The fourth Sydney FP&A Board took place in June 2025, marking our first in-person meeting in the city since COVID-19. Chaired by Larysa Melnychuk, Founder and CEO of FP&A Trends Group, the Board convened senior finance leaders across sectors to explore the latest developments in Financial Planning and Analysis. Participants engaged in presentations, polls, global case studies, and group discussions to reflect on what defines modern FP&A today and what will shape its future.

Members of Sydney FP&A Board №5, June 2025

The meeting was sponsored by EY in partnership with Page Executive and IWG.

Why This Topic Matters

FP&A is undergoing a profound transformation. The pressure to forecast faster, plan smarter, and partner better is mounting. Yet, as the 2025 FP&A Trends Survey shows, organisations are at vastly different stages of readiness. Many are still relying on disconnected spreadsheets, while others are exploring Predictive Forecasting, AI/ML, and advanced Business Partnering. This Board meeting focused on identifying what defines modern FP&A and how Australian finance teams can accelerate their evolution.

During the session, Board participants were asked to identify the #1 trend shaping FP&A in 2025. According to our participants and consistent with findings from five global FP&A Board chapters, the top trends include:

- Data and advanced analytics

- AI and emerging technologies

- Communication and storytelling

- BI tools and tech enablement

- Scenario planning for agility

- And the critical role of People in navigating transformation

Key Trends Explored

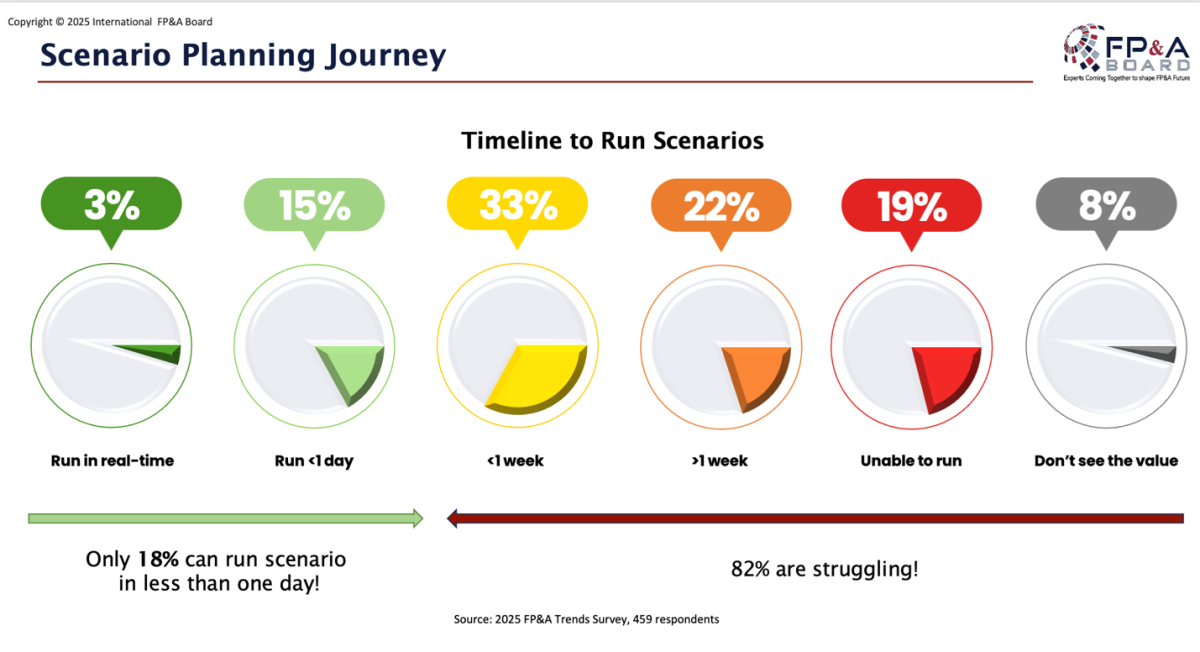

Scenario planning is no longer optional. It is a foundational tool for agile decision-making in today’s uncertain environment. But implementing it requires not only better tools but also better processes, alignment, and trust across functions. As the 2025 FP&A Trends Survey shows, most organisations are far from ready. In total, only 18% of surveyed organisations can run scenarios quickly enough to respond to rapidly changing conditions.

