To navigate the uncertainties in 2020, FP&A had to change their way of working. On the 4th of February 2021, I hosted The Digital Swiss FP&A Board, where we looked at the Scenario Planning via different perspectives. The insightful meeting was delivered by a board panel of 4 distinguished FP&A Board members. This article summarises the key case studies and polling questions.

To navigate the uncertainties in 2020, FP&A had to change their way of working. On the 4th of February 2021, I hosted The Digital Swiss FP&A Board, where we looked at the Scenario Planning via different perspectives. The insightful meeting was delivered by a board panel of 4 distinguished FP&A Board members. This article summarises the key case studies and polling questions.

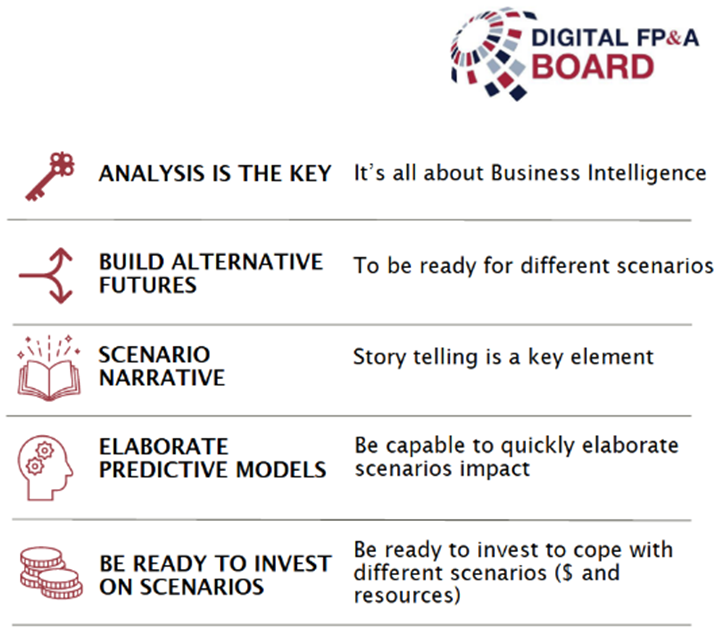

Scenario Planning Implementation: Five Steps for Success

Based on the presentation by Massimo Magliocco, planning director at STMicroelectronics.

The concept of Scenario planning was first introduced by Peter Wack by then Royal Dutch / Shell oil in 1985. Although it was adopted some 35 years ago, the process is still slow due to several reasons:

It requires a strategic mindset – a change in culture.

It is not a plug-in tool nor a decision tree. It is complex and considers multiple variables.

Playing different scenarios has costs implications.

In selecting which scenarios to play, key considerations should be given to:

Risk assessment: a detailed analysis of risks and opportunities.

Bias free: avoid mood planning / wilful blindness / number illusion.

Impactful: Impact on critical customers /sales /gross margin.

The slide below best summarises five pillars of successful Scenario Planning implementation.

