In his insightful presentation, Garrett outlined how FP&A Connector can bridge the gap between operational planning...

“The only certainty is change.”

This is true for many aspects of our professional lives and the organisations we work for.

Even if you work in a ‘steady state’ industry like public service, the Financial Planning & Analysis (FP&A) function will also experience the winds of change.

Is your FP&A function set up for change success? Do you have the right ability and capacity to support the changes happening to your business and take advantage of them?

This is a question I recently posed to myself and my managers. And it led us to re-think our purpose and objectives:

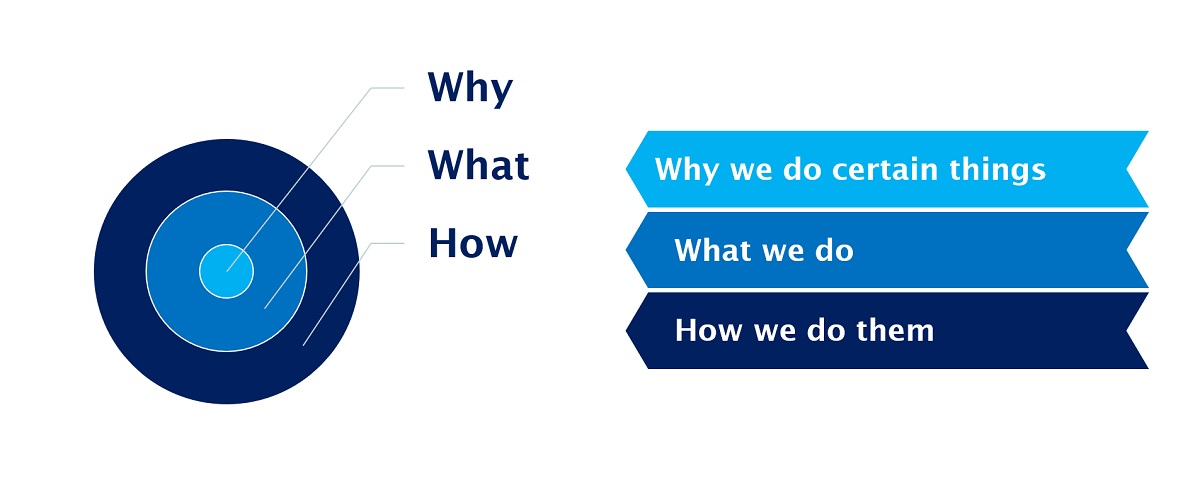

Figure 1: How Business Planning & Reporting rethought its objectives

Through revisiting our purpose objectives and how to deliver our services, we were able to ask what needed to be changed. Was it systems, technology, processes, or people, or all of them?

All were within our scope. However, for this article, I’ll talk about our mix of people. Did that need to change? What aspects needed to be changed: their skills and capabilities or, perhaps, capacities and culture?

I’ve summarised the steps we’ve taken towards this change below.

Understand Your Purpose and Know Your ‘WHY’

It was time to revisit our role in the business. Why do we exist? Are we still relevant? Could we support the growth and continuously changing requirements?

We knew where we wanted to be, partnering with proactive and future-focused advice and insight derived from data-driven analysis and dynamic forecasts.

But were we delivering it? To help answer this, we had an independent person who conducted a short survey of senior stakeholders in the business. Their feedback was illuminating.

They strongly appreciated our reporting, forecast and budget process and associated support. However, there was some confusion about our role in producing deeper analysis and insights and a demand for future-focused analytics.

We were strong at providing historical and reactive information but inconsistent with providing insights or the ‘what’s next’.

Figure 2: Leading-edge and mature FP&A practice needs to be proactive and provide foresight

There was also ownership confusion about where financial and non-financial information converged. There was ambiguity as to who should be providing the performance reporting at an operational level and who should be responsible for extracting the ‘what ifs’ and ‘what’s next’ from that information.

