The 8th face-to-face meeting of the Singapore FP&A Board was held on 8 July 2025 at Signature by Regus, Asia Square. It marked the 280th International FP&A Board session, part of a global series now spanning 33 cities across 19 countries. Senior finance leaders from Barry Callebaut, Barclays, DBS Bank, Zuellig Pharma, Volvo Group Singapore, Lenovo PCCW Solutions, and others joined to explore the current evolution of Financial Planning and Analysis.

The meeting was sponsored by OneStream Software and supported by Michael Page and IWG.

Why This Topic Matters

FP&A is under pressure to adapt. Static budgets and manual processes are no longer fit for purpose in today’s volatile, data-heavy environment. Across industries, finance teams are spending too much time collecting data and too little time delivering insight.

Singapore FP&A Board meeting focused on accelerating the shift from traditional planning to modern, dynamic FP&A.

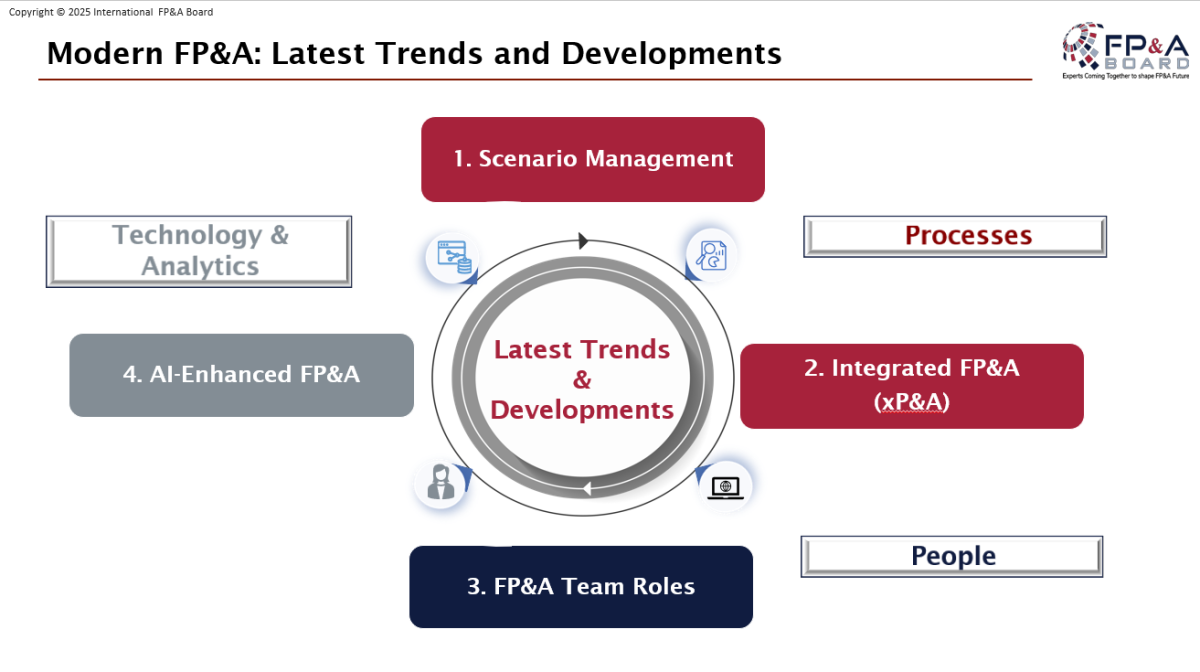

Four forces are driving that change:

- Scenario Management to prepare for multiple futures

- xP&A to align financial, strategic, and operational planning

- AI/ML to improve speed, accuracy, and automation

- New FP&A Team Roles focused on business partnering and decision support

Together, these trends represent a clear call to action: FP&A must evolve into a faster, more connected, and more strategic function.

These drivers, scenario planning, integration, AI, and talent, formed the backbone of the day’s discussion. Each theme was explored in depth using global research, case examples, and collaborative group work.

