The 8th face-to-face Paris FP&A Board took place on October 8, 2024. 27 senior finance leaders from companies such as TD Synnex, VYGON, Renault, Atos, GE Vernova, dentsu, Fitch Rating, Medtronic, Danone, and many others convened in the beautiful venue, SPACES Les Halles. This time, the participants explored the key components to master Predictive Planning and Forecasting (PPF).

Larysa Melnychuk, CEO and Founder of the FP&A Trends Group, led the discussions during this meeting. The agenda included the following items:

- Evolution from traditional to Predictive Planning and Forecasting

- Risks and rewards of Predictive Planning and Forecasting

- Key elements of Predictive Planning and Forecasting Solution Framework

- Roadmap to Implementation: Navigating through the FP&A Trends PPF Maturity Model

- Twinings Case Study on PPF, presented by Julien Lerolle, Head of Transformation Finance at Twinings & CO

- Group work

- Conclusions and recommendations

Figure 1: Paris FP&A Board №8, October 2024

We are grateful to Pigment for sponsoring this event. We also express our gratitude to IWG and Michael Page for their support.

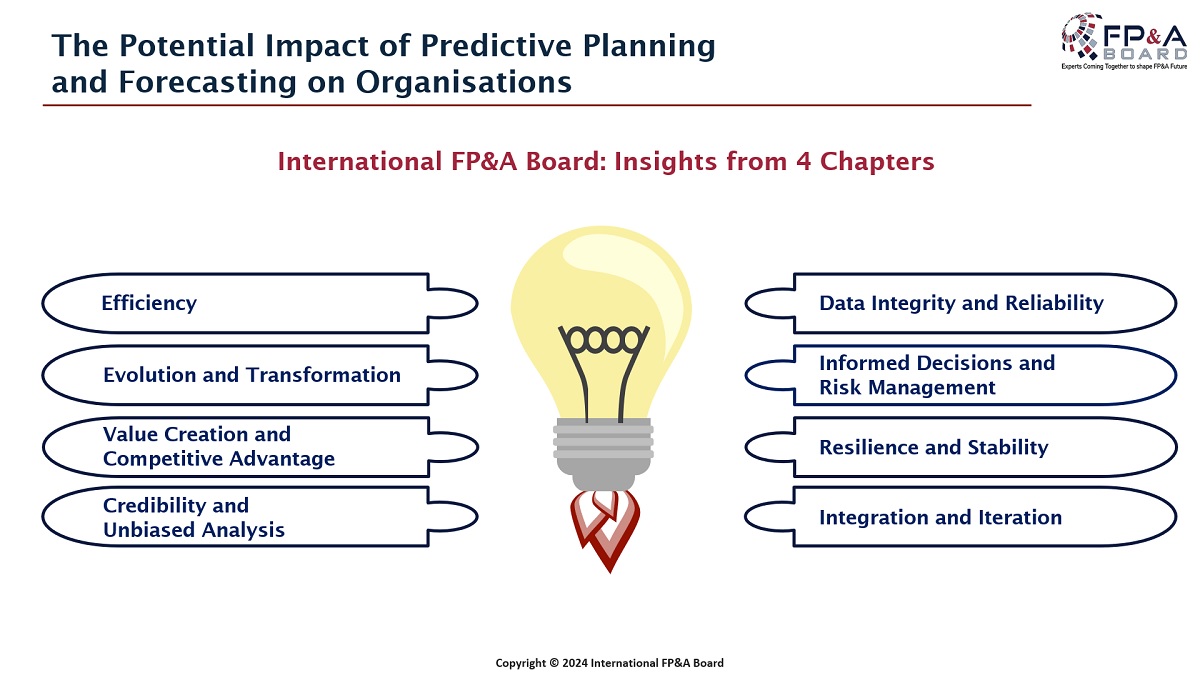

What Predictive Planning and Forecasting Can Bring?

The Paris FP&A Board started with the participants’ introductions. They shared their associations with Predictive Planning and Forecasting. The most cited insights were as follows:

- Efficiency

- Agility

- Accuracy

- Complexity

- Scenario analysis

These insights resemble those of FP&A leaders from other chapters, where the International FP&A Board hosted discussions on this topic. They highlight that we face similar challenges worldwide, regardless of our company sizes and industries.

