The cost of complexity can be significant – upwards of 5% of sales in global organizations. Forward-thinking...

Forward

Forward

Integrated Financial Planning (IFP) and Integrated Business Planning (IBP) mean different things to different people. Primarily because there is no universal definition of what “fully integrated” processes entail. This article presents a maturity model to explain what it means and the capabilities that comprise it.

Introduction

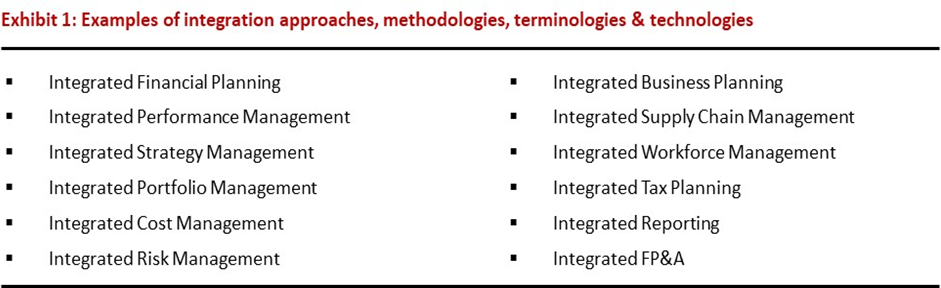

What’s the difference between IFP and IBP? And how do IFP and IBP differ from the plethora of integration approaches and terminologies, examples of which are shown in exhibit 1? These questions were posed to me by a Vice President of Finance of a Global Manufacturing Company, hereafter referred to as Bob and GMC respectively.

Why was Bob asking these questions? GMC had made significant investments in planning and performance management (P&PM) methods and tools. Despite these investments, capability gaps remained. GMC was still struggling to achieve the strategic, financial and operational (SFO) management objectives shown in exhibit 2. What Bob didn’t appreciate was that most of his [global manufacturing] peers were also struggling to achieve these interconnected objectives.

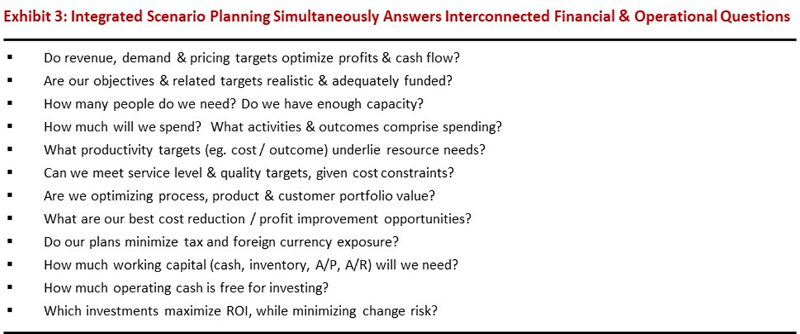

For Bob, the most glaring of these capability gaps was scenario planning. He envisioned an end to end scenario planning process that could answer interconnected questions, like those shown below in exhibit 3. This process would provide the basis to develop and deploy executable plans, while simultaneously optimizing free cash flow and exposing financial and operational risks.

To Bob’s dismay, this vision never materialized. GMC’s rolling forecast process was only loosely connected to IBP and could only support the most basic forms of cash flow [and foreign currency exposure] forecasting.

Bob was frustrated by the situation. GMC had partnered with a large / leading software company (hereafter referred to as LSC) to avoid this very problem. LSC provided both IFP and IBP solutions, albeit by way of separate financial and operational P&PM applications. He assumed that the combination of the two would result in an integrated process that enabled GMC to achieve these objectives.

Questions & Complications

Bob now questioned the validity of this assumption. He wondered how LSC could be classified as a leader (by technology analysts) if they couldn’t support these SFO objectives. In light of this, Bob sought answers to 3 questions. First, what are “fully integrated” processes? Second, are our processes integrated? And third, what capabilities [that GMC could be missing] comprise fully integrated processes?

One factor complicates the ability to answer these questions. There is no universally accepted definition of what constitutes fully integrated P&PM processes and technologies. Which is one reason why terms like IBP and IFP are so liberally used. Another is that technology analysts still use separate maturity models to evaluate financial and operational applications.

There are two limitations of these technology-based maturity models. First, they aren’t industry-specific, so they don’t reflect unique needs of specific industries, like manufacturing. Second, they don’t recognize that SFO objectives [shown in exhibit 2] become highly interconnected as complexity increases. As a result, capability gaps in traditional financial and operational applications are not always exposed.