Figure 2

Key Frameworks and Themes

1. Scenario Management: Planning for Uncertainty

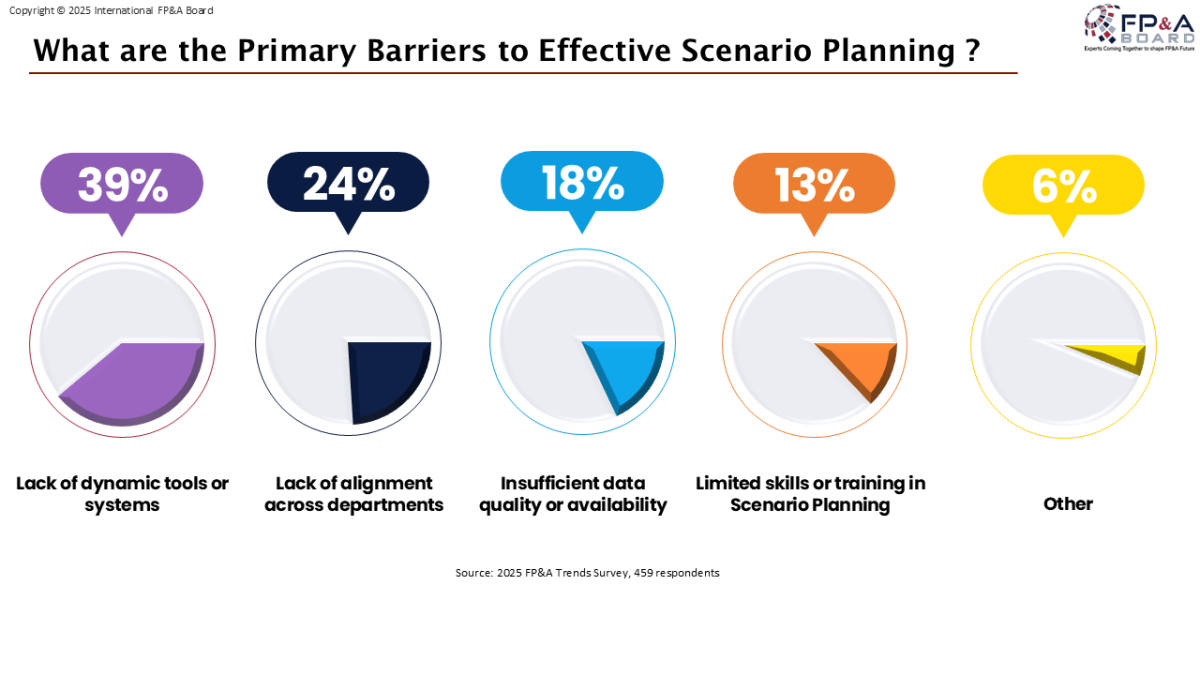

In an environment defined by volatility and shrinking predictability, static forecasts fall short. Scenario Management emerged as a core FP&A capability. Yet the 2025 FP&A Trends Survey shows only 18% of organisations can run scenarios in under one day, while 82% struggle with time, tools, or skills.

Top barriers identified include:

- Lack of dynamic tools (39%)

- Misalignment across departments (24%)

- Insufficient data quality (18%)

Figure 3

2. xP&A: From Siloed to Integrated Planning

Extended Planning and Analysis (xP&A) links financial, operational, and strategic planning into a single, connected process. But integration remains limited: only 10% of organisations have fully connected planning systems today.

Singapore participants explored how to move from isolated planning cycles to holistic collaboration.

Key enablers include:

