Discover how FP&A professionals can lead digital transformation by integrating AI, Power BI, automation and continuous...

How is the FP&A function evolving in response to digital transformation? And what does that mean for finance professionals today? What new roles are emerging as AI becomes more integrated into planning and analysis? And how are leading organisations rethinking structure, collaboration, and technology to stay ahead? These are the questions explored in this article, which brings together insights from seasoned FP&A leaders navigating change from both finance and business leadership perspectives. Their stories shed light on the urgent need to evolve, not just in tools but in mindset, and offer a roadmap for transforming FP&A into a strategic, future-ready function.

This article provides an overview of the topics and cases presented and discussed by the expert panellists in the "Making FP&A Teams Fit for the Future" webinar, as well as the results of our polling questions.

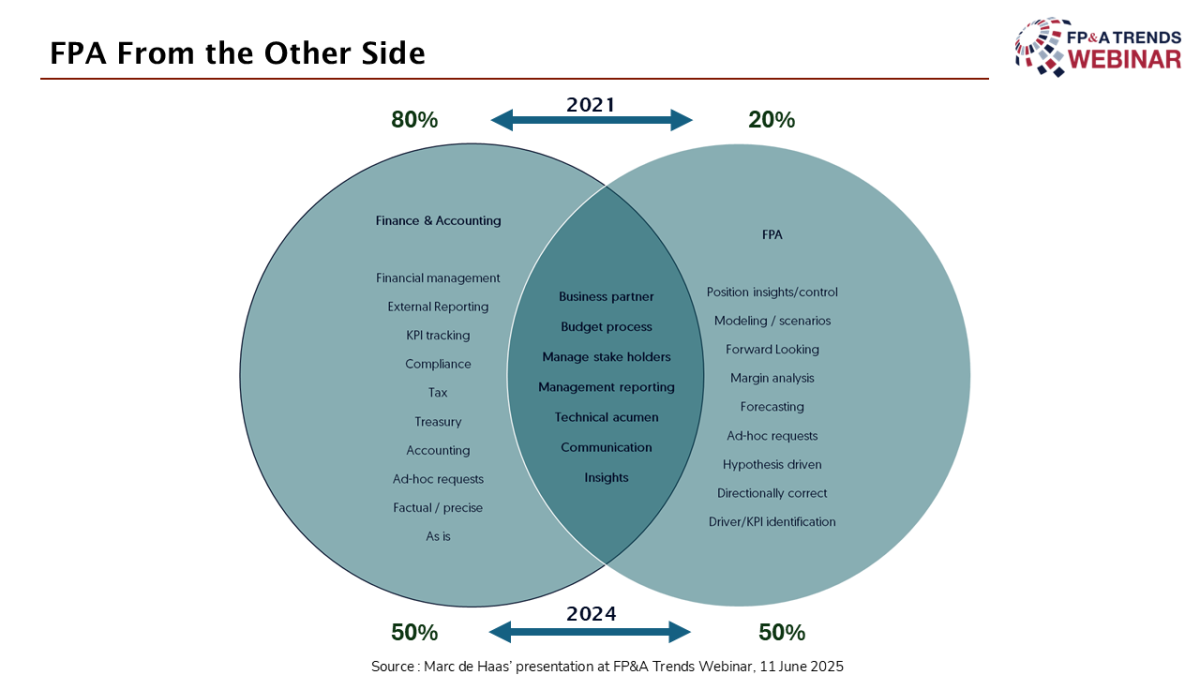

FPA From the Other Side

Marc de Haas, Managing Director & Finance Director at Interfood Americas, shared his perspective on the evolution of FP&A through his experiences at two multinational companies. At his former employer, he helped build a mature FP&A function recognised by leadership. Upon joining Interfood 18 months ago, he found a more traditional finance team focused mainly on accounting and reporting. Identifying the opportunity to develop FP&A capabilities, Marc initiated a strategic transformation, aligning efforts with commercial stakeholders and setting clear long-term goals.

Figure 1

Under his leadership, Interfood expanded its focus on margin analysis, performance reviews, competitive benchmarking, and forecasting. Marc emphasised three core areas where FP&A adds value: robust forecasting and scenario planning, incorporating external market intelligence, and effective storytelling to drive decisions and action. He also highlighted the importance of integrating FP&A with accounting, treating them as one cohesive finance team with complementary strengths.

