This paper evaluates the transition process, and the challenges organisations may encounter when embracing the Scenario...

While the world is becoming more unpredictable, Financial Planning and Analysis (FP&A) professionals are looking for new tools and techniques for planning and forecasting in a constantly changing environment.

In March 2020, when the pandemic hit and the business world was full of "dead budgets" and unrealistic forecasts, Scenario Planning became a critical technique for the decision-making process.

Evolution from Scenario Planning to Scenario Management

Scenario Planning has been around for many years. It has been used not only for Strategic Planning but also for Risk Management and Financial Analysis. Practically every traditional budgeting and planning process has often included three "classical scenarios": the best, the worst, and the average. The reality shows that having these basic scenarios is not enough. Indeed, the events of the past years have dictated the requirement for agile and adaptable planning.

John Murphy, CFO of the Coca-Cola Company, once said a great phrase about the evolution of Scenario Planning.

"I've become less and less of a fan of the term ‘Scenario Planning' in the last nine months... I think of it more as Scenario Management than Scenario Planning."

Scenario Management is not just a process; it is a mindset. In other words, we need to recognise and accept that the traditional "one annual plan-four quarterly forecasts" framework no longer works. To manage uncertainty, FP&A professionals need to understand multiple futures and the drivers that create them. We must manage multiple scenarios on demand, collaboratively, analytically, and quickly (practically in real-time).

We all know what we need, but how exactly can we create a Scenario Management "eco-system" that will work?

We have to ensure the harmonisation of all organisational planning and forecasting processes. In practice, it means that if the strategic plan changes due to new environmental factors, the connective adjustments in operational and financial plans are automatically updated. Therefore, the best-in-class Scenario Management Process is the ultimate goal for any FP&A department.

Challenges with Scenario Planning

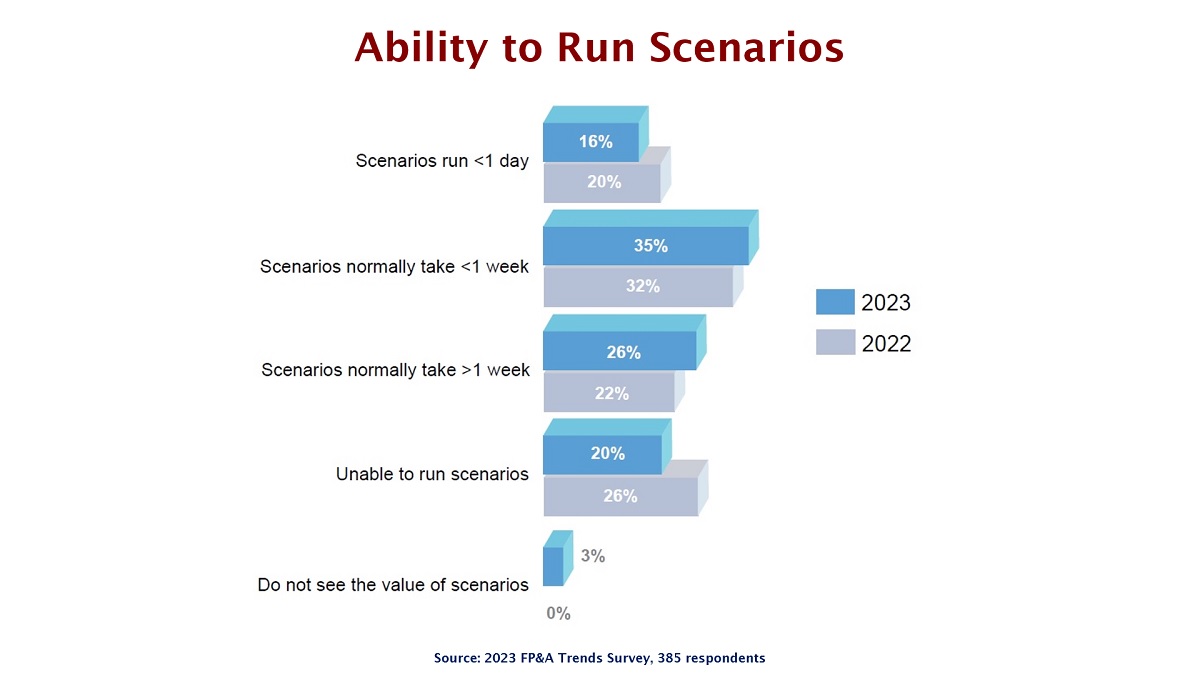

Many organisations are still struggling with Scenario Planning today. According to the 2023 FP&A Trends Survey, only 16% of the respondents surveyed could run scenarios in less than one day. Surprisingly, 20% of respondents cannot run scenarios at all, and 26% struggle with them for weeks (Figure 1). The scenarios will become useless if they take days to produce.

