FP&A has an impact on the organisational structure, enhanced by the possibilities of new technologies. Where previously companies are classified as having a centralised, decentralised or matrix structure, the future promises to be less clear, more diverse yet potentially very agile!

FP&A has an impact on the organisational structure, enhanced by the possibilities of new technologies. Where previously companies are classified as having a centralised, decentralised or matrix structure, the future promises to be less clear, more diverse yet potentially very agile!

On 26 March 2019, the FP&A Trends Group organised the webinar “FP&A Transformation through Effective Organisational Structure”, exploring structure and technology. The webinar was sponsored by Unit4 and I was fortunate to present a very compelling storyline from three great thought leaders:

- Larysa Melnychuk, CEO at FP&A Trends group and MD at International FP&A Board

- Fredrik Hedlund, Senior Vice President, Global Markets CFO at Nielsen

- Matthias Thurner, Chief Product Officer & Analytics Visionary at Unit4

This article is an overview of the webinar.

FP&A Trends & Organisational Structure

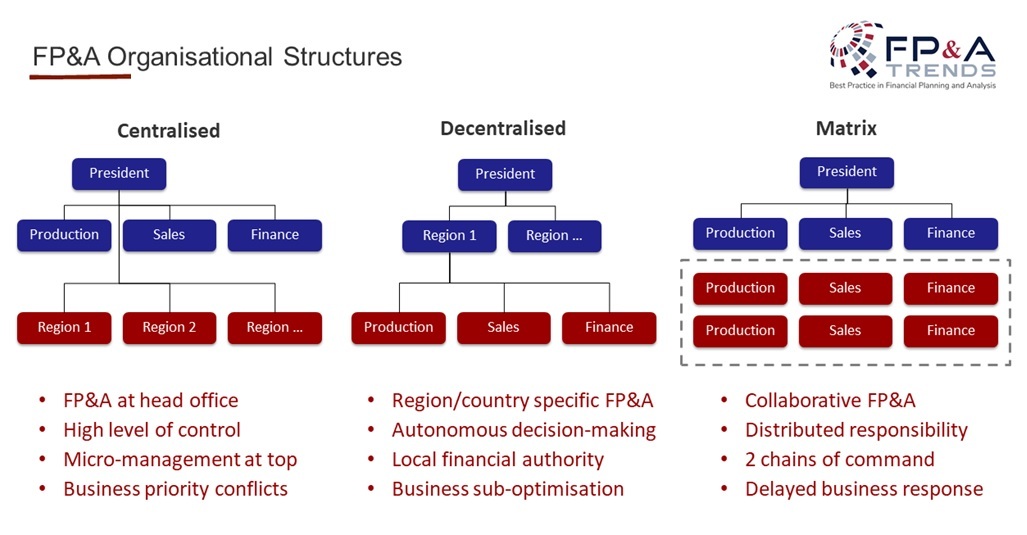

The trends presented by Larysa Melnychuk show the equally important challenges companies face today. If FP&A is moving forward to more driver-based planning, analytics (AI/ML) and integrated FP&A, then serious attention should be given to data quality, talent, and outdated technology many companies still use. Traditionally, organisational structures can be classified as centralised, decentralised and matrix structure.

With each structure having both advantages and disadvantages, the real challenge is on establishing an effective structure for FP&A to evolve. Of these three structures, most companies follow a matrix structure. A quick poll during the webinar confirmed that 47% of the companies can be classified as having a matrix structure.

“FP&A Transformation through Effective Organisational Structure”

Fredrik Hedlund presented his business case on Nielsen, a global company, where he transformed Finance across 100+ countries, and where today FP&A thrives within a centralised structure.

