In this short video, Tom Vanoverschelde, Finance Director at Capita, shares his practical experience in implementing...

CFOs are often reluctant to abandon a strategy or course of action because they have invested heavily in it, even when much better investment opportunities are already available. This phenomenon, called the "sunk-cost fallacy", affects many strategic financial decisions.

At the opposite end of the spectrum, business owners often change or rotate the management of their company every three or five years. Not because the new models and projects were better but because they had not been emotionally attached to the previous ones in the first place. The zero-based approach prevents business owners from being tied to sinking ships and stops them from jumping from vessel to vessel. It is a healthy way to align resources with the company's strategic objectives and eliminate unnecessary expenses and activities.

The Digital UK & Ireland FP&A Circle discussed answers to key questions concerning ZBB implementation.

This article provides an overview of the topics and cases presented and discussed by the expert panellists in the webinar "A New Age of Zero-Based Budgeting" and the results of our polling questions.

Zero-Based Organisation vs Zero-Based Budgeting

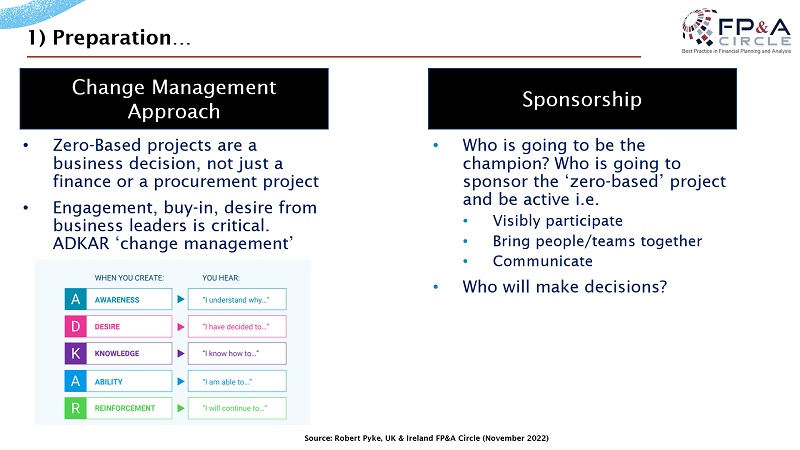

Robert Pyke, FP&A Director at Suntory Beverage & Food Europe, shared his experience with ZBB philosophy in three large organisations.

He emphasised the importance of the zero-based mindset, change management approach, and these key sponsorship questions:

- Who is going to be the champion?

- Who is going to sponsor the 'zero-based' project?

- Who will make decisions?

Figure 1

As well as sharing several practical tips on ZBB implementation, Robert drew our attention to the critical role of trapping and tracking.

In identifying savings, it is important to:

- Publish and communicate the identified savings

- Be crystal clear on assumptions

- Distinguish between savings and cost avoidance

While tracking savings sounds easy enough, it can be notoriously difficult. To achieve the necessary results, the following questions need to be asked:

- How can savings be isolated in reports?

- How can I build into budgets?

- Have I set up regular reviews to stop slippage?

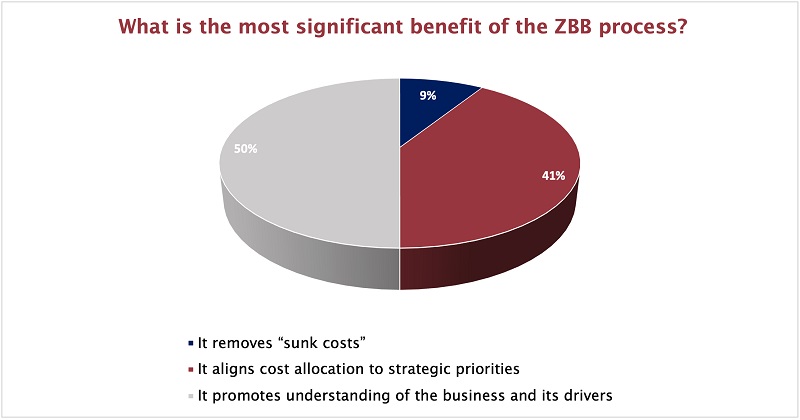

What Is the Most Significant Benefit of the ZBB Process?

During the webinar, guests from the FP&A industry participated in a poll and stated what they considered the biggest benefit of ZBB. 50% of respondents saw a clear connection between ZBB and understanding business drivers, while another 41% emphasised the benefit of aligning costs with strategic priorities.

