In this blog, we will look at integrated Financial Planning and Analysis: what it is and...

I enjoyed attending a fascinating webinar on Integrated FP&A recently organised by the FP&A Trends Group. This time, the panel of senior finance practitioners from Mondelez, Mitie, and Jedox discussed what we need to consider before aligning our plans. 552 finance professionals joined the session from different parts of the world.

The topic covered is close to the heart of many finance professionals - how to have an integrated planning process? It can help us:

- save time,

- enable input from multiple areas,

- generate outcomes and scenarios which can be communicated effectively in a business where everyone is aligned and can contribute to effective decisions.

It sounds so simple! The truth is that going ahead with integrated FP&A is possible, and the path to get there is not insurmountable.

This FP&A Trends Webinar featured presentations from a strong panel of speakers:

Figure 1: The Panel of Speakers at this Webinar

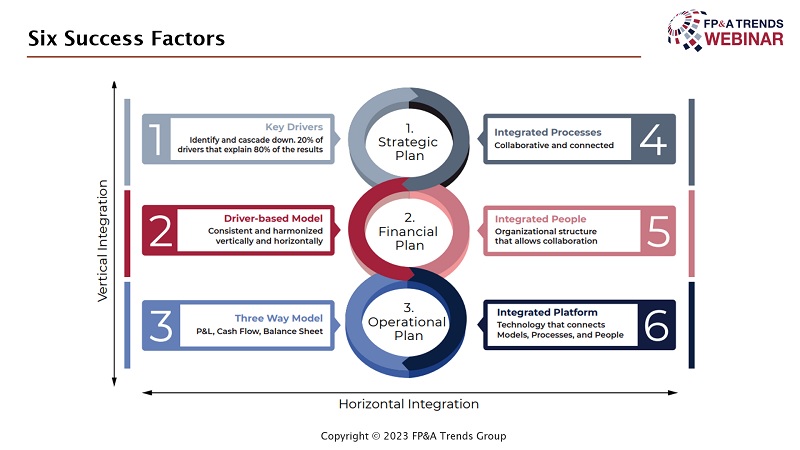

The Ground Rules, i.e. the Six Success Factors for Integrated FP&A

At the core of the process is the need to establish some principles. These rules should transcend industry and technology and enable the cadence of the planning process to be sustainable.

Figure 2: Six Success Factors for Integrated FP&A

Once understood and applied effectively, these six principles allow the gains many FP&A teams worldwide seek to become a reality. And this session provided a window into that future.

Integrated FP&A - A Case Study at Mondelez International

Jana Kottasova, VP Finance at Mondelez, provided a fascinating insight into the journey Mondelez embarked on towards the integrated FP&A. At the outset, Jana faced the same struggles as CFOs and heads of finance teams have had. These were as follows:

- no dedicated planning tools,

- FP&A people used Excel for their planning,

- different teams generate different numbers, and many people spend time reconciling data, resulting in a long and cumbersome forecast process that no one is happy with.

So how to bring about change? Mondelez started on some basics, establishing some key principles for the forecasting process. They decided to take a high-level approach to implement it globally, as shown in the following picture.

.jpg)

Figure 3: Source: Jana Kottasova's presentation during the FP&A Trends Webinar on Integrated FP&A

The first step was to set out the frequency of monthly Rolling Forecast for over 18 months horizon. The second was not to touch the volume forecast with an automated upload from the demand planning tool. If there were adjustments, they were very transparent. Finally, they wanted to establish a globally aligned Rolling Forecast calendar like a month-end calendar.

Once the parameters for the process were established, then Mondelez moved on to principles for input, and these were as follows:

- Standardise the scenarios and apply driver-based forecasting.

- Allow FP&A teams to model scenarios effortlessly.

What happened then? Mondelez trialled this on one division and came out with the following results, and then one of their key business units reported a 20-40% reduction in the manual workload. Except for it, producing a monthly financial forecast now takes only a day. Before applying driver-based forecasting, this process took five. Now Mondelez is rolling out the revenue automation to other divisions and benefits from better forecast accuracy.

Some of the key learnings from Mondelez were as follows:

- There was one set of numbers that everyone agreed on for transparency of adjustments.

- Integrating people, processes and technology into a single ecosystem can provide reliable outcomes and improve the abovementioned forecast accuracy.

- Integrating data and insights improves decision-making.

- She also noted that three levers were the most important for them to succeed: people, reinventing the processes, and technology with data.

After this presentation, the audience was asked to assess the level of FP&A Integration at their organisations. It was the first polling question during that insightful session. Its results are shown in the figure below.