Figure 1

How can we afford to spend so much time on one scenario in this incredible environment of "Black Swans" and "Perfect Storms"?

Modern Scenario Management Framework

To fight these inefficiencies, FP&A professionals should be aware of how they can improve the situation.

Most organisations typically have three distinct planning processes:

- Strategic Planning – determines future goals of the organisation and the strategies to achieve them;

- Financial Planning – determines cash requirements, investments, and the assignment of resources to achieve organisational objectives in the short-term (e.g., next 12 months);

- Operational (or tactical) Planning – continually tries to balance supply with demand, maximise the use of resources, improve efficiency, and deal with unexpected changes at an operational level.

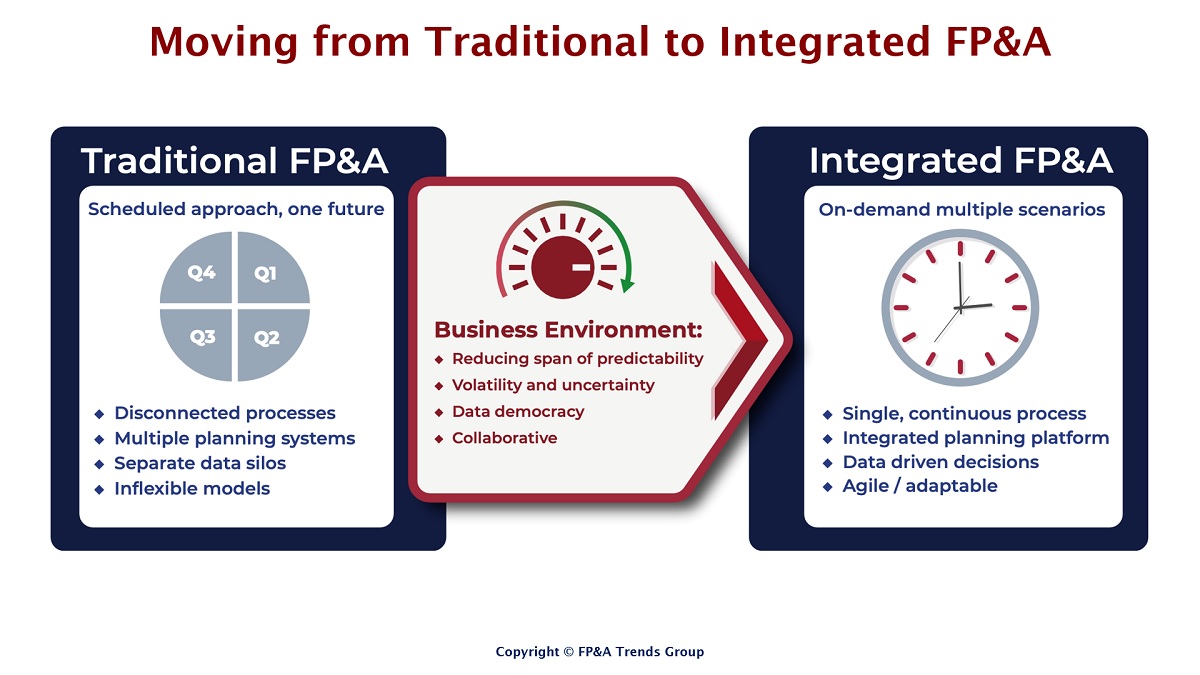

The first step in developing the modern Scenario Management framework is harmonising three key organisational planning processes (Strategic, Operational, and Financial). These processes should become single, continuous, and integrated horizontally and vertically. In other words, we need to shift from Traditional to Integrated FP&A.

Figure 2

What Is Integrated FP&A?

