Rolling Forecast can become the path leading to better company’s profitability and improved operating performance. This...

A Global FP&A Trends Webinar that was held on the 16th March 2021 focused on how to master rolling forecasts and how they can revamp the way an organisation works.

This article summarises this insightful meeting, interactive polling questions and compelling discussions on the below topics:

Stages of Rolling Forecast Maturity.

Evolution of the forecasting process with practical insights.

Optimal decision making with the help of rolling forecast.

Reflection on the Rolling forecast experience.

Why is forecasting about decision making?

Larysa Melnychuk began the session by explaining how it is important for the companies to have a plan in place, as the world often turns out different than what is expected, hence it is important to work out where you are heading, in the form of a forecast and then set a target to get back on track.

Traditional vs Rolling Forecast

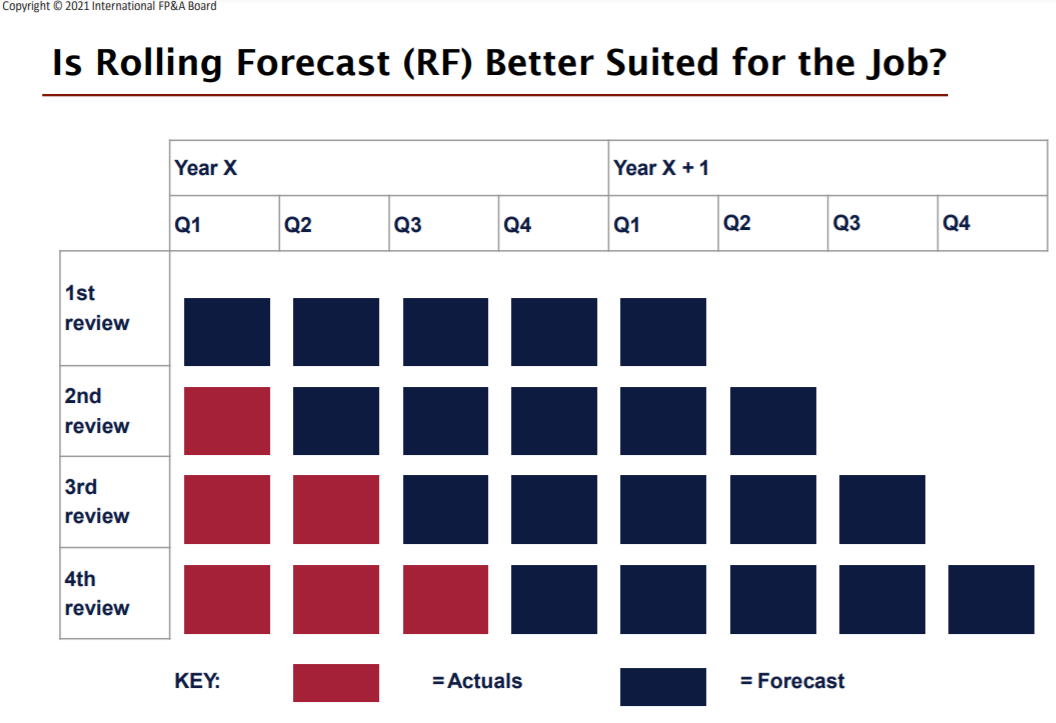

Although rolling forecast has its own limitations, it presents opportunities for better budgeting, as it is more flexible and dynamic than the traditional forecast. As depicted below, in traditional forecasting the focus is only on one quarter whereas rolling forecasts can be rolled over the periods and is not just a year-end activity.

