A practical guide to Scenario Planning — understanding the ‘when’, ‘why’ and ‘how’ to make strategic...

"The key is not to predict the future but to prepare for it."

Pericles, an Athenian statesman, orator, and champion of democracy

The current age of fragility, AI acceleration, and cascading economic shocks challenges the business. FP&A — once comfortably retrospective, even with rolling forecasts, is being pulled into a new role: a proactive guide through uncertainty. In a business world moving from VUCA to being BANI — brittle, anxious, nonlinear, and incomprehensible — an outlook that compares the status quo to the one just weeks ago already feels outdated. The need to anticipate change takes the spotlight from monitoring its execution.

Enter Strategic Foresight. Unlike forecasting, foresight does not extend yesterday's numbers into tomorrow. It is a structured, participatory discipline to have your organisation anticipate change, explore multiple plausible futures, and act on unfolding scenarios. For CFOs and FP&A professionals, it offers a critical complement to analytical mastery: judgement in ambiguity.

What Strategic Foresight Is and What It Is Not

Foresight is the disciplined exploration of alternative futures to inform present-day decisions, enabling individuals and organisations to anticipate change, surface assumptions, and expand their strategic imagination. Strategic Foresight applies this approach systematically within organisations to better strategy and future preparations that strengthen long-term resilience and adaptability.

Too often misunderstood as futurism or trend hunting, Strategic Foresight is not about prediction. Nor is it about speculative moonshots or technological evangelism. It is a systems-thinking approach that helps organisations prepare for disruptions, detect weak signals, and adapt strategies accordingly. The approach builds on a skill unique to humans, the ability to act today with the past and the future in mind. It led us from silicate axes only thousands of years ago to silicate microchips today.

Strategic Foresight shares wording with many related methods, yet it differs sharply from:

Futurology — which often seeks to inspire or provoke with visions of distant futures

Trend research — which maps what's already gaining traction, which is a given

Black Swans — which are rare, unpredictable, high-impact events and thus excluded

Scenario Planning in FP&A — which typically explores cases within an existing business logic

Foresight embraces uncertainty rather than eliminating it. It equips finance leaders to think in probabilities, not plans. It elevates the joint and very human competencies of foresight and judgment, the ability to hold space for multiple futures while deciding what must be done today.

A CFO's New Imperative: Prepare for What You Cannot Yet Measure

The Copenhagen Institute for Futures Studies outlines Strategic Foresight with ten tested principles. Most important among them seems:

- Foresight and strategy are one process, as strategy is blind without foresight and foresight alone is reduced to fiction.

- Plausibility trumps probability as scenarios aren't about guessing right, but stretching thinking beyond current trajectories.

- The process matters more than the output, as a well-applied foresight process is a learning framework with a common language for change.

- Lastly, joint intelligence is key as judgment improves as diverse voices shape the view of what might lie ahead.

"What is going to happen is not the future, but what we are going to do."

Jorge Luis Borges, an Argentine writer, essayist, and master of philosophical fiction

Process and cooperation are mission-critical in the BANI World. The diverse toolbox offers quick and creative results for a single application. Yet, a persistent and cooperative process that uses established and easily applied tools brings rigour to creativity and opens doors to strategically relevant insights.

