In this short video, Tom Vanoverschelde, Finance Director at Capita, shares his practical experience in implementing...

Those who follow developments in FP&A closely have proclaimed a New Age of Zero-Based Budgeting. So what exactly does this mean? What do organisations find so appealing about this alternative to traditional budgeting, and how can we best implement it?

A panel of experienced professionals discussed these questions at a recent FP&A Trends Webinar. Their insights are summarised here.

How Did Zero-Based Budgeting (ZBB) Evolve?

Larysa Melnychuk introduced the session by demonstrating the evolution of budgeting from Traditional to FP&A. In the current scenario, organisations are using ZBB for decision-making and supply chain management.

Is this the New Age of ZBB?

Figure 1

According to a recent survey by McKinsey, more than 300 global companies currently use ZBB. The majority do so to achieve cost reduction, with average savings of $280m per year. Some organisations have even achieved 10-25% cost reduction within 6 months.

Amongst companies that announced cost reduction programs, only 26% were able to sustain the reductions for 4 years, and only 17% achieved growth.

Kraft Heinz Case Study

Kraft Heinz introduced ZBB in 2015. Despite investments in technologies, the company’s share price dropped by 29% in 2019, as its cost-focused strategy resulted in a high-pressure and anxious environment.

What is new in ZBB?

ZBB is not a cost-cutting exercise. It is part of every line of the planning process.

It is also a method to identify key drivers, so it is linked to driver-based planning.

It is a rethinking of the traditional budgeting process.

It is improving Business Partnering due to collaborations and the use of modern technology.

ZBB as a Management System and Culture

The next presentation was given by Tom Vanoverschelde, Portfolio Finance Director at Capita.

To achieve exceptional results, we should not see ZBB as a budgeting method, but as part of a wider management system. This can be achieved by:

Having continuous focus and more visibility on costs.

Setting ambitious targets for long-lasting results.

Making ZBB a key metric of performance systems.

Ensuring the rules apply to everyone, including the senior management.

How to establish an organisational setup?

As per below, the organisation must set core principles. ZBB teams should be involved in every business unit, region, and headquarters, and form a part of financial reviews.

What are the results and takeaways of ZBB?

If implemented correctly, ZBB can have a big impact on profit margins. This allows organisations to increase investment, as it ensures all the managers know their budgets.

It’s a continuous process that should be supported by technology, and should fit into a broader category for the company.

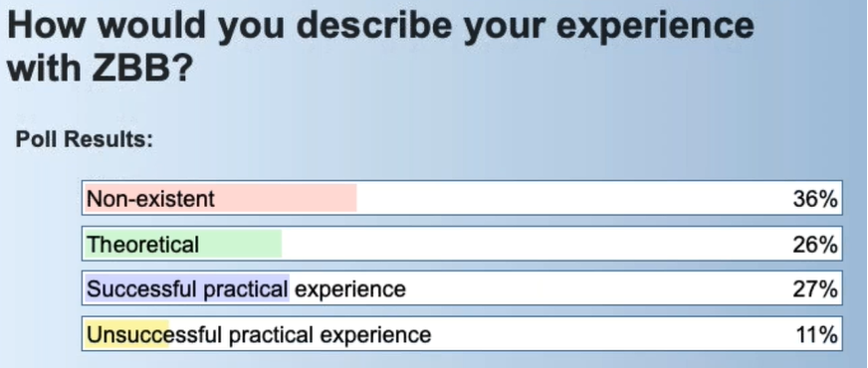

The below results show that most organisations think of ZBB as theoretical, while some have managed to successfully implement it. (Figure 2)

Figure 2

Team Readiness for ZBB: How to Manage the Change?

The next to present was Vincent Boon Seng Lim, Chief Financial Officer Asia Pacific at Datalogic.

Vincent shared a case study of long-serving employees of a manufacturing concern. The results showed that the majority were neutral to the concept of ZBB, and only 10% were interested in it. Meanwhile, some even had a negative outlook, which meant that achieving the desired results required convincing employees.

What are the drivers of success?

Communication is key so that everyone is aligned. Keep your team abreast of every step.

Form groups and map out the dynamics.

Leaders must invest in resources and focus on those who will drive the change.

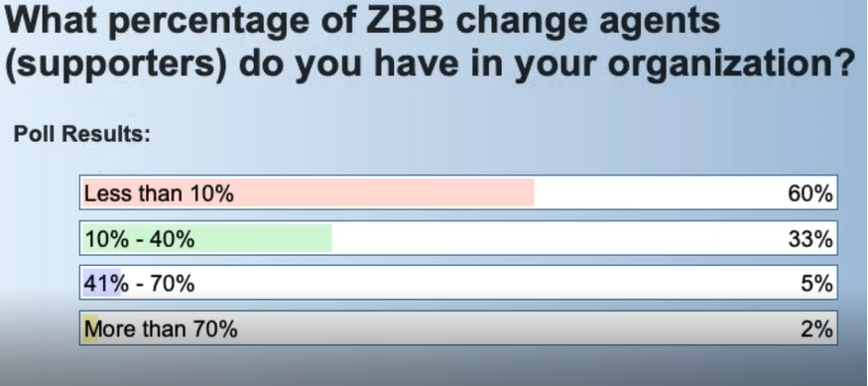

Vincent’s presentation was followed by another polling question, which showed that organisations typically had less than 10% of ZBB change agents. These results were surprising yet illuminating. (Figure 3)

Figure 3

ZBB Implementation in Imerys (example in Malaysia)

After this polling question, the audience heard from Nicolas Perrin, CFO at FN Herstal.