Question 1: What Are Fully Integrated Processes?

What’s needed is a more business-oriented maturity model. One that describes how integrated SFO process enable the achievement of one overarching business objective. That being, the ability to optimize the value of business outcomes for customers and stakeholders, across functions and entities.

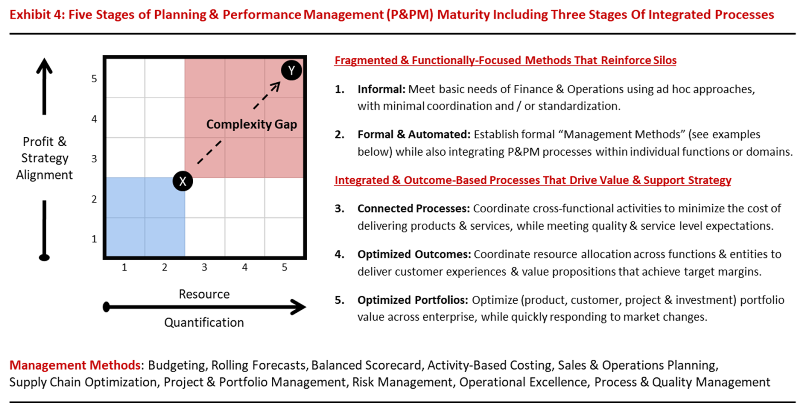

Mature processes support this objective by enabling strategy and cost structures self-adjust to changing market conditions to achieve financial and operational performance targets. Two business capabilities play a central role in supporting such a process. They are explained below and form the framework for the maturity model shown in exhibit 4.

- Resource Quantification: Quickly and accurately quantify opportunities to optimize value [across functions and entities] while translating targets [eg. revenue, price, profit, cost, service and quality) into executable financial and operational plans for the outcomes and business processes that comprise customer value propositions. Further details of this capability are provided in a separate FP&A Trends article entitled “Driver Based Planning Maturity”.

- Profit & Strategy Alignment: Establish effective accountability, decision rights and rewards for managing key outcomes and tradeoffs that comprise customer value propositions and enterprise performance, while focusing and motivating people to behave and make decisions that optimize value for the organization as a whole, in both the short and long term. Further details of this capability are provided in a separate FP&A Trends article entitled “Productivity Management”.

This model presents five stages of maturity across these two business capabilities. Stages 1 and 2 are the lowest level of maturity and are represented by the blue box in the bottom left corner. A key feature of stage 2 is the introduction of formal management methods and tools, examples of which are shown at the bottom of exhibit 4.

Stages 3 to 5 represent mature forms of integrated [and outcome-based] processes that are represented by the pink box in the top right. The hallmark of these maturity stages is improving the effectiveness of these management methods by embedding them into processes that integrate strategy, finance and operations.

Question 2: Do Our Tools Support Integrated Processes?

This maturity model provides the basis to answer Bob’s second question. The conclusion being that LSC did not support the integrated processes that GMC required, as denoted by Point Y on the chart.. It’s processes were stuck at stage 2, as denoted by Point X. Two primary factors led to this conclusion about gaps in GMC’s processes and tools.

First, LSC did not support mature planning models that could be shared by finance and operations, as defined in the “Driver-Based Planning Maturity” article. For example, it lacked a planning model that could support cash flow forecasting, profit-based sales & operations planning and scenario planning. This corresponds to a stage 2 maturity for Resource Quantification.

Second, LSC did not support cross-functional performance management, as defined in the “Productivity Management” article. For example, it didn’t support the capabilities defined as matrix planning and tradeoff management, which are stages 3 and 4 capabilities respectively. This corresponds to a stage 2 maturity for Profit & Strategy Alignment.

Bob was somewhat consoled by the fact that global manufacturers often experience this same “complexity gap”. It did much to explain why complex organizations, like GMC, struggled to execute against business objectives requiring superior cross-functional coordination. This includes operational excellence, profitable growth and sustainable cost reduction.

What it also helped Bob to understand is that, in mature processes, there is no distinction between IBP, IFP and other integration terms. There is simply an integrated P&PM process. To Bob, they now sounded like marketing hype that should be met with greater skepticism.

What Capabilities Comprise Fully Integrated Processes?

