The 12th Dubai FP&A Board meeting, held on 20 November 2024, brought together senior finance leaders for an insightful exploration of FP&A transformation. In partnership with global sponsor Jedox and recruitment partner Michael Page, the session focused on leveraging the FP&A Trends Maturity Model as a practical roadmap for elevating financial planning, forecasting and decision-making processes.

With leaders from renowned organisations such as Richemont, Emaar Hospitality Group, OM Pharma, KraftHeinz, Nielsen IQ, Ecolab Inc, IDP Education, Majid Al Futtaim Retail and Gulf Craft Group in attendance, the event provided a collaborative platform to address shared challenges, exchange best practices and chart a course towards achieving higher levels of FP&A maturity.

Figure 1. The 12th in-person Dubai FP&A Board, November 2024

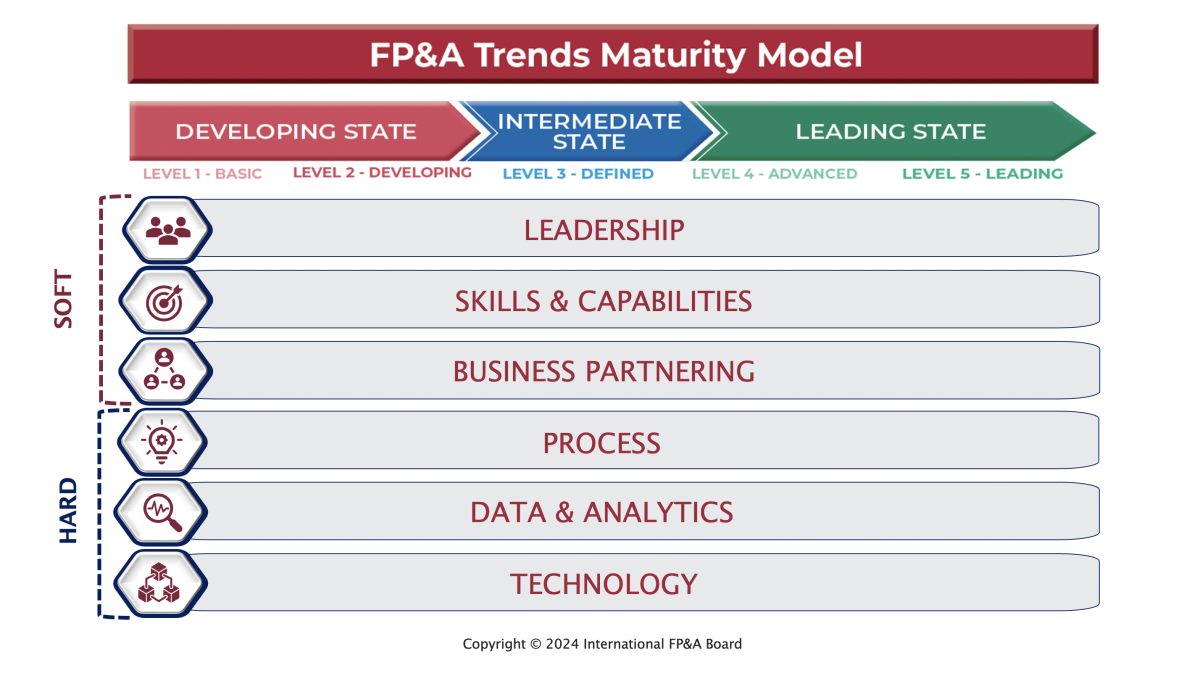

Framing Transformation: Understanding the FP&A Trends Maturity Model

The session opened with an in-depth introduction to the FP&A Trends Maturity Model — a comprehensive framework developed through insights from 33 FP&A Boards across 19 countries. This model benchmarks organisations across six core dimensions:

- Leadership – The role of FP&A leadership in driving transformation

- Skills & Capabilities – The evolving competencies required in modern FP&A

- Business Partnering – Enhancing collaboration and influence across the organisation

- Data & Analytics – Leveraging insights for better decision-making

- Process – Establishing agile and efficient FP&A processes

- Technology – Utilising advanced tools to enable FP&A excellence

Each of these dimensions plays a crucial role in determining an organisation’s maturity stage, ranging from Basic to Leading. The model provides FP&A professionals with a structured approach to evaluate their current state, identify gaps and navigate their path towards a more strategic, value-driven function.

