Introduction

When building a best-in-class FP&A team, you have to factor in people (organisation), processes and tools. Since everything starts with people, we can ask a question: what roles should an ideal team encompass to deliver coherent and compelling FP&A? Where does my work start, where does it end, what is expected from me, and how can I embrace the full complexity of the function? Obviously, we also may want to address future challenges, such as ESG reporting, Artificial Intelligence (AI), globalisation, and so on. Quite a number of exciting uncertainties spice up your thinking when it comes to hiring your next FP&A colleagues.

In this article, I will share the key takeaways from the inspiring Brussels FP&A Board meeting held on the 26th of September in the SPACES Manhattan Meeting Center. Together with 26 senior finance peers from diverse industries and companies such as the London Stock Exchange Group, Esko, IBA, Eurofins, Volvo, Goodyear, Stellantis, DHL, Renault and many others, we brainstormed the topic of building the best FP&A team and the essential roles for it at this meeting.

This meeting was proudly sponsored by OneStream. Thank you, IWG and Page Executive, for your great support with the event organisation.

Figure 1: Brussels FP&A Board №10, September 2024

Key Capabilities for FP&A Professionals

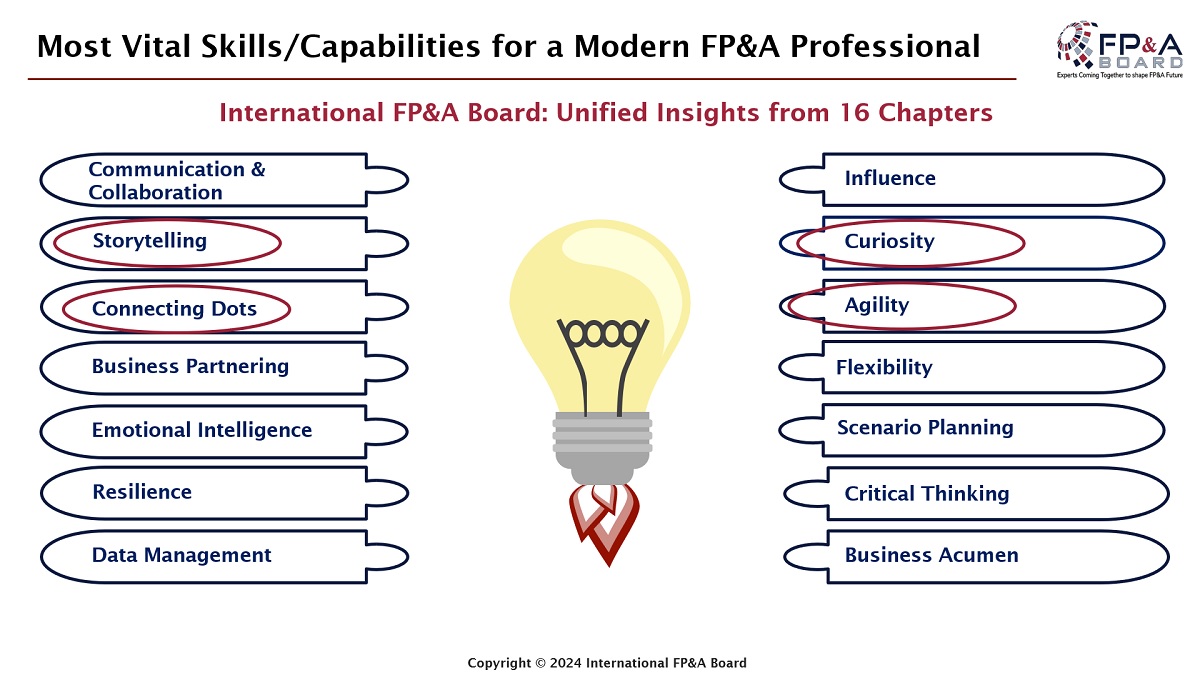

We kicked off the meeting with a question on the essential capability an FP&A professional should have. Answers converged to a few key elements:

- Agility

- (Commercial) storytelling

- Curiosity

- Connecting dots (data, people, concepts)

- ESG

Actually, practitioners at the previous International FP&A Board meetings identified 16 key capabilities for FP&A, highlighting the broad spectrum of qualities required to perform our job effectively. Except for data management competencies, we are shifting towards soft skills, while technical finance expertise also remains necessary.

