A recent FP&A Trends Webinar focused on how to master rolling forecasts and how they can...

If the last year has taught us anything, traditional Financial Planning and Analysis(FP&A) approaches did not work (or at least proved suboptimal) when navigating through uncharted landscapes. The pandemic forced FP&A practitioners to reassess and adapt our approach to planning, and forecasting, and bring to the forefront the importance of scenario planning.

Last month I had the unique opportunity to join over 650 finance professionals from 79 countries around the world to have a robust dialogue on myths and misconceptions of Rolling Forecasts and Scenario Planning.

Five Key Success Factors for Rolling Forecasts

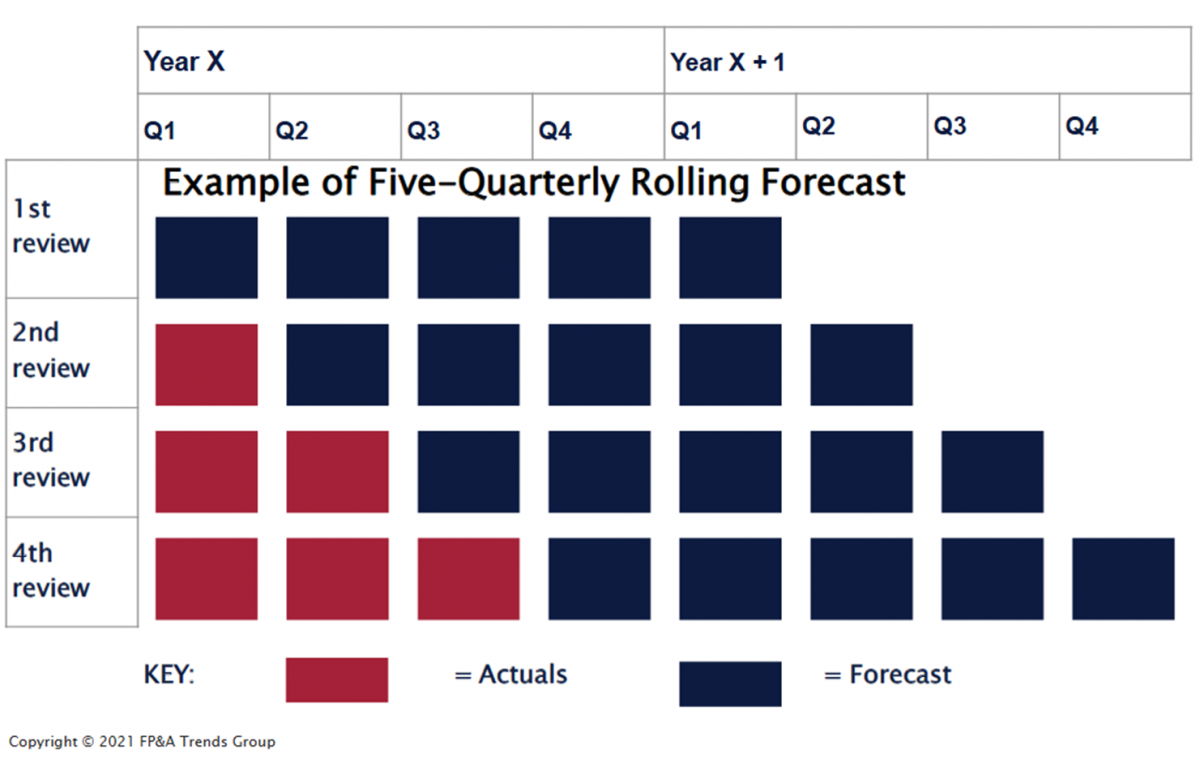

A Rolling Forecast is a path that leads a company to better profitability and improved operating performance by assessing the current scenario rather than leaning on what was our believed assumptions 6 months ago during the Planning or Budgeting process. The aim is to inform decision-makers about future risks and opportunities based on a reset of what is happening now. Rolling Forecasts are not tied to a fiscal period, and planning horizons can straddle over multiple fiscal years or fiscal quarters.

At the FP&A Trends webinar, Nitu Agarwal, Senior Director Finance from Thomson Reuters, explained how the current plan in March 2020 immediately became obsolete, and they quickly had to reassess assumptions. While the pandemic ended up being much longer than originally anticipated, Nitu’s team learned the Key Success Factors for Rolling Forecasts:

1. Cultural and mindset shift

2. Driver-based models

3. Alignment

4. Systems/Process

5. Design

In order to successfully pivot to Rolling Forecasts, some may consider stepping functioning with an interim Hybrid Scenario (annual planning with monthly forecasting) if the business is not ready to leap directly from Traditional Forecasting to Rolling Forecasts. It’s important to note that we don’t lose sight of Rolling Forecasts and find ourselves getting stuck in the Hybrid Model.

Case Study: Leveraging AI to Understand Relationships Between Drivers

Richard Melia, Finance Director at IQVIA described that their pre-Covid approach was fairly traditional. Starting with a 3-year strategic plan, followed by top-down and bottom-up planning as well as capital allocation. IQVIA also ran Monthly Forecasts with limited and partial Scenario Planning leading to risks and opportunities to course correct.

