FP&A as a profession changed dramatically during the Covid-19 pandemic. The Chicago FP&A Board met in...

Did the turbulent events of the past two years bring new challenges to FP&A teams, or did they reveal problems that had been around for quite some time? What's on the leading CFO's table?

The FP&A Trends webinar looked at the main challenges we are facing these days.

This article provides an overview of the topics and cases presented and discussed by the expert panellists at the webinar "Top Five FP&A Challenges and How to Address Them", as well as the results of our polling questions.

Being a True Finance Business Partner

Luis Parra, Financial Executive - CFO (most recently with Scotiabank), outlined the prerequisites needed to create a partnership between FP&A and the rest of the business.

Without understanding the key business drivers and their P&L impact, this association will not be possible. There are several steps that finance must take to establish that culture of partnership:

Governance Model, which means answers to the questions "what?", "how?" and "when?" business drivers will be measured and discussed.

Discuss & Find Opportunities which are hidden in detail.

Coordinate actions with areas: make sure that our recommendations to the business are feasible and coordinate with other support areas of the business.

Implementation: make sure that our recommendations have been implemented.

Figure 1

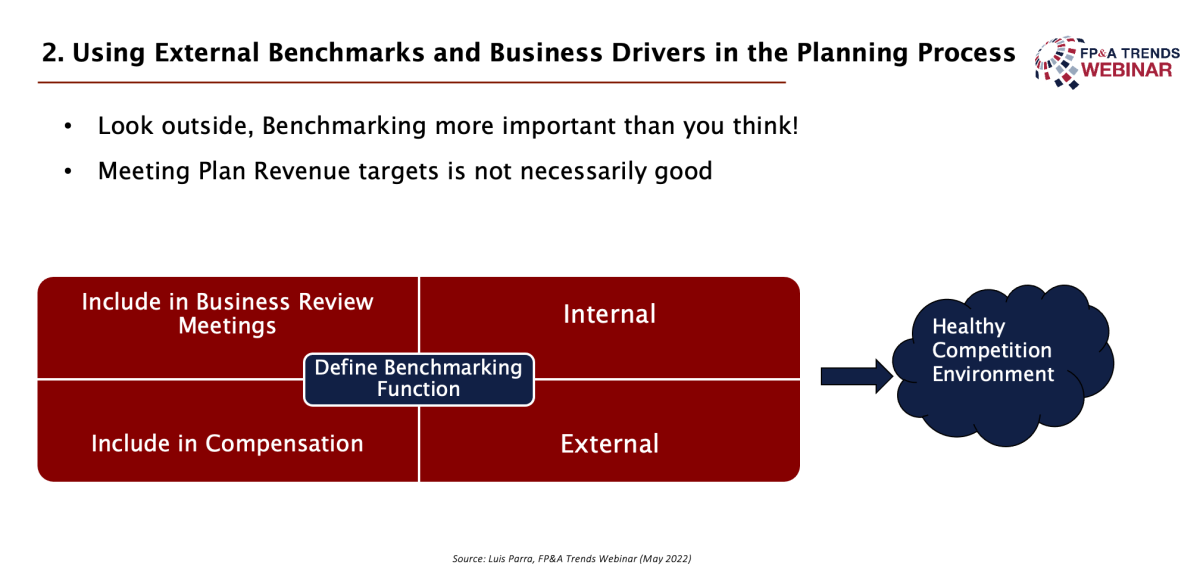

Using External Benchmarks and Business Drivers in the Planning Process

In addition to Business Partnering, Luis spoke about the importance of external benchmarking for business success.

External benchmarks are essential in driving organisational performance. The main problem is how to get that external data.

Agencies, professional associations, government bodies, social media and other open sources provide considerable financial and non-financial information about your industry or competition to benchmark externally.