Figure 2

The group agreed: enabling fast, structured, and credible scenario planning is now one of the most urgent capabilities for modern FP&A.

xP&A – Extended Planning and Analysis

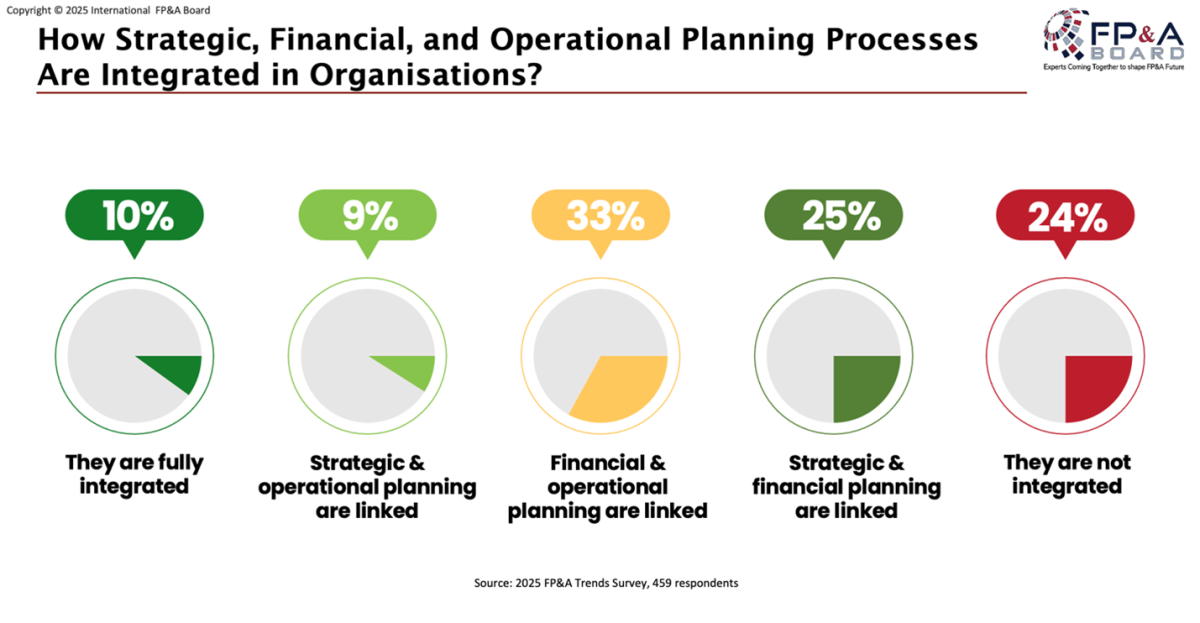

Extended Planning and Analysis (xP&A) is a major transformation trend discussed at the Sydney FP&A Board. It reflects the shift from siloed financial planning toward fully integrated, enterprise-wide collaboration. According to the session slides, xP&A involves:

- Moving beyond finance into cross-functional planning

- Aligning strategic, financial, and operational plans

- Accelerating the digital transformation of planning tools and processes

When implemented well, it enables organisations to become more responsive, better aligned, and resilient to market volatility. But despite its strategic importance, lots of organisations are far from full integration.

