In this article, we will look at how driver-based advanced analytics has overcome the problems with...

This is the fourth article in a series of eight articles devoted to the wide variety of benefits provided to the firm by the next generation budget, the operational budget (OB), and its associated operational income statement (OIS).

This is the fourth article in a series of eight articles devoted to the wide variety of benefits provided to the firm by the next generation budget, the operational budget (OB), and its associated operational income statement (OIS).

This article focuses on the operational budget’s enhancements for the rolling forecast process. Previous articles have focused on:

- Part 1: How predictive and prescriptive analytics make the operational budget (OB) possible and how easy it is to demonstrate OB’s value for a firm.

- Part 2: OB’s benefits for the traditional budget.

- Part 3: OB Test Case: Profit opportunities in excess of 50% and more

NOTE: It’s important to understand that the fundamental idea underpinning the operational budget (OB) is that it’s causal. It uses a single driver to model the entire firm--its activities (aka, flow, operations). All of the OB’s model’s benefits flow from this activity-based driver causality as described in the first article.

Operational budget’s benefits and enhancements are possible because:

- Operational budget’s activity-based driver allows a prescriptive model to be created (see Part 1)

- The model’s solution includes a new forecast built on the original forecast. The new operational budget (OB) forecast is the one with the best possible profit. The OB solution also includes a revised budget which contains all the COGS and SG&A resources required to make and fulfil the new forecast (see Part 1)

- Other benefits accrue because this is a prescriptive model. These benefits have been described in Parts 2-4 and will be described further in parts 5-8.

This article has three sections: i) background; ii) operational budget's benefits for the rolling forecast process and) conclusion including future articles.

Background

The rolling forecast advantages were nicely summarized in John Stretch’s article “Ten Reasons to Adopt Rolling Forecasts.” In addition, Larysa Melnychuck in her article “Modern FP&A: Some Important Techniques, Methods and Concept” concluded the section on the rolling forecast by observing that “quite a few organizations have abandoned the old budgeting and planning process in favour of the more flexible rolling forecast.”

Operational budget’s benefits for the rolling forecast process

The Table 1 below shows how the operational budget strengthens Stretch’s 10 reasons for adopting the rolling forecast, making it more attractive to adopt.

|

John Stretch’s “Ten reasons for adopting rolling forecasts” NOTE: The 10 reasons have been paraphrased and combined to 7 |

How the operational budget (OB) enhances these 7 paraphrased and combined reasons |

| 1. Variances are based on current, not outdated information: In a rolling forecast, each business unit sets a monthly or quarterly target and reports actual performance against this target. Since these targets are based on current information, “excuse variances” are eliminated or reduced. |

1. Monthly or quarterly targets are not required from the business units because the current OB includes monthly business unit forecasts. Furthermore, those business unit forecasts are always up to date because the OB is immediately updated whenever any of its underlying assumptions are changed. Also, the OB is an entirely flexible budget, something never possible before. The OB variance analysis is performed quarterly by programmatically normalizing the OB with the actual volumes. The results obtained are immediately actionable. |

| 2. Rolling forecasts avoid the effects of unrealistic and unattainable budgets including time taken, cost and disruption, game playing and padding. In summary, current budget systems are outdated. |

2. It is not possible for OB to be unrealistic or unattainable. All of the resources required to make and fulfil the current forecast are in the OB. The OB also eliminates the disruption, time taken and the cost of preparing the traditional budget because it’s a model. Next year’s budget is available immediately after next year’s planning assumptions are entered into the current OB. For more details, see the second article on OB’s benefits. Finally, being a model, OB eliminates gaming/padding. It also eliminates overhead expense allocations, obsolescence (updated in real-time) and command/control from C suite. |

| 3. Strategy is no longer an annual event but a continuous dialogue between head office and the business units. With annual budgets, organizations have to wait until the next budget year before including the effect of strategy changes in their targets. | 3. OB is updated immediately if any of its underlying assumptions changes during the rolling forecast planning horizon. Thus, the OB enables an informed and fact-based dialogue between head office and the business units. |

| 4. Forecasts enable better anticipation of change, greater responsiveness and flexibility. | 4. OB creates a new forecast with any changes in assumptions with the best possible profit. That’s as flexible and responsive as it gets. |

| 5. Improves the organization’s ability to forecast and thereby manage investor and banker expectations. The share price can suffer when analysts and investors react to a significant mismatch between an outdated budget and actual results. | 5. OB always contains the most profitable forecast possible, something that should appeal to analysts and investors |

| 6. Encourages managers to think more strategically and promotes a better understanding of the organization’s value drivers. | 6. OB has only one driver: activities. Certainly, a driver the entire management team understands since activities are the only driver that truly drives the firm’s value for its customers. |

