The 10th Chicago FP&A Board convened on 23 October 2025 at the elegant Michael Page office, marking the 285th International FP&A Board meeting worldwide.

Finance leaders from across the region came together to explore a defining question for the profession:

How can FP&A move from static forecasting to truly predictive, agile, and insight-driven planning?

The event was sponsored by SAP and hosted in partnership with Michael Page, bringing together a diverse group of FP&A professionals to discuss how organisations can harness data, technology, and human judgment to achieve agility in planning and forecasting.

Why This Topic Matters

In today’s volatile business environment, uncertainty is the only constant. Traditional forecasting methods that rely on rigid cycles and past data no longer offer the clarity or foresight businesses require.

The Predictive Planning and Forecasting (PPF) approach reframes planning as a dynamic, ongoing process. It connects data, key business drivers, and decision agility to help FP&A teams navigate change in real time.

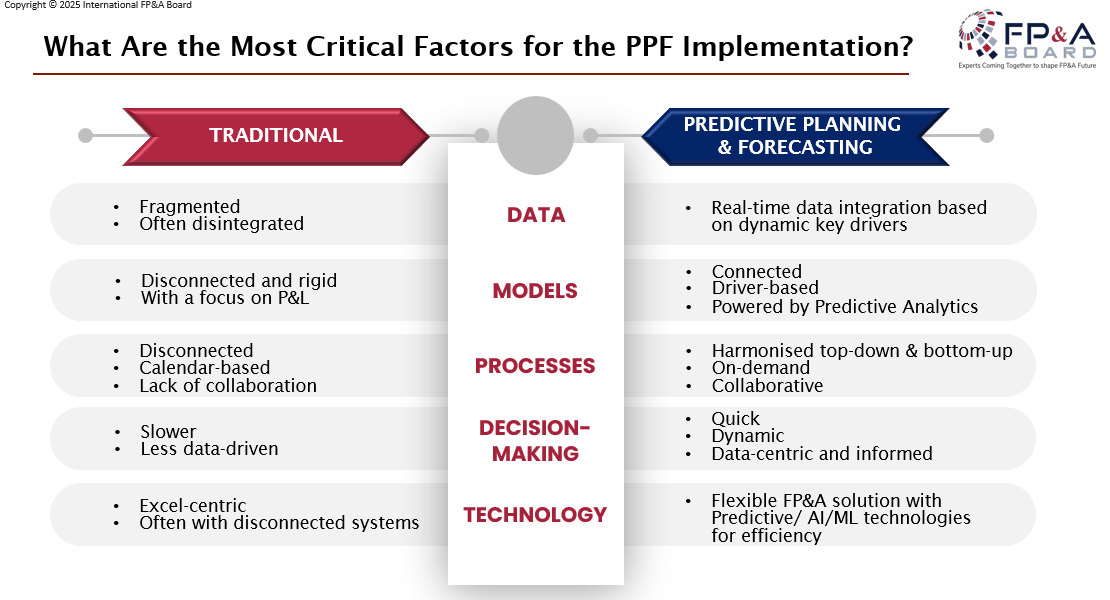

Figure 1

Figure 1

From Static to Predictive Planning

The evolution from static, spreadsheet-based forecasting to predictive, continuous planning is reshaping the role of finance. Predictive FP&A doesn’t replace human intuition, but it enhances it. Finance professionals remain the interpreters of business context, ensuring that technology supports rather than overrides decision-making.

At its core, predictive FP&A is about foresight, anticipating rather than reacting. It combines human judgment, data-driven insights, and advanced analytics into one integrated, intelligent planning framework.

To make this transformation successful, FP&A teams must align their data, models, processes, and technology around a single predictive mindset.

Figure 2

This framework highlights how predictive FP&A connects every layer of the planning ecosystem from real-time data integration and driver-based models to collaborative processes and dynamic decision-making. It sets the foundation for agility, accuracy, and strategic foresight in modern finance.

