In this article, discover how AI is transforming FP&A roles, skills, and storytelling — and what...

The 28th meeting of the AI FP&A Committee convened to address one of the most pressing topics in modern finance: the Transformation of Artificial Intelligence in FP&A.

The session was facilitated by Larysa Melnychuk, Founder and CEO at FP&A Trends Group. Tanbir Jasimuddin, a respected FP&A thought leader, FP&A Trends author, and Ambassador, shared his insightful presentation, “AI Transformation in FP&A and Analytics”. It provided a comprehensive overview of AI's current impact, building AI foundations, Agentic AI, and transformation using the FP&A Trends AI Maturity Model.

The discussion focused on theoretical and practical applications with real-world examples. The session also explored tangible use cases and the foundational requirements necessary to achieve the shift in the finance world. Jasimuddin elaborated further on the theme that it's not just about improving how AI operates, but it's actually about what the finance function aims to achieve out of the designed process. This provided a strategic tone to the discussion. The key theme was that AI's true potential lies not in replacing finance professionals in the process, but aims to reduce repetitive low-risk tasks to increase their bandwidth to drive greater strategic value.

The Evolving Impact of AI on FP&A

AI's influence on FP&A is unfolding across three primary domains: Productivity Enhancement, Insight Generation, and Decision Support.

Productivity Enhancement: This benefit is most evident among other impacts, where AI automates repetitive manual tasks that have traditionally taken up a significant portion of an FP&A operation. According to the 2025 FP&A Trends Survey, teams still spend 46% of their time on data collection and validation. AI directly addresses this inefficiency. Tanbir shared an AI use case of Allianz, which reduced its workload in data integration by 60%. Another powerful example is "budget seeding," where AI generates the first 70-80% of a budget based on existing data and trends, freeing up the FP&A team to focus on subjective and strategic areas.

Insight Generation: Once productivity achieves an efficient benchmark, AI can now focus on uncovering the sub-layers that provide deeper insights from the data. It can serve as a "virtual assistant" that provides a natural language interface to vast datasets. This can behave like a self-serve portal where, instead of navigating complex reports, users can simply ask questions and receive immediate responses. Hence, it transforms how data is explored, understood, and utilised.

Decision Support & Simulation: This is where AI delivers its most strategic value when it has achieved its stability by handling and understanding the right data. Although Machine Learning (ML) forecasting has seen fluctuating adoption rates over the years, with AI correcting its course of action and taking correct measures, it can increase its potential for accuracy. One telecom company, for instance, achieved 99.9% forecast accuracy within six months of implementation. This case study supports that with the proper assistance from AI, these models can now leverage a much greater data source to generate multiple, dynamic scenarios, moving beyond simple forecasting to sophisticated simulation.

Building the Foundation for Success

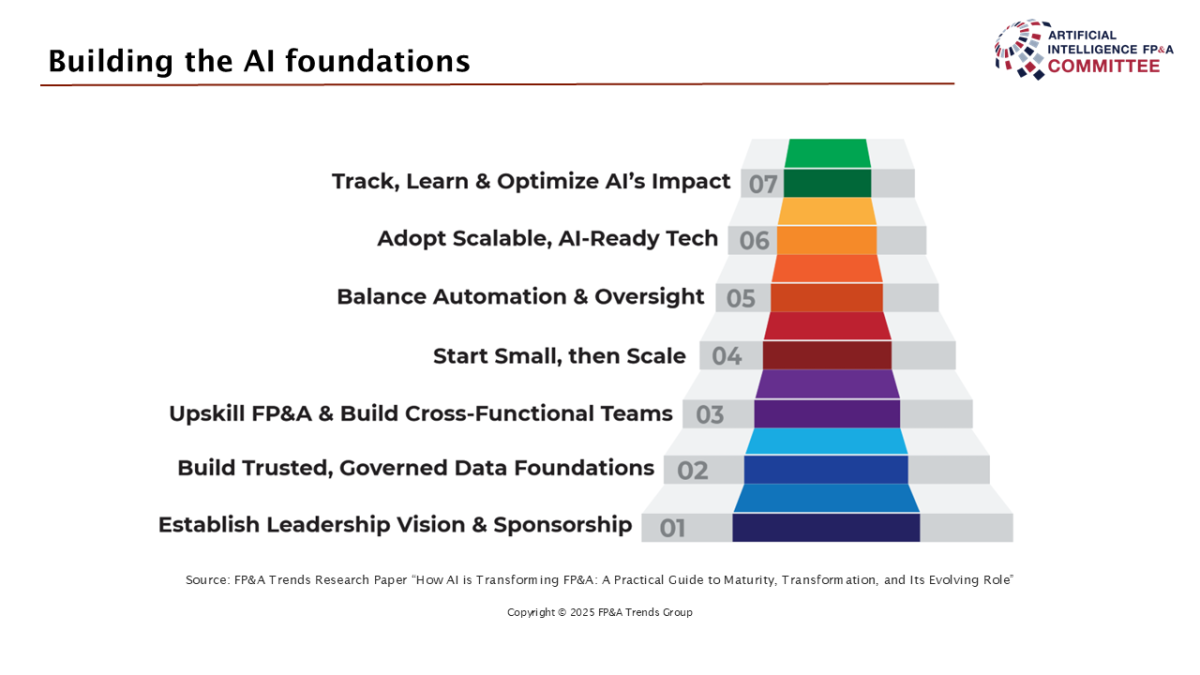

Adopting AI is not a simple plug-and-play exercise. Jasimuddin emphasised that successful implementation requires a deliberate, foundational approach built on seven key steps:

