In this article, the author talks about two of the most prominent applications of AI in...

FP&A transforms from manual, assumption-driven forecasting to intelligent, automated financial planning.

According to Statista, the Artificial Intelligence market is projected to reach US$243.72bn in 2025. The market size is expected to show an annual growth rate (CAGR 2025-2030) of 27.67%, resulting in a market volume of US$826.73bn by 2030 (Artificial Intelligence—Worldwide, n.d.).

It gives rise to Agentic AI Solutions for FP&A — a transformative approach that enhances efficiency, accuracy, and strategic insight. By integrating AI-driven automation, FP&A professionals can shift their focus from data gathering to strategic analysis and business growth. The concepts and practices mentioned in the forthcoming article are based on my experiences and my futuristic vision for Agentic AI Solutions.

The adoption of AI in FP&A is occurring at a faster pace. According to the FP&A Trends Survey 2024, with 383 finance practitioners, 6% have already implemented it, 15% plan to implement Artificial Intelligence (AI) / Machine Learning (ML) for planning and decision-making within the next six months, and 44% have longer-term adoption plans [3]. Now, in 2025, it will be interesting to see how much the projections are surpassing, and one of the main drivers of this growth will be Agentic AI solutions for FP&A.

What Are Agentic AI Solutions?

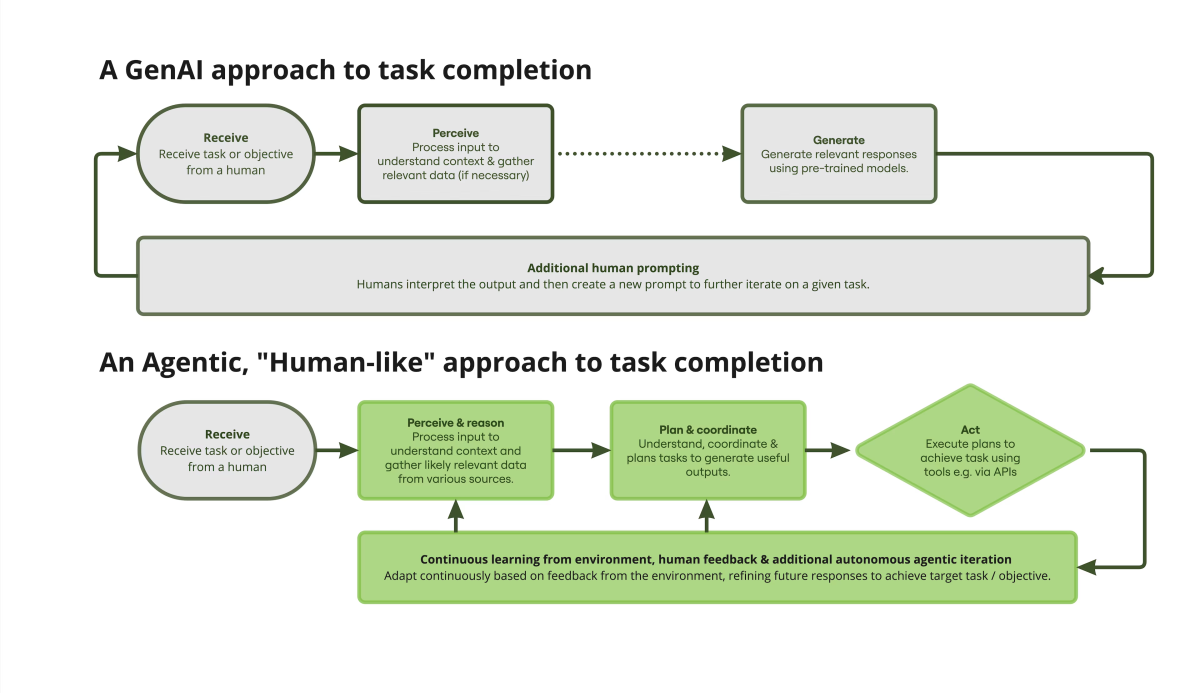

Agentic AI Solutions pertain to next-generation AI systems that utilise AI to automatically collect, validate, and analyse financial information for better forecasting and decision-making. These AI models ‘remember’ past patterns, constantly update themselves with real-time data, and execute financial planning such as budgeting, planning, and variance analysis, without human intervention. It is a Human-Like approach to task completion [4]. By utilising self-learning Machine Learning algorithms, Agentic AI empowers FP&A teams to make accurate predictions, identify classes of variance, and create actionable reports leading to increased business agility and better strategic decision-making. The chart below presents approaches for “GenAI” Vs “Agentic AI” for task completion.