Figure 2

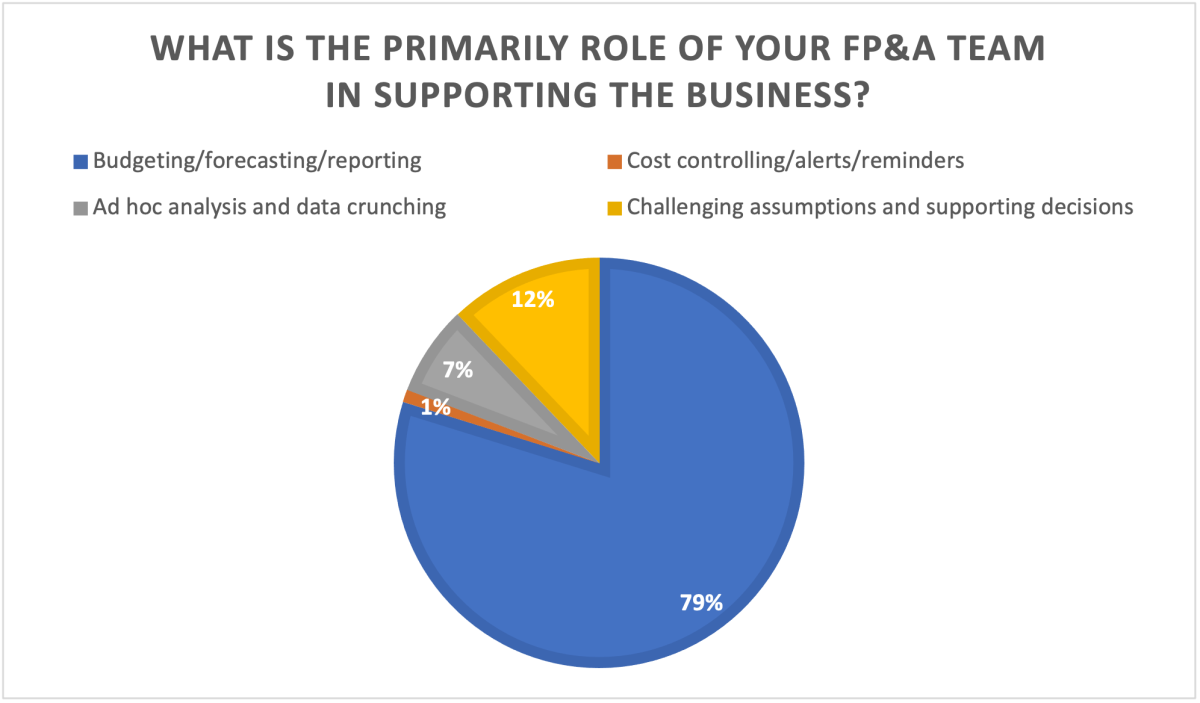

What is the primary role of our FP&A teams?

During the webinar, attendees from the FP&A industry took part in the poll and stated what the primary role of their FP&A teams is. 79% of the FP&A teams see their main role in budgeting, forecasting and reporting, while only 12% focus on challenging assumptions and supporting decisions.

Figure 3

Need for Higher Agility and Flexibility

Fernando Schreiner, FP&A Director at Gensler, shared with us his lessons learned at the early stages of the COVID-19 outbreak.

The organisation managed to address key issues early and made some sacrifices (reductions in salaries and working hours or even laying off some of the employees) to stay financially healthy.

Eventually, Gensler managed not only to weather the storm of the pandemic but develop a strategy, reflecting a much higher need for agility in the future. That approach was relying on Scenario Planning, transparent and effective communication and fast data-driven decision-making.

Figure 4

Need for Systems and Processes Integration

Besides that, Fernando has focused on the need for systems and process integration, sharing his experience with digital transformation in Gensler.

Gensler uses a robust Human Capital Management (HCM) system for Employee Experience Management, Skills Management and Workforce Optimisation.

The same applies to their Client Relationship Management (CRM) platform, which is used to sell smarter and faster, create more engaging marketing and empower teams to forecast accurately.

There has been quite an improvement in the budgeting and forecasting process across the firm, achieved by implementing Business Process Management (BPM) Platform.

These are great tools, but it would be even better and more insightful to integrate them, connecting detailed business metrics and FP&A.

Figure 5

Implementing Extended Planning and Analysis (xP&A) and Scenario Planning

Pras Chatterjee, Senior Director at SAP, explained planning should be integrated across business functions and with strategic goals.

Planning is an absolute business imperative, and organisations are striving to be more intelligent and agile in the world, where black swan events are becoming a new normal.

In order to achieve that, we need to get into a state where people and plans are completely aligned, but so far, people are planning in silos with spreadsheets and disconnected tools.

The step to get to the desired state is adopting an xP&A process, which requires:

Strategic alignment with all departments in terms of modern cloud-based planning solutions

Responding at the moment to market disruptions based on the integrated data from all the business departments

Integrating with your core applications (ERP, CRM, HCM tools)

Figure 6

Conclusions

FP&A should be a strategic partner to the business and should be prominent at the executive table not only to present budgets and forecasts but also to deliver results, provide guidance and support the business in making strategic decisions. Getting there involves overcoming the five main challenges we have outlined. Best of luck to you on your journey.

We would like to thank our global sponsor, SAP, for their great support with this FP&A Trends Webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.