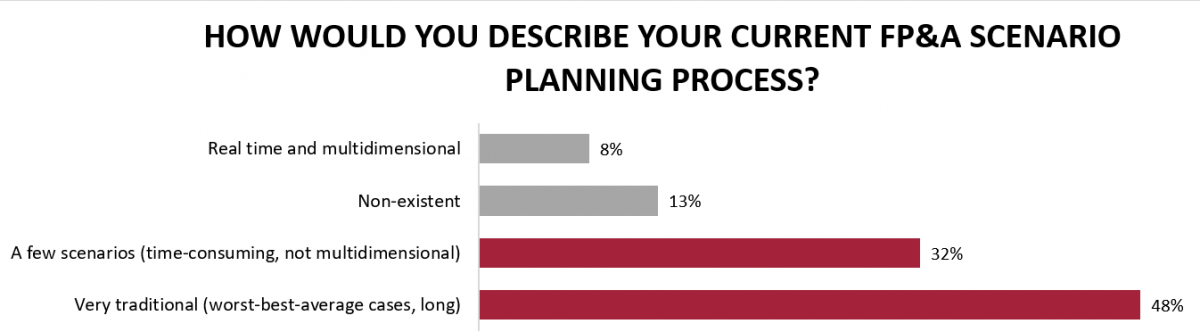

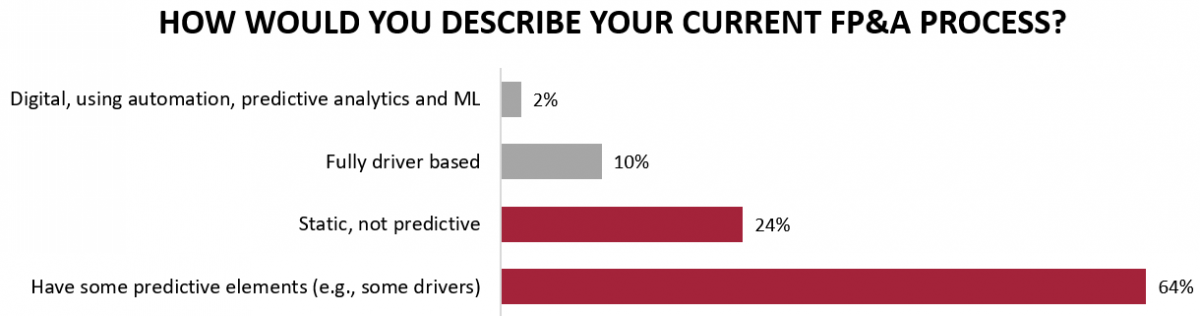

Our first interaction with the audience was on “How would you describe your planning process”.

Question 1. Replies from FP&A Board participants (approx. 127 responses).

We can conclude that the pandemic has moved a lot of companies into scenario planning. However, there is more work to do to move these organisations from best/worse cases into playing different scenarios based on what is happening.

Shell Case Study: Forecasting in time of uncertainties

Based on the presentation by Remko Boer, VP Finance at Shell Upstream.

In 2020, oil prices collapsed from $70 to almost negative. The speed of transition to alternative energy is also putting a lot of pressure on the energy sector.

In the short term, Shell navigated through by using different scenarios:

Short & Sharp (V-shape recession)

Deeper & Longer (U-shape recession)

Base case & likely worse case & worse case

Updates on risks, the financial outlook for 2020/2021/2022

Cash preservation measures are based on different scenarios.

When playing scenarios, Shell pays attention to descriptions of the potential future landscape, modelling these scenarios for margins, free cash flow and capital allocations. The company also assesses the uncertainty highlighting top risks that need management attention.

For example, Remko makes sure that everyone is clear on the role of Upstream in the overall Shell strategy. They also look for flexibility in the portfolio and allocate capital based on project ranking. To forecast in uncertain environment, the Upstream team assess different scenarios based on multiple project outcomes and identifies inflexion points.

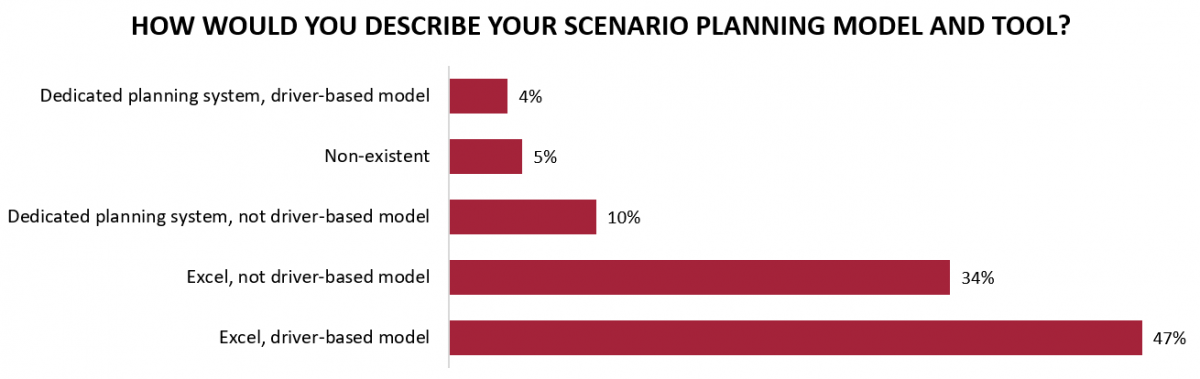

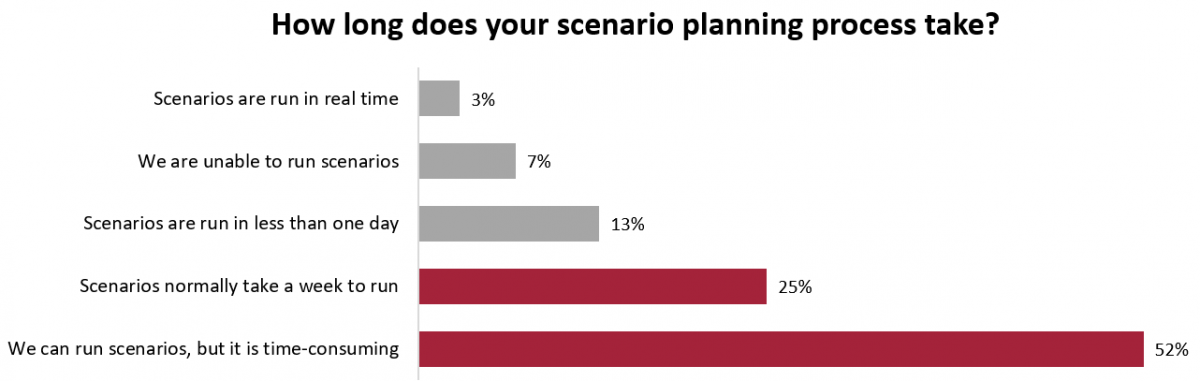

Question 2. Replies from FP&A Board participants (approx. 127 responses).