Figure 3

Modern FP&A Teams

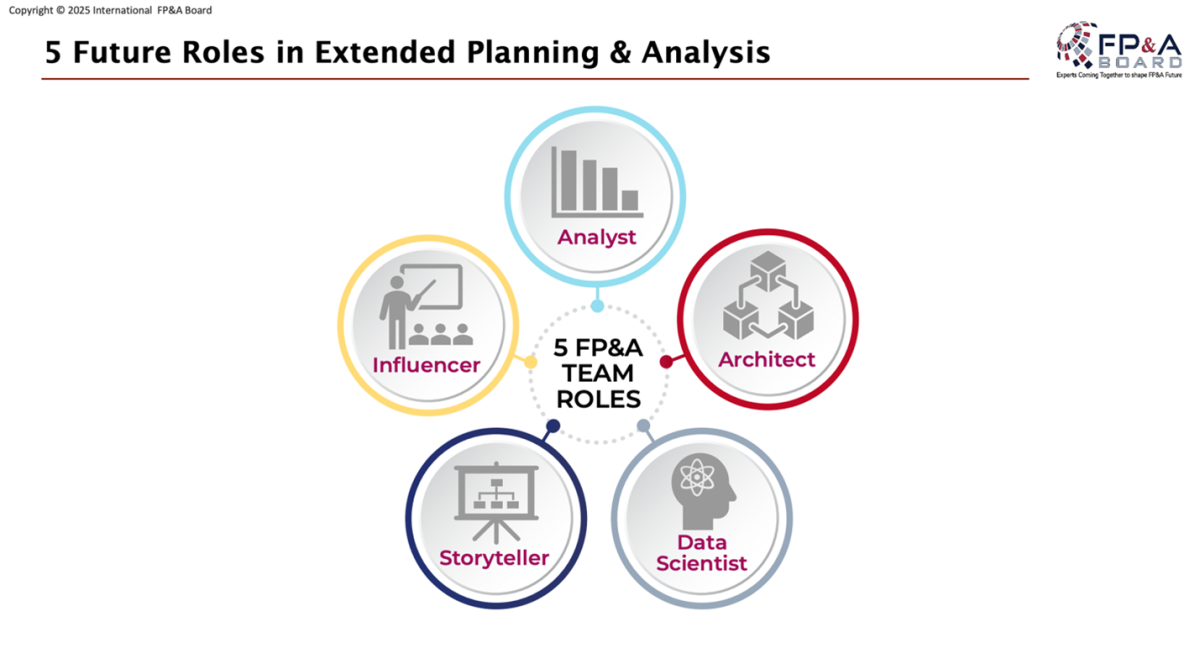

One of the core themes discussed in Sydney was the transformation of FP&A teams — from traditional finance analysts to a blend of technical, strategic, and communication-focused roles.

The Sydney FP&A Board discussed five critical roles for modern teams:

Figure 4

The 2025 FP&A Trends Survey shows that only 18% of FP&A teams are described as “optimised or performing well.” The remaining 82% are still wrestling with manual work, limited automation, and underdeveloped collaboration structures.

This signals an urgent need to pay closer attention to how we build and evolve our teams. As expectations grow and complexity increases, FP&A functions must invest in new capabilities, rethink team structures, and nurture the roles that will define their future value.

