In this article, Juniper Networks shares two practical GenAI use cases in Finance that redefine finance...

FP&A teams can effectively use earnings call information about management’s future priorities and concerns when they learn how to decode this data. We over-focused on our internal number crunching while completely ignoring the valuable forward-looking insights that our executives share with analysts and stakeholders every quarter.

The experience resembles “It’s like planning a road trip with just a map of your driveway, but not an idea what’s happening on the highways ahead”. The reality is that most FP&A teams are still operating blindly in many areas. According to the latest FP&A Trends Survey, only 11% have fully connected their strategic, financial, and operational planning, and almost half of our time is still eaten up by manual data collection and validation. It's no wonder that we are still reacting to changes rather than pro-acting.

The Missed Opportunity

Here is the one solid example of what we have seen time and again: FP&A trying to build accurate forecasts while the market keeps changing, and we are often the last ones to find out. That is because we are not paying attention to what companies say about their outlook. Even though earnings call transcripts are full of valuable information, they are messy and hard to work with. It is difficult to extract key points and track changes over time systematically. Manual analysis takes much effort and is not fast enough to meet the increasing demand for real-time, data-driven planning.

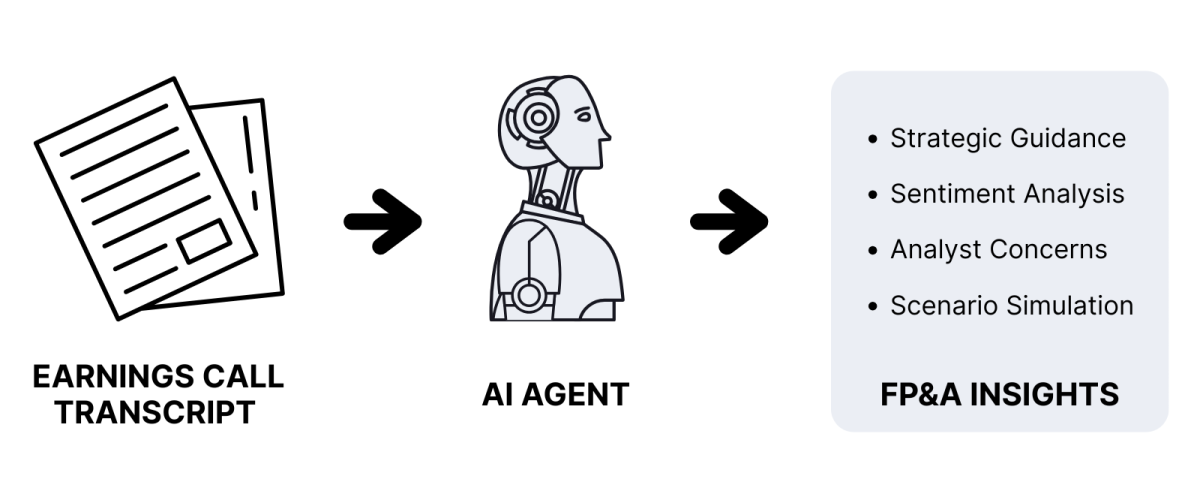

Figure 1 shows the step-by-step map from raw transcripts to usable FP&A insights, making it easier to see how each stage fits into your planning workflow.

How to Apply AI Agents to Earnings Call Analysis in FP&A

Figure 1. How to apply AI Agents to earnings call analysis in FP&A

Step 1 – Define Objectives

Don't make the mistake of trying to analyse everything at once. In the first implementation, pick one problem keeping me up at night — our quarterly revenue forecasts are kept blindsided by competitor pricing changes. Focus on the area/product where you are consistently deviating significantly from the forecast. Whether it is market shifts, or competitive intelligence. Start there.

Step 2 – Identify Target Companies and Sources

Similar to step 1, limit the number of companies/peers who are critical competitors to your business. For us, that meant our two largest competitors, our biggest customer (who also competed in adjacent markets), and one trendsetter company that typically signals industry trends six months early.

Step 3 – Set Up AI Agent Workflow

Use AI agents that are capable of:

- Scrutinising transcripts into the parts that actually matter (skip the legal disclaimers, focus on forward-looking statements)

- Pulling out key themes like guidance, risks, and strategic priorities

- Performing sentiment analysis on executives and analyst commentary

- Tagging insights to match your internal planning drivers (e.g., revenue segments, cost inputs)

Step 4 – Map Insights to FP&A Models

Take those insights and plug them into your forecasting models, rolling forecasts, or scenario planning. If you are already using a planning tool, this can be done via APIs or simple integrations.

Step 5 – Double Check Before You Act

Here comes the important step: AI will confidently tell you things that are completely wrong. In our early days, the AI flagged a competitor's "cautious outlook," which turned out to be standard legal language they use every quarter. So, now I have a simple rule: if an insight would change our forecast by more than 2%, a human validation is required before it goes into the model.