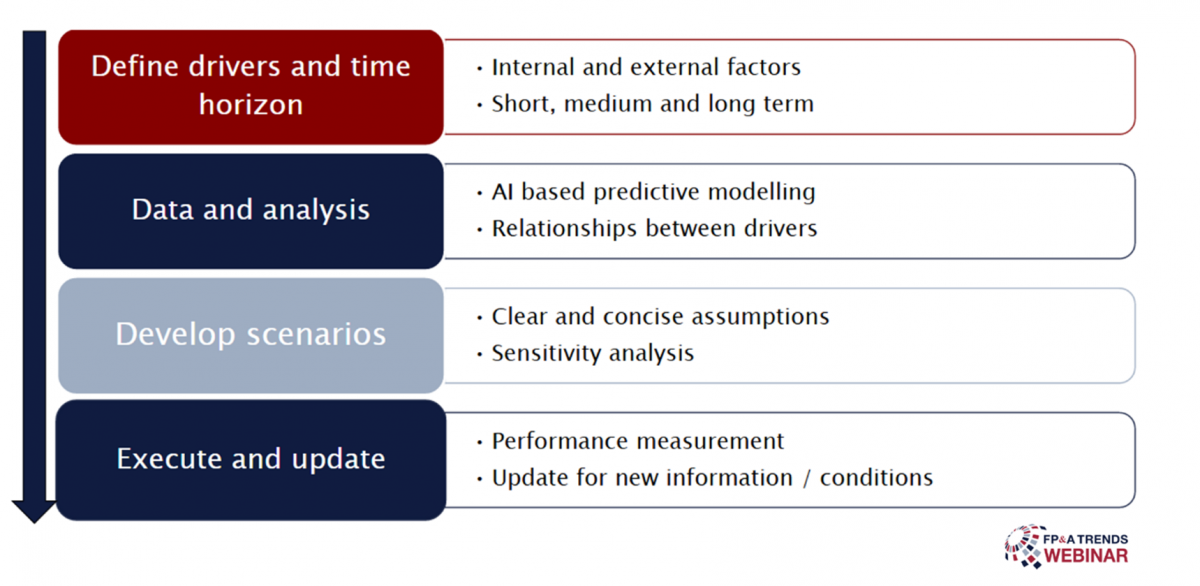

Covid-19 provided a catalyst to change their approach and lean on Scenario Planning. First, their corporate finance team tackled defining drivers, then ensured a robust way to model and analyse. IQVIA was able to leverage existing AI-based predictive modelling to understand relationships between drivers. Having clear and concise assumptions was key to developing scenarios and sensitivity analysis in order to scale the model across markets. The last step was to execute and update.

It’s critical to define drivers and assumptions and investment in scenario modelling tools. Scenario planning has to move away from looking in the rear-view mirror to define what the future may hold.

67% of our participants reported that they could run scenarios, but it is time-consuming. Businesses recognise that scenario planning is important, but lack the systems/tools.

Modern Technology: Bringing together functional teams

Chris Davenport, Business Value & Strategy Director at Anaplan, shared how technology plays a critical role in enabling Rolling Forecasts, Analytics and Scenario Planning.

Traditional setup has functional teams (such as procurement and Supply Chain, R&D, etc.). Technologies platforms stitch together these groups. A lot of investments are being made in the planning and analytics platforms to manage performance.

Organisations are starting to connect their planning models in their supply chain to demand planning. When these planning models are running off the same platform, you can ingest all this data into your financial model (including risks and opportunities). That will allow executives a variety of levers to pull to navigate and steer towards outcomes when making financial decisions.

A great example of scenario planning done right is at an automotive manufacturer that had three defined scenarios tied to inflexion points in their drivers – volumes of sales of certain product lines. The scenarios used pre-negotiated terms with unions, employees for bonuses and supply chain. As soon as those inflexion points happen, the scenarios will switch over to those pre-negotiated terms depending on where the inflexion points happen. This gives a major competitive advantage to steering a business in real time.

Lessons Learned and Takeaways

Companies are starting to move away from Traditional Forecasting in favour of Rolling Forecasts and Scenario Planning. Planning and Budgeting is an opportunity to assess your Risk and Opportunities. It’s key to avoid mixing your Rolling Forecasts with your Planning/Budgeting and Target setting as many companies find themselves making the mistake of conflating the two processes. It is also important to note that in order to be agile in managing your business you absolutely need agile technology that can easily change with an everchanging external environment.

This FP&A Board Webinar was a fantastic exchange of experiences, approaches, and a lot of ideas to move towards Rolling Forecasts and Scenario Planning. A very special thank you to our event sponsor Anaplan for making this forum possible. I would also like to thank Nitu Agarwal, Senior Director Finance at Thomson Reuters, Richard Melia, Finance Director, FP&A Corporate Finance at IQVIA and Chris Davenport, Business Value & Strategy Director at Anaplan.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.