Figure 1: WEF | Cambridge Centre For Alternative Finance (How Agentic AI will transform financial services with autonomy, efficiency and inclusion, 2024)

Transforming Forecasting and Budgeting with Agentic AI

Advanced Budgeting with AI-Driven Insights:

Until today, budget creation was a labour-intensive process involving multiple iterations. Agentic AI Solutions for FP&A has revolutionised this process by the following:

Creating AI-Powered Assumptions with Machine Learning models that analyse past financial data, industry trends, and economic indicators to generate data-driven budget assumptions.

Automating Forecast Adjustments, forecasts are constantly made in line with real-time feedback, ensuring that projections are accurate and timely.

Providing Multiple Forecasting Approaches to make financials more predictable, such as:

- Trend-based Forecasting for stable expense and revenue lines.

- Zero-Based Budgeting, where costs must be justified from scratch.

- Rolling Forecasts that adjust dynamically based on actual performance.

Automating Standardised Inputs for Efficiency with Agentic AI:

A key bottleneck in FP&A is correct assumptions & financial inputs from various stakeholders spanning different functions. Most organisations continue to use spreadsheets and submit stuff manually, which is obviously inefficient and error-prone. Agentic AI Solutions for FP&A come with standard templates and automated data collection, allowing a consistent data entry procedure across the business units. Integrating all the systems with seamless data integration architecture and keeping finance data inputs flowing directly between operational systems (ERP, CRM, HRMS) reduces dependency and manual interventions. By automating the gathering of input and assumptions, FP&A teams will spend less time “wrangling” data and more time on value-added analysis.

Another aspect where Agentic AI changes the way FP&A teams work with business leaders is accumulating intelligence and inputs via AI-powered chatbots and digital assistants designed to proactively collect financial information and resolve disparities in real time. AI further legitimates assumptions and cross-checks them against historical data and industry benchmarks before incorporating them into forecasts. Further, AI-based reporting delivers specified insights for each level of management. Operations managers receive reports at an operational level of detail, and senior managers receive reports at a strategic top-down perspective. This intelligent interaction ensures FP&A teams are able to gather fast, accurate data in an efficient manner, while stakeholders can make decisions with confidence.

AI-Driven Variance Analysis and Commentary:

One of the most time-consuming aspects of FP&A is analysing variances between actuals and forecasts. 42% of FP&A teams rate their forecasts as ‘great’ or ‘good’. This statistic rises to 65% in teams that use Artificial Intelligence (AI) or Machine Learning (ML) [2].

In 2025 and onwards, as AI grows, I anticipate Agentic AI to make life easier by automatically creating commentary and interpreting financial variances. AI sorts variances as general variances, which are slight changes for which attention is necessary, and key variances, which focus on areas with large deviations impacting strategic decisions. AI further produces actionable insights by flagging trends and anomalies and allowing management to concentrate on the root causes. Automated variance analysis allows FP&A teams to move from reporting historical results to driving future performance.