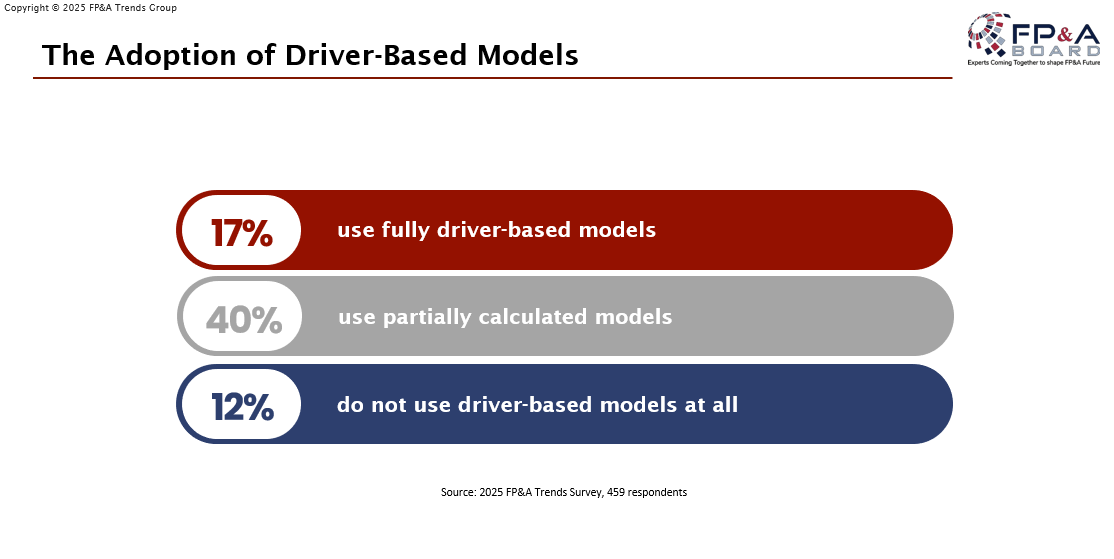

Building Agility through Driver-Based Models

A major discussion focused on the importance of driver-based planning as the backbone of agility. According to FP&A Trends research, only 17% of organisations currently use fully driver-based models, while 40% use partial models.

Figure 3

Participants agreed that success depends on identifying the 20% of key drivers that explain 80% of results and building models that adjust dynamically as these drivers change.

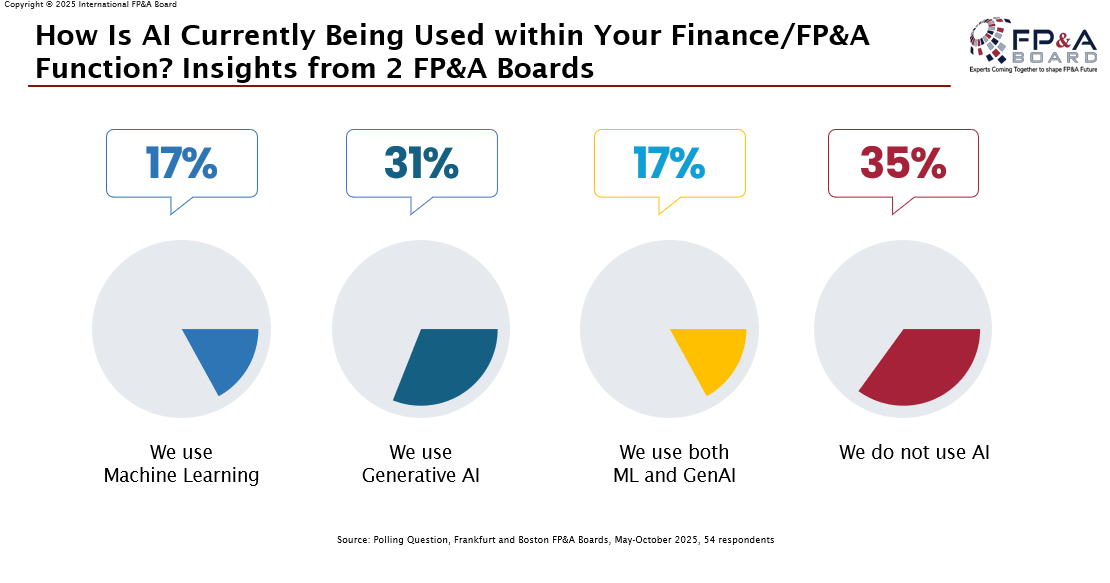

The Role of Technology and AI

Technology and AI act as key enablers of predictive transformation. They provide the automation, speed, and analytical depth that allow finance teams to move from reactive reporting to proactive decision-making.

