Many experts agree that IBP has a monthly check and balance with the budget and the...

For large organisations, Integrated Business Planning (IBP) is the crowning achievement of most FP&A functions. Many organisations aspire to achieve it, but few actually do.

For large organisations, Integrated Business Planning (IBP) is the crowning achievement of most FP&A functions. Many organisations aspire to achieve it, but few actually do.

Integrated Business Planning is a complex alignment of people, processes, and technologies that can provide immense value creation for the business and end-user efficiency when brought together under a single unified framework.

For Integrated Business Planning to stand a chance of success, all stakeholders involved must align on the same goal. It often requires strong leadership and a pragmatic/visionary mindset to achieve.

Is your organisation ready for the challenge?

FP&A’s Role in Integrated Business Planning

The FP&A function is the logical team for most organisations to lead an organisation’s IBP transformation.

But for the organisation to adopt a world-class IBP, FP&A must establish a unified framework that focuses on the big picture and is inclusive to everyone involved in financial planning.

Taking a top-down approach to IBP means considering all organisational levels of the business, all levels of financial detail (from Cash flow down to transactional drivers) and all time ranges (both short-term and long-term).

FP&A cannot work in a sandbox but rather needs to be better business partners. Integrated Business Planning is not a single, one-size-fits-all approach to planning. Instead, it is the recognition of multiple business processes working together to add more value than simply the sum of the parts.

Key Business Processes

As indicated above, IBP is a unified framework of different business processes.

In more candid terms, trying to solve Integrated Business Planning using a single business process is not only naive but also a recipe for disaster.

I suggest starting your IBP journey with four key business processes:

- Strategic Planning

- Tactical Planning

- Operational Execution

- BI/Analytics

A quick definitions of these processes are as follows:

Strategic Planning is the process of evaluating alternative strategies in order to maximise shareholder value (or long-term viability for organisations that don’t have shareholders).

Tactical Planning is the process of communicating and coordinating business plans across the organisation. It is often synonymous with Budgeting and Forecasting.

Operational Execution is the process of setting daily or weekly objectives using operational metrics.

BI/Analytics is the process of building a unified data model (a centralised hub for data collection) and aligning financial and non-financial data as it flows through both historical and planning processes.

Evaluating IBP based on a Forecast-Cascade Construct

Now that we have defined the four basic Integrated Business Planning Processes, we can shift our focus towards how they operate under two different constructs.

As you will see, the best approach to integrate multiple processes is to orchestrate a series of handoffs that not only have a healthy overlap but also operate fluidly (data flows in a bi-directional way).

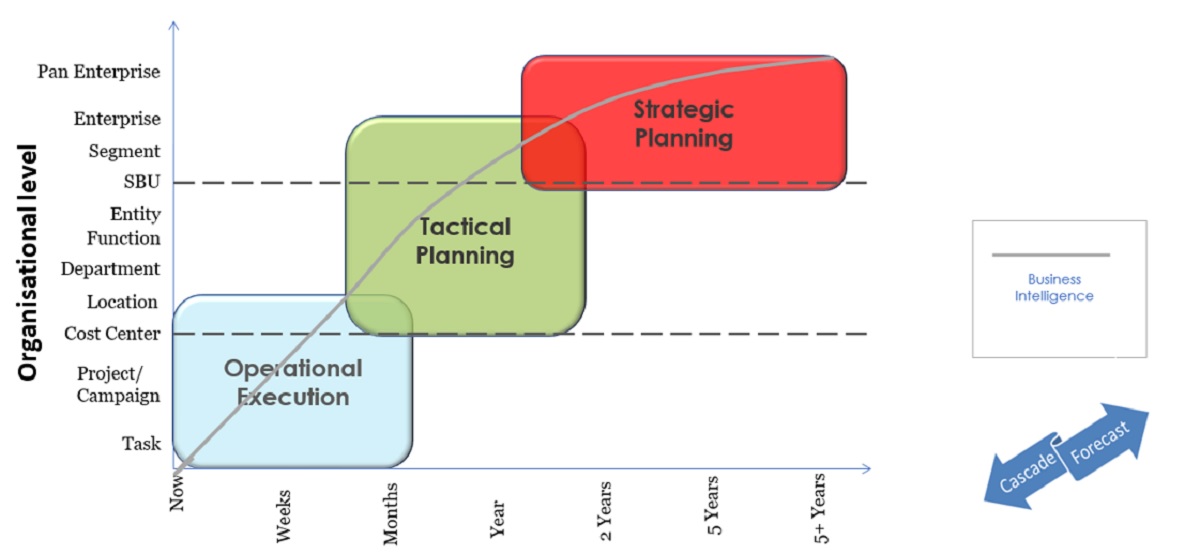

Construct 1: Business Process by Organisational Level

In the diagram below, we plot the four business planning processes against the organisation level in the Y-Axis.

Figure 1: Key Planning Processes by the Organisational Level

Doing so provides a clearer understanding of where each business planning process typically operates and a good understanding of where the overlaps exist.

Just as it is important to define the key business processes at play, it is equally important to recognise where the optimal overlaps exist. Overlaps are important as these are your integration points.

Too much overlap creates complexity, but too little overlap creates disconnects.

In the diagram above, we have highlighted the traditional budgeting and forecasting sweet spot (the space between the two dotted lines). This occurs between the Cost Center and Strategic Business Unit (SBU) for most organisations.