Figure 2: Most Vital Skills for Modern FP&A Professionals

Thanks to our business acumen, Business Partnering, connecting, storytelling or influencing, we can interact, challenge the status quo and conduct the transformation. Being at the intersection of so many aspects, FP&A requires a new skill set that redefines its role. While factors impacting your business are becoming even more interconnected, we need to adjust our plans and models on the fly. Then, the question is whether you are able to manage your scenarios effectively. FP&A is not about number crunching anymore. It is about adding value, using financial insights to steer the business, supporting decisions, and designing strategies.

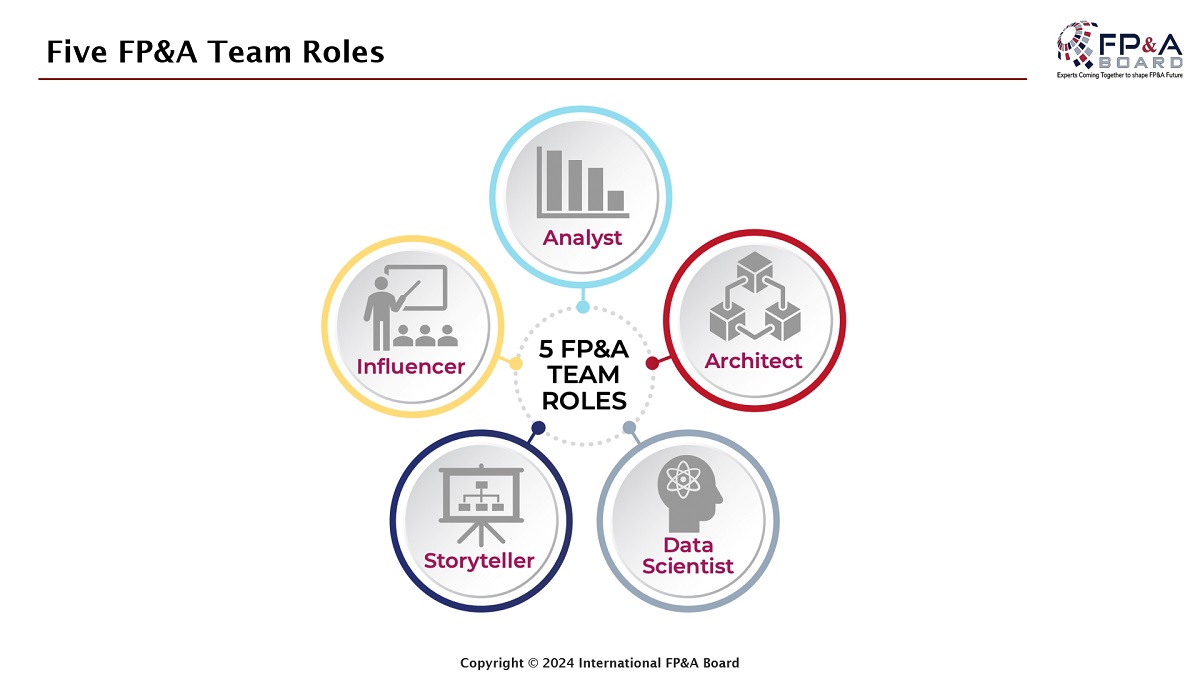

5 FP&A Roles for Optimised Performance

The percentage of time spent on data collection and validation remains the main frustration for FP&A managers today, as 45% of FP&A time is used for non-value-adding activities, according to the 2024 FP&A Trends Survey. Despite technological improvements, the abovementioned Survey shows that only one-third of the time is spent on high-value-adding activities, like insight generation and driving actions. Data science, data crunching, reporting, and analytics remain explicit expectations from a well-performing FP&A team. This invokes five different FP&A roles that can be deployed in a good team.

Figure 3: Five Essential FP&A Team Roles

The most common element between all of the five roles is the analytical part:

- An FP&A architect is distinguished from an IT specialist due to his understanding of the underlying analysis;

- the data scientist can automate their view on the expected analytical treatment, which can make him a scenario modeller;

- a storyteller is required to ground his vision on educated insights;

- The influencer will oversee the realisation of the strategies thanks to his capacity for connecting all its aspects.

All of these underscore that analytics is at the core of the FP&A roles.

Despite this common characteristic, it is remarkable to notice the differences between these FP&A profiles.

While analyst, architect, or data scientist are already recognised roles, storytelling and influencing are rather considered skills today. These are often seen as an extension of the existing ones while we are contemplating drastically different profiles.