Rolling Forecast Maturity Model

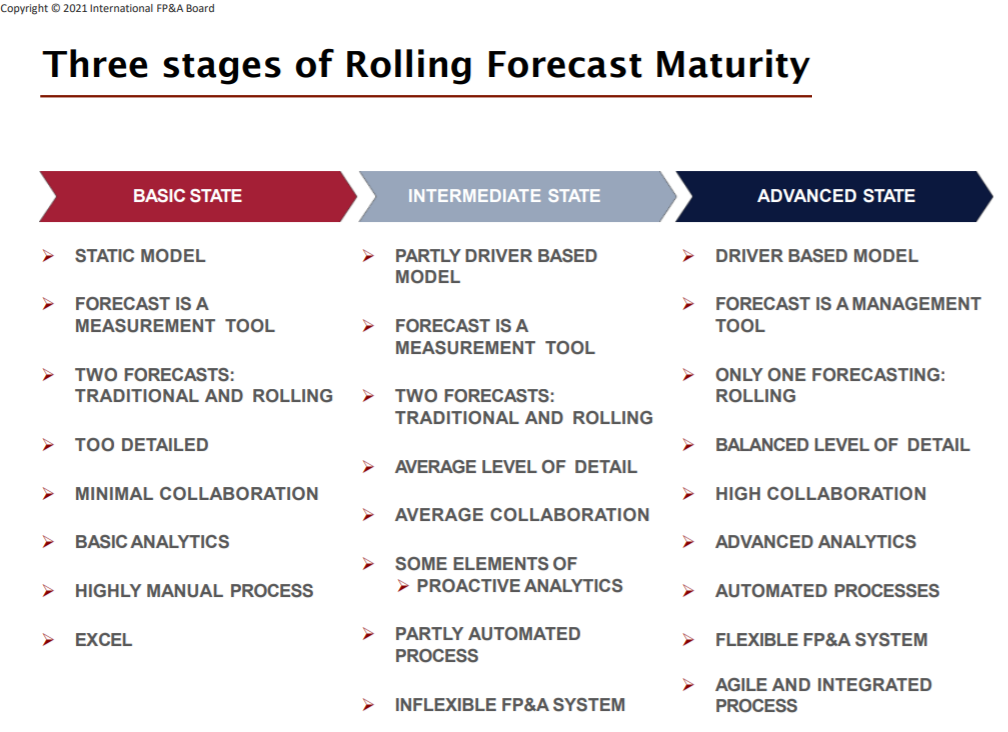

The Maturity model comprises three stages, characteristics of each stage can be seen below. In order to reach the advanced stage, the management should follow a flexible and collaborative approach. The rolling forecast should be used as a management tool and ideally, it should be the only forecasting process that an organisation follows.

A.P. Moller-Maersk Case Study: How did the forecasting process move from traditional to rolling?

Based on Matthijs Schot’s, CFO at Svitzer A.P. Moller-Maersk Group, presentation

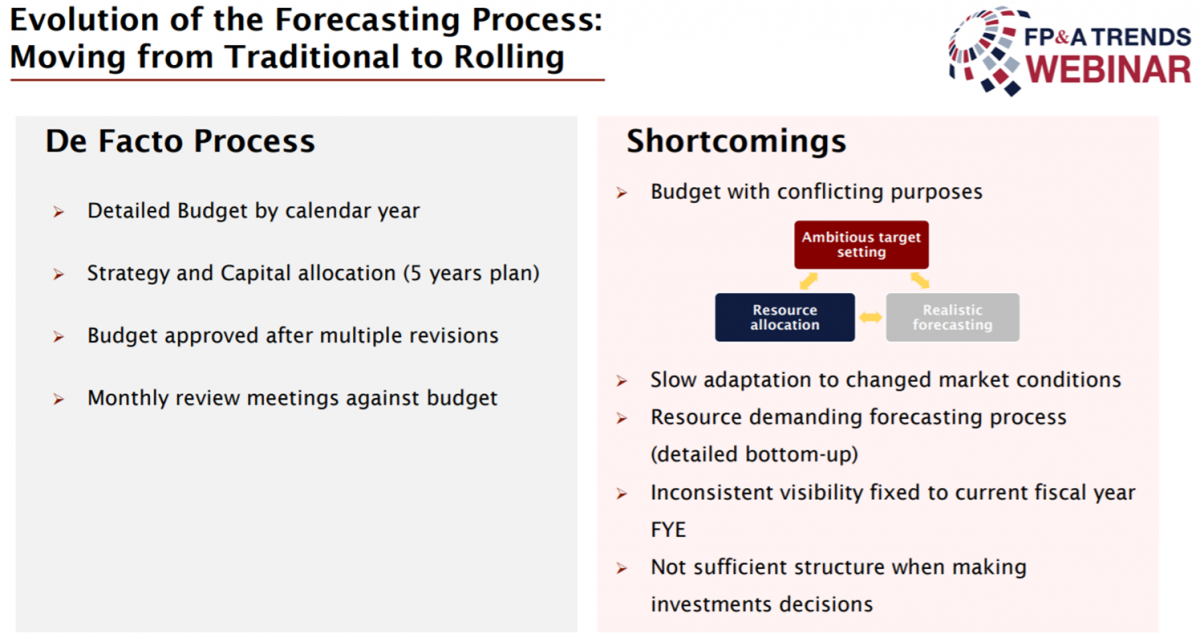

Matthijs explained how they followed the De facto process (as per the above picture) at his organisation wherein they would perform the budgeting process by the calendar year which was approved after multiple revisions. This process had several shortcomings as it could neither adapt to market conditions nor provide a horizon to the decision-making process.