The areas above and below the dotted lines illustrate where Integrated Business Planning expands the realm of business planning.

It includes Strategic Planning, which is challenging to do in most EPM/CPM solutions primarily due to its agile and what-if nature, and Operational Planning, which is often too detailed for most organisations.

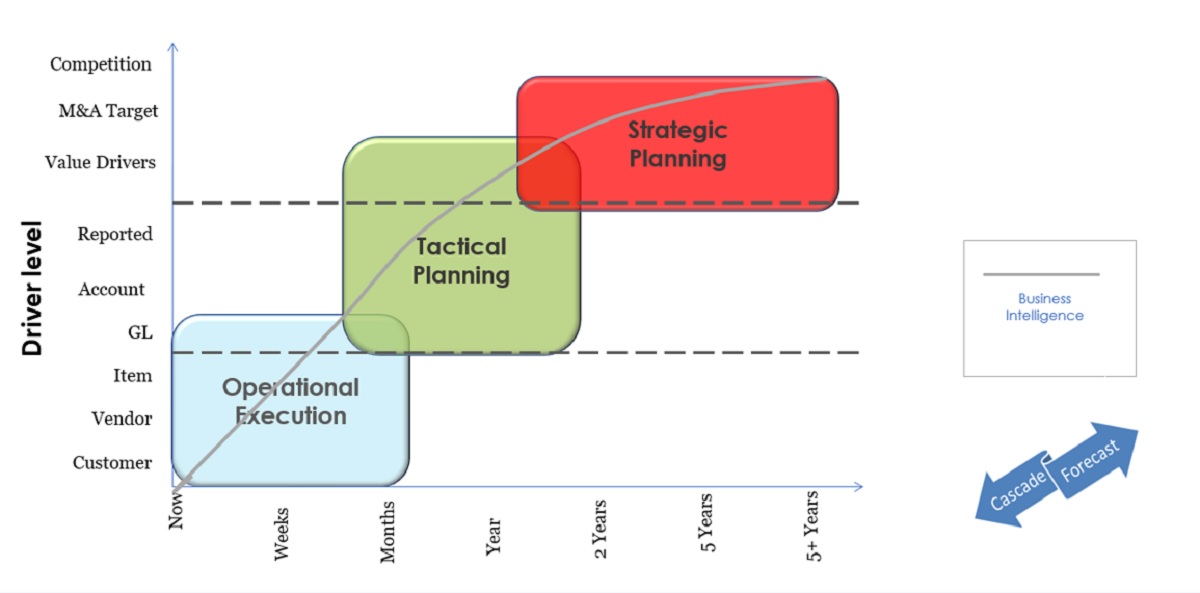

Construct 2: Business Process by Driver Level

Swapping out the organisation level for the driver level provides another key distinction worth exploring.

Figure 2: Key Planning Processes by the Driver Level

For most organisations, traditional budgeting and forecasting is done either at a GL level or perhaps one of two levels higher (at an “Account” level, for example). This is where most FP&A teams who only deal with Tactical Planning feel most comfortable.

But in an IBP world, there are advantages to planning at different levels of detail.

For example, at the strategic level, the emphasis should be more on driving shareholder value at the SBU level. Trying to produce a 5+ year forecast view by GL or even at an individual P&L line item for that matter is often fraught with error. A more realistic approach to Strategic Planning is to focus on the life cycle of a given SBU from its initial inception (cash investment) through the key life cycles (Investment, Growth, Plateau and Decline).

This approach requires more than just financial account drivers; it also requires forecasting the Cost of Capital and the Duration of the SBU (the life cycle).

In Tactical Planning, there is often no need to consider either of these drivers. Still, without these two drivers, making valuation projections is impossible (DCF models require both Cost of Capital and Duration assumptions). That is why we use Value Drivers and not just financial accounts.

The Operational Execution level is where we’ve seen most of the recent technical advances in financial planning. Several years ago, it would have been comical to think that FP&A should be planned by Vendor or Customer. It would have taken far too long and been outdated quickly.

However, with the more recent adoption of Artificial Intelligence/Machine Learning by FP&A, this is exactly where organisations can start to take advantage of this granular level of planning. Not only can a machine run the calculations quickly, but it can also run the calculations often (once a week, for example).

It helps organisations stay on track and adapt when hurdles crop up.

With the rise of AI/ML, this is also a great opportunity to point out that AI/ML is not a replacement for Strategic Planning or Tactical Planning. This is a common misconception that many people fall victim to. AI/ML shouldn’t set targets; rather, AI/ML should help us reach our targets by telling us how to get there based on the latest hurdles or headwinds.

After all, AI/ML relies on data. Much of the efforts into Strategic and Tactical Planning are about creating new business opportunities that do not exist today. As a result, little data is available to fuel AI/ML. AI/ML is a complement, not a replacement, for other planning processes.

Conclusion

Integrated Business Planning provides a competitive advantage for organisations able to integrate these individual business processes successfully.

The speed at which an organisation can take a business idea, stress test that idea with various scenarios and then cascade that strategy down through the business in order to set tactical goals that can realistically be achieved is no easy task.

The need for Integrated Business Planning also grows as organisations grow, yet the challenges required to unify people, processes and technology under a single framework also become tougher. It is where FP&A needs to step up and help close the gap.

This article was first published on the SAP Blog.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.