Rolling Forecasts are an essential tool for financial planning and analysis (FP&A), with a potential to radically transform corporates’ traditional budgeting process.

Rolling Forecasts are an essential tool for financial planning and analysis (FP&A), with a potential to radically transform corporates’ traditional budgeting process.

The London FP&A Board of senior practitioners’ most recent meeting focused on why Rolling Forecasts are ideal for financial planning and analysis (FP&A) professionals. It also discussed best practice and the ‘Three Stages of Rolling Forecast Maturity’ model, summarised in this article.

The latest meeting was again jointly sponsored by Metapraxis, the consultancy, analytics for financial professionals and software provider and Michael Page, the global specialist recruitment firm.

Definitions

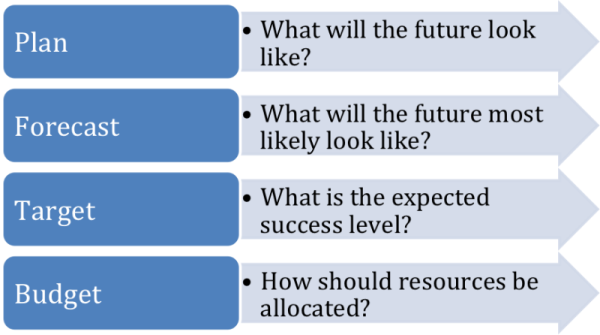

Forecasting is an important process in the FP&A cycle, which assists with looking into the future and managing organisational performance. However, confusion can result from the mixing up of definitions for key FP&A processes. Each process answers a key question, as outlined below in Figure 1:

Figure 1 - Key FP&A definitions

Hockey stick forecasting

Each planning process plays its own separate, distinct role and should not be combined with any other. When the forecasting process is treated as a performance measurement tool, it becomes highly political, non-value adding and inaccurate.

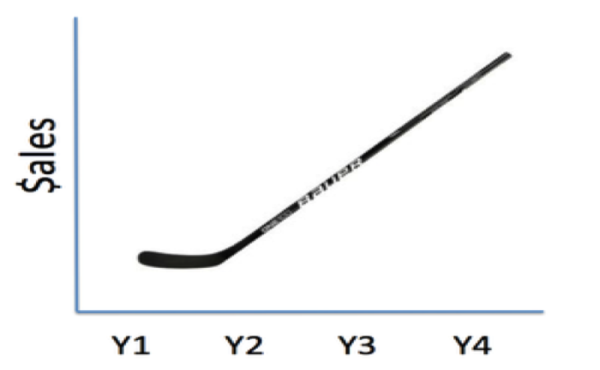

Mixing forecasting with target evaluation processes often happens in organisations, where the target is closely connected to the compensation. Unless this emotional bias is eliminated from the forecasting process, it’s very likely your forecast revenue will resemble a “hockey stick”, as pictured below in Figure 2: low at first (representing the actual results) and suddenly jumping higher (representing the forecast).

Figure 2 - “Hockey stick” forecasting

A forecast helps to shape a different future, so it should be based on analytics and be independent of the target evaluation process.

Why Rolling Forecast?

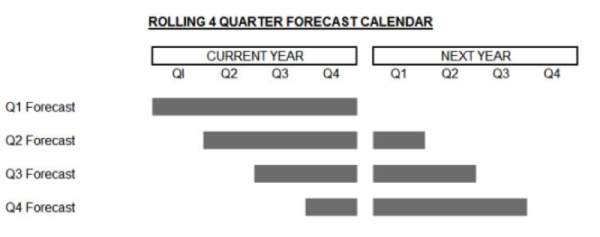

The number of periods in a Rolling Forecast always remains constant. For example, Figure 3 illustrates a four-quarters rolling forecast.

Figure 3 - Example of a four-quarters rolling forecast

In traditional forecasting, the length of planning process contracts with each quarter into the year and extends beyond the year-end wall.

Bjarte Bogsnes, vice president (VP) of performance management development at Norwegian oil and gas multinational Statoil, compares the traditional forecasting process with driving:

“During the budgeting cycle we shine a strong light into the future,” he suggests. “Then we turn off the high beams and start driving into the next year with low beams only. As we drive on and the quarters pass, the low beams get gradually covered in mud and become weaker and weaker. Is this a safe way of driving in the dark?”