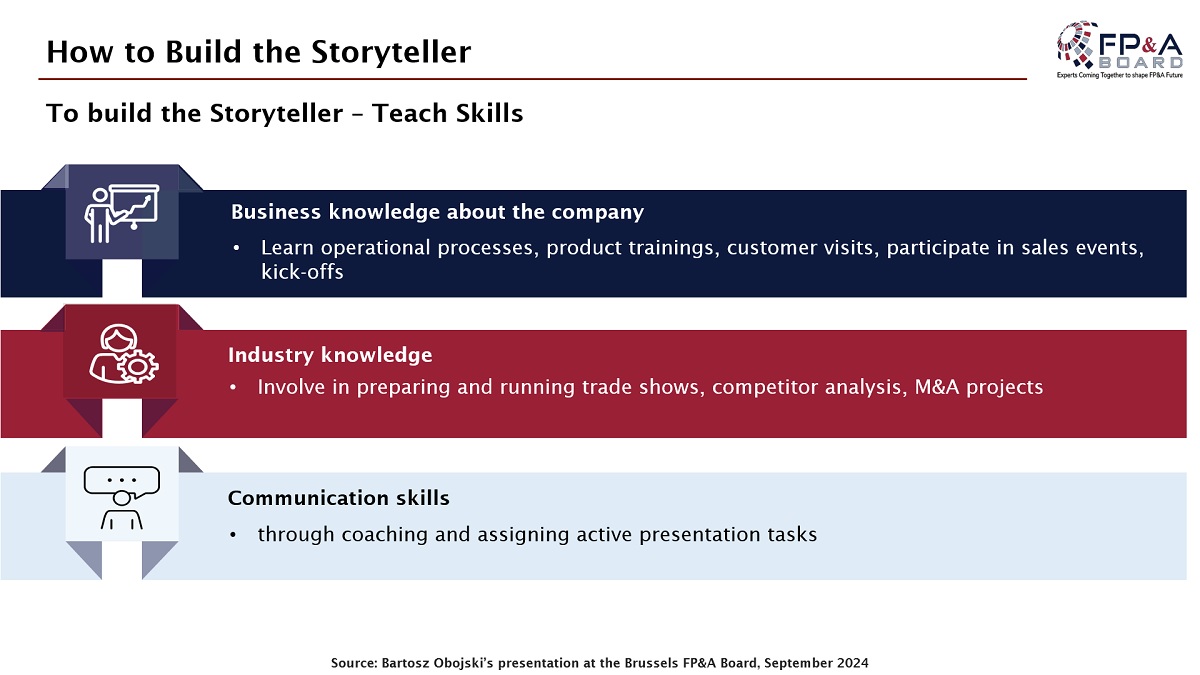

"Back office" functions, such as data architecture, data science and analytics, can now be linked to "front office" roles that are crucial for decision-making in business. A remarkable example comes from Bartosz Obojski, Director of Global Finance Planning and Analysis at Esko and Brussels FP&A Board Ambassador, who talked about his experience at Goodyear. A few years ago, this company decided to create a Shared Service Centre for FP&A. This was dedicated to the back-office aspects of the role, including data collection, validation and reporting. They managed to achieve notable efficiency gains through the specialisation and synergies across the various business branches. In this setup, the emerging and local FP&A roles would only focus on storytelling and influencing while receiving full business analysis produced centrally for every business unit or their subsidiary in the world. It allowed them to highlight how different the profiles become, where the local FP&A roles focus on Business Partnering and added value without spending the least time behind the screen to come up with the insights.

Figure 4: Key Insights on Building an FP&A Storyteller’s Role

The key challenge of the new FP&A manager is to orchestrate these profiles. On the one hand, you will have “nerds” whose brains are bubbling with the most complex data puzzles; on the other, you will have “commercials” skilled in communication, networking and convincing. Data-oriented profiles will feed story-oriented ones, and you will see how they can work together.

