Artificial Intelligence (AI) is one of those terms surrounded in mystery and which promises a lot...

With technology developing at breakneck speed, it is no wonder that FP&A teams around the world are beginning to capitalise on innovative modern tools. In particular, planning processes have been transformed by the implementation of Artificial Intelligence (AI), Machine Learning (ML) and Predictive Analytics.

In November 2021, the Digital Swiss FP&A Board was held to discuss the impact of these tools on the planning process.

Introduction

Discussion facilitator Hans Gobin began by sharing the results of the 2021 survey comparing the actual time distribution of FP&A compared with the desired time distribution. It was found that there was much less time spent on high and medium value activities than was desired, while driving action was only 16%.

These results demonstrate great scope for tools like AI and ML to optimise FP&A processes. As stated in 2020 FP&A Trends research: “AI does not change the basic role of FP&A, but it does change the way in which that role is carried out.”

Hans then gave key definitions of ML and AI:

ML: a system that can learn from data through self-improvement and with minimal supervision

AI: enables the machine to think and react like humans.

The Lonza Case Study

Following Hans’ introduction, Patric Somlo presented Lonza’s pilot case study on Predictive Analytics.

Patric advocated prioritising use cases before jumping into implementation. Lonza spent six weeks examining prospective areas, weighing up the potential benefits, cost savings, and impact on business decisions.

After this process, the organisation then implemented in an area that had a high chance of success: NWC forecasting.

Now that the system was built, Lonza reviewed the results, which were very encouraging. They found that the automated process produced a similar level of forecast accuracy to the manual process. However, the automated process had done so with a lot less time and effort.

Patric then shared the key learnings from Lonza’s pilot case study on Predictive Analytics:

Develop in-house capabilities. This may mean hiring new talent and/or providing training.

Data quality is key.

Set up appropriate rollout infrastructure.

Balance fundamental change projects with easy wins. Starting with difficult areas risks becoming disappointed and losing momentum.

Strengthen ‘trial and error’ DNA and manage expectations. It is important to accept that sometimes implementation works and sometimes it does not, and to be able to explain why.

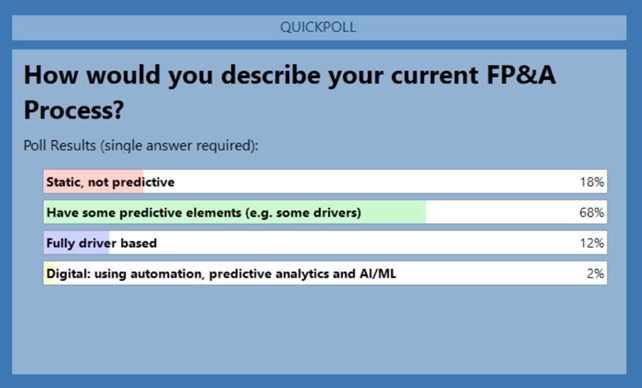

After Patric’s presentation, Hans asked the participants the first polling question: “How would you describe your current FP&A process?”

Figure 1

As the majority of respondents had only some predictive elements in their FP&A process, the panel concluded that there was a lot of opportunity for more implementation of these tools. Patric predicted that there would be much more adoption in the next 10 years.

The FP&A of the Future

The next presentation came from Vignesh Dumonceau. The CFO at Flex began by exploring how the FP&A journey has been evolving. He reminded attendees of the goal of FP&A, which is to make or support decisions that improve EBITDA or cash. This goal has not changed, but the way professionals achieve it has.

Figure 2

The follow figure compares traditional approaches to FP&A goals (left) with new methods (right):

Vignesh devoted the rest of his presentation to the new innovations that are taking FP&A to the next level:

- Integrated reporting

It was explained that integrated reporting involves using not only internal data (e.g. historical sales made to customers), but also external data. For example, when it comes to pricing, organisations can examine how competitors price similar products, and this can lead to better decision-making.