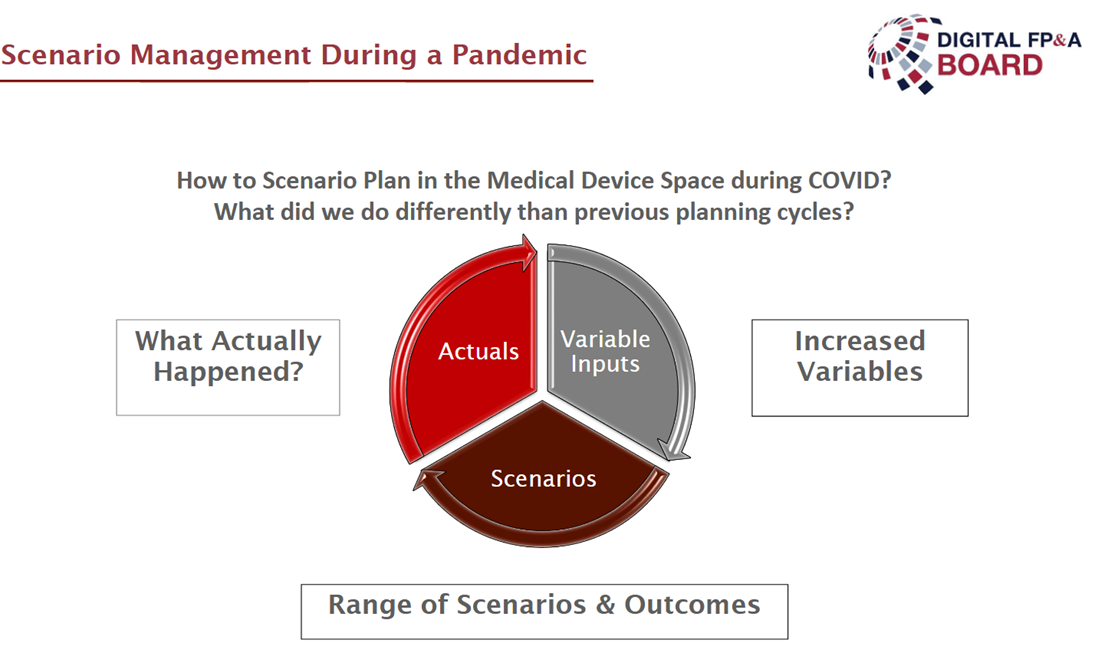

Johnson & Johnson: Navigating through different scenarios

Based on the presentation by Kristina Dalesio, Senior Finance Director Global Vision FP&A COE at Johnson & Johnson.

In 2020, J&J was confronted with the question: “What key factors and variables do they need to manage?” They bought in a lot of data from third parties, updated it on a regular basis and focused on a small handful of scenarios. It was a range of reality of what might happen based on the available numbers. After creating these scenarios, the company discussed how they can react to each of them. This enabled reduced cycle times, faster strategic decision making and integrated planning across various units of the business.

Based on J&J experience, FP&A can add real value to the business through:

Preparing for a range of possible outcomes

Using Multi Scenario Planning with added complexity and increased drivers

Driving the right strategic choices for the organisation

Question 3. Replies from FP&A Board participants (approx. 127 responses).

Leveraging Technology: Moving scenario planning to the next level

Based on the presentation by Dennis Christoph Nann, the Managing Consultant at Horváth & Partners.

How to leverage the power of technology to implement best practice scenario planning?

Define the different scenarios. Look at the use cases and what management actions are taking place against there. The combination gives you different scenarios.

Compare to the base case

Identify all the relevant business drivers so we can have a driver-based mode.

Ensure that any measures and projects already in existence and their impact are considered.

Question 4. Replies from FP&A Board participants (approx. 127 responses).

For best scenario planning the model needs to be driver-based and the use of a dedicated tool is highly recommended.

Conclusions

Scenario Planning is an imperative business tool, without which we saw quite a few organisations struggle and some go under during the pandemic in 2020/21. Scenarios should be realistic based on real business drivers, multidimensional and best in real-time. FP&A needs to push for all of these to happen and manage the business through uncertainties via Scenario Management.

We would like to thank our global sponsors CCH Tagetik for their great support with this Digital FP&A Board.

Also, we are grateful to our panel of experts for sharing with us their valuable insights and to the FP&A Board attendees for their valued presence!