In short, there was a lack of clarity on who from the FP&A teams was responsible for different business insights.

We also received comments like, ‘sometimes I think we are talking about different things’, and ‘I’m left wanting more’. Ouch! That was a hint that our Business Partnering and storytelling were lacking.

Although disappointing, it explained why we often duplicated effort, reports, and why sometimes I heard that contradictory information was offered.

When discussing this with my managers, we felt confident we had the right ingredients for a powerful FP&A function. But what was holding us back?

Systems and processes also play a part here. Nevertheless, people were the priority, and we wanted to focus on them and figure out where the focus for change should be:

- Mindset

- Team culture and values

- Role alignment with skills

- Clarity and expectations?

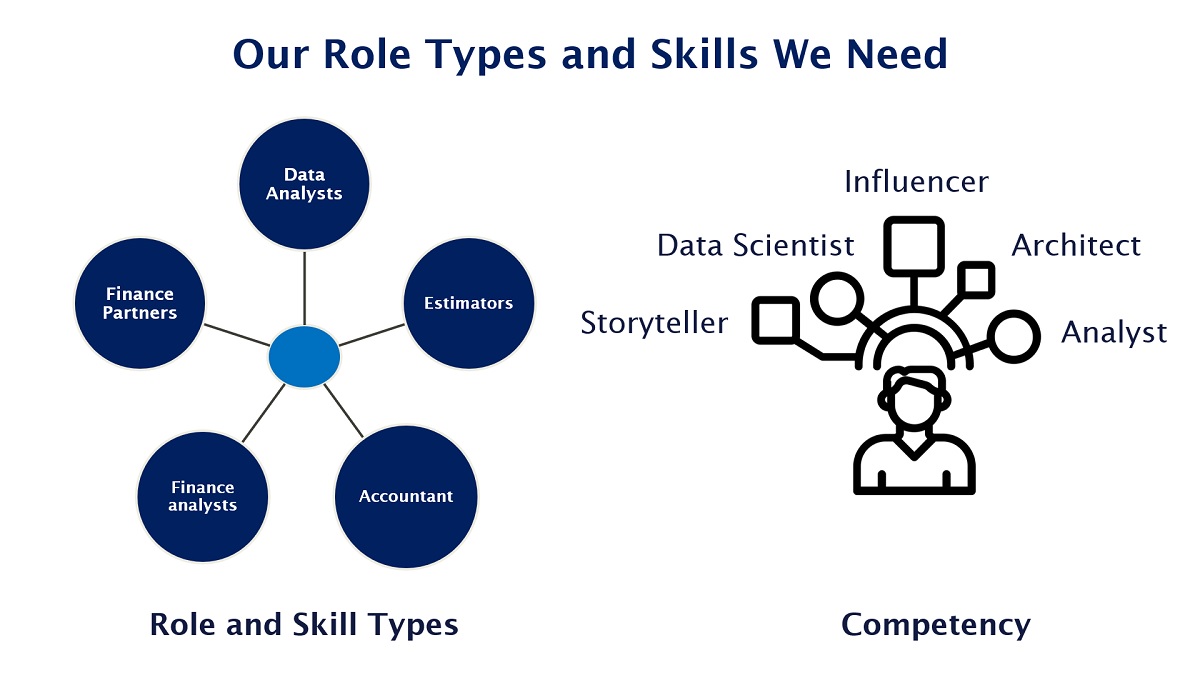

Had we gone too far in our effort to develop staff who were “a bit of everything” in their roles? Some others in our profession call them ‘purple people’ or unicorns.

This could create role ambiguity and lead to some confusion. We have analysts trying to be partners, though they are not as confident in their business knowledge, storytelling or influencing. Conversely, we have staff with great relationship skills and business knowledge but they could not support their message with reliable data and analysis.

Can people assigned to different roles also have all of these competencies?