Figure 2

Predictive Planning and Forecasting: Understanding the Key Notions

The essence of this planning approach was revealed in the definition presented by Larysa at the beginning of the event.

“Predictive Planning and Forecasting is a dynamic, data-driven approach that integrates strategic, financial, and operational planning processes by using flexible driver-based models and Predictive Analytics (PA) to inform decisions. By enhancing collaboration and responsiveness to change, PPF sets itself apart from traditional planning methods, which are often static, rely on fixed calendars, and struggle in environments laced with uncertainty.”

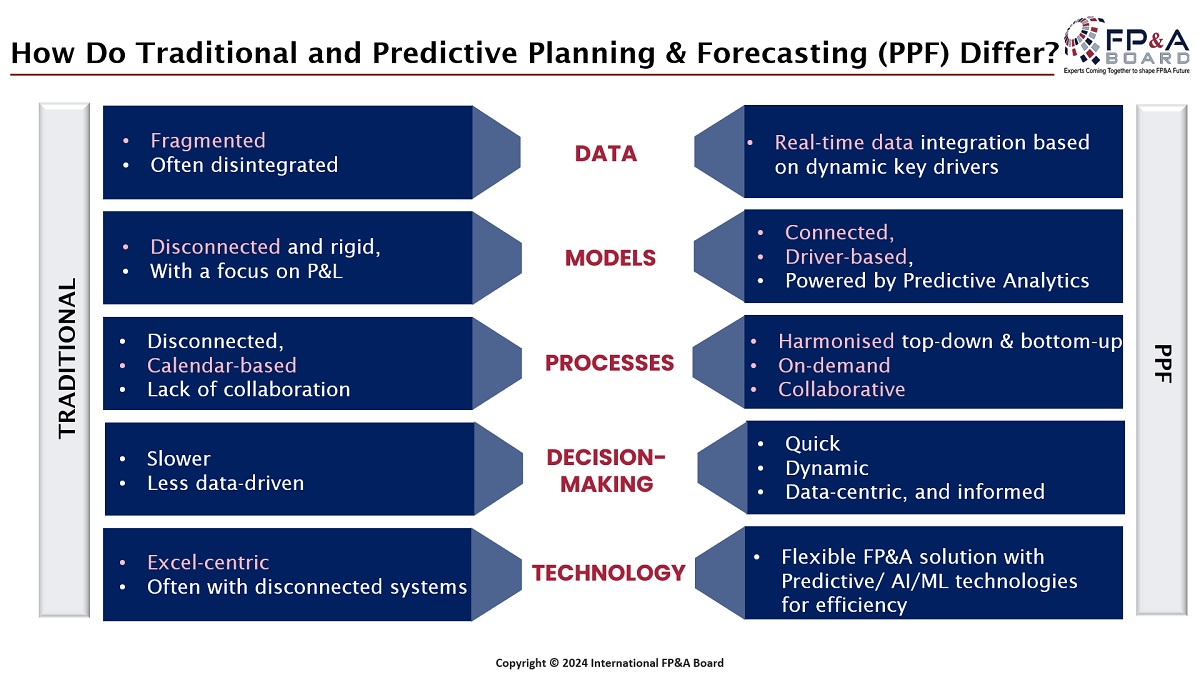

First, the Paris FP&A Board members explored the differences between traditional planning and PPF. Among the most notable contrasts, we can underscore the improved flexibility aided by technologies like Artificial Intelligence (AI)/Machine Learning (ML) and real-time access to harmonised data, which are not achievable in traditional rule-bound and rigid planning processes.

Figure 3

An insightful discussion on the most important factors for implementing Predictive Planning and Forecasting followed. The participants agreed that adopting driver-based models, using AI/ML for forecasting and cloud platforms, and developing different roles in the FP&A team are equally crucial for a successful journey from traditional to Predictive Planning and Forecasting.