- A shared planning culture across functions

- Clear ownership and governance

- Driver-based models supported by real-time data

- Executive sponsorship and mindset shift

Figure 4

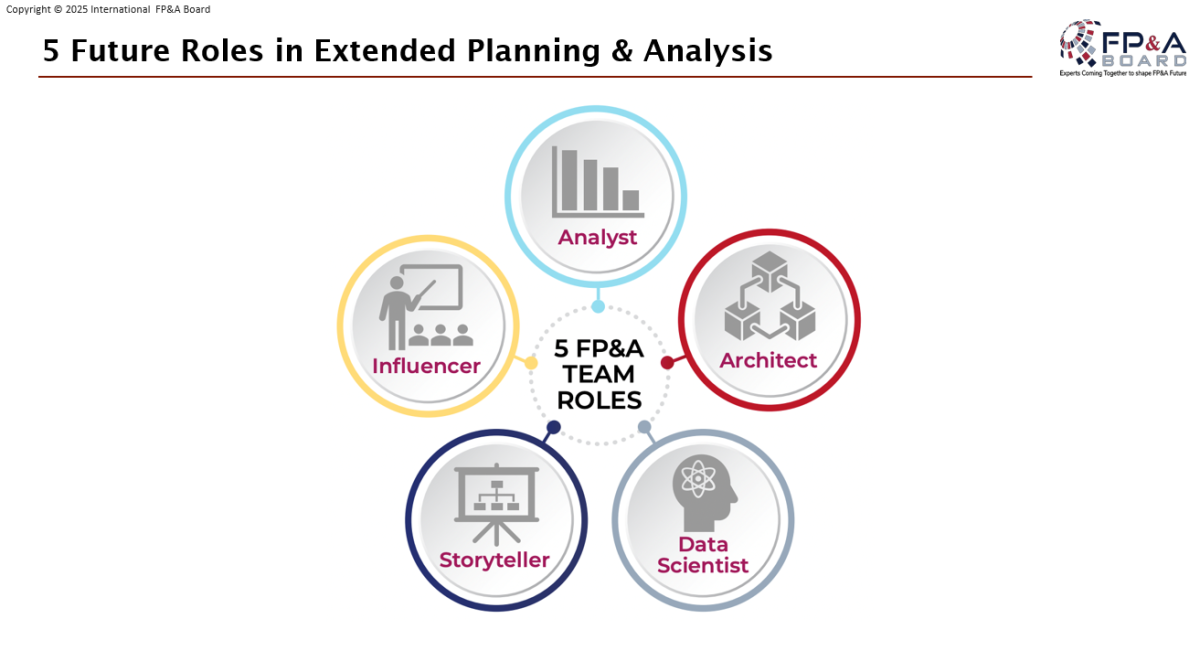

3. Rethinking the FP&A Team

FP&A teams are in transition. The 2025 FP&A Trends Survey shows 46% of team time is still spent on data collection and validation, leaving limited space for strategic work. There should be some connection to the picture.

Figure 5

Business partnering, modelling, and communication are rising as must-have capabilities.

4. Digital and AI-Enabled FP&A

AI and Machine Learning are becoming key enablers for modern finance. However, adoption remains uneven:

- Only 8% currently use ML (down from 11% in 2021)

- 36% report no plans to adopt ML at all

Use cases discussed include:

- ML models that uncover hidden drivers for forecasting

- GenAI tools that generate reports, narratives, and scenario variations

- AI-assisted decision-making via natural language queries

The message: AI is not about replacement, it’s about augmentation.

Case Study: ASTAR’s FP&A Transformation

Dr Vincent Lim, CFO at A*STAR, shared practical insights on building a modern FP&A team. His message: true transformation begins with critical thinking: questioning assumptions, designing adaptable team roles, and encouraging deeper inquiry beyond the obvious

He emphasised the shift from transactional work to strategic influence, supported by hybrid skillsets and team design.

Group Work Insights

The working groups reflected the key themes explored earlier in the session. Each group addressed one of the critical transformation areas: Scenario Management, xP&A, and Human–AI Collaboration.

Group 1 – Scenario Management

- Focus on what drives the business

- Build people's capabilities and critical thinking

- Integrate operational and financial data in real time

- Address the lack of system infrastructure

Group 2 – Implementing xP&A

- Unify financial, operational, sales, and supply chain planning

- Use tech for data validation, E2E integration, and 360° visibility

- Set a clear target timeline

- Establish a single source of truth

- Define structure and secure executive sponsorship

- Upskill teams and focus on actionable insights

Group 3 – Human + AI Collaboration

- Prioritise value and outcomes

- Engage stakeholders through communication and influence

- Simplify: less is more

- Use an iterative approach

- Address concerns with creativity

- Validate with KPIs

- Ensure data security and governance

Conclusion

The Singapore FP&A Board session demonstrated that FP&A is undergoing a fundamental shift from static to strategic, from siloed to integrated, and from reactive to insight-driven.

With contributions from both global frameworks and local leadership, Singapore continues to play a critical role in shaping the future of planning across the APAC region and beyond.

As FP&A continues to evolve, sessions like this provide a platform not just to observe the change but to lead it. The insights shared in Singapore will continue shaping how planning, analysis, and decision support are redefined across the region and globally.