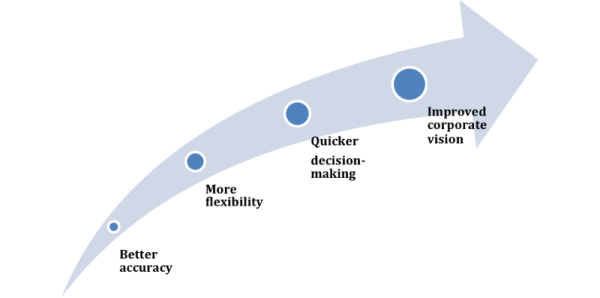

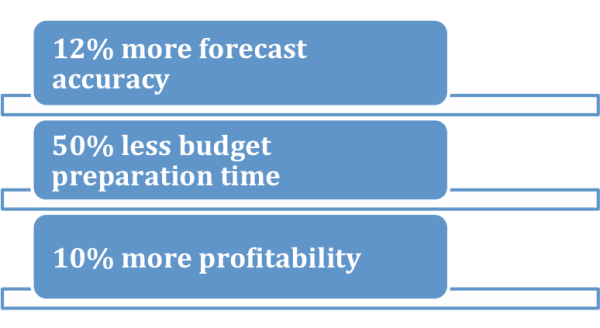

Obviously, the answer is ‘no’ and explains why leading organisations opt to use Rolling Forecasts – the benefits are outlined below in Figures 4 and 5.

Figure 4 - Advantages of rolling forecasts

Figure 5: IBM study demonstrating “measurable” benefits of a rolling forecast

Among the biggest advantages of the Rolling Forecast is that it can help organisations completely abandon their traditional budgeting process. However, having mentioned this advantage at roundtable discussions in several countries, any suggestion that the budget can - and should - be abandoned can evoke fear, rather than enthusiasm. Financial professionals are reluctant to lose the budget as we need it for various reasons: setting bonuses; reporting to market analysts, managing the company’s resources and others.

So are we ready to abandon the budgeting process - or at least to transform it to the more value-adding format? We should be as RFs are the way of the future and can help us on this journey of transformation.

The Maersk Group: from Rolling Forecast to Beyond Budgeting

Matthijs Schot, a group FP&A manager from the Maersk Group, shared his company’s experience of Rolling Forecast at a recent London FP&A Board meeting. He illustrated how cultural, strategic, and operational processes can be transformed into the valuable ecosystem of effective and efficient corporate performance management.

Founded in 1904 as a shipping company, Denmark’s AP Moller Maersk Group is represented in more than 130 countries, with 88,300 employees, and generates annual revenue of US$40bn-plus. In 2010 the group undertook a transformational journey, aiming to eliminate several issues typical of the traditional budgeting process:

- Slow adaptation to changed market conditions.

- Lengthy and costly forecasting processes (detailed bottom up).

- Poor visibility fixed to the current fiscal year end.

- Lack of structure when making investments decisions.

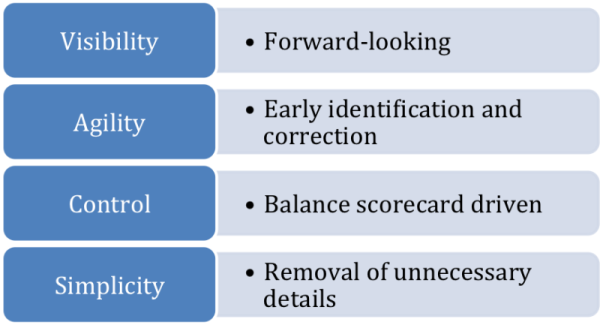

Through collaboration and management discussions, Maersk generated the management process design criteria shown in Figure 6:

Figure 6 - Rolling Forecast design criteria introduced by Maersk Group

Maersk also separated three processes for each purpose in a continuous rolling cycle: quarterly Rolling Forecast; strategy and capital allocation; and target setting.

The transformation created major benefits for Maersk, including:

- A simplified planning process.

- Improved performance discussions.

- Increased visibility.

- Better and faster decision making/action taking.

- Better targets.

- Dynamic capital allocation based on opportunity.

- Increased autonomy and ownership

The heavy budgeting process was completely abandoned and its replacement, the Rolling, is now used for all of Maersk’s market communication processes.

Schot singled-out the following key success factors:

- Executive sponsorship and management buy-in.

- Recognition of the need for change.

- Decentralisation to make better decisions

- Market volatility and business results.

What does Mature Rolling Forecasting involve?