Figure 2

Attendees reflected on their own FP&A maturity levels, discussing key barriers to transformation. The most frequently mentioned challenges included:

- Data integration and quality issues

- Resistance to change and cultural buy-in

- Systems integration.

These challenges were consistent across FP&A Board discussions in London, Zurich, New York, Geneva and Amsterdam.

Mölnlycke’s Beyond Budgeting Journey: Turning Insights into Action

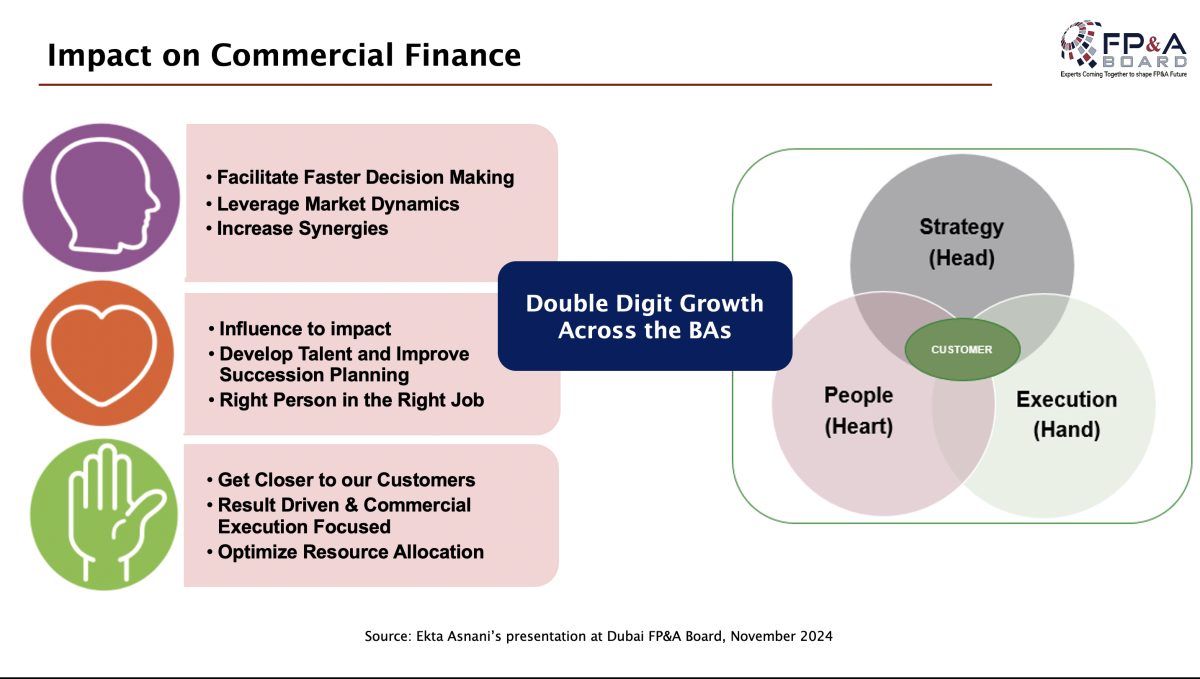

The presentation by Ekta Asnani, Regional Finance Director (EMEA) at Mölnlycke Health Care, illustrated how her organisation moved beyond traditional planning and adopted a Beyond Budgeting approach.

Figure 3. The 12th in-person Dubai FP&A Board, November 2024

Mölnlycke's transformation journey began with an assessment of the challenges they faced under the traditional budgeting model. Recognising the limitations, Mölnlycke embarked on a transformation to Beyond Budgeting, adopting a rolling, driver-based planning model that focuses on continuous forecasting and real-time decision-making.

Key Steps in Mölnlycke’s FP&A Transformation:

- Shifting Leadership Mindset: Driving Change from the Top

- Process Automation: Enhancing Agility and Efficiency

- Investing in Skills Development

- Strengthening Business Partnering: FP&A as a Strategic Advisor

By embracing Beyond Budgeting principles, Mölnlycke achieved significant improvements in FP&A efficiency, agility and strategic influence.