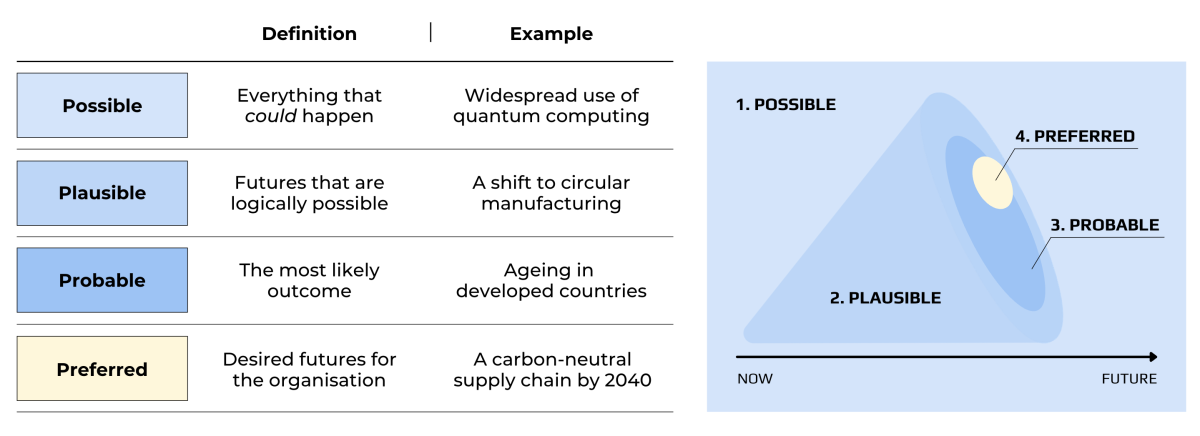

One of the most prominent methods is the cone of futures. It labels scenarios as shown below. It opens the challenge to decide on actions that make a company's preferred futures also probable.

Figure 1: The Cone of Futures

Scenarios are stories of how the future may unfold. They are a focal point that can be tracked and typically include three complementary activities:

Perceiving: Scanning for weak signals and emerging trends beyond the immediate industry or market.

Prospecting: Developing future narratives and scenarios that allow organisations to explore different strategic options.

Probing: Testing hypotheses and new business models through pilot projects and iterative experiments.

Scenarios and futures provide the foundation for effective foresight initiatives named Scenario Planning. This develops and tracks plausible alternative futures to challenge current assumptions and stimulate strategic thinking. It is paramount to understand that scenarios in Foresight fully describe a possible world outside the business, exceeding the narrow scenario definition of FP&A.

Strategic Foresight in Finance: Why Now?

FP&A is already managing uncertainty, from shifting cost structures to currency volatility and geopolitical risk. However, few have the tools to reframe decisions in light of structural change proactively. Strategic Foresight offers three distinct benefits to finance leaders:

Extended strategy alignment by challenging assumptions and broadening scenarios.

Improved investment timing by integrating signals of emerging disruptions early into capital planning.

Cross-functional credibility by becoming the orchestrator of scenario-based planning in transformation efforts, not just financial planning and analysis.

The transformation from VUCA to BANI provides a window of opportunity for CFOs who are able to extend organisations' reach into the future earlier and more effectively. Strategic Foresight seems fit like no other. I will borrow the call to action from two elder statesmen:

"Want of foresight, unwillingness to act when action would be simple and effective, lack of clear thinking, confusion of counsel until the emergency comes, until self-preservation strikes its jarring gong — these are the features which constitute the endless repetition of history."

Winston Churchill, a British statesman, wartime leader, and Nobel laureate

"The time to repair the roof is when the sun is shining."

John F. Kennedy, the 35th U.S. President, Cold War statesman, and eloquent orator

Further Research and Article Outlook

For further research, applications from the Shell Scenarios to Siemens' infrastructure strategy, foresight can turn insight into action, and do so well integrated when embedded into FP&A.

The next article in this series is an exclusive interview with Peter Thommen, long-time CFO at IKEA Poland, Russia, and Japan, and a pioneer of foresight integration at one of the world's most iconic brands. His insights show how a finance function can become a compass for the future, with foresight as the needle.

This is followed by approaches to integrate foresight within the Office of the CFO.

Sources

Churchill, Winston S. "House of Commons Speech on Air Defence." Parliamentary Debates (Hansard), 5th ser., vol. 301 (May 2, 1935): cols. 1870–1902. UK Parliament. https://api.parliament.uk/historic-hansard/commons/1935/may/02/air-defence

Kennedy, John F. "State of the Union Address." Public Papers of the Presidents of the United States: John F. Kennedy, 1962, 4. Washington, DC: U.S. Government Printing Office, 1962. https://www.presidency.ucsb.edu/documents/annual-message-the-congress-the-state-the-union-3

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.