The organization tried to bridge the gap between the new and the old process and embraced several changes:

Visibility: A forward-looking process, going beyond the existing capacity and providing insights for the future.

Agility: After identifying the trends to be able to adapt easily to them and make the necessary changes.

Control: To be able to exercise control and have a balanced scorecard driven process to measure the performance of the employees appropriately.

Simplicity: A simplified approach, in terms of removal of unnecessary efforts and details.

The implementation of the rolling forecast (RF) mindset in the organization was incorporate in several steps:

Macro Assumptions: This included the Group forecast on FX, Oil price and GDP Growth and then aligning all the numbers.

Branding Forecasting Process: This included designing the process Top-down, Bottoms-up, Centralized and Decentralized, which could vary from one organisation to the other.

Submit Financials and Presentation: This step included submitting quarterly financials supported by the numbers corresponding to Balance sheets, Profit and loss, Cash flow, Key performance indicators.

Consolidation and review: Forming a complete picture with the elimination of internal revenue, dividend assumptions and funding costs.

Management Reporting: Standard Reporting package with a summary result along with line-item details ensuring same numbers are being discussed.

Quarterly Financial Review: Formal review of the past and forecast performance and learning to adapt to the future.

Final executive summary: Summary with action points and focusing on the next forecast.

According to Matthijs, the need to make a change in the form of flexible forecasts, which is supported by the management becomes a necessity in order to achieve the results. The Maersk Group managed to avail several benefits due to rolling forecast:

Increased Visibility and performance discussions: Due to forward-looking and decentralised process.

Improved Decisions and better targets: As the process was future-oriented, it helped in making informed and faster decisions and set targets as per trends.

Dynamic capital allocation: As the management had better visibility and insights, the capital was used more appropriately in line with the available opportunities.

Increased autonomy: As a result of flexible budgets, the stakeholders were able to take ownership of their tasks.

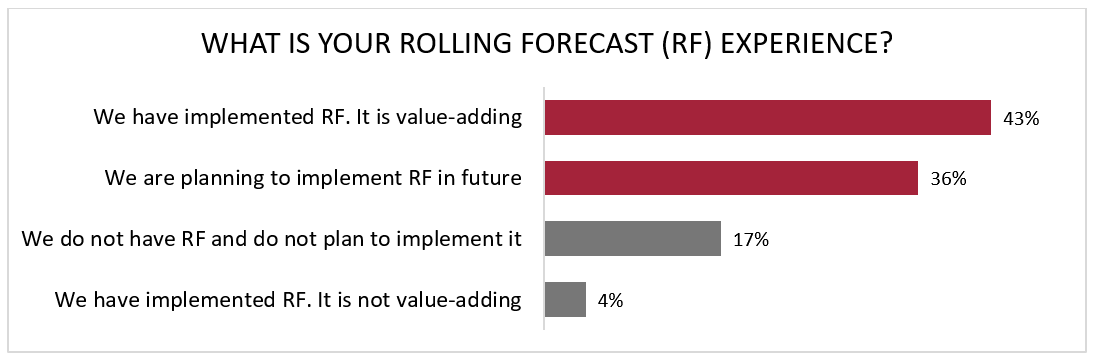

During the webinar, we also had an interactive poll where we asked the audience about their experience with rolling forecasts. The majority of FP&A Webinar participants agreed to have implemented rolling forecast and some are planning to implement it in future, a few respondents said that they do not plan to use rolling forecasts.

Rolling Forecast: An instrument to optimize decision-making

Based on Stefan Spiegel’s CFO at Swiss Railway Freight Logistics (SBB Cargo AG) presentation.

Stefan began his presentation with an example of Wirecard, where the stock prices were fluctuating between 2015-2020. Although all the financial information was available in public domain, the stocks crashed only after the external auditors refused to testate the financial statements. As an informed investor, one should develop a goal with regards to their investment and check the market news, share price on a rolling base before deciding to buy/ sell.

Learnings from Wirecard Example

Overall Goal: To have a goal that is fixed over time and not depending on market conditions which are by the way beyond the budgeting approach.

Clear decision focus: Whether to buy or sell a stock.