During the meeting, Cass Holloway, Planning Account Executive at SAP, demonstrated “AI Agents for Predictive Planning and Forecasting”, showing how intelligent agents can automate scenario generation, streamline workflows, and provide real-time insights.

The demonstration highlighted how predictive tools, when coupled with explainable models, enhance decision-making while maintaining transparency and user trust—a recurring theme across global FP&A Boards.

Figure 4

Predictive planning, powered by AI, doesn’t replace FP&A; it elevates it. When human insight meets intelligent technology, forecasting becomes faster, smarter, and far more strategic.

Polling Insights

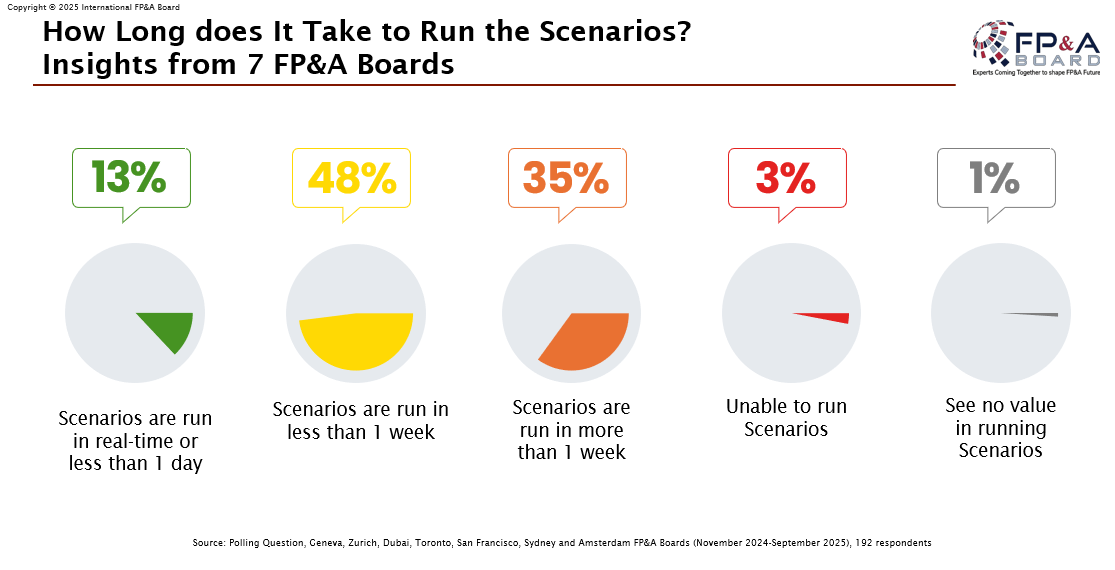

The first poll asked participants:

“How long does it take your organisation to run a forecast scenario?”

Results reflected the global trend from recent FP&A Boards:

- Only 18% can run scenarios in less than one day.

- 82% are either too slow or unable to run scenarios at all.

Figure 5

This insight revealed a familiar challenge: while most teams possess the right tools, the true barrier lies in data integration, process design, and team enablement.