Figure 3: Our role types and skills we need

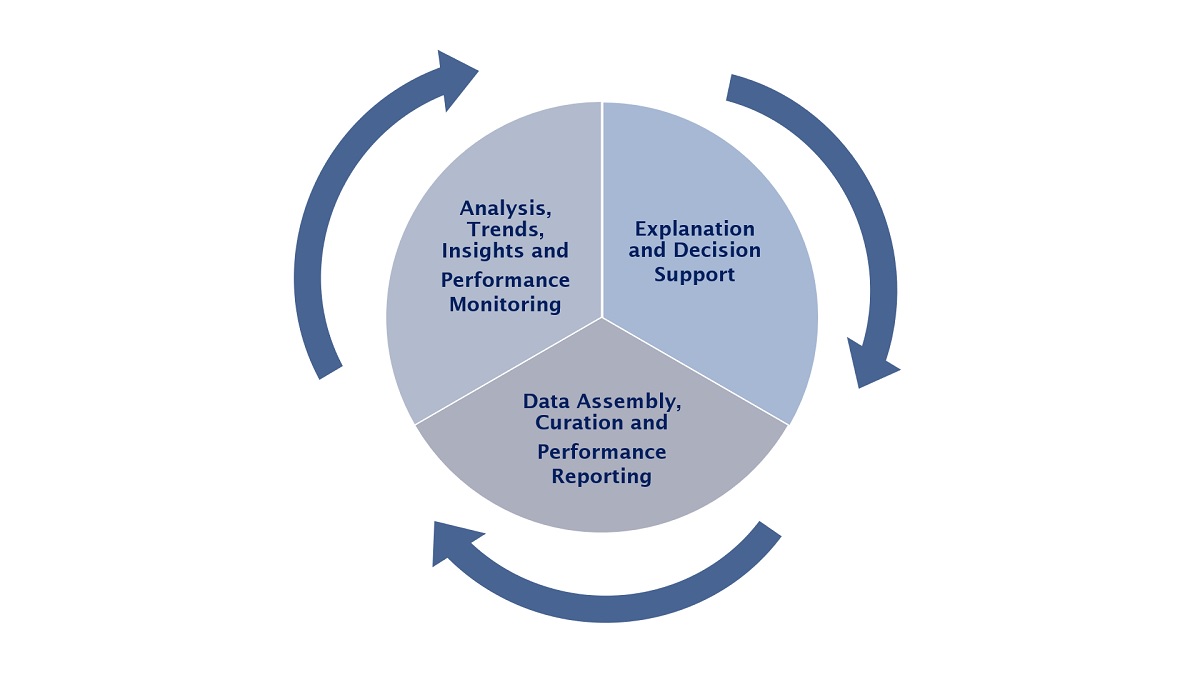

Review Your Operating Model

Align job design and skills to find role clarity. This is where we started to assess how the job design, descriptions and alignment fit with the outcomes we were seeking.

Using workshops to prompt discussion and ideas, we figured out that the team structure and role alignment needed to change. We concluded that a better approach would be to group similar expertise to deliver specialised services aligned to business needs.

This would lead to greater role clarity and expectations and an improved service to our Business Partners.

We organised the teams into areas aligning with the expected outcomes, answering “What we do”.

Figure 4: Areas aligned to outcomes

Enterprise planning, forecast scenarios and performance trends

Providing strategic performance monitoring, short- to long-term strategic direction, and risk management. Consolidated reporting to the C-suite, Board, and external stakeholders.

Provide Business Partnering and decision support

Enabled through dedicated analysis of financial and non-financial metrics for commercial and operational performance management.

Provide business analytics and reporting

Achieved through data curation and best-practice data governance, enabling end-to-end business performance analysis, reporting, and monitoring.

