In this article, discover how FP&A strategic business partnering helps finance professionals challenge assumptions, expand decision...

FP&A is not just finance but a frontline of future-ready leadership. It translates ambiguity into direction and forecasts into action.

The face of the CFO in the 21st century is quietly evolving across the globe. The days when a top-table position could be guaranteed just by having technical accounting knowledge or audit supervision are long gone. Today’s Leaders need a strategic co-pilot who can anticipate problems, use data to guide decisions, and help the company make better, faster decisions. Because of this, today’s CFOs must be leaders of change, strategists, storytellers, and data architects. FP&A is the only financial function that excels at developing this combination.

This article explores why FP&A has become the most direct route to the CFO role and what practical capabilities make the difference.

To understand why FP&A is rising as a launchpad for leadership, we must first look at what makes the function fundamentally different in how it supports decision-making.

FP&A: The Analytical Engine Behind Smarter Decisions

Professionals in FP&A work at the nexus of strategy, execution, and data. The heart of their work is to predict performance instead of just monitoring it. They collaborate with almost every function and operation in the organisation, put together growth ideas, stress test them, and link appropriate business drivers to achieve desired financial results. Many people fail to recognise that FP&A is a cockpit position, not a back office one. No other role refines the business lens as much as FP&A does, primarily because:

- Accounting is about accuracy and precision.

- Audit is about control.

- Treasury is about liquidity.

- But FP&A? It’s about foresight. Influence. Storytelling.

This day-to-day proximity to strategic decisions gives FP&A professionals real-time exposure to how the business runs, how trade-offs are made, and how value is created. It’s a fast track to CFO-level thinking.

Let’s Compare: FP&A with Other Functions in the Finance Domain

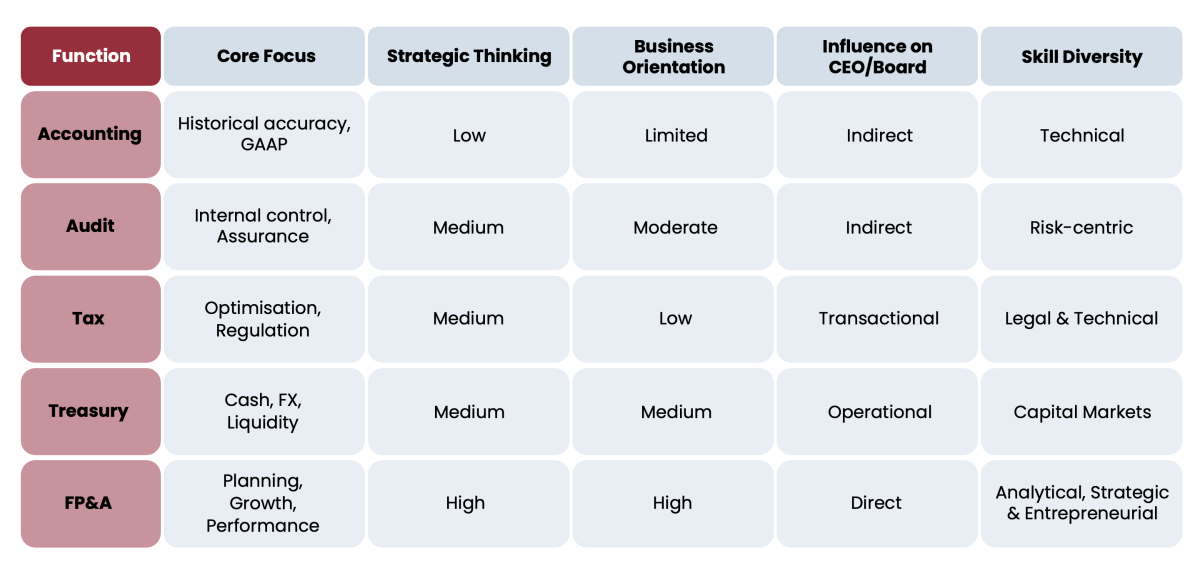

But how exactly does FP&A differ from other finance functions in preparing leaders for this role? A closer look at the core focus, strategic alignment, and business influence of each function reveals a sharp contrast.

Table 1: FP&A vs. Other Finance Functions – Strategic Differentiators

The above table highlights what sets FP&A apart — both in skills and scope. It’s the only finance function that directly shapes decisions and business performance. And that is exactly why FP&A professionals are uniquely positioned to grow into the CFO role.

