Discover how AI agents revolutionise FP&A by enhancing decision-making, streamlining workflows and enabling professionals to focus...

As Artificial Intelligence (AI) becomes increasingly integrated into FP&A, finance professionals are presented with both unprecedented opportunities and significant challenges. The recent Digital North American FP&A Circle explored how organisations can navigate AI-driven transformation while managing the complexities of change. The session, enriched by insights from industry leaders and interactive polls, examined AI’s impact on FP&A, the human and technological barriers to its adoption and actionable strategies for change management.

This report summarises the key insights and takeaways from the webinar, offering a roadmap for FP&A professionals to leverage AI effectively while overcoming the challenges of adoption.

How AI Will Transform FP&A in 2025

Enrique Rodriguez, Ex-Finance Director of Corporate Procurement at Walgreens Boots Alliance, opened the discussion with a comprehensive overview of AI trends shaping FP&A in 2025. He highlighted the transformative power of Agentic AI, which enables autonomous decision-making and real-time optimisation of financial operations. Another key trend is Hyperautomation, the convergence of AI, Machine Learning, and Robotic Process Automation (RPA), which streamlines complex financial processes. The democratisation of AI is also gaining traction, allowing non-technical finance professionals to develop and implement AI-powered solutions without extensive programming knowledge.

Figure 1

Despite these advancements, Enrique underscored several barriers to AI adoption, including legacy systems, skill gaps, and data security concerns. To navigate these obstacles, he outlined a structured approach: cultivating a culture of agility and innovation, securing leadership buy-in, and engaging stakeholders with clear communication about AI’s value proposition. He emphasised the importance of pilot projects to demonstrate AI’s potential before scaling adoption across an organisation.

Poll Insight: How Does Your Organisation View AI in Finance?

Following Enrique’s presentation, participants were polled on how their organisations perceive AI in finance. 41% of respondents considered AI a nice-to-have tool, while another 38% viewed it as essential for growth. However, 14% of respondents expressed concerns about AI’s potential risks, and 7% saw it as unnecessary complexity. These results highlight a divide between early adopters and those hesitant about AI’s implications.

Figure 2

Navigating the Human Change in AI Adoption

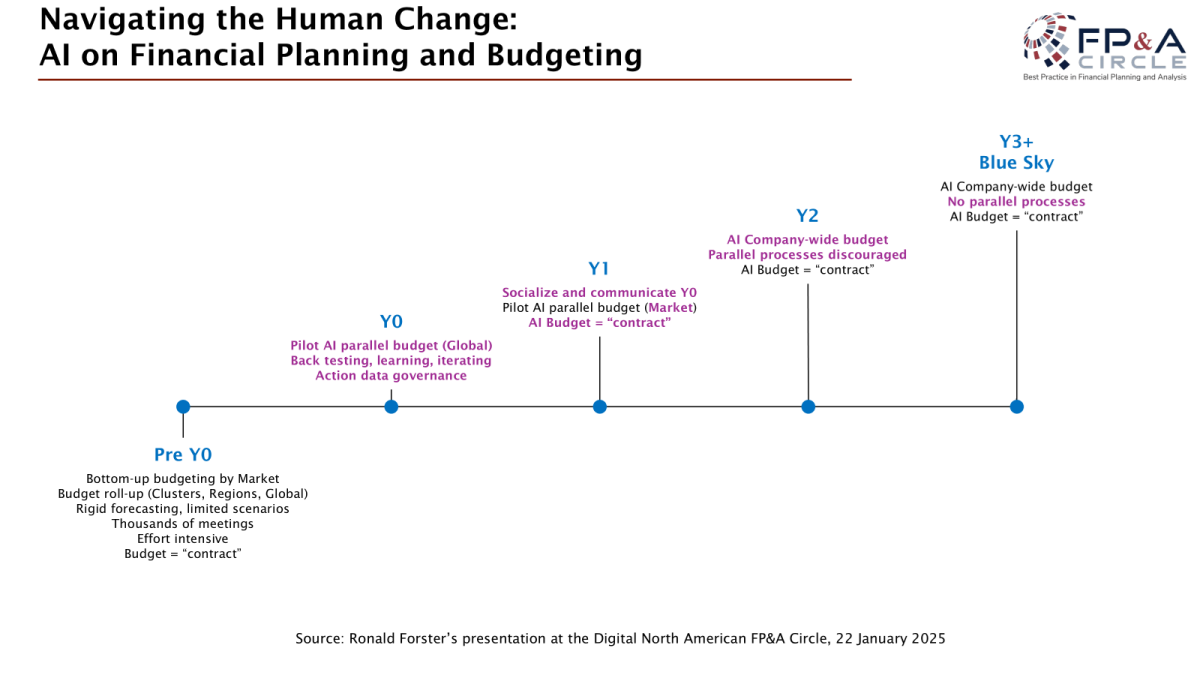

Ronald Forster, Head of FP&A Technical Research & Development at Novartis, provided a deep dive into AI’s role in enhancing budgeting speed and agility while reducing bias. He emphasised the importance of clear problem definition when implementing AI — rather than adopting AI for the sake of innovation, organisations must first identify specific challenges AI can solve. At Novartis, AI has been instrumental in automating budgeting processes, improving forecasting accuracy, and reducing manual inefficiencies.

