The 2nd Riyadh FP&A Board welcomed the ongoing discussion on the Extended Planning and Analysis (xP&A). Riyadh became our 20th chapter, where we discussed this subject.

Figure 1: Riyadh FP&A Board №2, February 2024

30 finance leaders from diverse businesses attended this event, including PepsiCo, Tanfeeth Co, Red Sea Global, Nadec Foods, Lucid Motors, Emirates NBD, Signify, and many others. Senior FP&A practitioners gathered in a beautiful Regus Esplanade.

Wolters Kluwer/CCH Tagetik sponsored this meeting. We are grateful to Michael Page and IWG for their tremendous support and help with the event organisation.

In this report, we are highlighting the key takeaways from this insightful session.

Facing Crucial Challenges and Ensuring Top-Notch Performance

The Riyadh FP&A Board members began their discussions with introductions and personal reflections on the crucial FP&A challenges. Echoing the insights from their peers in Europe and North America, the Saudi finance leaders underscored the significant impact of the challenges enumerated below on our industry:

- Digitalisation

- Change Management

- Accurate data

- Uncertainty

- Multiple scenarios

- Artificial Intelligence (AI)

- Choosing the right tools

Such insights correlate with the thoughts of International FP&A Board members in different parts of the world. The cruciality of Change Management and choosing the right tools was also highlighted in other chapters, as well as the rising importance of effective Scenario Management and ensuring data quality.

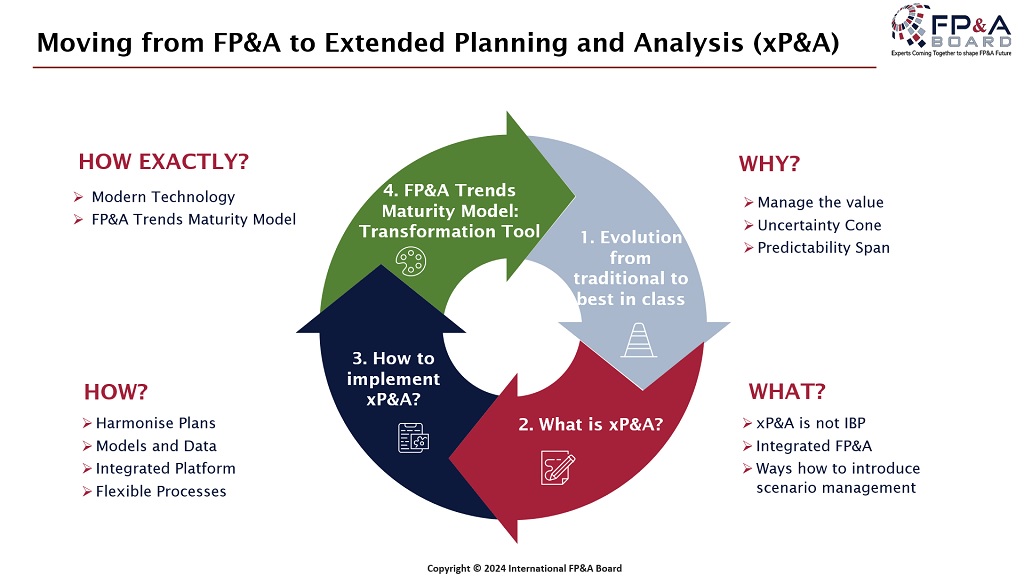

Figure 2

After an enthusiastic discussion about the challenges, the forum swiftly transitioned to the main topic – Extended Planning and Analysis (xP&A).

Understanding xP&A and Why We Need It

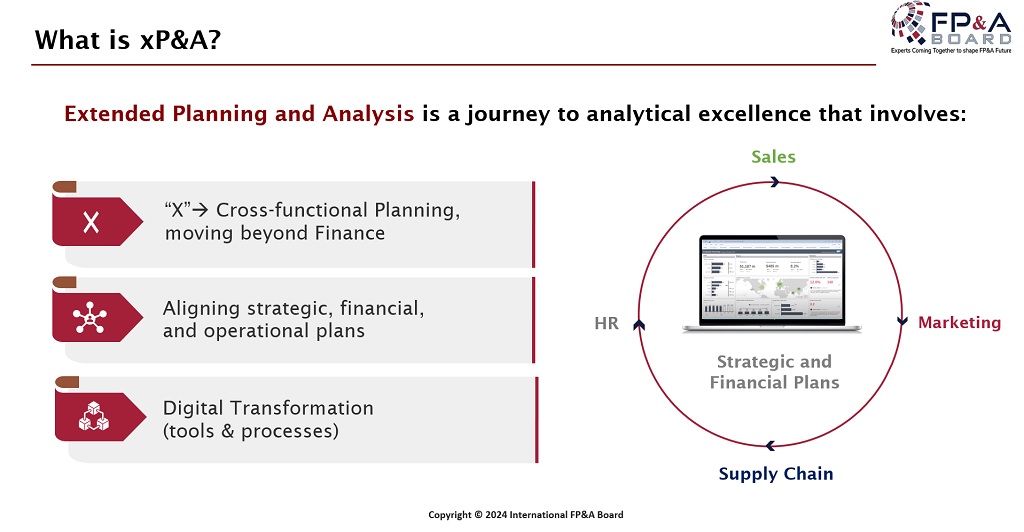

The facilitator introduced the concept of Extended Planning and Analysis (xP&A) to the attendees and sparked a vivid discussion about this approach.