Figure 2

Finance Business Partnering as Enabler of ZBB

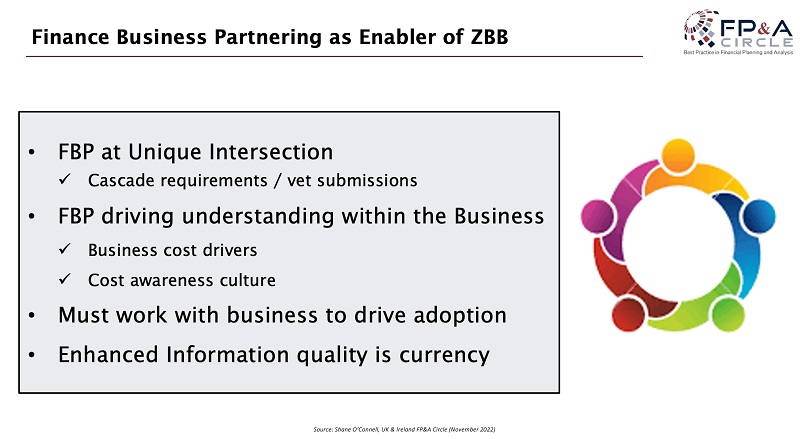

Shane O'Connell, CFO EMEA at Honeywell, shared with us his thoughts on the role of Finance Business Partners in successful ZBB implementation.

ZBB can be an aspirational ideal, but it cannot bring value without effective support from Finance Business Partners to embed it within the business. Business and finance should work hand in hand to analyse the enterprise, understand the drivers of performance and allocate spend and investment appropriately for growth.

Figure 3

Shane highlighted the potential for ZBB in the Post-Covid era, now that former non-negotiables like Office Space & Business Travel are discretionary costs.

Lessons Learned from Implementing ZBB

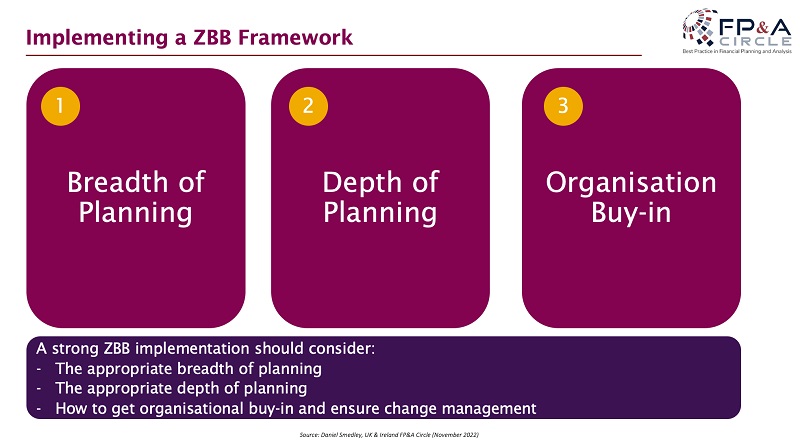

Daniel Smedley, CFO at AstraZeneca Canada, shared a practical case study on the implementation of ZBB at the multinational pharmaceutical.

According to Daniel, strong ZBB implementation should consider the following:

- The appropriate breadth of planning

- The proper planning depth

- How to get organisational buy-in and ensure change management

Figure 4

Breadth of Planning

- Decide on how broad the ZBB exercise will be (all cost categories vs one or two high-impact cost categories)

- Start with discretionary spend or a portion of discretionary spend

- Consider the frequency of ZBB planning – semi-annual, annual, bi-annual

- Rotate the use of ZBB planning for cost categories depending on the year

Depth of Planning

- Identify operational business drivers

- Decide on the level of simplification (expected volume x average rate vs expected volume x specific rate for each group/category)

Organisation Buy-in

- Establish the burning platform trigger and articulate the "WIFM" (What's In It For Me)

- Use both Top-Down and Bottom-up Communication, Education and Change Management

- Ensure the right processes and tools are in place to support the change

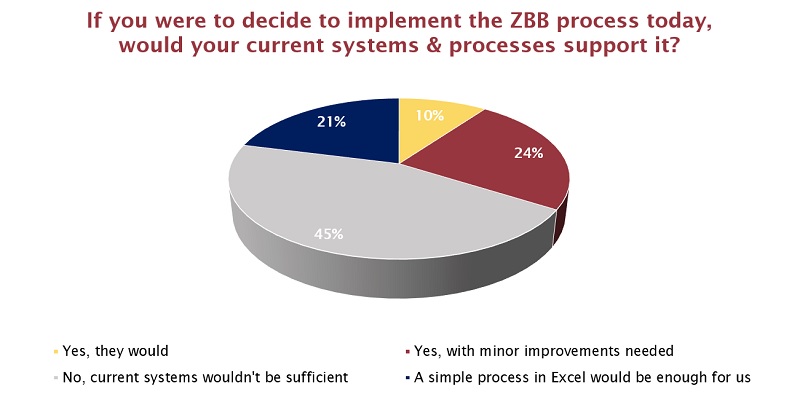

Would Our Current Systems & Processes Support ZBB Implementation?

