of the dataset and model. The presentation concluded with a demonstration illustrating the practical application of these concepts, showcasing how technology automates insights and facilitates predictive planning.

Conclusions

In essence, the webinar highlighted the transformative potential of technology in the financial domain, empowering finance professionals to navigate the future with confidence and foresight.

Our expert panellists ran through some practical examples of how and where in FP&A predictive planning is being used, explored a great case study and, finally, looked at how technology could help us on that journey.

This webinar was proudly sponsored by Wolters Kluwer/CCH® Tagetik.

To watch the full webinar, please follow this link.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.