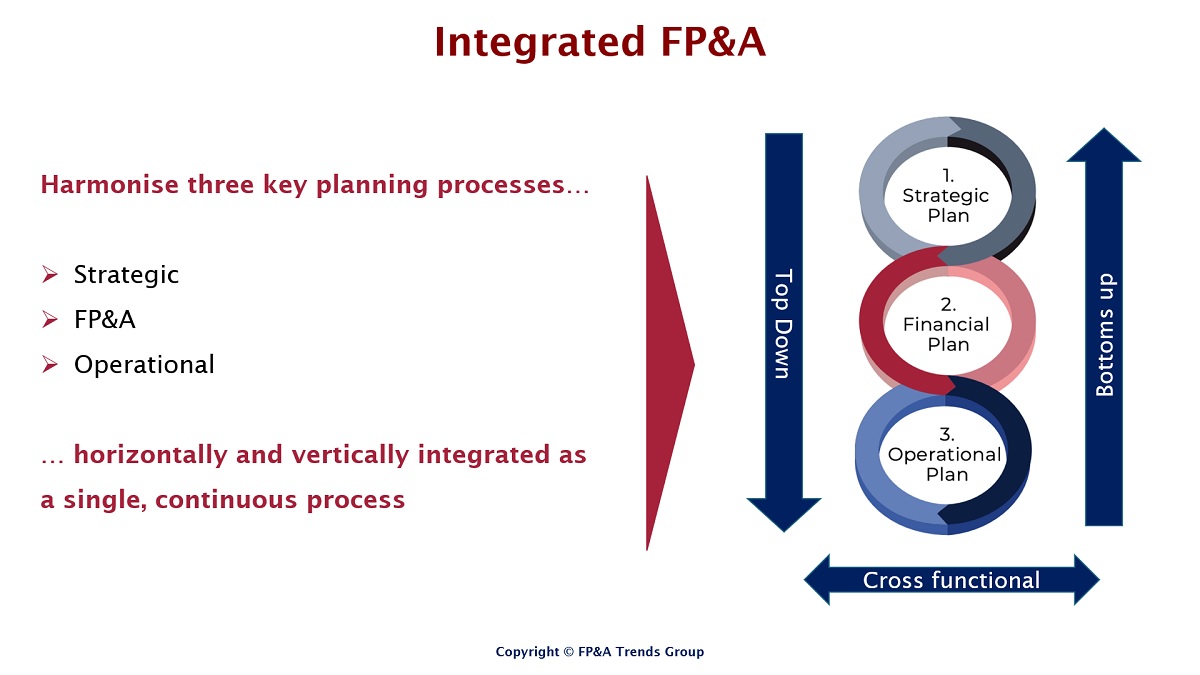

Integrated FP&A is a single and continuous framework where plans and forecasts are horizontally and vertically integrated (Figure 3). This concept represents the coordinated departmental activities that lead to developing, assessing, and implementing ''the most likely scenarios" to achieve corporate goals. Also, it allows businesses to evaluate and support the impact of multiple futures on demand.

Figure 3

"Six Success Factors Matrix" for Integrated FP&A

Now we understand that Integrated FP&A is essential for modern Scenario Management. But how can we implement it in practice?

