Organisations that pursue Zero-Based Budgeting (ZBB) often cite three main reasons for doing so: limited resources...

Zero Based Budget has seen a resurgence over the last few years, especially during the pandemic. As organisations feel the effect of the pandemic, they are turning more and more to using Zero-Based Budgeting (ZBB) to ensure survival.

Is ZBB Just a Cost-Cutting Exercise? No!

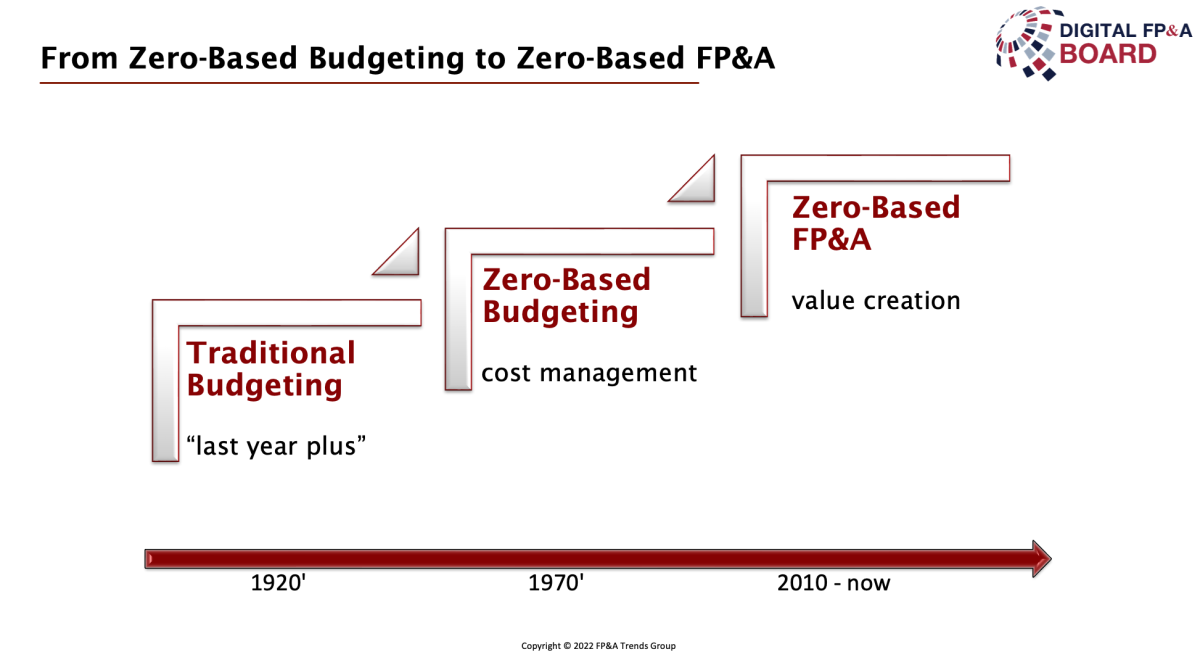

Well established profitable organisations are championing this concept. To them, it’s a completely different way of working, a change in mindset that encourages resource allocation and re-investment where most needed ensuring the company's growth. Financial Planning and Analysis have been leading in this area with the new concept termed Zero Based FP&A.

The members of the digital German FP&A Board met virtually in February 2022 to explore Zero Based Budgeting in much more detail. Below is a summary of what was discussed.

Figure 1

A New Age of Zero-Based Budgeting: Learnings and Successes

Zero-Based Budgeting is where we develop a budget from scratch or zero bases by examining each Profit & Loss and Balance Sheet item without regard to the prior year activities. Zero Based FP&A takes this to the next level by applying the same concept to the overall planning and forecasting framework. We use this concept to:

Identify business and value drivers

Applicate to lines in not only P&L but B/S and CF

Enable educating stakeholders and business partners on key business drivers

Resource reallocation for maintaining company growth

On the day, 74% of the respondents said they do not utilise Zero-Based Budgeting in their organisation. This must mean that there are plenty of opportunities for adoption and gaining all the benefits of ZBB.