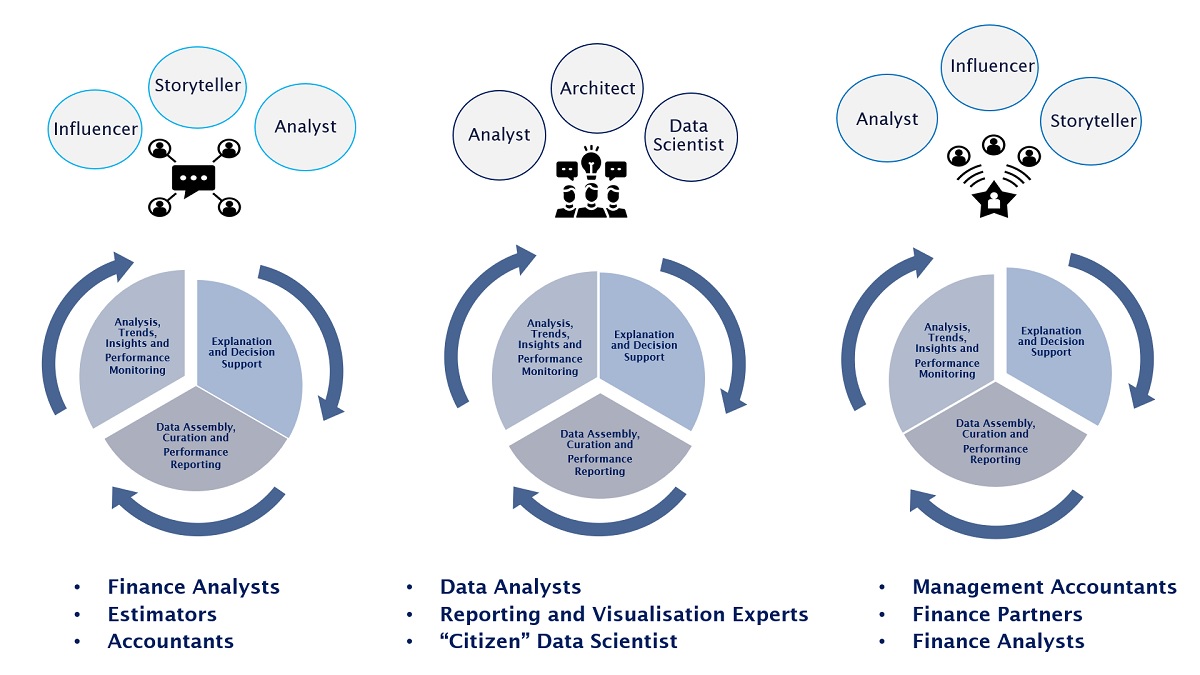

Service Delivery Model - How It Is Delivered with the ‘Right Mix’

Each area has a blend of skill sets. However, these skills are weighted differently depending on the outcomes required.

Figure 5

Benefits

There are other benefits to reassessing your skills mix and job alignment:

- Grouping expertise together encourages knowledge sharing.

- Removes sole dependency or key person risks.

- Creates learning and growth opportunities.

- Improves retention through providing improved career pathways.

- Creates a platform for improving digital capability.

Artificial Intelligence/Machine Learning (AI/ML) is an important technology for FP&A to utilise. I believe it should be developed and encouraged, so I recommend building this capability.

The major change we have made was the creation of an area focused on data skill sets and bringing that expertise together. It was not created just for finance but as a ”hub” for digital knowledge to leverage leading technology and best practices within the whole business. It is important to note that it is not a shadow tech, IT, or data function.

We are now set to move up that curve from being reactive to proactive!

Figure 6

This is not a one-size-fits-all approach, and I expect we will continue to improve what we have started.

Do you know if your FP&A purpose and objectives are still aligned with stakeholder expectations?

Why not try a similar approach to understand?

Conclusions and Recommendations

Confirm your purpose or “why”.

Seek externally.

Consult internally.

Define your operating and service delivery model.

Align skills and capability to the outcomes required.

Set foundations for tech and digital capabilities.

Create the bridge between technology and business knowledge.

Lastly, be flexible. Change will continue.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.