AI/ML in FP&A

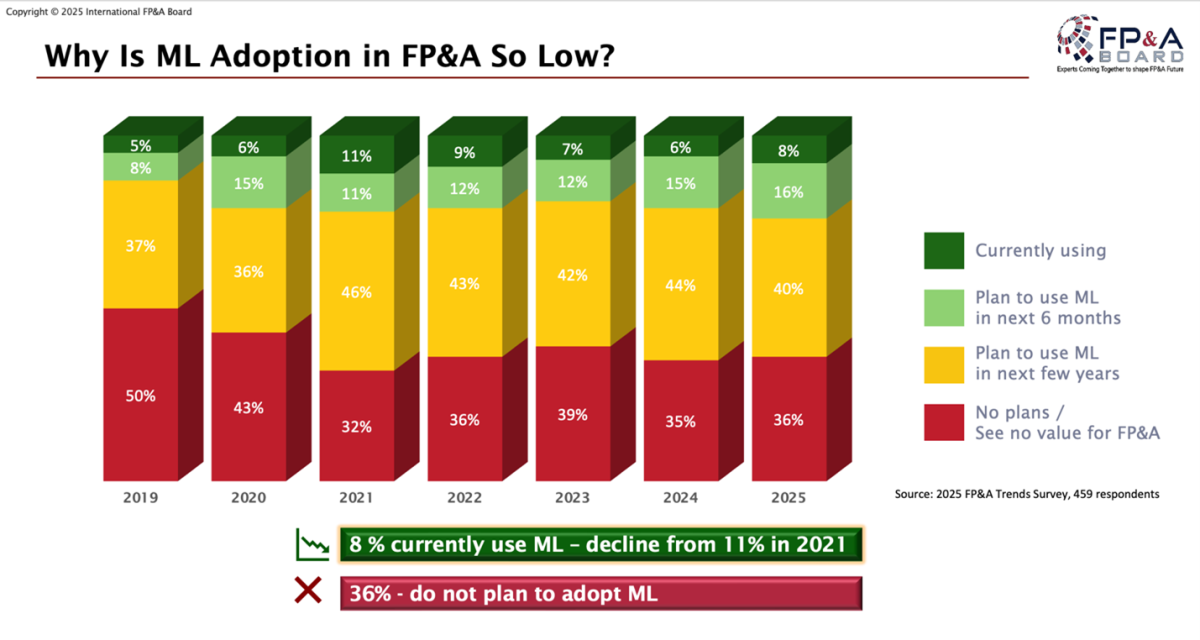

The fourth key trend highlighted in Sydney was the use of Artificial Intelligence and Machine Learning in FP&A. While AI has captured global attention, its actual implementation in finance remains in early stages.

Figure 5

The discussion focused on two key branches:

Machine Learning (ML):

Enhances forecasting accuracy and scenario planning

Uses algorithms to uncover hidden patterns

Example: Improves demand forecasting through driver analysis

Generative AI (GenAI):

Automates workflows like report generation and simulations

Enables natural language queries via chatbots

Example: Creates narrative reports, saving analysts significant time

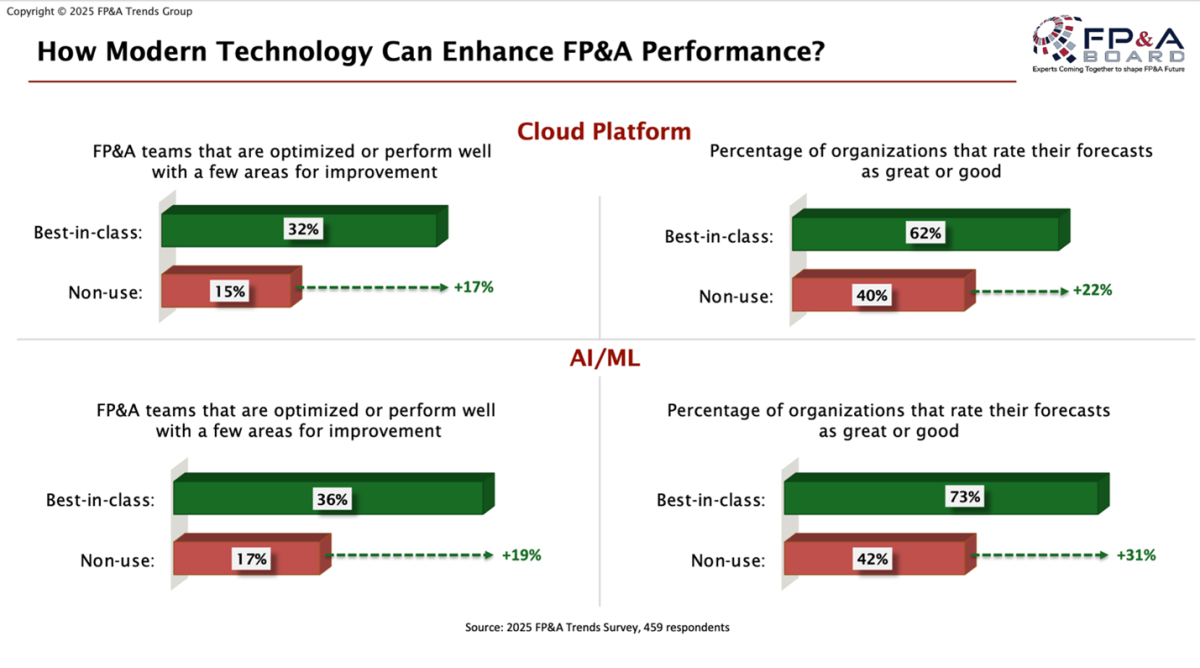

The 2025 FP&A Trends Survey shows clear performance advantages for companies already applying AI/ML:

Figure 6

Conclusions

The fourth Sydney FP&A Board marked a significant milestone: our first in-person meeting since COVID-19, and a powerful moment to reflect on how far FP&A has come and where it’s heading next.