Why FP&A Builds Better CFOs Than Traditional Accounting

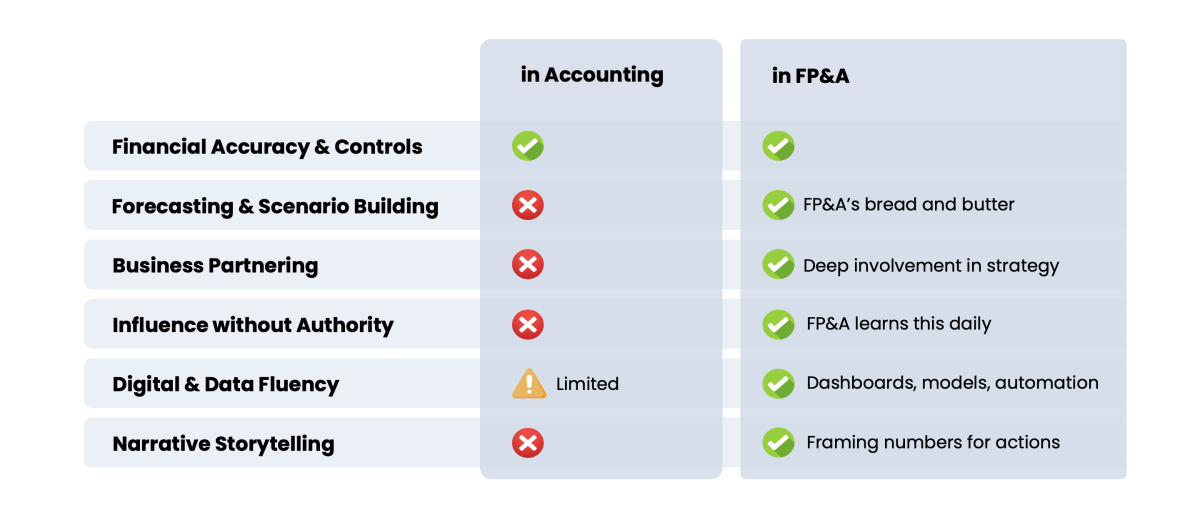

To understand what truly sets FP&A apart in developing future CFOs, the table below compares the day-to-day capabilities built in FP&A versus those in traditional accounting.

Table 2: Capability Comparison – Accounting vs. FP&A

FP&A leaders work across silos, manage ambiguity, and build credibility without formal power. These experiences train them in the soft power and strategic influence essential for CFO success.

Path Towards CFO Leadership

Recognising the advantage is just the beginning. The question now is — how can FP&A professionals convert that edge into a defined path toward CFO leadership? Here are four essential steps to accelerate the journey.

Step 1: Get Closer to the Business

You are simply reporting whether your contributions do not impact a decision or contribute to the business. Sit in on operational reviews. Ask business leaders how they use your numbers. Challenge assumptions with curiosity, not confrontation.

How exactly:

- Develop a deep understanding of the value proposition of your brand, product, or service that provides to end customers. Unbox it in terms of WHAT, WHY, and HOW.

- Spend time with ‘real’ doers in the business, not just managers. Learn what a day looks like for them and understand their priorities and pain areas.

- Learn to summarise what matters, and talk not numbers but their impact on the business.

- Two important things which matter most for business are (a) agile forecasting, scenarios analysis — develop a pulse to master it (b) customer satisfaction — apply principles of customer segmentation, if possible, meeting a few lead customers to know their perspective.

Step 2: Master Digital Tools That Matter

Excel is not enough. PowerPoint was introduced in 1987. Learn Python in Excel: master dashboards and visualisation tools. Leverage AI. You don’t need to be a coder, but you must understand what tools can automate, simulate, and explain business outcomes.

How exactly:

- Learn the front office and middle office systems that your organisation uses — only a few can master both.

- Move away from static reporting to custom reporting — master visualisation tools for storytelling.

- Excel has changed 300% over the last 2-3 years — master newer functions, focusing on simplifying tasks with greater accuracy.

- Automate routine reports — focus on tailoring insights to specific business units or functions.

Step 3: Go Beyond the Forecast

Ask how your models can unlock profit and growth potential rather than merely keeping an eye on it. For example, can your forecast influence hiring decisions? Supply chain timing? Margin mix? That’s where value is created.

How exactly:

- Understand the key industry behaviour you are operating in and your key competition — without this, your forecast can turn into a fiction story written in Excel.

- Talk about drivers and levers that influence decision making — leading and lagging indicators.

Step 4: Tell the Story Behind the Numbers

Be a translator! It is just noise until data is transformed into a narrative that the leadership or company can act upon. Practice your storytelling. Lead with “here’s what this means” instead of rows of numbers. The best FP&A professionals speak both finance and business fluently.

How exactly:

- You own the data, so choose where to focus more — post-mortem of numbers or proactive use of numbers to tell either a warning signal or a future opportunity.

- No one is interested in data; everyone is interested in what those numbers can tell them — insights are the key.

Taken together, these steps offer a practical direction for FP&A professionals aiming to grow into broader leadership roles.

Conclusion: From Stepping Stone to Launchpad

FP&A is no longer a stepping stone — it is the launchpad to the CFO chair. In a world where business speed and complexity are accelerating, companies need finance leaders who don’t just interpret numbers — they influence outcomes.

The CFOs of tomorrow will be known not for closing the books but for architecting growth: opening new markets, steering strategy in real-time, and turning data into decisive action.

To earn that seat at the top, today’s FP&A leaders must:

- Influence decisions across functions

- Own the performance narrative with clarity

- Master digital tools that drive insight and automation

- Guide outcomes — not just track them

The question isn’t whether FP&A can lead at the highest level. It’s whether you’re ready to leap.

Are you ready to architect the future — or just record the past?

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.