Many companies measure their progress against annual objectives through profit and loss (P&L) reporting and a...

Over the last ten years, the environment of decision-makers has evolved in the direction of greater complexity and interdependence, extreme speed and omnipresent volatility. As a consequence, new risks of all kinds have arisen: this is the now well-known "V.U.C.A." world that the shock of the great pandemic only serves to illustrate.

Over the last ten years, the environment of decision-makers has evolved in the direction of greater complexity and interdependence, extreme speed and omnipresent volatility. As a consequence, new risks of all kinds have arisen: this is the now well-known "V.U.C.A." world that the shock of the great pandemic only serves to illustrate.

Faced with this situation, to continue to operate, serve their customers effectively and sometimes survive, companies must adapt in near-real time to changes in their internal and external environment. It is all about developing the "agility" of the organisation. This means literally being able to move forward and act as required by the pace of business change.

FP&A teams have here obviously a key role to play in providing access to up-to-date, comprehensive as well as reliable data and information to management.

Corporate Performance Management (CPM) has long consisted in breaking the company’s strategy down into operational objectives and indicators, measuring the achievement of these objectives against operational entities' budget or forecast and taking action on that basis. This approach was effective in a stable business environment, with slow and controlled changes. This time has gone. FP&A teams must undergo a transformation process to be effective in the “next normal” environment and aim at positioning themselves as ”trusted business partners" for management.

Transforming Corporate Performance Management, a few ideas...

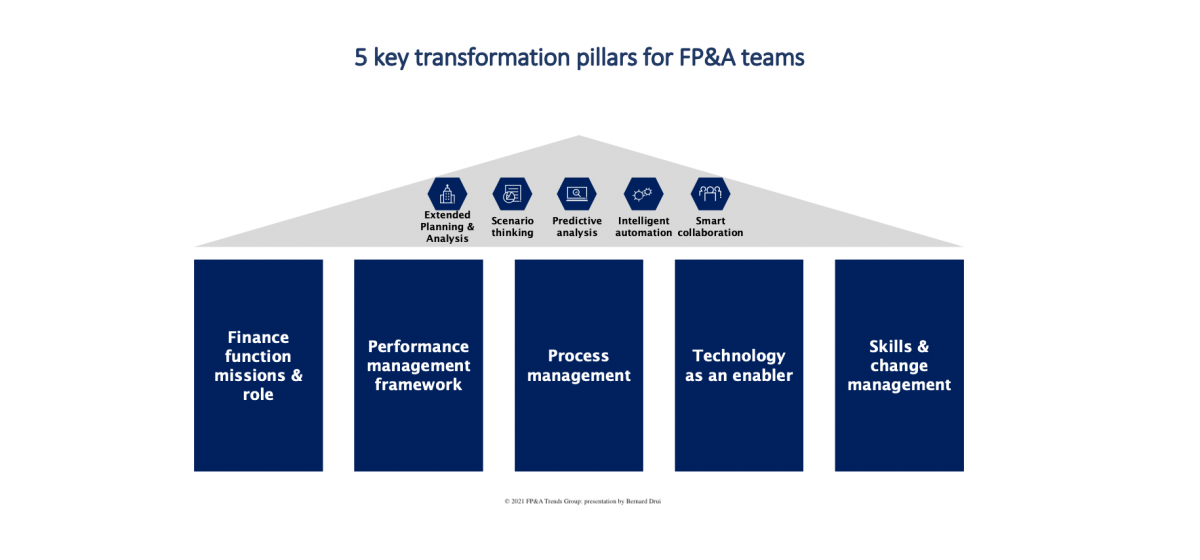

Digitalisation of the forecasting cycle and better data management (access, reliability, traceability, security, etc.) are essential today and constitute often a first step in the transformation process. However, to maximise the return on investment, they must be accompanied by:

a broader transformation including a reflection on the global mission of the finance department,

a review of the Corporate Performance Management framework, process effectiveness and control (roles and responsibilities, operational risk management),

implementation of efficient and scalable systems,

the development of soft skills within the company (digital, ability to collaborate, empowerment, responsiveness and flexibility, etc.).