Step 6 – Make it a Habit

Make this process a recurring FP&A activity, e.g., within 24–48 hours after major earnings calls of selected companies. Track how these insights impacted forecast variance, decision lead times, and business outcomes.

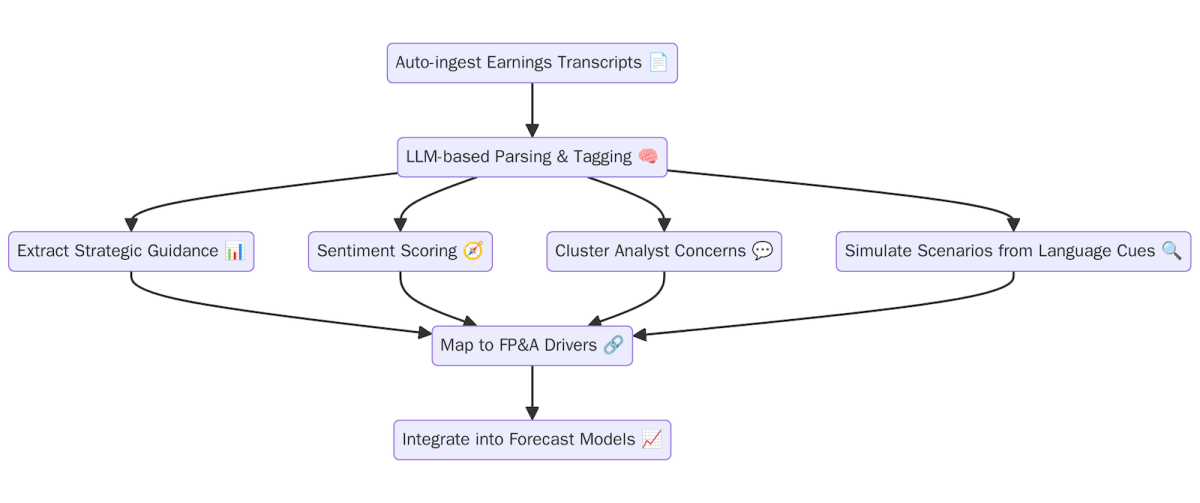

Technical Blueprint: From Transcript to Model Input

Ingestion: Auto-download transcripts from investor portals and no more manual downloads.

- Break down the content: Use LLM-based agents to scan and tag the parts that matter.

- Mapping: Align tagged insights to specific FP&A models/drivers (e.g., revenue segments).

- Feed insights to planning tools: Push outputs into forecast models or visualisation tools (e.g., Power BI).

Think of this as the "plumbing" behind the process — it is the system that takes unstructured earnings call content, flows through AI-powered scrutiny, gets linked to your FP&A drivers, and delivers useful insights to your models.

Figure 2. Process graph diagram illustrating Translating Narratives into Planning Inputs

Case Study 1: AI-Enhanced Earnings Call Analysis for a manufacturer

A CFO of a global manufacturing company was pulling his hair out over margin swings between the periods. Their FP&A team was drowning in spreadsheets, but missing the bigger picture of conversations happening in their industry. The FP&A team relied heavily on internal sales reports and supplier cost updates but lacked a structured way to integrate competitor and market intelligence into their planning models. As a result, competitive price shifts and market changes were often identified too late to influence their quarterly forecasts.

To bridge this gap, the FP&A team deployed an AI-driven transcript analysis process for quarterly earnings calls of key competitors and major customers. AI agents automatically extracted and tagged references to raw material price expectations and demand outlook by sector. The agents also scored sentiment in leadership commentary, flagging cautionary tones about supply chain disruptions or regulatory changes.

These structured insights were integrated into the company's driver-based forecasting model, enabling the FP&A team to adjust assumptions for cost of goods sold, and projected sales volume in near real time. The proactive adjustments allowed the manufacturer to optimise procurement contracts ahead of anticipated price hikes and realign production capacity with expected demand shifts, leading to improved forecast accuracy and an improvement in operating margin within two quarters.

Case Study 2: FP&A Agility through AI narrative analysis for a retail company

A multinational apparel retailer's FP&A team began using AI agents to analyse competitor earnings calls, indicating consumer demand trends, promotional intensity, and inventory positions. In one quarter, the analysis flagged multiple peers citing "softer foot traffic" and "higher-than-planned discounting" in North America. Incorporating these insights, the FP&A team revised sales forecasts downward, reallocated marketing budgets toward e-commerce, and adjusted inventory purchases to avoid higher inventory levels. These proactive steps avoided working capital block and protected margins during an otherwise challenging retail season.