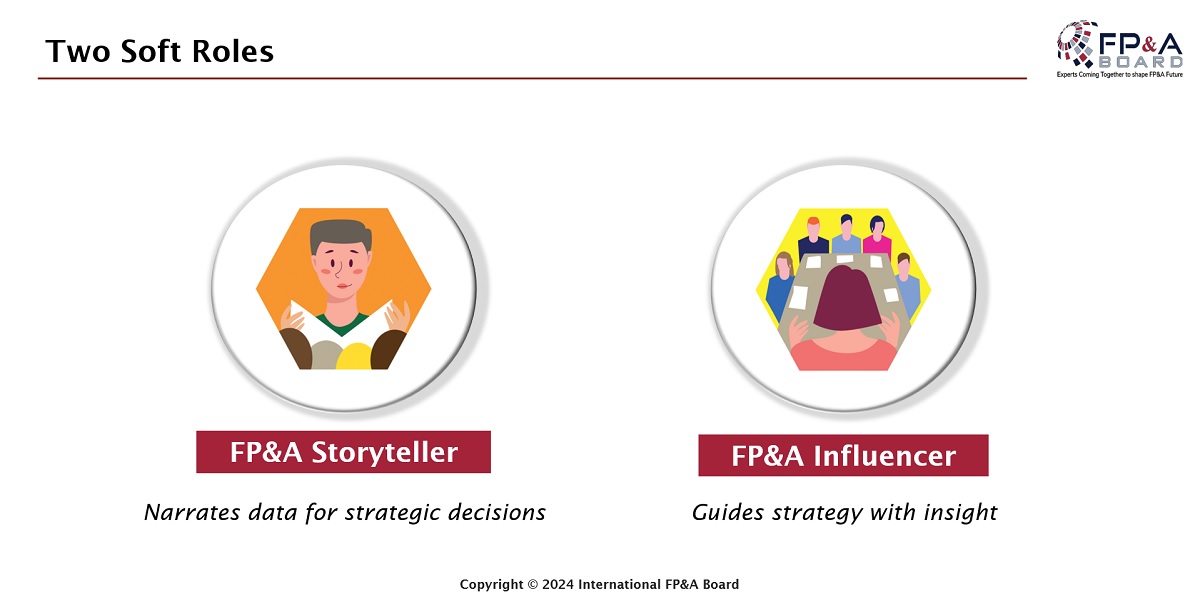

Storyteller or Influencer?

Although the line between these two roles may be thin, neither can exclude or substitute the other. The role of FP&A does not solely require driving the strategic plan with storytelling but includes Business Partnering and decision support.

Figure 5: Two “Soft” Roles – Storyteller and Influencer

To understand the difference between these roles, you can make the analogy with sales and marketing, where sales would be the storyteller and marketing the influencer. You need both. FP&A’s narrative is traditionally associated with the business and strategy plan. The influencer ensures that the story can be transformed into actions by refusing to let the business make a mistake. Each time when analytics indicate a risk or a deviation or when the team is not following the story, the influencer will trigger the discussion, clarify and ensure delivery. As a catalyst, the influencer cares that the strategy is implemented and the objectives are met.

Group Work

On hearing the input from the discussion facilitator, the attendees were asked to discuss practical steps for building the best-in-class FP&A teams in small groups. Each group was asked to discuss a particular aspect: leadership, functional skills, and Business Partnering.

Figure 6: Group Work at Brussels FP&A Board №10, September 2024

The first group discussed leadership. They highlighted that building vision, trust, and leading by example are crucial for a modern FP&A leader. They also stressed the importance of leaders recognising skill gaps within the team and providing the necessary support and resources to empower individuals to bridge those gaps effectively. By doing so, leaders can create an environment where continuous development and growth thrive.

The second group underscored the importance of developing our storytelling capabilities. However, technical expertise should not be neglected, and we must focus on improving it. This group emphasised the Influencer’s role, stressing that these professionals can foster a true Business Partner culture within the organisation.

The third group focused on the aspect of Business Partnering. Members of this group concluded that developing a deep understanding of the business and its specific needs is essential for becoming effective Business Partners. By fostering this understanding, we can align our efforts more closely with organisational goals and contribute meaningfully to overall success.

Figure 7: Group Work at Brussels FP&A Board №10, September 2024

Conclusions

It is amazing to notice how the FP&A roles continuously evolve, and expectations keep increasing. Next to classical financial reporting, ESG brings the requirements to intertwine strategy with sustainability and business understanding. Will AI drastically change the profiles within your FP&A team in the coming years? You can dream that AI will help us with architecture, data science and automation, reporting, and maybe even storytelling. However, when a board of directors decides on a major investment, they will only need trust. Your storytellers will evolve and become specialists in prompting AI with the right questions to build the scenarios. Your “commercials” will evolve, too, and will arbitrate between more and more scenarios at a faster pace. And you, as an FP&A leader, like a football coach, will keep orchestrating all these profiles to work together towards the winning finance team of the future.