Now, in a general management role, Marc advocates leveraging AI within FP&A. While Interfood is early in this journey, using technologies like RPA, he sees great potential in using AI for data analysis and predictive forecasting. He concluded that AI will reshape FP&A, positioning the function as a strategic enabler and opening a new chapter in its evolution.

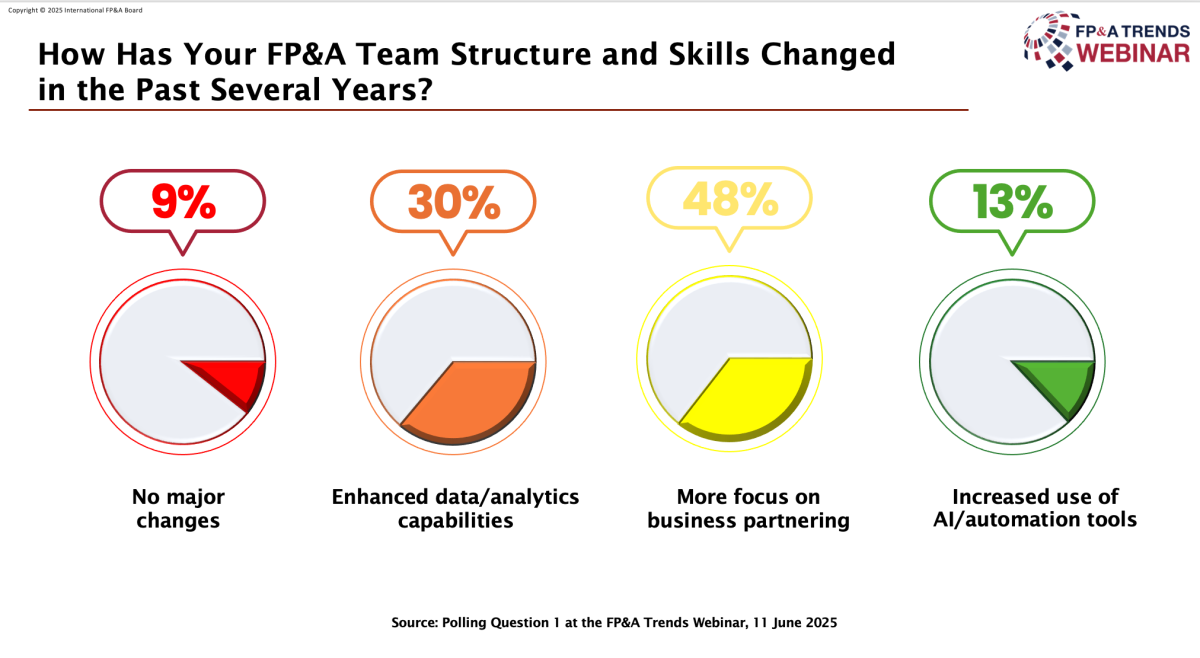

Poll Insight: How has Your FP&A Team Structure and Skills Changed in the Past Several Years?

The poll results reveal a clear shift in FP&A team priorities, with 48% of respondents indicating a stronger focus on business partnering as the most significant change in recent years. Enhancing data and analytics capabilities followed at 30%, reflecting the growing importance of data-driven decision-making. The adoption of AI and automation tools has also begun to take hold, cited by 13% of participants. Only 9% reported no major changes, highlighting that the vast majority of FP&A teams are actively evolving their structure and skillsets.