- Establish Leadership Vision & Sponsorship

- Build Trusted, Governed Data Foundations

- Upskill FP&A & Build Cross-Functional Teams

- Start Small, then Scale

- Balance Automation & Oversight

- Adopt Scalable, AI-Ready Technology

- Track, Learn & Optimize AI's Impact

Figure 1

During the Q&A, this foundational aspect resonated with attendees. Finance Project Manager at Azets talked about the challenge that potential sponsors often don't fully grasp the full picture, making top-level buy-in a slow process in large organisations. Tanbir agreed, describing the ideal champions as "unicorns" or "translators" who understand business strategy, operations, and technology and possess the influencing skills to bring stakeholders along.

Adding to that, the Corporate Functions Transformation Director of Nexans raised a critical point about educating and structuring teams, bringing into discussion whether skills should be centralised or distributed across business units to reap the maximum benefit. Jasimuddin advocated for a hybrid approach, stressing that collaboration in cross-functional teams is "the single most important skill to have as a finance person" in an environment where no one can be an expert in everything.

Data Architecture: The Engine of AI

Underpinning any successful AI initiative is a robust data architecture. Jasimuddin presented a next-generation model moving from disparate data sources at the bottom to user-facing presentation layers at the top, such as AI co-pilots and interactive dashboards. A key concept introduced was the "data fabric," which describes how data from various sources "knits together" through a combination of traditional ETL/ELT processes and modern low-code API available.

Figure 2

The discussion expanded on a common pain point, the Senior Director, Global Head of G&A Finance, Digital and FP&A Excellence of Takeda raised: data ownership and governance. This is key when finance data is moved to a central "data lake". She indicated challenges with reconciliation, loss of control, and managing access once the data is outside the financial ecosystem. Jasimuddin addressed the concern by suggesting that clear data governance be established by splitting data into domains (e.g., finance, HR, marketing) with designated business owners. He also stressed the importance of "data lineage" — tracking where data originates, what changes are made, and where it ends up to maintain integrity and pinpoint errors as data moves between systems.

The Next Evolution: Agentic AI

The conversation now elaborated on the key change agent that Jasimuddin coined as an "absolute game changer": Agentic AI. This represents the next step beyond rule-based Robotic Process Automation (RPA), bringing fundamental finance intelligence into the application that will not only add smart solutioning but also avoid model hallucinations. While RPA is constrained by if-else logic, AI agents are designed to be more autonomous and adaptive because they are trained on a specific domain. They combine large language models with algorithms to understand domain context, execute multi-step tasks, and learn as they go. Tanbir gave an example of AI agents used during the Trump tariffs to analyse SKUs, determine their origin and destination, look up rapidly changing tax rates, and apply them in real-time — a task far too complex for traditional RPA.

A Roadmap for Transformation: The FP&A Trends AI Maturity Model

To guide organisations on this journey, the FP&A Trends Group has developed the FP&A Trends AI Maturity Model. This tool provides a framework for assessing an organisation's current state across eight dimensions, including Data, Technology, People, and Governance, and five levels of maturity, from "Basic" to "Leading Visionary Level". This model serves as a roadmap, helping teams understand their current state and approach, define the target operating model, and identify the specific steps needed to get there.

This transformation also reshapes the FP&A team itself. The meeting highlighted the five key FP&A team roles: the Analyst, the Architect, the Data Scientist, the Storyteller, and the Influencer. Jasimuddin noted the particular rise of the FP&A Architect and Data Scientist, who bring the specialised skills necessary to build and manage the sophisticated systems underpinning an AI-driven finance function.

Figure 3

Conclusion: A More Human Future for Finance

After discussing various queries and supporting the responses with known case studies from the industry, the panel concluded that the AI transformation is not about technology replacing people. Still, it is about a more strategic approach where technology will elevate the human element of finance, enabling robust decision-making. Jasimuddin highlighted that systems are becoming more intelligent and stated that, on a macro level of operation, the goal of finance is to become more human, not less, and that will add value to our judgment, critical thinking, and the ability to influence. The sophistication of the tools does not define success in this new era, but rather by the strength of the leadership, the clarity of the strategy, and the collective will to embrace change.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.