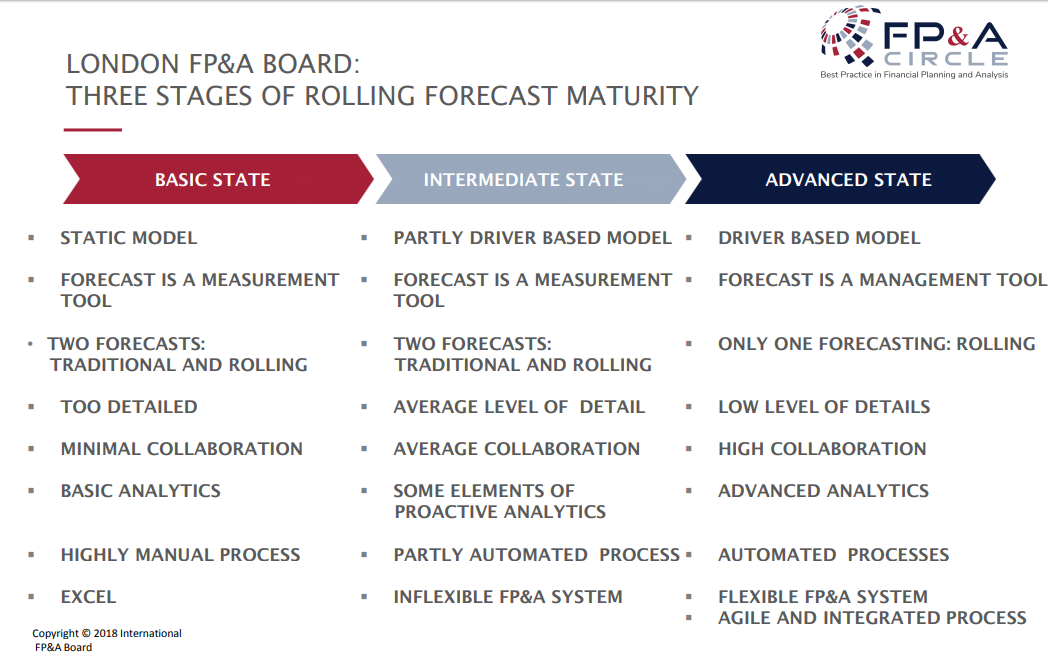

| 7. We have the technical capability. Today’s FP&A practitioners are highly trained professionals with a greater ability to see the big picture, analyze and interpret data, and build predictive models. | 7. OB extends current budgeting technical capability to include prescriptive modelling. In fact, as described earlier in this article, OB integrates elements of the technical capabilities of both i) activity-based budgets and ii) advanced analytics and driver-based models. The result is a capability more powerful than those cited in the rolling forecast’s maturity advanced state. See Figure 1, below. In effect, the OB constitutes a fourth, more advanced state of rolling forecasts. |

Table 1. OB’s benefits for the rolling forecast process

Figure 1. Three stages of rolling forecast maturity

Conclusion

The Table 1 above illustrates how the operational budget strengthens Stretch’s 10 reasons for adopting the rolling forecast. Thus, it helps to make the process’s adoption more attractive.

The next two articles (Part 5a/b and Part 6) will describe how operational budget can improve the current budgeting process besides its benefits to the rolling forecast process. They will explore how to eliminate the budget altogether by implementing the Beyond Budgeting Institute’s adaptive management model and zero-based budgeting (ZBB).

Part 7 will describe operational budget’s benefits for two functions outside finance (S&OP/manufacturing and sales/marketing’s ROI) and a cross-functional operational budget application (scenario planning).

The concluding article will explain how operational budget enhances three of M&A’s current separate advanced analytical techniques by integrating them into one model.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.