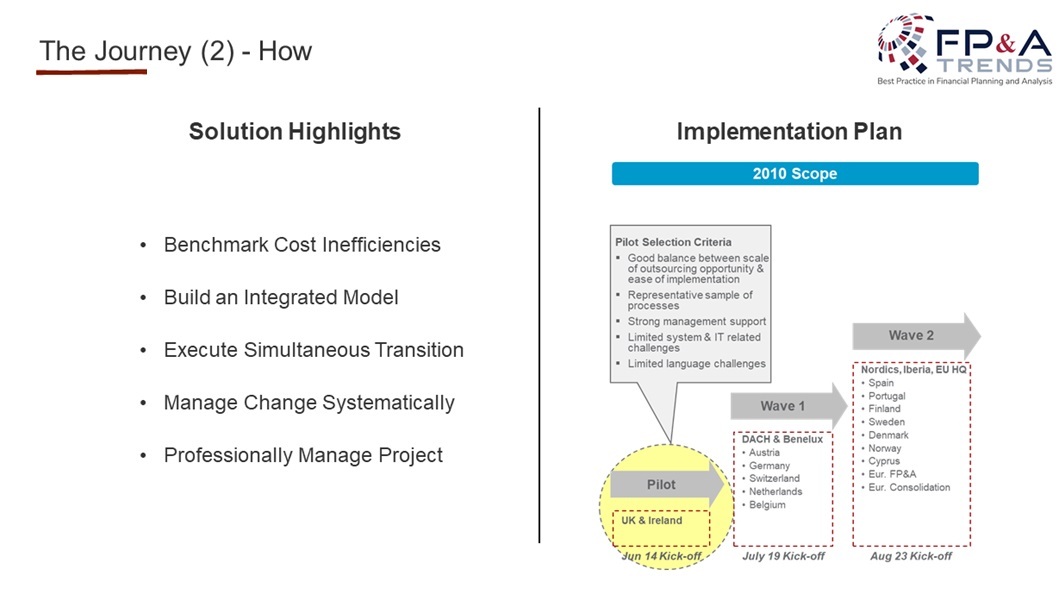

At the start the company had a completely decentralised structure, each country had its own FP&A and finance activities. A new system and IT structure created the opportunity for change. This would include solving complexities, such as multiple legal entities, different languages, statutory accounting, while also being compliant.

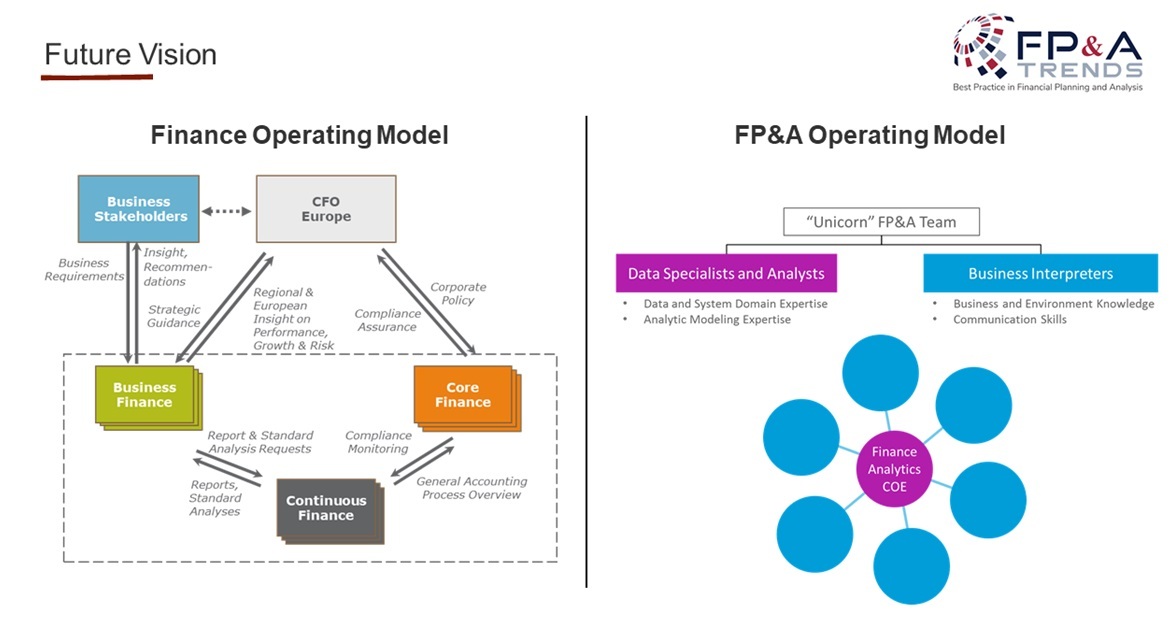

Having a vision of the future was essential for everyone, followed by having a good strategy and roadmap to get to that end-state. Fredrik mentioned that 6 months were spent on planning. Starting with a centralised infrastructure the aim was of having FP&A associates close to the business, not in a hub. All associates needed to report directly to one FP&A leader. Only at a later stage, an analytics COE (Centre of Excellence) with data scientists was set-up, leading to the FP&A Operating Model of today. The whole journey took nearly 9 years.

Fredrik explained in detail the drivers which made their solution a success. He highlighted that it was not only about cutting cost, but improving the service level to the business: lower cost and doing the same, and same cost but doing a lot more. The FP&A structure is now able to support the business, by owning the ‘truth’, simplify forecasting, be more accurate, cutting the budgeting process time in half, minimising the time operational and commercial teams spent on planning thus giving more time to run the business.