Figure 3

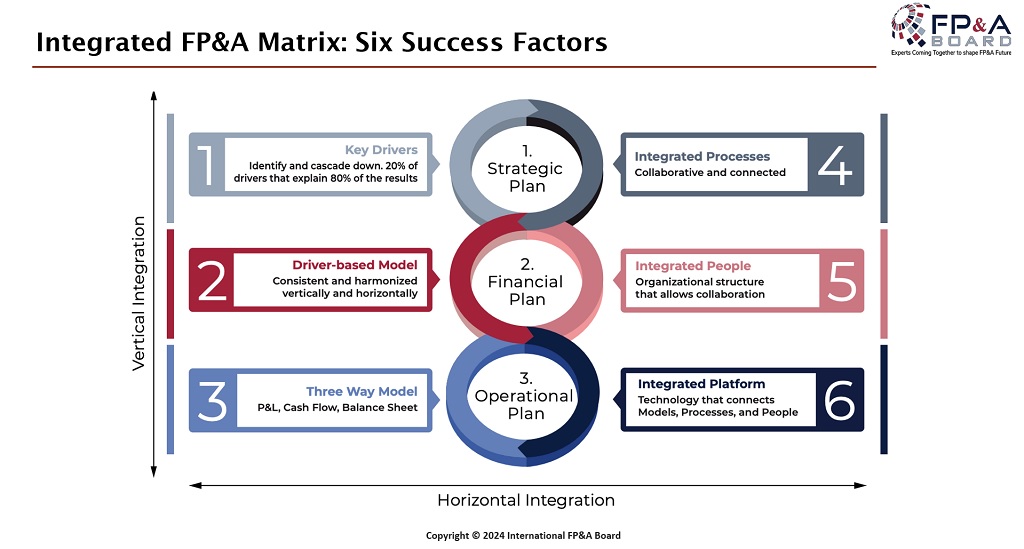

Implementing xP&A presupposes integrating the strategic, operational, and financial planning processes horizontally and vertically as a single, continuous one. The six success factors outlined in the picture below must be established to ensure you are on the right path to analytical excellence.

Figure 4

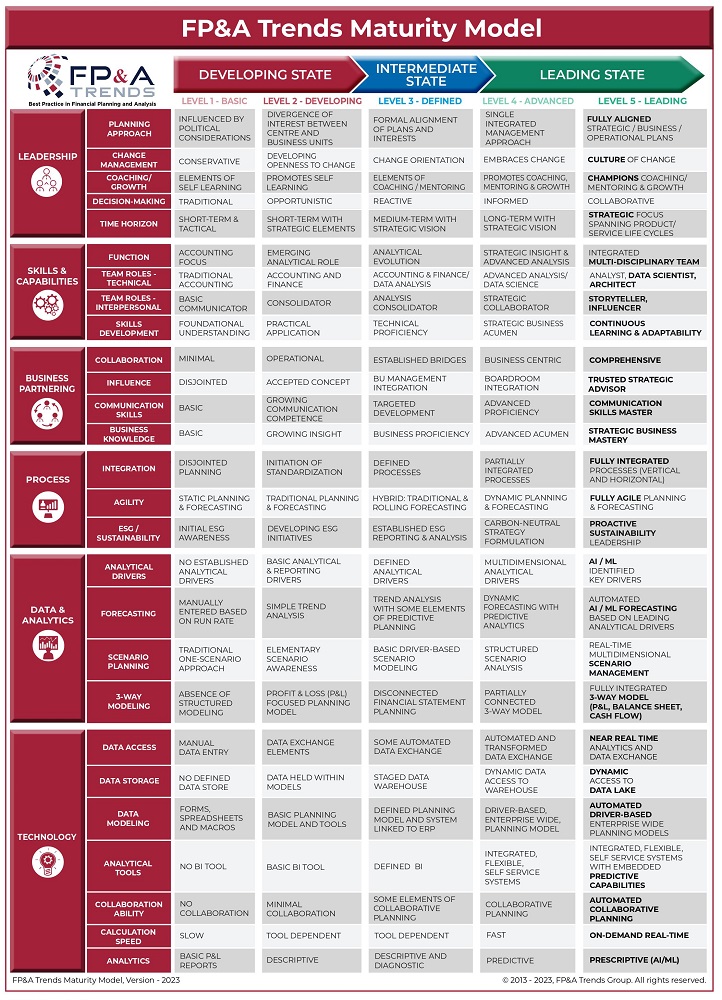

The forum also addressed how finance leaders can transition to Extended Planning and Analysis (xP&A) using the FP&A Trends Maturity Model.

Figure 5: FP&A Trends Maturity Model

Following the vivid discussions on the subject, the Riyadh FP&A Board members also listened to Safrin Sadik's insights, who was invited as a speaker and shared his experience related to xP&A. During his speech, Safrin underscored these specific challenges his organisation faced with xP&A:

- Disruptions in setting up an ideal xP&A model

- Varying priorities

- Race to find the right talent

- Resistance to Change and

- Balancing "the face of finance" dilemma

Figure 6: Safrin Sadik shares his insights, Riyadh FP&A Board №2, February 2024

Group Work and Networking

One of the last points in the meeting's agenda was dedicated to group work. Riyadh FP&A Board members were split into three groups to discuss three crucial aspects of xP&A implementation:

Figure 7: Group Work, Riyadh FP&A Board №2, February 2024

The first group highlighted the importance of the following:

- Mindset and knowledge

- Data integration

- KPI identification

- Artificial Intelligence (AI)

The second group presented their insights to the Riyadh FP&A Board Members and underscored the importance of the factors outlined below:

- Understanding the business structure

- Diagnostic process missing

- Relevant historical data

- Collaboration

- Change Management

- Selecting the right solutions

- Different systems and applications for FP&A

The third group was the last one to share their findings. They emphasised that the organisation should be ready to embrace xP&A.

Figure 8: Networking, Riyadh FP&A Board №2, February 2024

After presenting the group work results to the FP&A Board, the attendees could engage in topical discussions with their peers during networking. We look forward to the next meeting in Riyadh in late autumn this year.