- Predictive learning

Vignesh defined predictive learning as: “the use of data, statistical algorithms and Machine Learning to identify the likelihood of future outcomes based on any relevant data”.

He then provided 6 steps for successful implementation:

Expand the data lake. The more relevant data you have, the better.

Select the right tool to extrapolate and process the data.

Scenario Planning. Contextualise the data to extract conclusions.

Move from correlation to causality. This type of analysis allows you to identify a link between A and B, but also the lever that is producing this result.

Operationalise KPIs.

Execution is variance control.

- Real-time reporting

Vignesh defined real-time reporting as: “data which is delivered and processed immediately after it is collected”.

It means that up-to-date insights can be continuously delivered, producing faster, more accurate decisions. This can have a huge impact on EBITDA and cash flow.

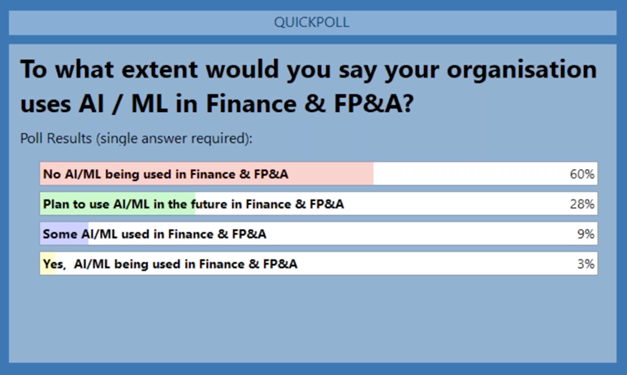

The second polling question asked: “To what extent would you say your organisation is using AI/ML in finance and FP&A?”

Figure 3

Vignesh was unsurprised that the majority were not using AI/ML, since these tools are still in their early days. But he commented that this still represents an increase in adoption, so there is some momentum.

The SBB Cargo AG Case Study

In the third presentation, Stefan Spiegel shared his case study of Predictive Analytics at SBB Cargo AG. To learn whether they should move from a two-part production system to a single locomotive type, the company built a digital twin of their processes using AI/ML.

The goals were:

Quick and optimal answers to strategic and tactical questions.

Automised forecast and operational dispatching processes.

Linkage between planning and operational levers.