Figure 2

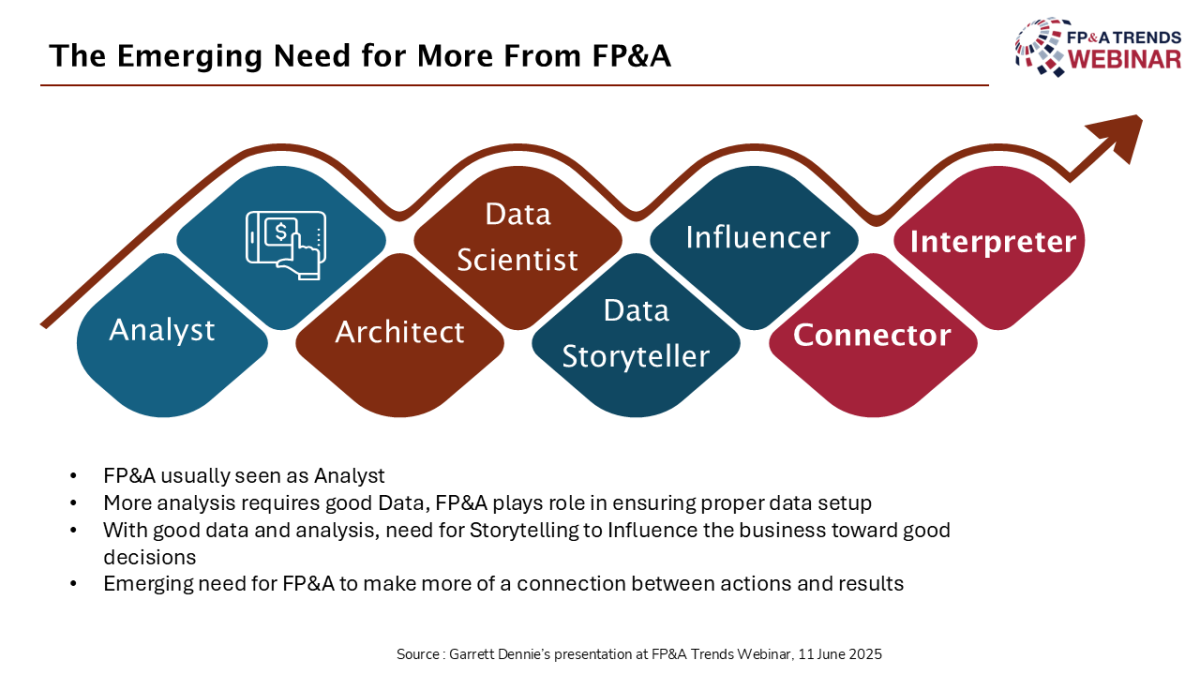

The Connector and Interpreter Roles in the Age of AI

In his presentation, Garrett Dennie, Chief Financial Officer at Knix, outlined the evolving landscape of FP&A roles, emphasising the growing importance of strategic influence over traditional analysis. He described a natural progression in FP&A maturity: from basic analysis to data architecture and data science, eventually evolving into storytelling and influencing business decisions. As AI increasingly automates foundational tasks, Garrett argued that the value of FP&A lies in its human capabilities: interpreting complex business dynamics and connecting strategic, operational, and financial plans.

Figure 3

Garrett highlighted two emerging FP&A roles: the Interpreter and the Connector. The Interpreter ensures alignment between departments by translating financial data into a shared language, facilitating consensus and coordinated action. Drawing from his experience at Sears Canada, Garrett illustrated how FP&A bridged the gap between management's short-term profitability concerns and merchants' long-term inventory strategies. The Connector, on the other hand, integrates strategic vision with operational execution and financial targets. He shared an example from Knix, where the lack of alignment between strategic, financial, and operational plans hindered performance. By implementing a long-range planning process, the FP&A team ensured cohesion across departments and timelines.

Garrett concluded that as AI advances, FP&A's role as a strategic integrator will become even more critical, ensuring plans are not just smart, but executable and aligned.