However, Ronald cautioned that AI implementation is not without challenges. Data governance remains a critical issue — without high-quality data, AI models cannot deliver reliable insights. Additionally, organisations must commit fully to investment in AI, ensuring that the necessary resources and expertise are in place. He stressed the importance of incremental deployment, allowing organisations to refine AI models before full-scale implementation.

Figure 3

Poll Insight: What is the Biggest Barrier to AI Adoption in FP&A?

Participants were then asked about the primary obstacles to AI adoption in their FP&A functions. The majority, 42%, cited data quality issues. Lack of skill training ranked second at 29%, reinforcing the need for targeted upskilling initiatives. Resistance to change (19%) and accountability blur (10%) were also noted as barriers, illustrating the challenges of convincing teams to trust AI-driven insights and unclear responsibility for AI forecasts.

Figure 4

Roche Digital Finance: AI in FP&A: Developing Meaningful Use Cases

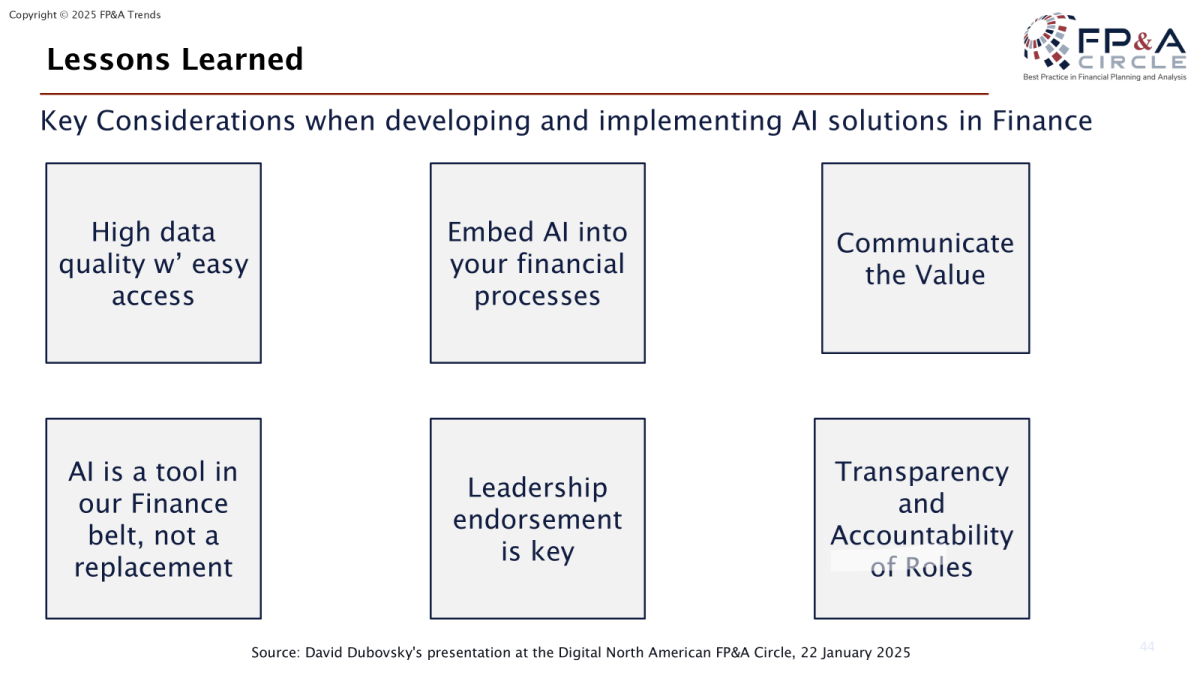

David Dubovsky, Digital Lead - Finance Enterprise Centre of Excellence at Genentech/Roche, discussed AI-driven decision-making in finance within the pharmaceutical industry. He highlighted the importance of selecting the proper use cases, ensuring AI adoption, and integrating it into business processes.

David emphasised three primary AI applications: improving finance operations through Automation, leveraging Machine Learning for predictive insights, and streamlining back-office functions such as contract generation and payment management.

A key example shared was Roche’s AI-driven daily sales forecasting model, which refines predictions by integrating 11 statistical models tailored to different regions and products. He stressed that AI models should complement human expertise rather than replace it, citing cases where market dynamics, such as weekly sales fluctuations and end-of-month accruals, must be factored in for accurate forecasting.

Figure 5

David also underscored the necessity of a strong data foundation, advocating for a federated data mesh approach to ensure meaningful data organisation. He concluded by emphasising the need for high-quality, accessible data, clear communication on AI’s value, and evolving organisational roles to facilitate AI integration. His insights reinforced AI’s role as a supplementary tool that enhances decision-making rather than replacing human judgment.

Poll Insight: What Percentage of Effort in AI Adoption is Dedicated to Data Quality and Data Governance in Your Organisation?

