FP&A has an impact on the organisational structure, enhanced by the possibilities of new technologies. Where...

For quite some time CFOs and the finance community have been talking about transforming the finance function, becoming better business partners and focusing on the value-add, strategic activities.

For quite some time CFOs and the finance community have been talking about transforming the finance function, becoming better business partners and focusing on the value-add, strategic activities.

At the core of that transformation is FP&A, as activities like business planning, business unit strategy, investment allocation and predictive analytics become important to fulfil finance’s new, expanded position within the company.

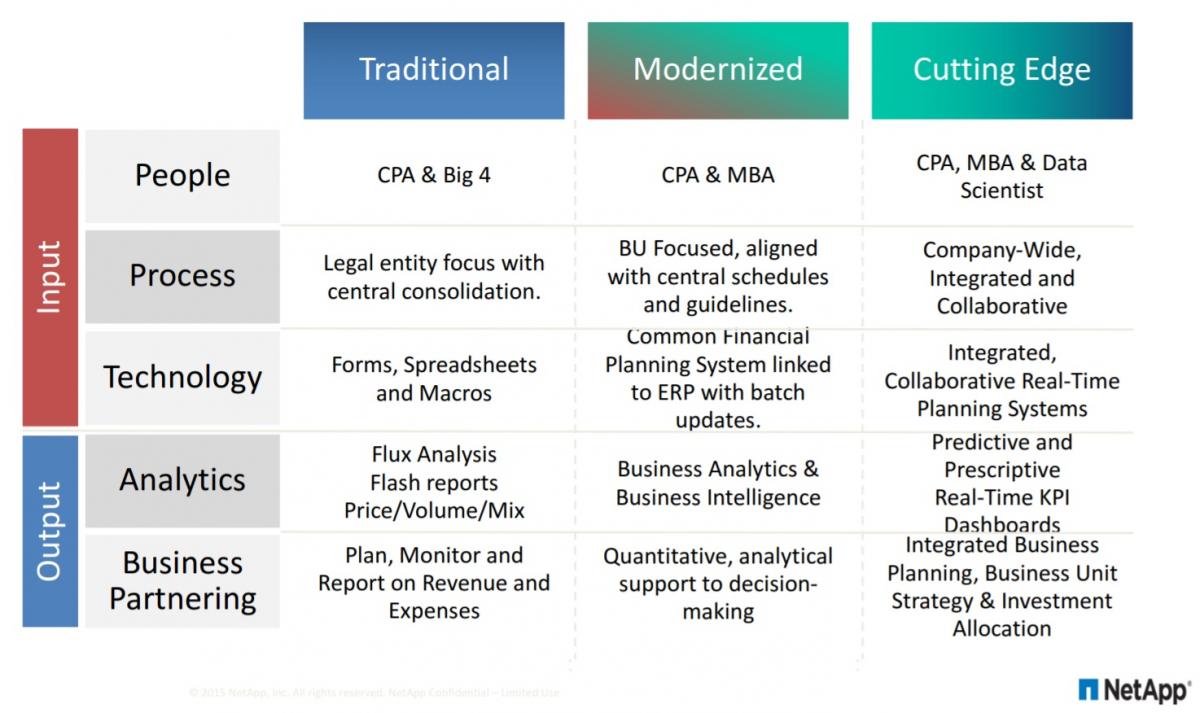

But to do that, FP&A itself must transform and change from its traditional flux analysis and flash reports to a much more modern and cutting edge department within the company. When starting to embark on your own FP&A Transformation journey, there are a couple of principles you need to keep in mind.

First, there isn’t a one-size fit all optimal FP&A operating model that all companies in all industries should implement. Personally, I have worked in finance in FMCG, Consumer Durables and Silicon Valley IT. It would not be possible to run the same finance operating model in all those companies at the various life-cycle and maturity stages there were in. The industries and companies were at very different levels of maturity, complexity, growth, and the technological capabilities were very different. So you need to make a proper assessment and decide on a model that is right for your specific company.

Second, you need to articulate the future operating model (see figure 1), what your new FP&A department will look like in a future state and what your key focus areas will be. If you only articulate what FP&A is not going to be doing, (for instance no flash reports, accruals, or expense reclasses) your transformation will be materially slowed down or impossible. Your team may even fear that they are losing their jobs and will actively work to resist your transformation efforts. Transforming FP&A needs to be a positive thing that will allow FP&A to take on an even more strategic role within your company.

Figure 1: FP&A Operating Models

Third, you need to work with a phased and structure approach. Transformation is difficult, time-consuming and not without risk. Your FP&A staff is very busy and working very long hours already. They are buried in basic duties and don’t have the time to undertake major transformations. Furthermore, there is operational risk involved when transforming FP&A. If you do it wrong, you could even inhibit your company’s ability to close the books timely and accurately. So you have to approach transformation in a structured way and use a phased approached to balance the workload of your team and mitigate the operational risk of the company.

Lastly, the optimal operating model evolves continuously over time, which means that finance leadership constantly must evaluate the current position and continuously transform their departments. Technology changes, your industry changes, your growth rate changes, your business complexity changes, and you need to continuously evolve and adjust your operating model to those changes. Transformation is an infinite game, not a finite game. What is cutting edge today, is probably old-fashioned tomorrow.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.