In the last couple of years, we have seen the business world turn upside down and...

In the era of rapid change, constant innovation, and permanent disruption, transformation becomes an integral part of running the business. Finance teams, FP&A in particular, play a vital role in supporting and even driving business transformation. In this article, I will use the example of my company, Philip Morris Switzerland, to discuss how Zero Based Budgeting (ZBB) helps accomplish this task. I will also explain why it is critical to develop a ZBB mindset and how this can be achieved.

Philip Morris International undergo a major business transformation. The company has re-defined its future and aims to replace combustible cigarettes with a range of smoke-free products. I will not go into detail about the transformation. Instead, I will focus on its impact on how we work and approach challenges and opportunities.

A product, route-to-market, much larger, and complex data sets are only a few elements of the business model that had to be re-designed. It required a significant shift in resource allocation. ZBB was an effective way to do it with the necessary degree of diligence, speed, and relevance.

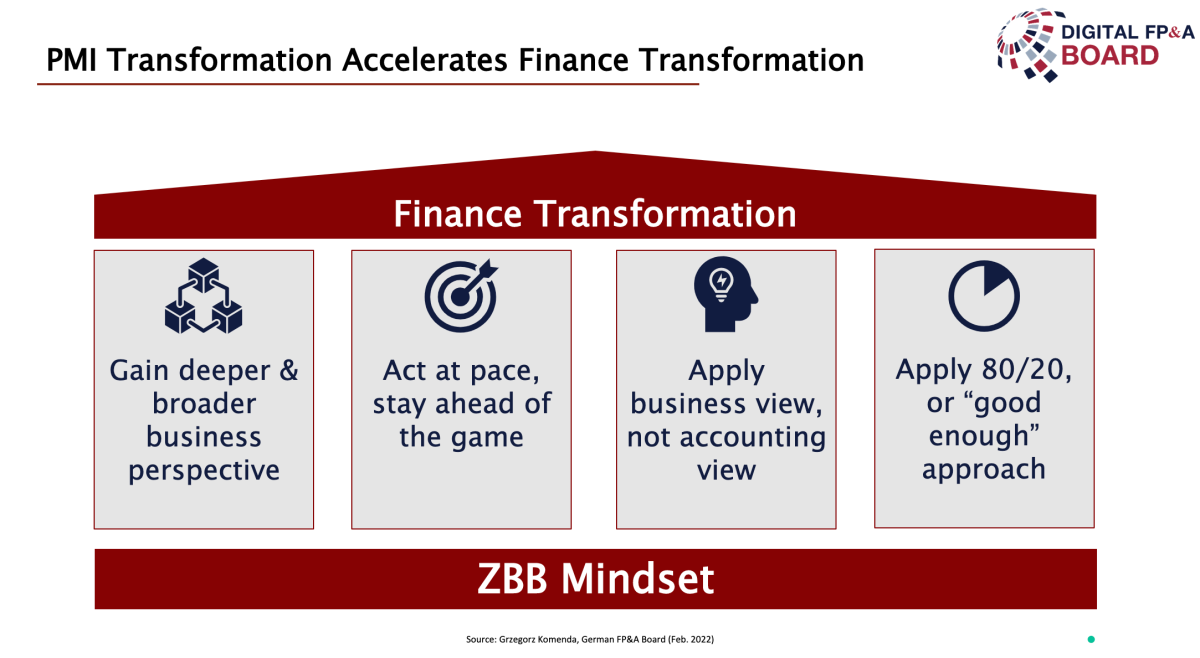

While the business transforms, finance teams cannot leave behind. They need to embark on the transformation journey as well to stay a relevant partner for the business stakeholders. I see the ZBB mindset as a critical enabler for the finance transformation. I define it as a constant quest to understand the “core” of the business and to connect the dots across the whole value chain. It goes beyond the costs and beyond the budget to become a new approach to measuring and driving the business performance.

ZBB mindset - what does it mean in practice?

In Philip Morris Switzerland, finance team members are an integral part of all main projects and initiatives. This way, they are part of all the discussions and decisions at the core of the business. Therefore, it is an excellent opportunity to learn and influence decision-making with the right financial perspective.

With such a level of business acumen, finance is much faster and more proactive. As a result, we can anticipate business challenges and be ready with the answers right when those answers are needed.

In addition, we can help in prioritizing the efforts. With an excellent knowledge of the business, finance teams will know best where the value sits. This will position them well to drive the decision of what to do, but more importantly, what not to do in order to maximize the overall business outcome.

It is also essential to speak the language of the business. While finance standards and practices determine accounting and financial reporting, in the business context, we need a new way of talking finance to our business colleagues. In Philip Morris Switzerland, we introduced a concept of a consumer income statement. Investments are treated as per the program they belong to, rather than accounting treatment. Moreover, we complement the costs view with resulting sales and revenues for the complete picture. This enables a dynamic assessment of the programs and the initiatives and reallocating resources if necessary.

Figure 1

ZBB mindset – and investment worth doing

The above are a few examples of how developing and applying a ZBB mindset will enable the finance transformation from a support function (a commonly used description of finance function) to a driving force of the business (a desired one). It is a long developmental journey, and finance teams need support from the organisation along the way. It has to be clearly stated what capabilities are required. They need to go beyond “traditional” finance capabilities into the area of storytelling, influencing, project management, or dealing with complex data. A robust assessment process needs to be provided to allow finance people to map the gaps between the current and intended capabilities levels. Subsequently, a targeted learning offer needs to be available, a healthy mix of theory and opportunities to practice newly acquired skills.

Developing a ZBB mindset is a long and challenging process that requires a lot of effort and energy. It comes, however, with a big prize, that cannot be neglected. Finance gains a seat at the table. They become a relevant and credible partner in all business discussions and decisions. In Philip Morris Switzerland, we have introduced a notion of co-piloting the business to stress the proactivity and driving ambition, the transformation from finance people to business people.

Finally, with the application of the ZBB mindset, finance jobs become more appealing and exciting, which helps attract talent in the increasingly competitive labor market.

Conclusions

The world is changing, the business environment is changing, and finance needs to re-imagine themselves as well. ZBB mindset supports finance teams on this journey by pushing them to deeply understand the business and connect the dots, build relevant insights based on available data, and use a new set of skills to influence the future direction. In other words: it enables them to become real co-pilots of the business.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.