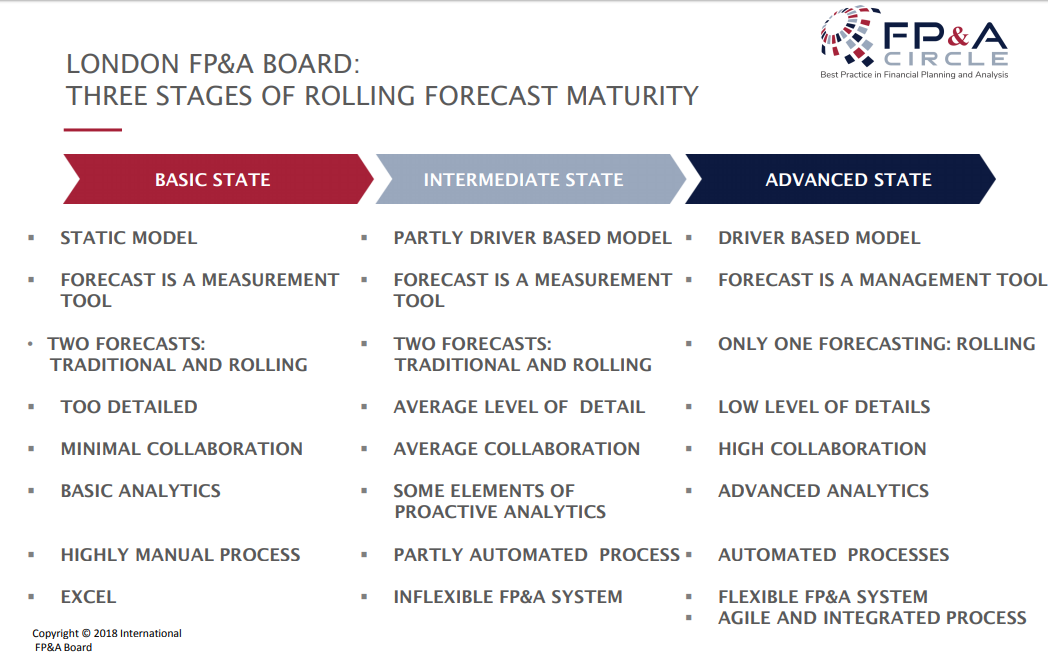

Through collaboration and discussion, the London FP&A Board developed the following Rolling Forecast Maturity Model:

Figure 7

Rolling Forecast: (i) the basic stage

The initial stage of Rolling Forecast is characterised by static planning: as it’s not driver-based it is also not flexible or dynamic.

There are two forecasting processes: traditional and rolling. While the two forecasting processes are run simultaneously, much time is spent managing them.

The level of forecasting detail is high; consequently, no time is left for decision-making process to adjust the course of the directions.

The level of analytics utilised is basic and descriptive. Actuals are not automatically uploaded into the forecasts, as Excel is the main tool used for planning and forecasting. This means the amount of non-value adding work is very high and FP&A personnel have little or no time for analytics.

If the organisation doesn’t progress beyond this stage, the RF becomes an unnecessary burden - merely a time waster and further expensive process. Yet statistics suggest that around one in five RFs are abandoned after the initial implementation. It’s likely the companies weren’t ready for the process and that their culture, people, systems and processes weren’t ill-equipped to move on to the next stage of maturity.

Rolling Forecast:(ii) the intermediate stage

By this stage, the planning model is partly driver-based and has already moved away from the “too detailed” approach of the basic stage. However, static and inflexible planning systems are still partly in use. Consequently, it isn’t easy to generate fast-paced rolling forecasts on demand and to model different scenarios with ease.

There is an average level of collaboration exist, but it is not yet well-developed due to a complexity of the process. Some elements of advanced analytics exist, but they are not fully realised at this stage.

The political acumen of forecasting is still in place because the process is treated as a performance measurement tool. As a result, the emotional side of the forecasting process influences its quality. Much time is spent completing it, leaving no lead time for decision-making and changing the course of actions.

Since two forecasting processes are being run side-by-side, significant time is wasted. FP&A professionals by this stage are overworked and demotivated, with no time for value-adding analysis.

This stage of development is stable but lacks efficiency and effectiveness. In order to realise its full potential, organisations have to progress further into the leading stage of the process.

Rolling Forecast: (iii) the leading stage

This is the Rolling Forecast’s most advanced level: the stage where all the potential of the process is realised through agile and prompt forecasting and planning, quick decision making and better corporate performance management.

The main characteristics of leading Rolling Forecast processes are as follows:

- It is generated through a driver-based model. The level of detail is not overly complex, allowing for quick re-forecasting, easy scenario planning and simple sensitivity analysis.

- As Rolling Forecast is a management tool, the process is not intermingled with corporate performance measurement.

- The forecasting process is a collaborative process; made possible due to the capabilities of the modern flexible system, education and simplicity of the driver-based concept.

- Routine processes are automated, so no time is wasted on unnecessary details. FP&A practitioners have time to analyse and to concentrate on improving the planning processes.

This advanced stage of the Rolling Forecast maturity is what organisations aim for. To reach it, they must be ready to completely re-think their traditional planning philosophies; be open to change in processes, and willing to invest in their people and systems.

Conclusion

The Rolling Forecast is an important modern management process that expands planning horizons, reduces planning cycles, and helps in executing organisational strategies.

Companies will realise the Rolling Forecast's full potential only when they are ready to change. If it is not implemented with thought, it can become another non-value adding process, an expensive time-waster without benefit to the organisation. It is up to each company to decide at which stage of its development it is ready to move into the Rolling Forecast process.

© 2016 London FP&A Board, All Rights Reserved

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.