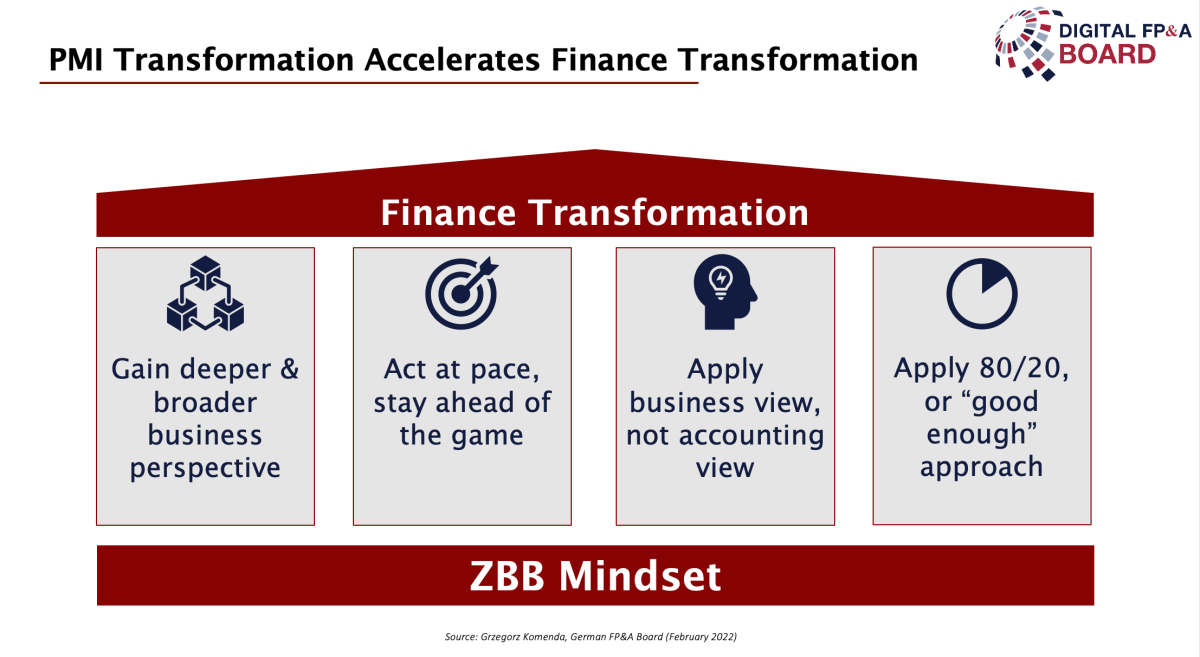

ZBB: Mindset Change for Finance Transformation

Grzegorz Komenda, Director of Finance and Business Planning at Philip Morris Switzerland, advocates ZBB as a way of working. We have to create a ZBB Mindset in the organisation and the keyway of achieving this is the buy-in from management as well as the finance team.

We need to clearly define and map out new skillsets. These go way beyond just classical finance. Have a robust assessment tool that enables learning journeys and provides opportunities to apply these new learnings in real life.

Figure 2

The ZBB Mindset allows the team to get a deeper and broader business perspective and understanding of the business, enabling quicker decision making. It also allows FP&A to step away from thinking around financial year ends and instead look at everything from a business perspective and work on progress rather than perfection which withholds the team from ever achieving anything in a timely manner.

Another benefit of the change is the mindset of FP&A getting a seat at the decision table as they transform from a support function to a driving force within the organisation becoming a true co-pilot of the business. This has also proved very efficient in attracting talent!