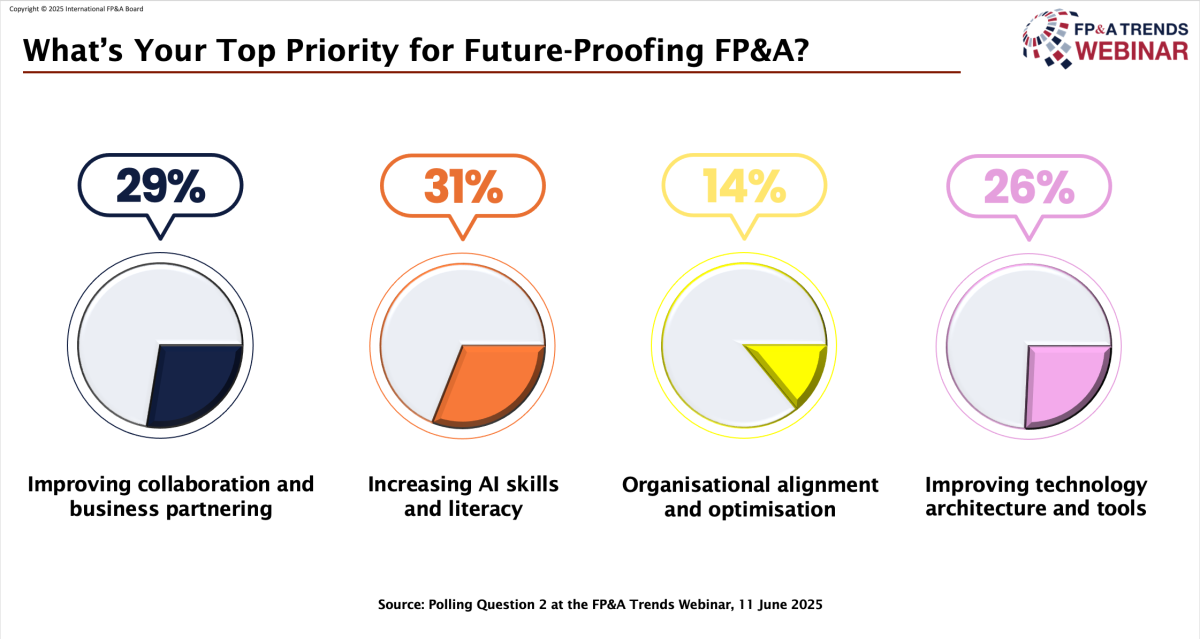

Poll Insight: What's Your Top Priority for Future-Proofing FP&A?

The poll results indicate a relatively even distribution of priorities for future-proofing FP&A, with a slight lead for increasing AI skills and literacy, cited by 31% of respondents. Close behind, 29% prioritise improving collaboration and business partnering, reflecting the ongoing need for stronger cross-functional engagement. Improving technology architecture and tools was selected by 26%, highlighting the importance of modernising infrastructure. Organisational alignment and optimisation ranked lowest at 14%, suggesting that while structural improvements matter, they are currently seen as less urgent compared to digital capabilities and collaboration.

Figure 4

Technologies Growing Role in FP&A

In his webinar presentation, Kyle Steep, FP&A Expert at Planful, focused on how technology, particularly automation and AI, can empower FP&A teams by shifting their efforts from data preparation to value-added analysis. Drawing from client experiences, he noted that many finance professionals spend the majority of their time preparing reports and budgets, leaving minimal capacity for insightful analysis. He emphasised the role of automation in streamlining routine processes like data collection, roll-ups, and calculations, enabling teams to work more efficiently and with greater accuracy.

Kyle highlighted three key benefits of technology integration: automation, scalability, and collaboration. By moving beyond spreadsheets to centralised platforms, organisations can generate forecasts and scenario updates more seamlessly, facilitate clearer communication across teams, and preserve institutional knowledge through structured commentary and data histories.

Figure 5

He also demonstrated practical applications of AI in FP&A, including automated forecasting using historical data as a starting point and anomaly detection for identifying outliers before budget submission. These tools enhance decision-making and reduce errors, acting as a second set of eyes over financial data. Kyle concluded that with the right technology, FP&A professionals can reclaim time to focus on strategic storytelling and business influence, truly delivering on the "A" in FP&A.

Conclusion

There is no longer any question about whether AI will reshape FP&A roles. As illustrated across all speaker perspectives, AI is not a distant ambition but an immediate catalyst for transforming FP&A into a forward-looking partner to the business. The human role in FP&A is evolving toward influence, interpretation, and connection - areas where AI augments, but does not replace, professional judgment and strategic thinking.

The message is clear for organisations that haven't yet begun this transition: the time to act is now. Whether it is starting with automation to reclaim analyst capacity or embedding AI in forecasting and anomaly detection, early steps can unlock significant efficiency and insight. Future-proofing FP&A is not replacing people with machines. It involves equipping professionals with the tools that elevate their impact. Waiting is no longer an option.

Special Thanks

We extend our gratitude to Planful, our technology sponsor, and our panellists for their invaluable contributions and thought leadership.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.