5 key transformation pillars for FP&A teams

1. Clarify and/or complete the scope of the Finance Department's missions:

Position FP&A as a strategic partner in operations: integrated vision of the company, development of scenarios, informed decision making

Structuring data governance: definition of finance department data, focus on data quality and security

Linking the Corporate Social Responsibility (CSR) theme to Corporate Performance Management

From a governance standpoint, ensure the role and scope of the finance function is positioned and understood as a global and strategic partner to the business. This is foundational to enable an integrated financial view of the company’s business and operations, aligning cross functional initiatives with corporate strategy It’s a condition absolute prerequisite to translate strategic goals into actionable plans and indicators. By reducing traditional silos, it ultimately contributes to creating a business intelligence shared between finance and operations.

2. Rethinking the Corporate Performance Management approach:

Redefining key performance indicators considering new requirements

Make the forecasting cycle processes more agile and relevant

Standardise reporting and operational and managerial dashboards

Understand what drives success in the business, develop relevant measures for those drivers and go to a truly integrated and driver-based business planning and forecast process. This is ideally performed by leveraging a relevant data governance structure and high level of automation in the finance function, enabling streamlined data integration, automated reports easily shared and distributed - even on self-service mode - as well as Artificial Intelligence when relevant for predictive analytics and planning.

3. Regain control of the processes:

Document processes and ensure that they are accessible, understood and known by as many people as possible in the company

Clarify the roles and responsibilities of each person (in terms of execution but also performance, efficiency and risk control)

Ensure that risks are identified and controlled

The basics are too often left aside. Finance processes and forecast cycles must be defined, documented with clear assigned roles and responsibilities as well as risks identified and mitigated. In short, finance and FP&A processes have to be robust and leverage best of breed planning cloud-based tools and technologies in a cybersecured way. Let’s stress here the fact that this is the condition for effective remote working in the finance function that has become relatively commonplace.

4. Optimise the use of technology:

Digitalise the forecasting and reporting cycle to promote collaboration and access to data while ensuring security and traceability

Take advantage of Artificial Intelligence (including analytics) to solve current problems and improve its ability to anticipate, decide and act

Equip yourself with a modern reporting tool that allows users to easily access data, conduct their own analyses, and define their own dashboards (taking into account mobility needs, if applicable)

Automation is an opportunity to reduce costs, free-up resources for higher added-value activities and forward-looking analytics and planning. Modern tools for planning and analysis allow to plan for multiple scenarios rather than for only one possible outcome. By considering different options for the future based on scenarios, organisations can improve their resilience and make the most of potential opportunities. Real-time, accurate and relevant information stemming from well-governed data and tools can be used to identify opportunities for growth, efficiency gains and performance enhancements.

5. Develop skills and foster collaboration within the company:

Have the ambition to increase the financial culture of the organisation in order to help decision making

Break down silos between functions and develop an integrated approach to planning (sales, logistics, finance, etc.)

Foster an agile and flexible mindset through careful change management

Eventually, the key change enabler in an organisation is the human factor. Nothing will happen if you do not prepare and train the finance team to be able to embrace the “new normal”. This implies giving them first the ability to understand and make the most of new tools and techs as well as a broad business literacy to collaborate effectively with business. Some strategic recruitment may be needed as a catalyst for change, as well as the use of design thinking approaches and tools. Doing so, you’ll foster progressively an agile mindset within the finance community and grow its ability to boost collaboration with business on a day-to-day basis and increase as well consequently financial literacy in the organisation.

The target of Corporate Performance Management in the agility age is clear: creating a robust, truly collaborative, integrated, up to speed and proactive informed-decision enabled organisation. This does not happen overnight though and requires leadership engagement from the top management team to show the way, explain, train, and nurture change. This is the path to really unlock the potential of digital, foster productivity and agility of the finance team to provide strategic decision support and be, at the end of the journey, a trusted business partner for the broad management team.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.