According to our respondents, systems currently in place are not likely to be sufficient for ZBB implementation (45% of respondents). 24% of respondents felt that minor improvements would be enough to make them fit for ZBB purposes.

Figure 5

ZBB Technology Enablers

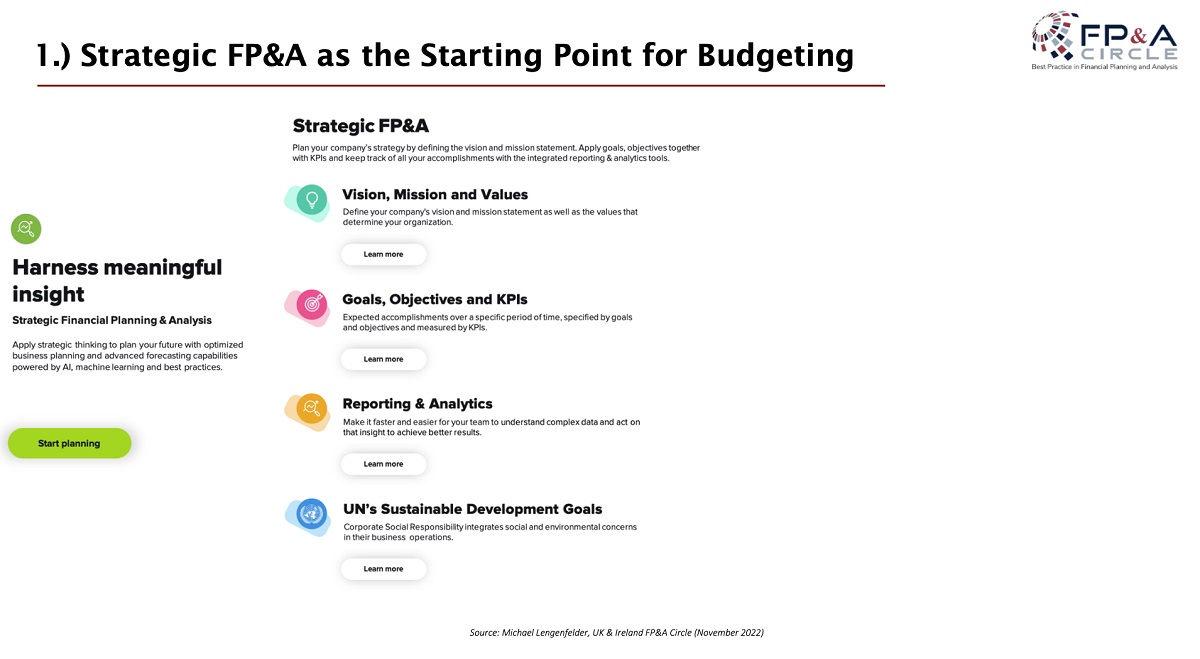

Michael Lengenfelder, Head of FP&A Product Management at Unit4, shared with us a practical overview of the role of FP&A software in ZBB implementation. He walked us through numerous examples of how software can help align cost allocation to strategic priorities with Strategic FP&A as a starting point for budgeting.

Figure 6

ZBB can also be automated thanks to Prefilling, Allocations, and Forecasting functions built into the platform. Value-driver forecasting and commenting functions can be extremely useful when discussing cost justification for ZBB purposes.

Michael went further in his examples, explaining how overhead allocation decisions can be made within FP&A software when in-house costs are not justified.

Conclusions

These days a zero-based philosophy extends well beyond cost savings, helping us set the right mindset and make clear strategic cost allocations. Although ZBB has more potential than ever in these post-Covid times, the lack of proper technology and automation makes it difficult to implement.

The only feasible solution here is to let the technology do the routine work for us and focus on business partnering skills, which will make the difference between a good idea and a successful implementation. These key skills encompass:

- Relationship building and communication

- Curiosity and challenger mindset

- Storytelling skills and making a good business case

We would like to thank our global sponsor, Unit4, for their great support with this FP&A Trends webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.