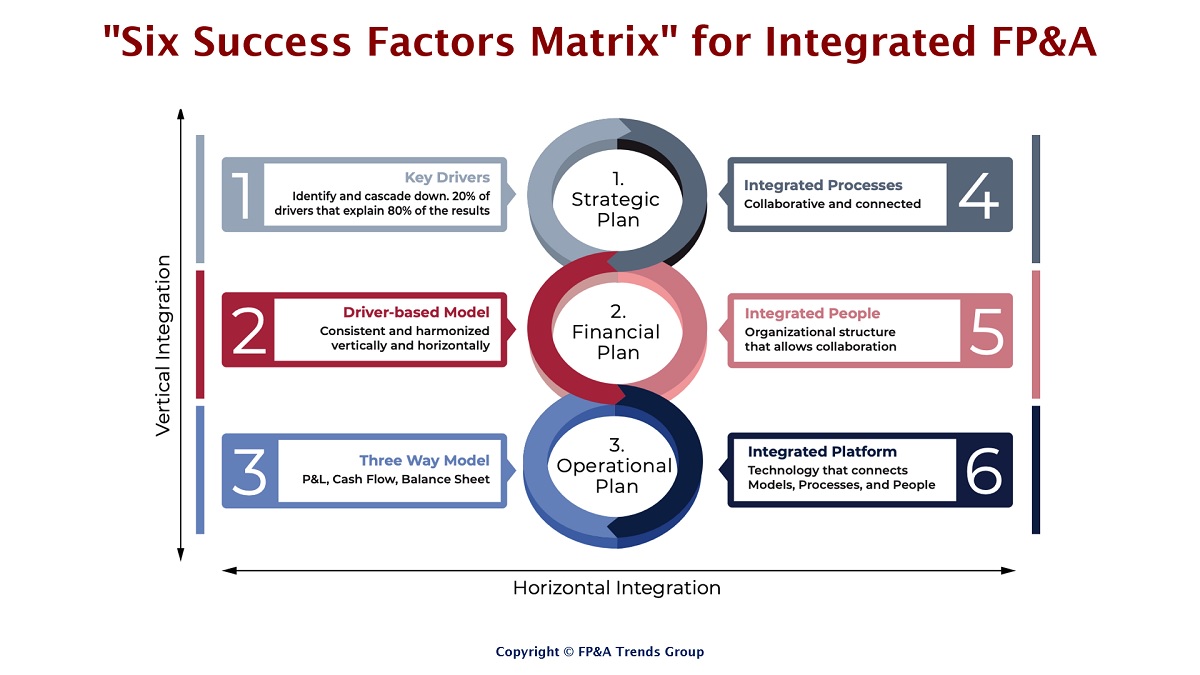

The International FP&A Board summarised the following six factors required for a successful journey towards Integrated FP&A, following discussions and research into practical insights from leading organisations (Figure 4).

Figure 4

In order to harmonise planning processes vertically and horizontally, we need to pay attention to the following six aspects outlined below.

1. Identifying key business drivers, both internal and external

It is important to focus on the most critical ones. For example, companies should focus on 20% of drivers, which can explain 80% of the results (according to the Pareto principle). Pay attention to the connection between drivers down from the Strategic to Operational level and up the other way. Understanding the key drivers and how they are connected to different levels of an organisation must become an important, regular exercise for any modern FP&A department.

2. Create a fully driver-based FP&A model with those key business drivers

From my experience, even a simple Excel-based, fully driver-based model will significantly impact your ability to run scenarios. Make sure the model connects all three levels of planning. You need to understand how drivers are connected and cascade and model them accordingly in order to integrate all your planning and forecasting frameworks within an organisation.

3. Any good model should be a "three-way model"

To illustrate my point, it should connect all three accounting statements: Profit & Loss (P&L), Cash Flow, and Balance Sheet. At first, it sounds simple, but from our experience, we know that only around 20% of organisations have three-way connected models. The majority still focus on P&L with disconnected Cash Flow and Balance Sheet matrixes being used. The connected financial model is a must for the environment of constant change where cash planning is important, and capital is limited.

4. Integrate your essential planning processes

Re-think who does what. The planning process should not be overcrowded. It should not be too centralised as well. As a Business Partner, the FP&A professional knows all the essential information flows for planning and forecasting. It is vital to streamline your processes, models, and workflows to the essential activities. Traditionally, some organisations continue to plan down to the general ledger level and/or to every cost centre. Remember to review the process to simplify and shorten it, removing and automating unnecessary tasks.

5. Factor in people's considerations

As any planning is a group exercise, review the team involved. Important considerations are:

- Do we have enough skills?

- Are there any knowledge and experience gaps?

- Do the non-financial people involved understand the whole process? Help them understand the key business drivers and ensure they understand the FP&A model.

- Eliminate any misunderstanding around the terms and processes.

6. Modern FP&A technology is an important asset for any organisation that wants to plan for uncertainty

However, we place it at the end because it would enhance the process significantly if all the above five factors were well taken care of. If modern technology is implemented with the static model and not integrated processes, the system will only enhance the inefficiencies within your FP&A team.

Conclusions and Recommendations

FP&A Scenario Management is an essential mindset that modern organisations should adopt to plan and make quick, informed decisions in this uncertain environment. However, most companies still struggle with old processes, static models, and outdated technologies. All of that raises a question: how and what can we change?

This article offers guidance on how to move to a more agile and adaptable process. Consider how long it takes you to run scenarios within your organisation, and if you are still stuck in a very long and complex planning process, start thinking about the six success factors described. Work towards an Integrated FP&A Process and Scenario Management mindset.

This article was first published on think-cell blog.

Learn more by accessing the related content below, and stay up-to-date on the latest FP&A best practices by following me on LinkedIn.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.