Establishing a natural rhythm based upon the decision subject to update the rolling forecast: Check the updates, for example stock prices on a weekly basis.

Adjust the frequency of decision-taking meetings to the rhythm of the rolling forecast process: Ability to make a decision basis the rolling forecast.

Clear identification of the relevant drivers that influence the stock price and updating them: Keep yourself updated about the factors that influence the stock price movements company news, market environment and update the rolling forecast accordingly.

Automation and check-up: In a portfolio of many stocks, it is helpful to automate the update process and also note that each stock will not require the same check-up rhythm.

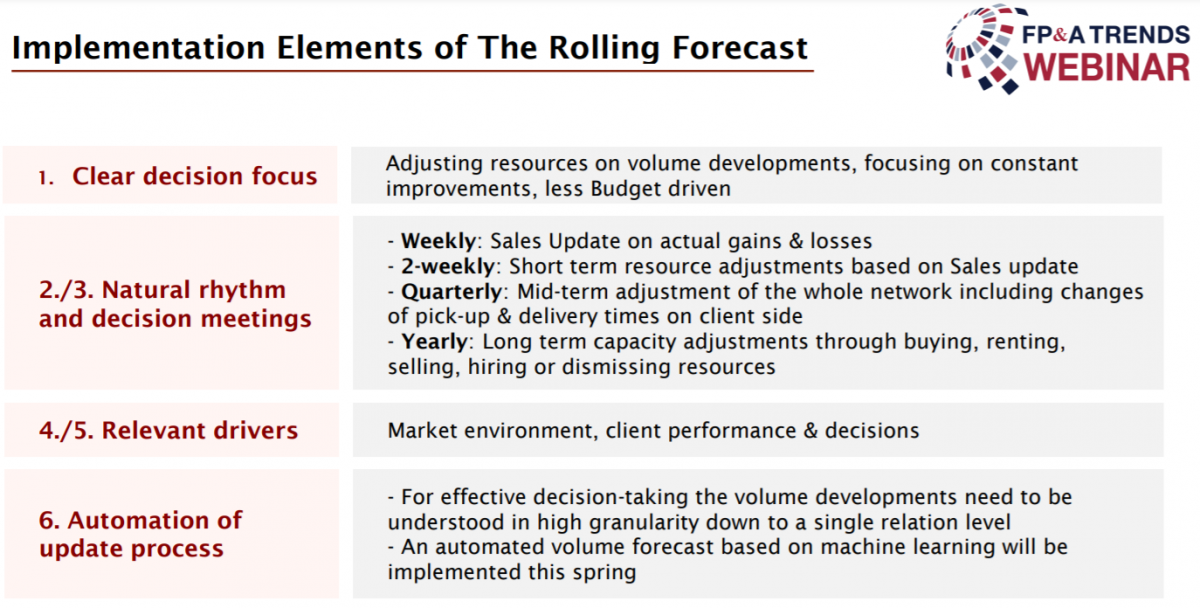

SBB Cargo also used rolling forecasts to improve their decision-making process. The goal was to adjust the rolling stock and manpower as accurate as possible and in time on actual volume development. The below table describes the steps of the implementation process:

While reviewing the quarterly rolling forecast of November 2018, the team anticipated a drop in volumes in 2020 based on the engineering algorithmics. This helped them adjust the long-term capacity, even before the pandemic as the resource decisions were forward-looking and taken in the right direction.