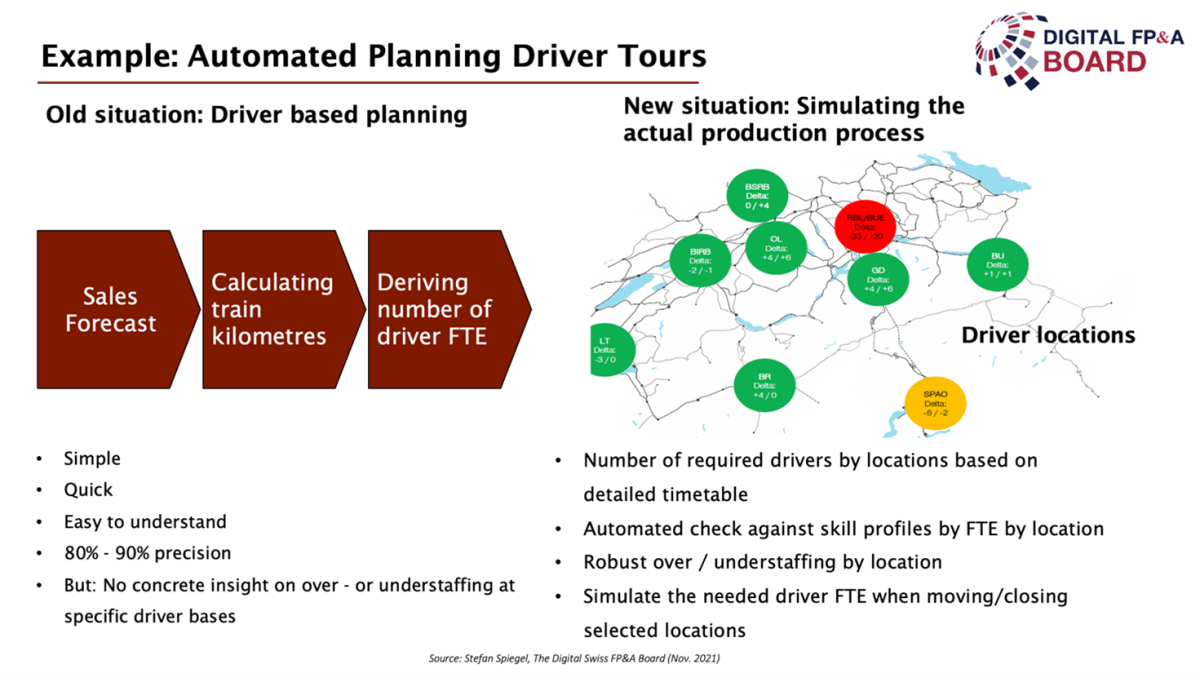

Driver based planning had its advantages, but it did not provide the concrete insights gained by simulating the actual production process, as seen in the following figure:

Figure 4

That said, there were impediments to be overcome when creating the digital twin:

Predictive forecast needs many special inputs from key account managements; simplifications for regular application must be developed.

Too little operational data for Last Mile Planning.

Some models need research input (e.g. from universities).

Prescriptive systems can be used for tactical planning, but not yet within daily dispatching processes.

Operational people do not have enough time to support the development of the analytics instruments.

Stefan concluded with 5 key takeaways:

Business consists of complex systems.

Financial planning often overcomes this problem by using simplified models, but this does not offer much optimisation potential.

Try to understand, simulate, optimise and automise your operating processes.

Using AI/ML can help to deal with these complex systems.

Planning is okay — but only execution makes the difference!