Advantages of AI-Driven Narrative Analysis in FP&A

What we found most compelling about this approach isn't just that it makes our forecasts more accurate, although it does; it's how it transforms FP&A from a backwards-looking reporting function into a forward-thinking strategic partner that executives want to hear from. By automating the extraction and translation of qualitative earnings call data, finance teams gain real-time insights into market expectations and leadership intentions.

This leads to better-informed forecasts, more agile scenario planning, and stronger alignment between internal performance metrics and external investor communication.

According to the 2025 FP&A Trends Survey, teams that use AI or Machine Learning for forecasting are far more likely to rate their accuracy as “good” or “great” — 73% versus 42%

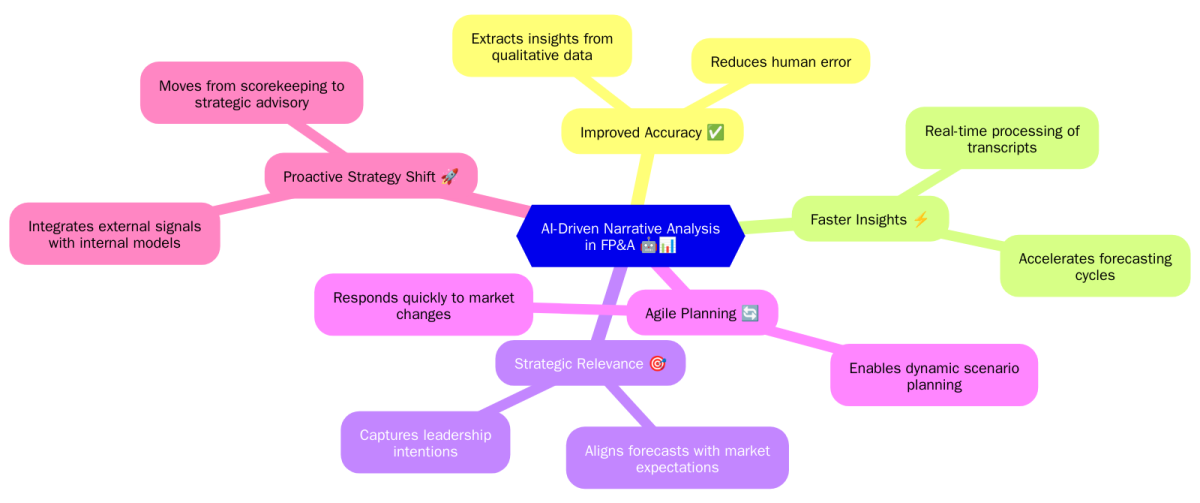

By integrating external signals with internal models, FP&A can shift from being a reactive scorekeeper to a proactive strategist. Figure 3 shows all the ways you can turn “market talk” into actionable planning inputs — from competitor moves to leadership tone shifts.

Figure 3. Mind Map: AI-Driven Narrative Analysis in FP&A

Conclusion and Roadmap

We are convinced that earnings calls are one of the most underutilised strategic assets in corporate America. We treat them like quarterly theater, but they are actually roadmaps to better decision-making if we know how to read them. With AI agents, FP&A teams can automate the extraction of critical insights, align forecasts with external narratives, and enhance the credibility of internal plans in front of investors and executives alike.

Start small and prove the concept to yourself first. Grab the last three earnings calls from your biggest competitor, run them through an AI analysis, and see what signals you missed. I guarantee you'll find at least one insight that would have changed your last forecast. If FP&A teams embrace this approach, I believe we'll finally bridge the gap between what's said on earnings day and what makes it into our forecasts, and that is the difference between reacting to the market and steering it.

Key Takeaways

- Earnings calls are not just regular updates— they're early warning systems for FP&A. They often hint at what’s coming before it shows up in numbers.

- Focus on a handful of companies/peers that truly influence your results.

- Build a simple, repeatable process for capturing and using these insights.

- Validate the big shifts before they touch your numbers

- Track the effect on forecast accuracy, decision speed, and business impact

References:

1. Yang, H., Liu, X.-Y., & Wang, C. (2023). FinGPT: Open-source financial large language models. arXiv preprint arXiv:2306.06031. https://arxiv.org/abs/2306.06031

2. Han, B., Zhang, Y., Wang, H., & Zhang, Y. (2024). Non-Responses During Earnings Calls and Analyst Forecast Errors. arXiv preprint arXiv:2505.18419. https://arxiv.org/abs/2505.18419

3. The Wall Street Journal. (2023). When IR Met AI: How the Technology Is Shaping Earnings Day Prep. Retrieved from https://www.wsj.com/articles/when-ir-met-ai-how-the-technology-is-shaping-earnings-day-prep-5054a057

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.