Recently, the step was made away from PowerPoint and Excel and only use web-based financials, increasing the efficiency both on the input side and reviewing. Fredrik also explained how a new best practise in one country gets picked by the central team and is then rapidly rolled out across other countries.

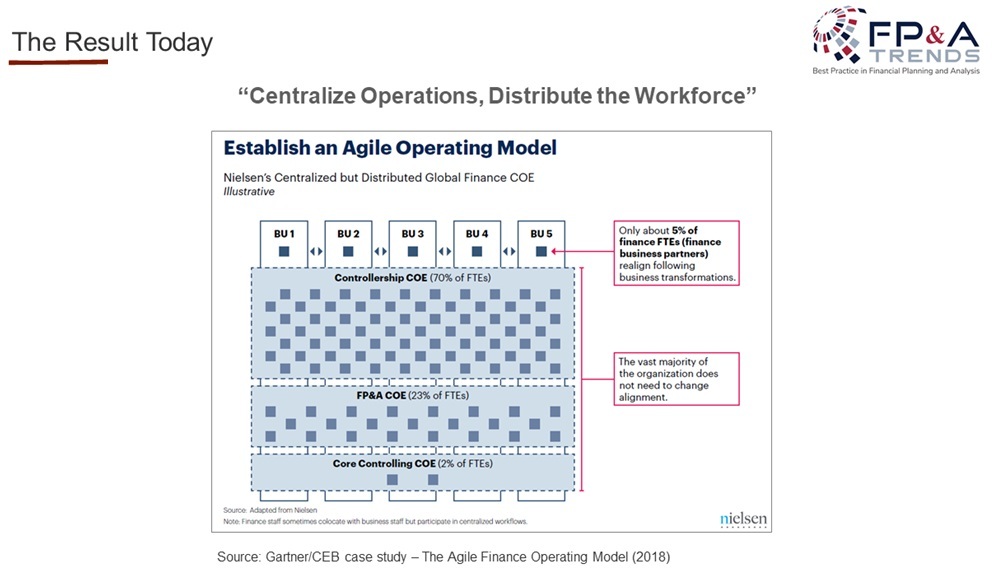

A Gartner/CEB case study of Nielsen showed that if business transformation occurs, like restructuring, consolidation or other business unit changes, only 5% of jobs in finance need to be realigned.

The results, Fredrik mentioned, are that people won’t get caught up in changes happening around them, but continue to be able to do their job. This design proved to work since they have had three major changes in the last three years. The rapid changes happening today isn’t disrupting the finance function, Fredrik explained.

Discussion value creation and finance transformation, Fredrik referred again to the focus being on improving the services and not a fixed cost target. This translates into shareholder value by investing a large part of the gains back into talent, training, and resources to improve the processes. According to Fredrik, the real value is translated into resilience.

Fredrik ended his presentation by showing the 10 transformation lessons learned. He indicated three lessons which stood out for him:

- Benchmarking to determine “best-in-class”

- Invest in change management

- Staff central PMO & fully dedicated core project team with “superstars”

FP&A technology

Next, a quick poll among the attendees showed that only 13% of the companies have FP&A technology in place that provide learning/business insights. 31% have no technology in place and 54% are slowly adapting to collaboration.

“How Technology can Enhance Organisational Structure and FP&A Collaboration”

With the impact of technology on FP&A showed in the previous presentation, Matthias confirmed that technology is one the most important drivers and enablers for having modern FP&A processes and tools within any organisation, being centralised, decentralised or a matrix organisation.