The poll results indicate that 40% of AI adoption efforts are dedicated to data quality and data governance, with 36% of respondents selecting this option. The distribution of responses shows a balanced spread, with 27% allocating 20% of effort, 25% allocating 60%, and 13% indicating that 80% of AI adoption efforts focus on data governance and quality. It suggests that while the majority recognise data quality as a significant factor, there is variability in how organisations prioritise it within their AI initiatives.

Figure 6

Greater Efficiency and Accuracy for Data Management

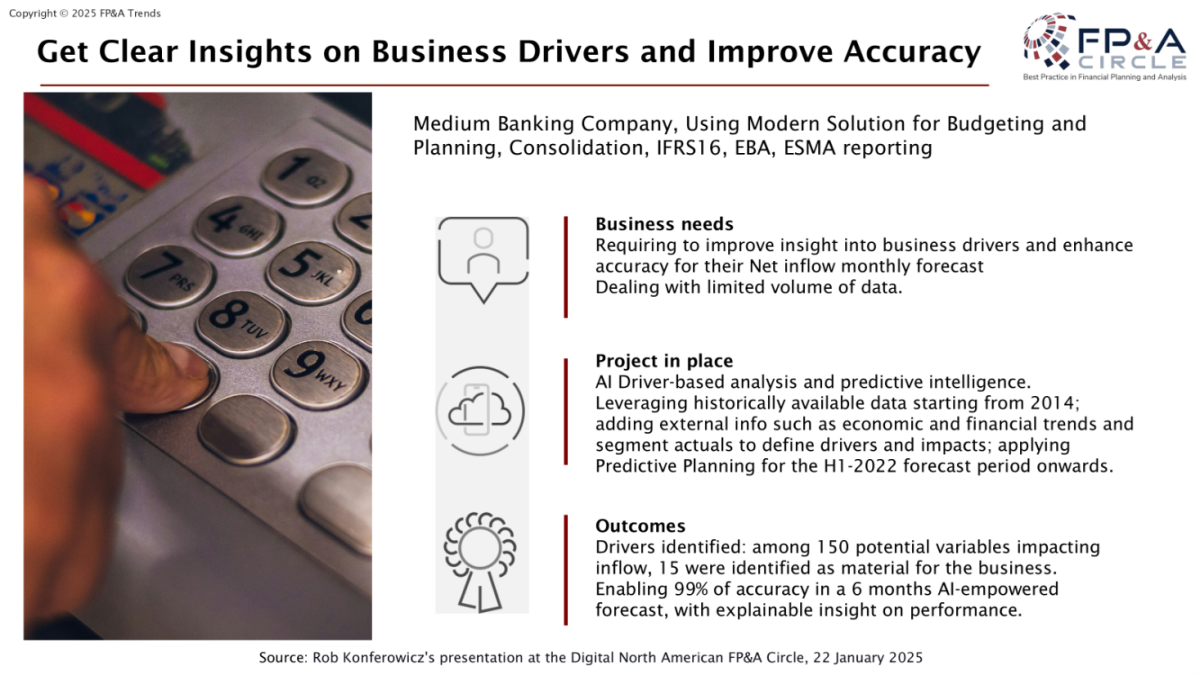

Rob Konferowicz, Director of Operations at Wolters Kluwer CCH Tagetik, discussed the critical role of data quality and governance in AI adoption, noting that many organisations struggle with siloed data across departments like marketing, sales, and R&D. These fragmented data sources make it difficult to get a clear, organisation-wide picture, placing undue reliance on a few individuals to piece together insights. As a result, companies spend more time preparing data than leveraging it for decision-making.

To address these challenges, organisations are turning to AI-driven finance transformation tools, such as AI-powered transaction matching, anomaly detection, and driver-based analysis. Rob highlighted how CFOs are increasingly embedding AI into Financial Planning and Analysis (FP&A) workflows, not just for predictive forecasting but also for deeper insight generation.

A key example he shared involved a company identifying 150 variables affecting cash inflow forecasting. Through AI analysis, they refined their focus to 15 key drivers, which significantly improved forecast accuracy. By integrating these insights into financial models, the company was able to anticipate shifts and make data-driven decisions more effectively.

Figure 7

Rob concluded by emphasising that AI must be embedded into daily workflows rather than used in isolation, ensuring finance teams can maximise insights and drive strategic outcomes.

Conclusion

AI is set to revolutionise FP&A, driving efficiency, accuracy, and strategic insight. However, adoption is not without challenges — data quality, cultural resistance, and skill gaps must be addressed for AI to reach its full potential. The webinar underscored the importance of clear problem definition, leadership alignment, and targeted upskilling in ensuring successful AI implementation.

FP&A professionals must approach AI as an enabler rather than a replacement, leveraging it to enhance, not replace, human expertise. The future of FP&A lies in a collaborative approach, where AI-powered insights and predictions support decision-making while finance professionals retain their critical thinking and strategic influence.

To watch the full webinar recording, please check out this link.

This Digital North American FP&A Circle was proudly sponsored by Wolters Kluwer.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.