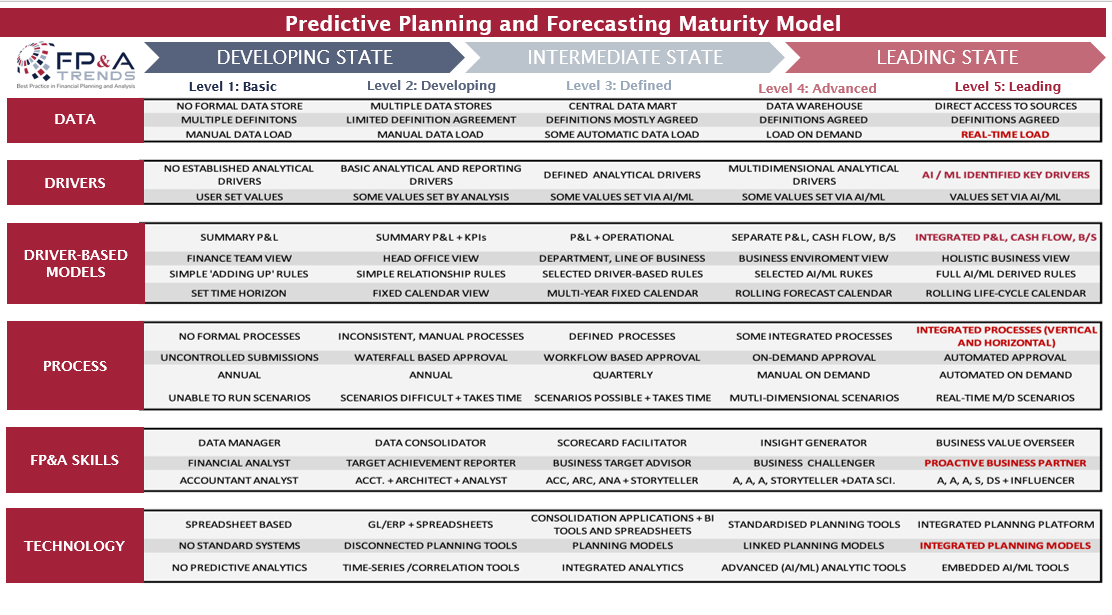

Using the Predictive Planning and Forecasting (PPF) Maturity Model, participants assessed where their organisations currently stand, ranging from basic data integration to advanced predictive and AI-enabled planning.

Figure 6

Figure 6

While some teams are still operating with fragmented data and disconnected models, others are beginning to automate scenario planning and integrate AI/ML forecasting capabilities. Across the room, one theme emerged clearly: the challenge isn’t technology — it’s integration.

Group Work Insights

Participants were divided into three groups to discuss practical dimensions of predictive transformation: driver-based planning, process improvement, and technology and analytics.

Group 1 – Dynamic Driver-Based Model Development

The first group focused on how to strengthen driver-based models as the backbone of predictive FP&A. Their key points included:

- Stakeholder feedback and engagement are critical to ensure alignment and ownership.

- Process mapping should clearly connect inputs, actions, and outputs — with people at the centre of the model.

- Drivers must be well-defined, combining quantitative and qualitative measures, and distinguishing between internal and external factors.

- Clean and accessible data is essential to keep models accurate and transparent.

- Business interdependencies should be clearly understood and reflected within an integrated FP&A framework.

These insights reinforced that predictive planning success depends not only on data but on collaboration, communication, and clearly defined accountability.

Group 2 – Process Improvement

The second group discussed how to make FP&A processes faster, leaner, and more adaptive. Their conclusions emphasised:

- Begin with current-state mapping to understand existing bottlenecks and pain points.

- Define the problem statement upfront — clearly articulating what the forecasting process is trying to solve.

- Apply Lean or Six Sigma methodology to reduce waste, streamline steps, and measure efficiency gains.

- Identify resources needed, form a cross-functional project team, and establish clear timelines and milestones for implementation.

- Continuously gather data to monitor progress and refine processes over time.

The group highlighted that process agility must be built on clarity, ownership, and measurable improvement, not just new tools.

Group 3 – Technology and Analytics

The third group explored the systems and analytical foundations needed to support predictive FP&A. Their key observations included:

- Build a structured data environment (database) that consolidates key financial and operational inputs.

- Integrate systems such as ERP, Data Lakes, and CRM platforms to centralise information and reduce manual reconciliation.

- Connect Business Intelligence (BI) tools with planning systems to enable unified reporting.

- Incorporate third-party market data to add external context to forecasts and improve accuracy.

Across groups, participants recognised that predictive planning is as much about mindset and collaboration as it is about technology.

Conclusion

The Chicago FP&A Board made it clear that most organisations already have the right tools. What they often lack is true connection between data, systems, people, and strategy.

Participants agreed that the journey to predictive FP&A begins with small, consistent improvements: cleaning data, simplifying drivers, and fostering collaboration.

As one attendee put it,

“Predictive planning is not a software upgrade — it’s a culture shift.”

The energy across regions, from London to Toronto to Chicago, showed how finance leaders are coming together to reimagine FP&A as a forward-looking, insight-driven partner to the business.