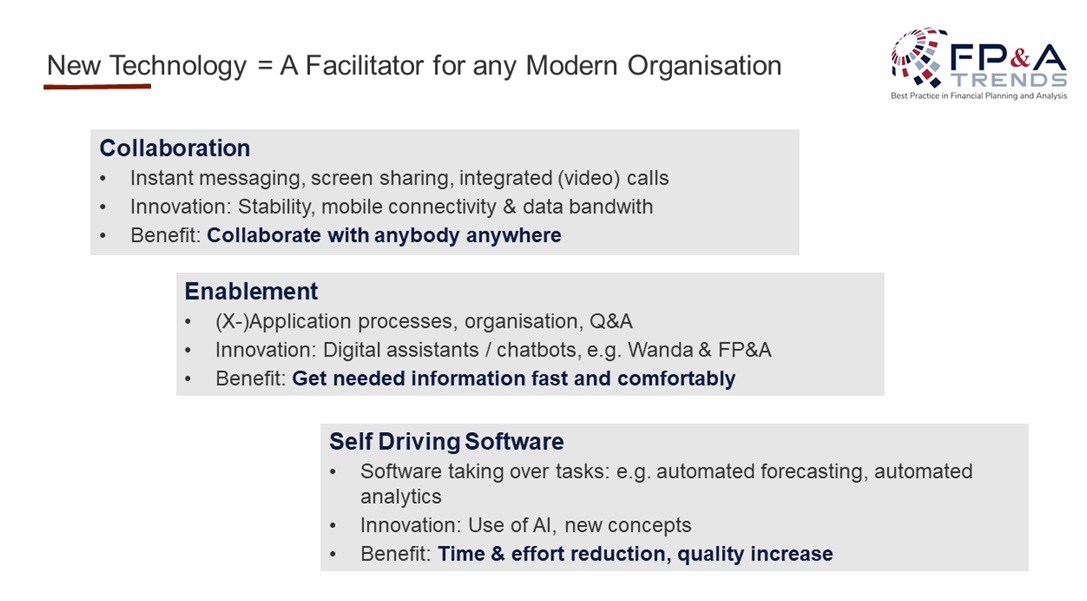

According to Matthias, new technology is facilitating the organisation in three ways: Collaboration, Enablement, and Self Driving Software.

Collaboration is already happening today and applies to many parts of the organisation. Matthias explains how technology as enabling work and people. The result of innovation here, as Matthias mentioned, is to really collaborate with anybody, anywhere, and anytime.

Matthias explained that enablement is related to processes within software applications inside companies. With practical examples, like travel or hiring a person, he showed how the right steps and rules can be guided, using a digital assistant. For FP&A this translates into asking for information on country revenues versus budget, and a graph, without having to call someone from FP&A.

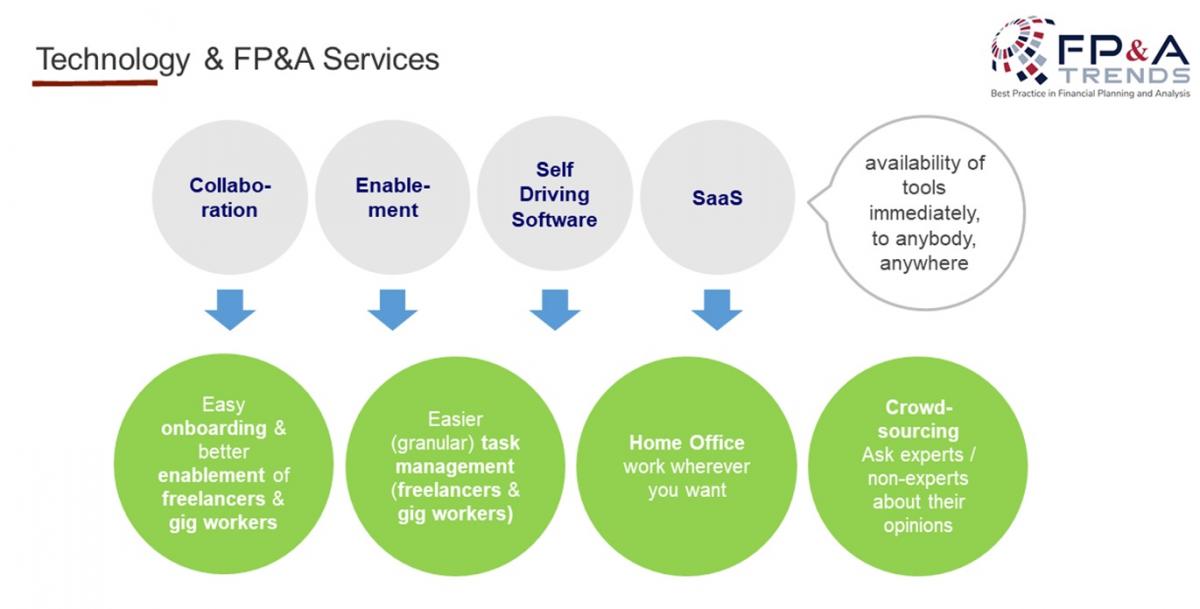

Self Driving Software goes even further. According to Mathias, this is intelligent software which takes work away, and not gives you more work. This he elaborated further by added with Software-as-a-Service. In his vision, this creates a new paradigm impacting the organisational culture and structure of ‘our time’.