Risk Planning in ZBB

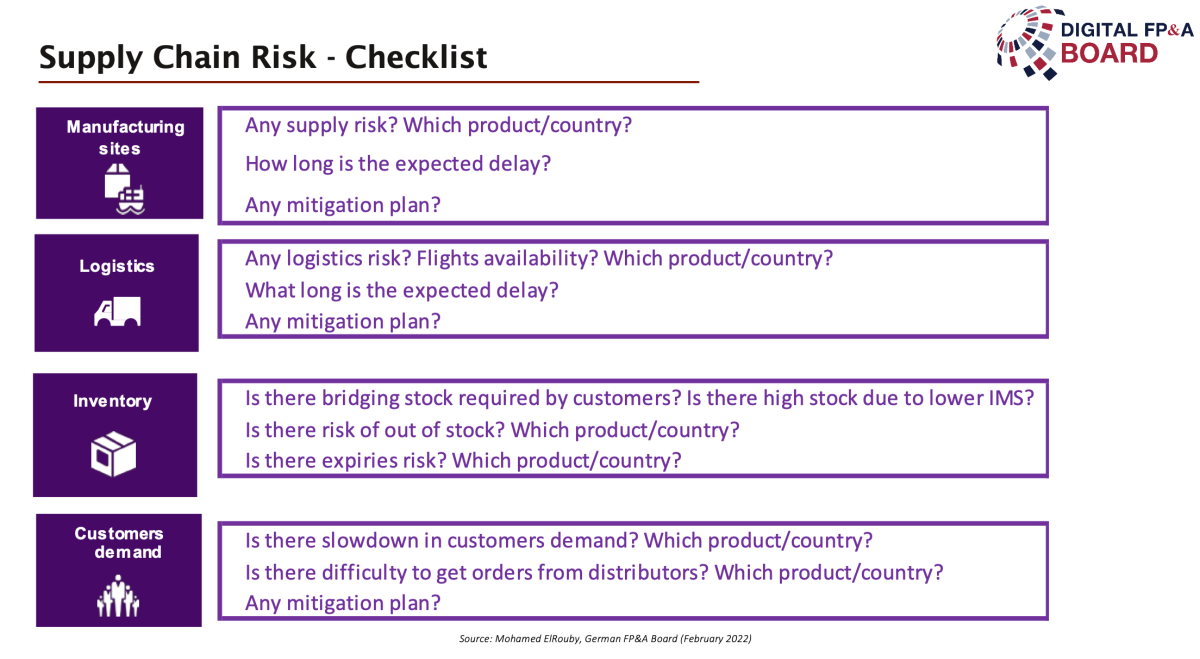

ZBB played a key role for Pharmanovia during the Covid period! Mohamed El-Rouby, CFO of Middle East Africa at Pharmanovia, describes how he had to integrate detailed level of risk management into his Zero-Based Budgeting process to ensure they navigated and planned their way through the thick of the pandemic.

16 critical areas were identified and assessed. These were Product & Supply, Commercial and Regulatory & Pricing. Each was looked at in detail, and their financial impact on P&L, B/S and Cash Flow was assessed.

A checklist for each of these blocks was designed and the following questions were addressed:

What are the risks?

What country/geographies does it affect?

What are the mitigation plans?

What are the financial impacts and how does that affect our ZB budget?

See the image below for a detailed assessment of Supply Chain.

Figure 3

Finally getting a rigorous governance process around the risk management and ensuring constant review ensures even in uncertain times, all the risks are mitigated.

42% of organisations on the day manage risk within their ZBB model whilst the remainder manage it outside. Really encouraging is that all of them look at risks very closely as part of their budgeting process!