Figure 4

Insights on Practical Steps to Reach the Leading Maturity Stage

During the Dubai FP&A Board meeting, participants were divided into three groups, each focusing on a key aspect of FP&A transformation:

- People & Culture

- Data & Models

- Systems & Processes

Each group provided practical recommendations on how FP&A teams can evolve toward the Leading Maturity Stage, ensuring that financial planning is agile, data-driven and strategically integrated into the business.

1. People & Culture: The Foundation for FP&A Transformation

The first group highlighted that FP&A transformation is not just about tools and processes — it starts with people. They identified key cultural and leadership attributes necessary for a high-performing FP&A function.

Key Insights:

- Business Acumen – FP&A professionals must develop a deep understanding of business priorities, moving beyond numbers to provide strategic insights.

- Empathy & Culture – The ability to understand stakeholder needs and foster a collaborative culture is crucial for effective business partnering.

- Continuous Improvement – FP&A teams should adopt a growth mindset, consistently refining processes and adopting best practices.

Change Mindset & Resilience – Transformation requires an adaptive mindset, where teams embrace change and proactively seek improvements. - Building Relationships – Strong business partnerships help integrate finance into strategic decision-making.

- Influence & Ethics – FP&A leaders must be influential communicators, balancing data-driven insights with ethical decision-making.

- Technology Savvy – The modern FP&A professional needs digital literacy, understanding how to leverage analytics, AI and automation.

- Risk Management & Balance – FP&A must strike a balance between risk mitigation and proactive financial planning.

- Strategic Mindset – The transition to the Leading Maturity Stage requires a forward-looking approach, where finance actively contributes to shaping business strategy.

- Diversity – A diverse FP&A team brings different perspectives and problem-solving approaches, fostering innovation.

Figure 5. The 12th in-person Dubai FP&A Board, November 2024

2. Data & Models: Ensuring Accuracy, Integration and Strategic Insights

The second group focused on the importance of data integrity, governance and harmonisation in achieving FP&A excellence. Without reliable and accessible data, financial planning cannot effectively support business decision-making.

Key Insights:

- Integrity of Data – Ensuring that financial and operational data are accurate, complete and reliable is fundamental for FP&A transformation.

- Multiple Sources of Data – Organisations need to consolidate internal and external data sources to create a single version of the truth.

- Capturing Data Efficiently – A focus on automating data collection and integrating real-time information is essential for forecasting agility.

- Ownership of Data (People & Collaboration) – Data governance must be clearly defined, with roles and responsibilities for maintaining data quality and security.

- Process of Data Creation & Implementation – Standardised data input, validation and processing are crucial for maintaining accuracy across systems.

- Organisational KPIs to be Aligned – Finance, operations and strategy teams must work with a common set of performance indicators.

- Collaborative Approach – Breaking down silos and encouraging cross-functional data sharing ensures better decision-making.

- Harmonisation of Data – Unifying financial and operational data sources improves reporting accuracy and consistency across the organisation.

Figure 6. The 12th in-person Dubai FP&A Board, November 2024

3. Systems & Processes: Building Agility and Scalability

The third group discussed how systems and processes can be streamlined and automated to support fast, accurate and scalable FP&A operations.

Key Insights:

- Agile Systems – FP&A should move away from rigid, outdated tools and adopt flexible, cloud-based planning solutions.

- From Disparate Systems to a Single Source – Eliminating data silos and creating a centralised planning platform enhances efficiency and agility.

- Collaboration & Integration – FP&A should work closely with IT, operations and commercial teams to ensure seamless data and process integration.

- Standardisation – Defining clear, repeatable planning workflows improves accuracy and reduces errors.

- Adaptability – FP&A processes should be dynamic, allowing quick adjustments based on market changes or business needs.

- Feedback Loops – Continuous improvement requires regular feedback from business stakeholders to refine forecasting models and decision support.

- Scalability – FP&A systems should be designed to support business growth, ensuring they remain effective as the company expands.

Figure 7. The 12th in-person Dubai FP&A Board, November 2024

Conclusions

FP&A transformation is not a one-time project but an ongoing journey. The FP&A Trends Maturity Model provides a structured path for organisations to assess their progress and identify areas for growth. Organisations that remain committed to innovation, continuous improvement and strategic alignment will be best positioned to navigate uncertainty and create long-term business value.

Figure 8. The 12th in-person Dubai FP&A Board, November 2024