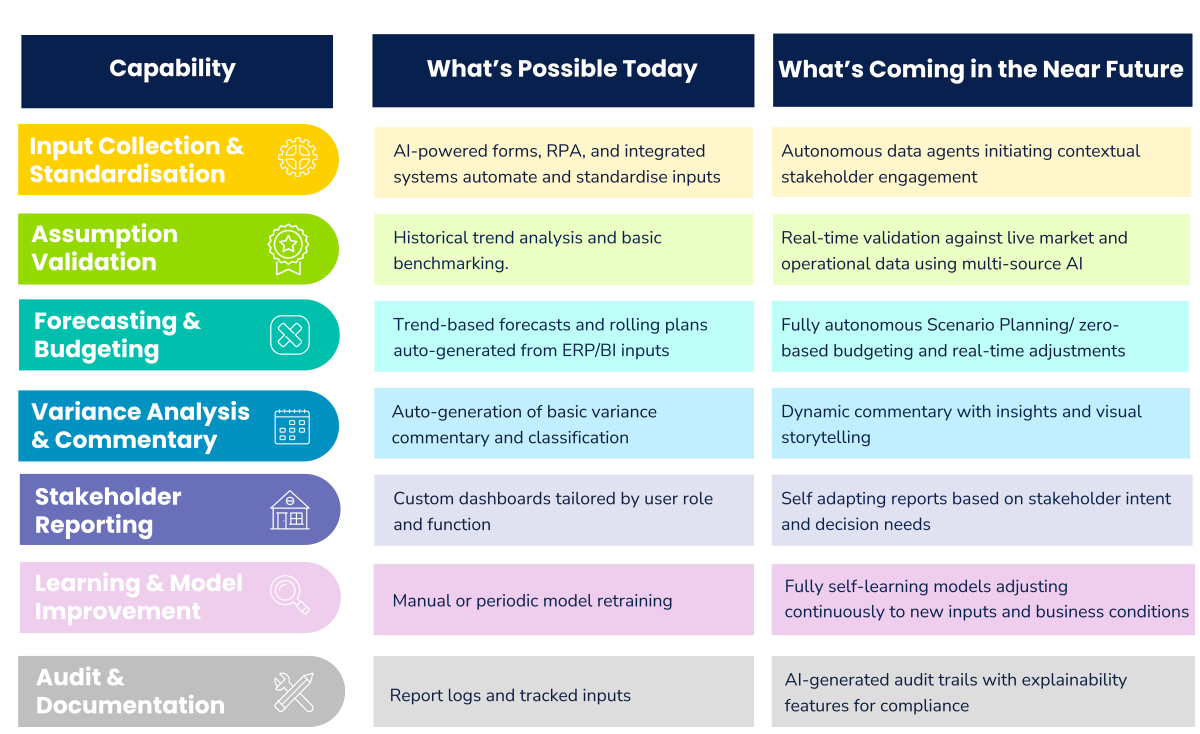

Quick Comparison - What’s Possible Today vs. Future with Agentic AI in FP&A

As organisations adopt Agentic AI for FP&A, it is important to distinguish between what is already achievable and what lies just ahead. While several AI-driven capabilities are actively transforming how FP&A teams operate today, others are on the horizon that are shaping the future of intelligent financial planning and analysis.

Figure 2: What’s Possible Today vs. Future with Agentic AI in FP&A

The Path Forward: Embracing Agentic AI in FP&A

As companies shift down the road to the future of FP&A, adopting Agentic AI for strategic finance transformation is becoming increasingly apparent. The first step on this journey is a clear diagnosis of the current maturity of the FP&A process. It is the assessments from the perspectives of tools, processes, stakeholder engagement, and analytical capabilities. By focusing on quick wins, like automating manual data gathering, standardising inputs, and other sources of short-term inefficiencies, leaders can tie long-term transformation goals to the organisation’s larger strategic objectives. Carrying out an extensive cost-benefit analysis is imperative to estimate the worth of Agentic AI investment through savings in efforts, increased accuracy in forecasting, and improved decision velocity.

References

Artificial Intelligence - Worldwide. (n.d.). Retrieved from Statista.com: https://www.statista.com/outlook/tmo/artificial-intelligence/worldwide

Empowering Decisions with Data. (2024). FP&A TRENDS SURVEY. Retrieved from https://fpa-trends.com/sites/default/files/docs/FPA-Trends-Survey-2024.pdf

FP&A Business Partnering in the Age of AI. (2024). FP&A Trends Insights Paper. Retrieved from https://fpa-trends.com/sites/default/files/docs/FPA-Trends-Insights-Paper-2024-FPA-Business-Partnering-in-Age-of-AI.pdf

How Agentic AI will transform financial services with autonomy, efficiency and inclusion. (2024). Retrieved from World Economic Forum: https://www.weforum.org/stories/2024/12/agentic-ai-financial-services-autonomy-efficiency-and-inclusion/

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.