Nicolas provided the practical example of Imerys largest carbonate processing plant in Asia, which has over 100 employees.

Successfully implementing ZBB requires a dedicated, motivated and competent local team, that effectively collaborates with the Finance and HR.

Focus areas for improvement:

Maintenance (of machines): to ensure the productivity of programs.

Quality and process: focusing on the critical production line.

Purchasing and SCM: to improve service and reduce costs.

People: those involved in developing the implementation process.

Actions taken to achieve the Target:

A performance development team was formed to achieve long-term results. This included plans to upskill operators, allocate resources, and simplify hierarchy.

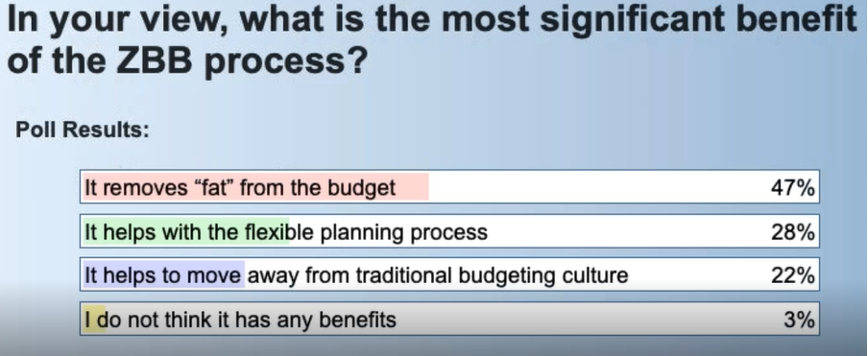

The results of the below polling question demonstrate that the majority agree that ZBB’s most significant benefit is that it removes the excess cost from the budget. Very few believe that it has no benefits. (Figure 4)

Figure 4

What Are the Technology Enablers for ZBB?

Next to speak was Pras Chatterjee, Senior Director at SAP.

According to a survey, 79% of companies reported deficiencies in access to high-quality data, while around 47% have integrated planning systems. Only 6% currently use AI, but the majority plan to implement it in the next few years.

What are the key drivers and features for enabling ZBB?

An organisation’s ERP should be integrated with planning, which gives access to relevant drivers and improves ZBB decision-making.

While Microsoft Excel is still used by many organisations, it has its pros and cons. Meanwhile, modern planning solutions make use of Machine Learning and in-built solutions that can help improve the decision-making process.

How can xP&A power ZBB?

Extended Planning and Analysis (xP&A) includes alignments within all departments, providing better insights into SCM, Operations, IT and Human resources. It helps eliminate surprises, enabling faster and more confident decisions.

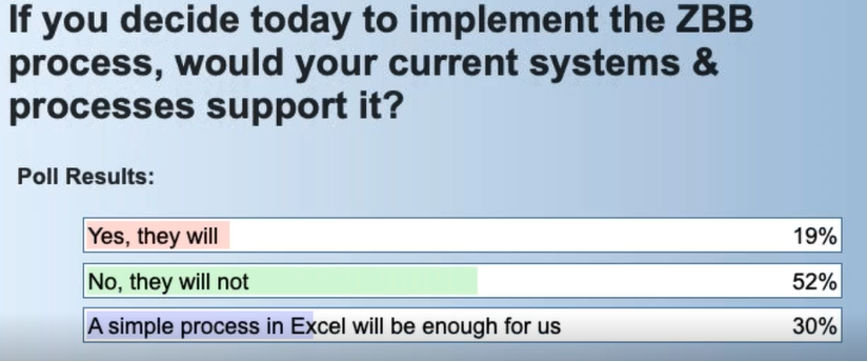

Pras’ presentation was followed by another polling question. Perhaps unsurprisingly, the results revealed that organisations’ current systems and tools do not suffice for ZBB implementation. (Figure 5)

Figure 5

What Is the Current FP&A Recruitment Trend in APAC?

Next, Manager Finance and Accounting at Michael Page Shintaro Ajito presented. As Shintaro explained, there has been a surge in demand for FP&A talent with transformation experience. Those that have the ability to support new business growth and process reformation are highly sought after.

What skills are most desirable?

Organisations are looking for candidates who can influence and challenge in every scenario, with strong communication, and the ability to adapt to this dynamic environment.

What are the challenges when hiring?

Organisations seek to hire someone from the same industry, so a lack of industry experience can pose a challenge for the candidates. They may also be at a disadvantage if they do not have transformation project experience and strong communication skills.

Key Takeaways

At the end of the meeting, all the speakers shared their takeaways. The panellists agreed, that successfully implementing ZBB requires organisations to establish a purpose, set clear priorities & identify drivers. They should also pursue collaboration with the help of technology, to monitor the outcome of ZBB implementation, and continue the cycle of reinvestments and savings.

We are very grateful to our sponsors and partners SAP and Michael Page for their support.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.