Matthias extends this vision to crowdsourcing knowledge from outside, which could be especially important for FP&A. As an example, he refers to developing an opinion on what the possible future oil price for the next 12 months, using a group of external experts.

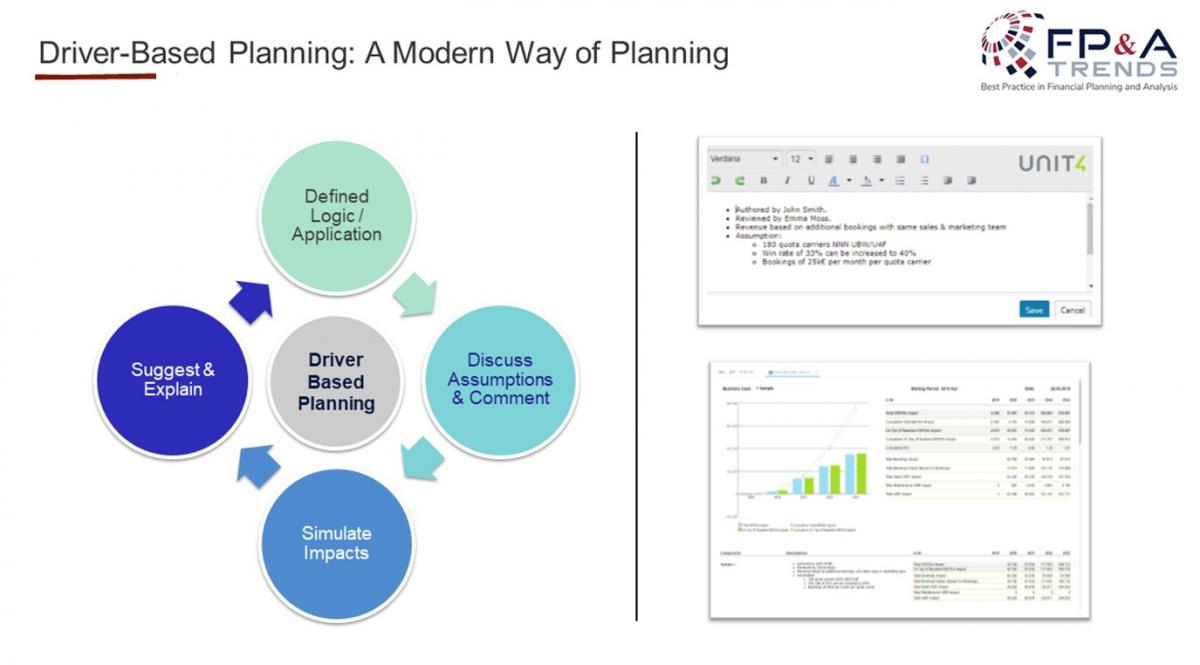

For Matthias Driver-Based Planning really shows the importance of collaboration, next to reflecting and thinking about how these figures came together in the budget.

Matthias demonstrated a practical case that goes from ‘Defined Logic’ (eg. contract deals) to ‘Assumptions’ (eg. dialogue on future performance). He showed that information on assumptions is being as important as the figure itself. Based on this, the next step is ‘Simulate Impacts’ to grow a deeper understanding of the drivers. For Matthias, FP&A is getting more multi-disciplinary and other departments will have to be involved, organised by FP&A. In the last step ‘Suggest & Explain’, it is the system that produces the report with all necessary information.

New technology, like AI, has an impact on people. Matthias explained this as follows. First, there is the fear of the unknown. Can the result be trusted? Will it take my job? Second, Matthias explains that these fears are the result of AI not explaining the presented results very well. User experience is key to gaining back that trust. And third, AI actually takes over the simple jobs, hence leaving value-adding work to the people.

Finally, Matthias showed where the ‘CFO office’ is at this point (data scientists & AI experts), and where it is headed towards to (eg. embedded AI/ML in standard software/SaaS).

Being ‘ahead of the curve’

In short, Fredrik showed that through a centralised organisation structure Nielsen made the transition into a new and modern ‘CFO office’: Centralize Operations, Distribute the Workforce”.

Matthias, discussed specifically how technology can be applied today, exploring Driver-Based Planning, and presenting the case for new technology to be a major advantage for FP&A: “collaborate with anybody, anywhere, anytime”.

If you want to learn more about the details and examples, offered by Larysa Melnychuk, CEO at FP&A Trends group and MD at International FP&A Board, Fredrik Hedlund, Senior Vice President, Global Markets CFO at Nielsen, or Matthias Thurner, Chief Product Officer & Analytics Visionary at Unit4, you can access the webinar recording here.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.