In this article, explore how FP&A professionals can turn the AI boom into a strategic advantage...

Let’s be honest, AI is shaking things up, and naturally, everyone in FP&A is wondering what their teams are supposed to look like in the near future and how to ensure we can build up new talent. It’s not just about having a vision – it’s about being resilient to change, and being able to transform quickly, with minimal spend, and without throwing your business off track. There is simply no time (or budget) for slow, expensive change in a world that never sits still. CFOs must adopt a transformation mindset – fast. And the senior finance leaders? They need to back up the CFO, making their teams more efficient, tech-savvy, and totally in sync with the business. Standing still is no longer an option. The pressure is on.

What Does AI Mean for FP&A?

With AI entering the FP&A world, the focus shifts. It becomes less about grinding through spreadsheets and more about making sense of the data, telling a story, and shaping business decisions. Of course, one can argue that this isn’t entirely new – storytelling and influencing have always been in the mix, but they still go into analysis most of the time. 2025 FP&A Trends Survey shows that 46% of FP&A time is spent on data collection and validation – the highest figure in five years [1]. Now, with AI, the shift to decision-making is on hyperdrive. FP&A isn’t just reporting the numbers anymore. It becomes a real business partner, pushing strategy forward.

Key Skills for the Future FP&A Team

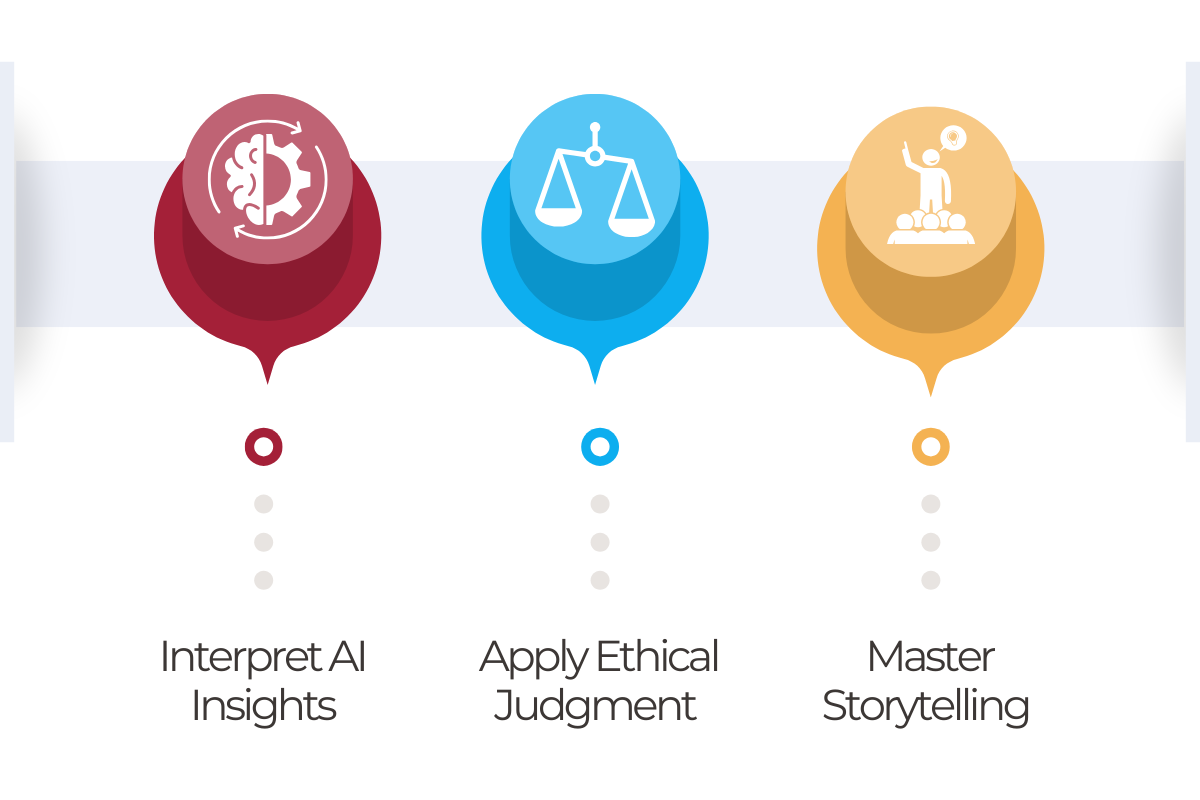

Everyone is curious today – what skills do you need on your FP&A team? And more importantly, what skills should we teach our young professionals who are just starting their FP&A careers? Here are some pieces of advice to take into consideration ( see Figure 1)

Interpret AI Insights – Someone has to make sense of what the algorithms spit out. Human judgment is still key here. AI is only as good as the data you give it, and often, it misses the subtle business context. FP&A professionals must ensure machine output is accurate and translate it into actionable business insight.

Apply Ethical Judgment – AI can pick up all sorts of biases from its data. It might miss ethical implications, too. Even though some AI tools clearly state that they will not provide any opinions or judgments, we cannot simply trust them. We need people who can spot and manage this – AI won’t (always) run itself responsibly.

Master Storytelling – You can have the best data in the world, but if you can’t communicate it effectively, it doesn’t matter. The art of storytelling is what turns information into action.

How to Become a Great Storyteller in Finance

So, how do you make storytelling happen in finance? It is more straightforward than it sounds. Here’s what matters:

Know Your Audience – Tailor your message. Know their roles, why they are there, what they care about, and what their goals are. The art of influence is directly shaped by how well you understand what drives people’s actions.

Frame Data in Context – Don’t just present numbers; connect them to the business. Make sure that the arguments used are of an appropriate level; obvious things are never appreciated and, in unfortunate events, can cause a loss of interest in the presentation. AI can crunch the data for you, but only people understand the strategy and nuance. Use that knowledge – FP&A superpower – to make your insights hit the audience.

Choose the Right Medium – Visuals, text, charts – different people process information differently. No one wants to hear, “How should I read this slide?” in the middle of the presentation. If you are not sure what works best, use both text and visuals (waterfall charts are usually well received by most people). Over time, you will figure out what clicks with each stakeholder.

Drive Action – Know your objective. Whether you are raising awareness or recommending a plan, make sure your story supports your goals. Watch real-time feedback (both verbal and body language) and adjust your approach if needed. Storytelling isn’t just about sharing facts; it’s about making things happen.

Anyone can develop these skills – it is not about being a natural-born storyteller. It is about following a process, learning as you go, and getting better with time. And most importantly, not being afraid to receive feedback, as this is a great opportunity for improvement. Confidence comes with practice. And there are no learning curves without mistakes.

Final Thoughts: FP&A Isn’t Disappearing – It’s Evolving

So, FP&A is not going anywhere, but evolving into a stronger, more strategic function, with data analysis handled by smart technology. Just layering AI onto your workflow isn’t enough – you need a shift in mindset. The teams that get this right and get it early will stay ahead of the pack. The future of FP&A? It is wide open for those willing to evolve.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.

Cinthya Henzelin

September 25, 2025