Demystifying new technologies

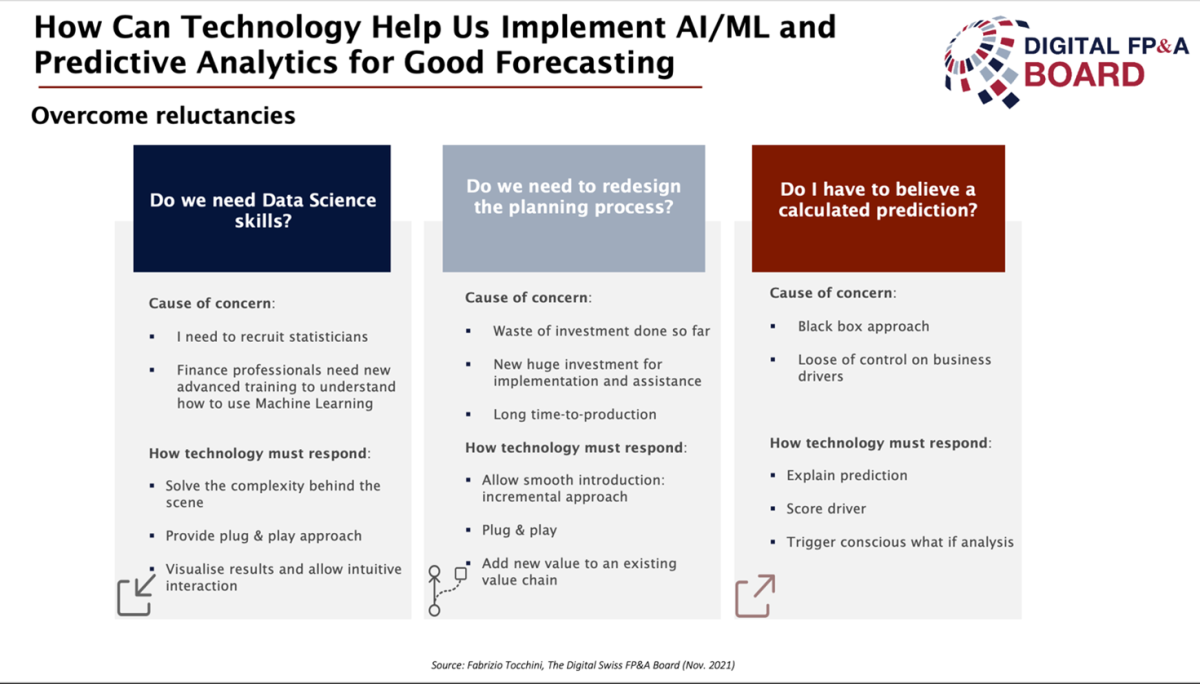

The final presentation was given by Fabrizio Tocchini of CCH Tagetik. Fabrizio highlighted that despite the uptake of AI/ML in the forecasting process, there is still a lot of skepticism towards these tools.

Fabrizio identified the three main causes of concern, and explained how technology providers like his own company should respond to them:

Figure 5

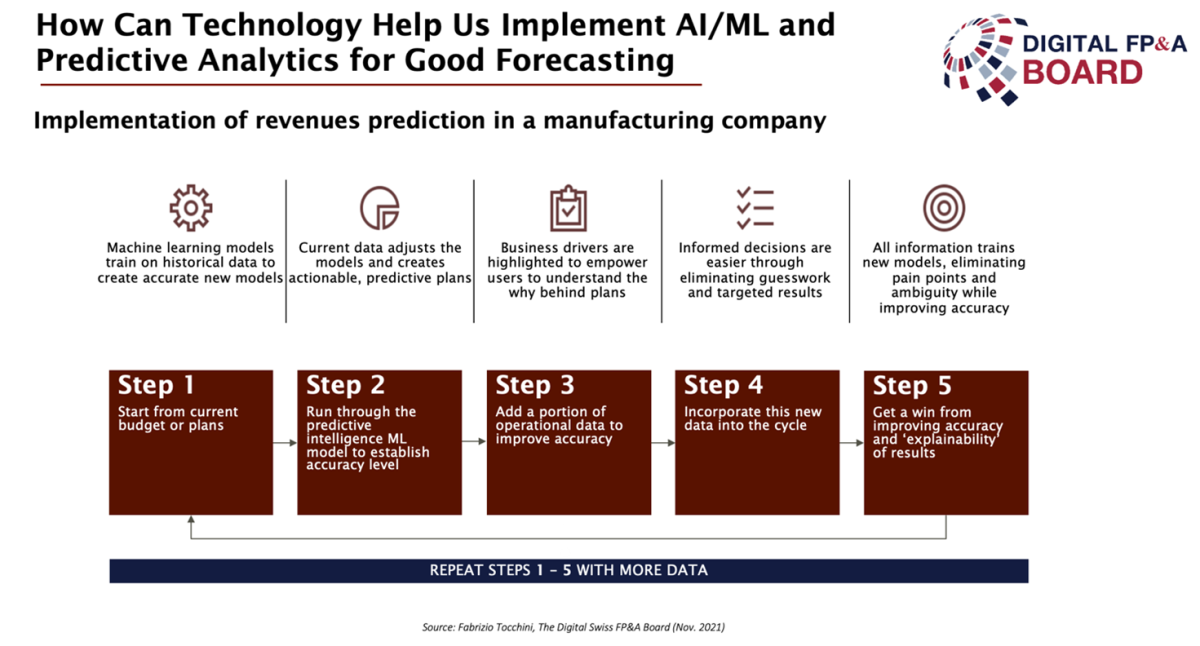

Next, Fabrizio broke down the 5 steps for implementing revenue prediction with AI/ML:

Figure 6

Fabrizio concluded by discussing how these tools can help with data asset management, and the power of conscious Scenario Planning.

Conclusions and Recommendations

The panel offered a number of insightful takeaways from the discussion. Above all, the speakers emphasised that FP&A adoption of AI/ML is accelerating, so practitioners should embrace these tools early to gain a competitive edge and avoid being left behind. The panel also highlighted the importance of having leadership support when experimenting with or adopting AI/ML.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.