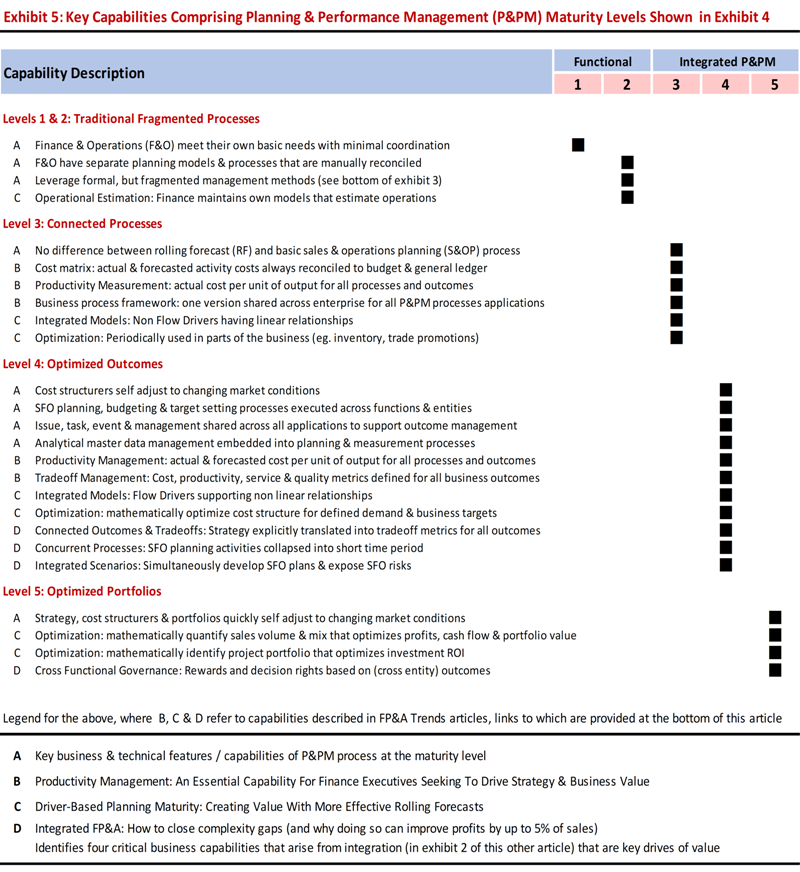

Bob’s third question was aimed at further understanding specific capabilities that comprised the gaps identified in exhibit 2. The capabilities that GMC lacked are identified below in exhibit 4 in the columns denoted as maturity levels 3 to 5.

Details of the capabilities [shown above in exhibit 5] are contained in three separate FP&A Trends articles, links to which are provided at the bottom of this article. Each capability in the exhibit has a letter reference, which is described in the legend at the bottom of the exhibit. Three key insights can be gleaned from this exhibit:

- Specific capabilities [in stages 3 to 5] comprise the gaps of GMC’s processes

- Four of these capabilities [labelled “D”] are the primary gaps because they comprise the others

- The probability is high that these four capabilities are missing from IBP and IFP applications

This last point is of particular note. These four capabilities play a central role in helping global organizations manage complexity. Their absence undermines the ability to manage complexity costs. This is important because [as noted in the “Integrated FP&A” article] complexity costs can approach 5% of sales. In this context, these capabilities need to be a key focus of strategically focused finance executives.

Key Takeaways

Bob, like other forward-thinking finance executives, understood the importance of integrating SFO P&PM processes. Especially as a means of coping with complexity. Despite this understanding, GMC still failed to establish mature forms of integrated processes that could support their objectives. Here are four things you can learn from GMC’s experience that will help you to avoid these mistakes:

- Develop a healthy skepticism of IBP, IFP and other solutions, like those in exhibit 1. Many lack the capabilities to support mature forms of integrated processes.

- Employ a holistic approach for developing SFO P&PM processes. As GMC learned, failure to define integrated SFO processes and requirements at the outset, can lead to missed requirements and the capability gaps that they are now coping with.

- Consider the views of technology analysts, but remember that they view technologies from functional perspectives. Not from a process-driven one that brings together SFO perspectives. Without understanding this, their views can lead organizations in the wrong direction.

- Develop a shared understanding of what fully integrated P&PM processes look like, the specific capabilities that comprise them and why they are important for driving strategy and value.

This last point is especially important. Had GMC established such an understanding at the outset of their program, they could have avoided the situation in which they found themselves. In this context, the insights in this article can help to get you started in the right direction.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.