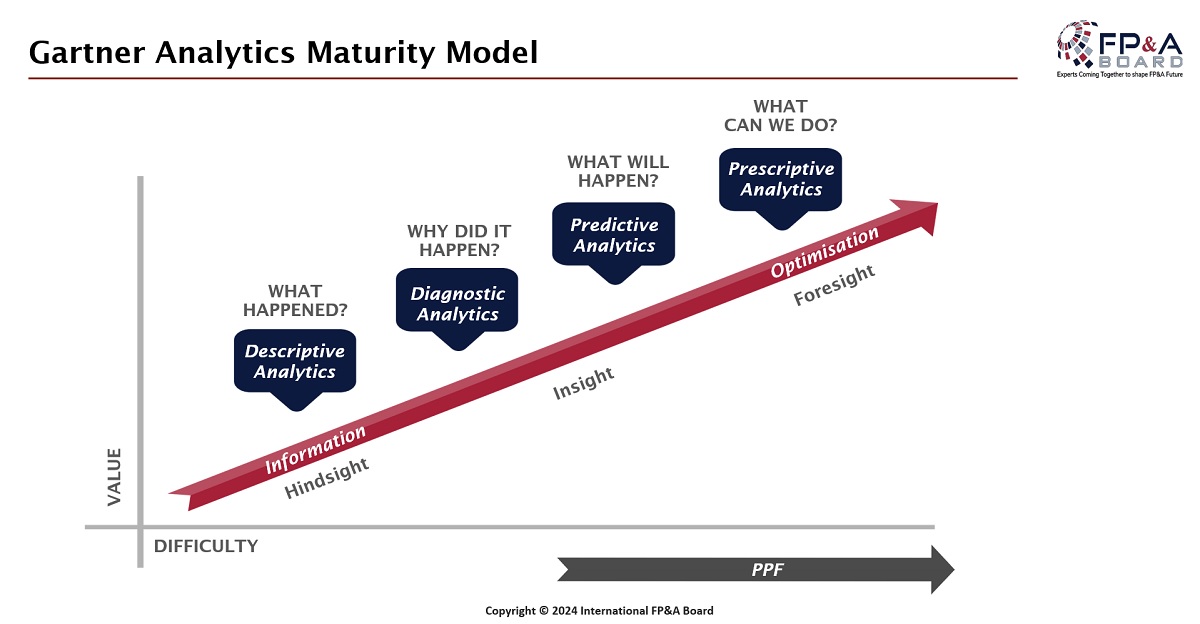

The event participants also talked about how Predictive Analytics and Machine Learning enhance PPF. In addition, we explored different types of analytical techniques (descriptive, diagnostic, predictive, and descriptive) associated with human and Artificial Intelligence.

Figure 4

Case Study on Leveraging Predictive Planning and Forecasting

On heated discussions centred around the essentials of PPF, participants welcomed Julien Lerolle, Head of Transformation Finance at Twinings & CO, to highlight his case study on how they moved from S&OP to a prescriptive planning solution.

The most critical points of his presentation included some practical steps to convince the management and get the appropriate talent in the team. To make sure that everything went as planned during the transition, Julien suggested the following:

- Develop a collaborative approach

- Encourage a culture of continuous learning and upskilling

- Understand business drivers

- Automation of data

Group Work Insights

The next point of the agenda was group work. The participants were divided into three groups to discuss the critical steps in implementing Predictive Planning and Forecasting from three distinct viewpoints:

- From the point of data and models

- From the point of FP&A skills

- From the point of technology and analytics

Figure 5: Paris FP&A Board №8, October 2024

The first group suggested the following:

- Start with models and measure what you need

- Identify the source of data, the quality and authenticity

- Check which data can be relevant

- Make it easily and fast accessible

- Ownership from management

- Focus on data quality enrichment

Adding their unique perspective to their peers’ thoughts, the people from the second group underscored the importance of the following skills and capabilities:

- Mindset change and evangelisation

- Storytelling

- Testing and learning

- Active listening and collaborative approach

- Finding and nurturing appropriate talent and creativity

Finally, the third group shared their ideas regarding the technology aspect. They stressed the need for:

- Establishing trust and understanding how to build it

- Having realistic expectations

- Leveraging Business Intelligence

- And defining the “Why” before the “How”

Figure 6: Group Work at Paris FP&A Board №8, October 2024

Conclusion and Recommendations

The meeting was wrapped up with brief recommendations for finance professionals on the critical steps to implement Predictive Planning and Forecasting. The participants had the opportunity to continue the discussion in an informal ambience and to network with their peers when the board ended.