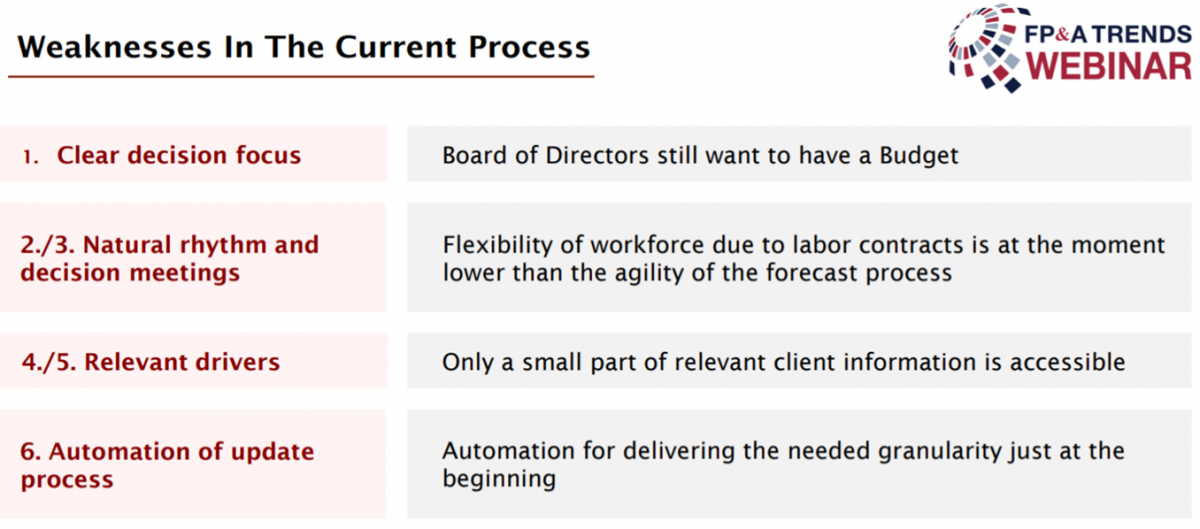

There were some weaknesses in the current process and the organisation faced some challenges that had to be addressed:

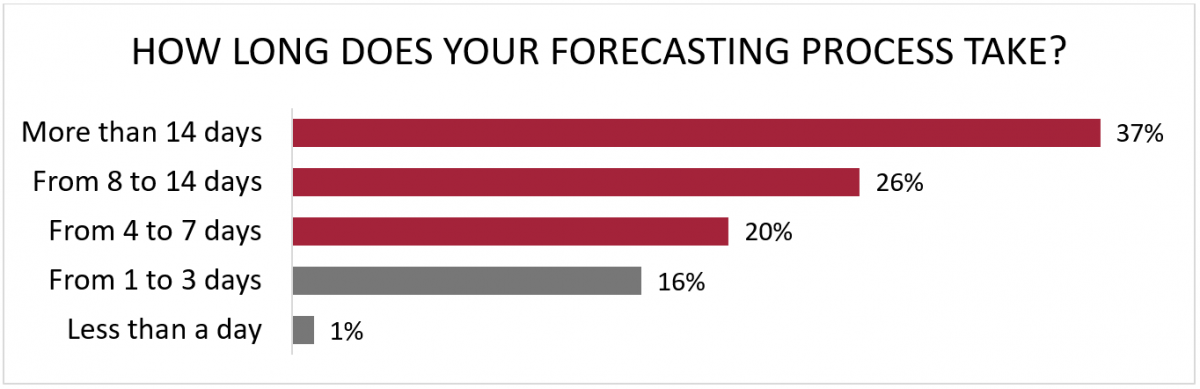

When asked about the length of their forecasting process, the majority of the webinar participants said that their forecasting process takes around 7-14 days leaving less time for decision making, while very few agreed that it takes less than 3 days.

Reflection on Rolling Forecast experience

Based on Eric Cheung’s, CFO at Unit4 Asia, presentation

Eric began the presentation by explaining that there should be a business objective before implementing a rolling forecast and an organisation must define what it is trying to accomplish. The goal could be better forecast accuracy, efficient resource allocation or eliminate the negative impact of a static budget.

According to Eric, there are four pillars of the successful RF implementation:

People: It is imperative to understand that the implementation process should not only involve the finance function but also the entire business unit. Hence a change of culture is a must for the inclusion of stakeholders.

Process: It’s important to note that time horizons may differ depending upon business circumstances and inputs from operations, whilst the focus should be on identifying the drivers and not the static numbers.

Technology Tool: It plays a significant role since enterprise-wide scenario planning cannot be done using excel. The organisation should focus on using cloud-based technology to sync all the business units that can be accessed anywhere.

Technical: Use of data modelling in order to track performance and continue planning, which ensures consistency and accuracy in the entire process.

To start the process towards rolling forecast, organizations need to consider the following steps:

Ensure sponsorship from the top as it plays a key role in the overall success

Identify where you are right now

Determine the key drivers and focus on the process

Align modelling and architecture to business needs

Use advanced analytics wherever possible

Decide on the design and frequency of the process

Introduce an integrated platform to get better results

Execute and perform a collaborative review of the process

Key Takeaways

At the end of the meeting, all the speakers shared their takeaways from the session. The panellists agreed that the rolling forecast needs to be integrated across all business functions and the use of collaborative models greatly facilitates the process.

We are very grateful to our sponsor Unit4 for their support with this digital event.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.