.jpg)

Figure 4: Polling Question #1

A Case Study of Interserve Support Services

The next session was presented by Sile Lillis, Finance Director at Mitie. She gave a succinct presentation based on her experiences with her previous company, Interserve Support Services.

The organisation was having some financial difficulties, and the key takeaway Sile wanted to give people was that you didn’t need huge financial resources to have integrated planning.

They started their integration by diligently going through the following factors: people, processes, organisation, drivers, and stories. She said they decided to pick a 3-way model and understand their key drivers (including macroeconomic factors). The next step was to assess which process they wanted to integrate. Sile pointed out that they had at least two hundred different spreadsheet models, which was very inefficient.

Indeed, they also understood they would bring disruptive change into the business and needed to bring the different stakeholders along. They decided to convey different messages explaining the benefits of these disruptive changes to various parties. Per Sile, there were four groups of stakeholders: the board, finance, organisation and shareholders.

After it, she elaborated on how they managed to achieve FP&A Integration. The first step was establishing a continuous improvement process with several "sprints". The key consideration was eliminating the spreadsheet inefficiency and passing their function to a platform that could produce the P&L forecast. The second "sprint" was about bringing sales CRM data, purchase and sales ledgers to get an overall view of the balance sheet. In the third one, they added procurement.

The key learnings are as follows:

- Do not let the insistence on perfection prevent the implementation of good improvements.

- Celebrate the wins. Understand where you are on the journey, acknowledge the people and the achievements along the way and celebrate them.

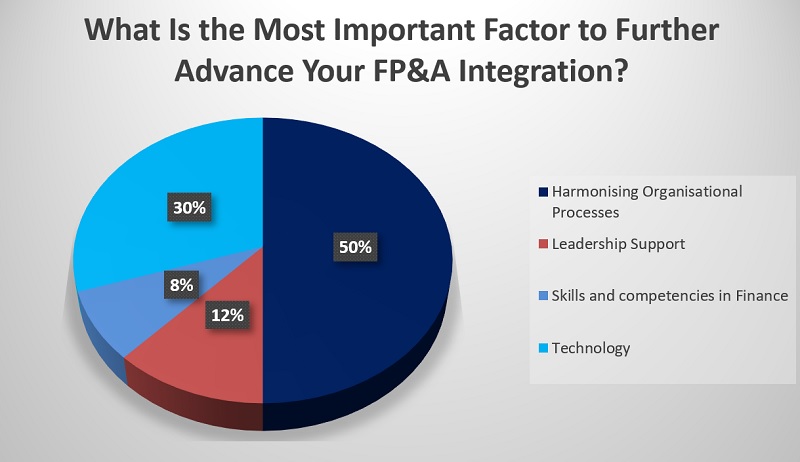

When Sile Lillis finished her speech, the discussion facilitator, Hans Gobin, asked the audience about the most important factors for advancing FP&A integration. The responses are shown below.

Figure 5: Polling Question #2

The Role of Modern Technology and Analytics

Finally, Rolf Gegenmantel, Chief Product Officer at Jedox, gave a presentation on the technology element.

One of the key things Rolf started with was the importance of a flexible enough system, i.e. an adaptable Performance Management Platform. This can then manage multiple scenarios and issues and deal with different drivers. It is essential in terms of driver logic that has to be modelled – the system should be flexible enough to understand the driver and use it to create multiple what-if scenarios. One of the other key elements of a platform was the question of how the system’s user interface works. This might be Excel or a mobile interface, so the platform provides a single set of numbers. Also, it should have an effective interface for people to use the system.

Artificial Intelligence mechanisms that analyse the data then take the data with the highest correlation to the outcome and bring that into the system.

So, in summary, an effective platform:

- Brings multiple data from different sources (i.e. excel, another software tool, etc.) into the platform, allowing the data to change and even change the sources of this data.

- Brings correlated and effective data (value drivers) into the platform, which can be modelled, and Scenario Planning can be done.

- And finally, communicating back to the team to drive behaviour change or more effective decision-making and workflows, dashboards & online communication are essential to align people.

Closing Thoughts

Jana Kottasova believes that moving towards Integrated FP&A is necessary for many organisations operating in this dynamic environment and states that technology can help us get better insights faster. Sile is sure that the company's culture is also critical for achieving it, while Rolf summarised that adaptability remains the key.

We are very grateful to our global sponsor, Jedox, for sponsoring this webinar. The session provided an in-depth look at the Integrated FP&A, and we also want to thank our panel of experts for delivering great presentations and sharing their insights with our audience.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.