ZBB Technology Enablers

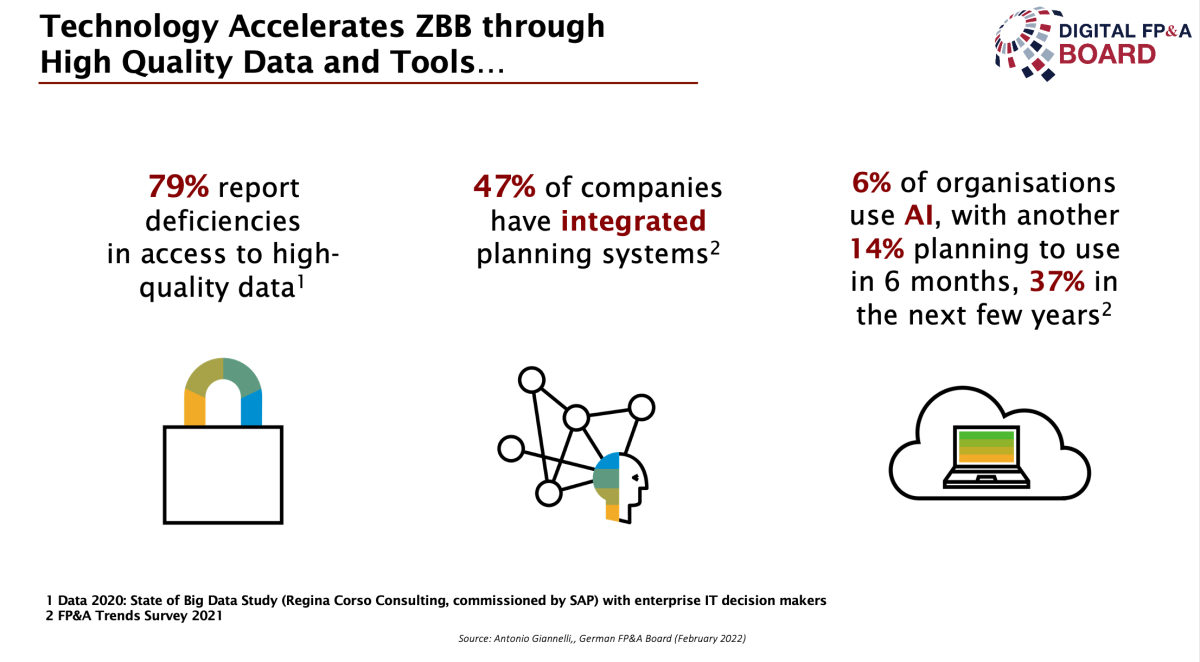

The start point for Antonio Gianelli, Finance Development Expert at SAP, were the stats from FP&A Trends and Data 2020 surveys as per below.

The 3 key messages were:

1. Planning should be Integrated with ERP & Data Warehouse

Giving access to relevant drivers

Providing better Accuracy

Enabling better bottom-up plans build

2. Modern Planning tools provide great features and functions

Built-in collaboration

Machine Learning and AI tools to discover hidden insights

The ability for simulation and Scenario Planning

3. Zero Based Budgeting powered by xP&A

Provides strategic alignments with all departments

Creates awareness and elimination of surprises across the organisation

Makes for faster and more impactful and confident decision making.

In the final poll, we looked at what functionalities respondents said they were missing from the current budgeting tool. Whilst 18% responded Predictive, AI and ML, 11% wanted their financial and non-financial system to be integrated. Another 8% each mention the lack of Collaboration on their platform and xP&A enterprise-wide platform. A huge majority of 55% said all of these were missing.

At the end of the session, we have concluded that the adoption of ZBB and Zero-Based FP&A is a must. Not only does it provide the cost-cutting measure that it initially sets out to do, but it is now looked at as the way forward to grow the company.

In Summary:

Apply ZBB to the overall planning process

Should look at P&L, B/S and CF and it relates to costs as well as revenue lines

ZBB is a growth engine

Create a ZBB Mindset in the organisation

Achieved by ensuring buy-in from management as well as the whole of finance

Include risk management within your ZBB

Use the power on the Integrated platform

New AI technologies to uncover those hidden drivers

We would like to thank our global sponsor SAP for their great support with this Digital FP&A Board.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.