Today, the tools that are being offered are smart enough that with a few inputs and financial...

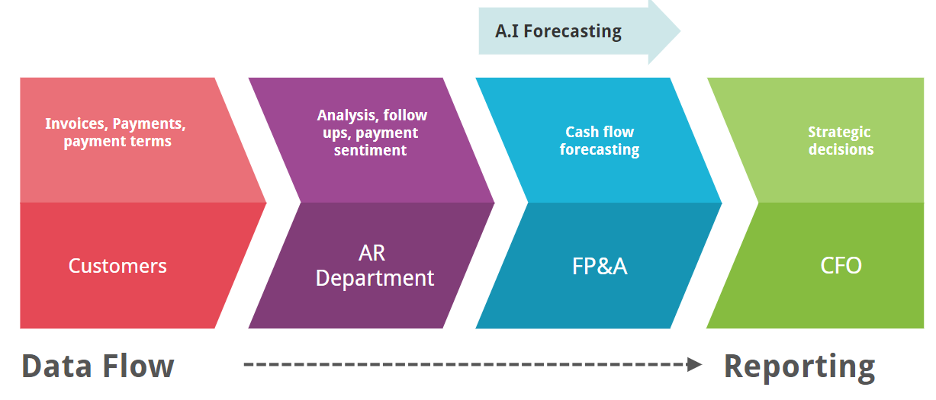

This is the second in my series “How to get started with Machine learning in Finance”. This blog explains how FP&A can utilise Artificial Intelligence (AI) to make a data-driven forecast of Account Receivables by examining historical invoices and payment data.

This is the second in my series “How to get started with Machine learning in Finance”. This blog explains how FP&A can utilise Artificial Intelligence (AI) to make a data-driven forecast of Account Receivables by examining historical invoices and payment data.

Account Receivables play a critical part in a company's financial stability. The majority of B2B enterprises offer credit to their customers, allowing them to pay in 30/60/90 days. Despite it, companies fall into serious Cash Flow problems and may even go bankrupt as a result of poor AR management.

That is why every CFO desires to effectively handle their Accounts Receivables. Overdue invoices are followed up on by collection managers in AR to convince consumers to pay. These collection managers can use various tools to assist them to prioritise which invoices, customers to focus on and also help detect the unusual customer behaviour.

In some organisations, FP&A need Cash Flow predictions for the coming month, quarter, or two in order to report on their predicted financial statements. Typically, they speak with AR teams to gain a sense of how the Cash Flow from various outstanding invoices will be. This necessitates a great deal of communication and leaves the possibility for human error.

This is where advanced prediction techniques, such as Machine Learning, may be extremely useful. Credit history, prior customer behaviour, the economy, customer industry expansion/contractions, and other factors can all be used to forecast AR flow using these strategies. Machine Learning may appear to be a difficult undertaking, but it may be utilised to improve the accuracy and speed of FP&A operations with the correct resources.

Let's look at how FP&A teams can use advanced prediction techniques like Machine Learning to estimate Cash Flow using AR data from ERP and then report on it in their financial statements. It comprises 3 steps:

- Prepare Input data

- Data cleaning & Processing

- Apply Machine Learning models

1. Preparing Input data

Prepare a dataset with historical invoices with customer information and payment dates etc. . Finance ERPs have AR invoices with the following attributes:

- Invoice amount

- Customer

- Payment terms: 30/60/90

- Overdue days etc

- Payment date

- Credit history

- Credit score etc.

2. Data cleaning & processing

You've probably heard the phrase "garbage in, garbage out" when it comes to data. We must ensure that the data we extract from ERPs is free of number format errors, missing values, and outliers and that the data is normalised. Missing values and outliers can be dealt with in a variety of ways, which are outside the scope of this article. After the data has been cleaned, we must divide it into two sections. This will assist us in determining which model is most appropriate for our data set. We'll use the Train data set to make predictions and compare the results to the test data set. We can choose the optimum model and parameters for predicting future periods by minimising the error rate.

Splitting Data into Train and Test:

- Train dataset with historical invoices will be processed to identify patterns in the input data,

- Train dataset should contain historical invoices for the last 36-48 months with all the attributes mentioned above.

- Test data set will contain active invoices with all the attributes above, except the payment date. (Since invoices are not paid yet and need to be predicted)

3. ML models

ML models examine patterns in the test dataset and use those patterns to determine the due date for invoices in the test data set. Model output can then be aggregated to months/quarters to provide Cash Flow for the following month/quarter. Gradient boosting models like XGboost and Light GBM operate well with invoices and payment data, according to Tadaa.ai research.

You can begin experimenting by training and testing the models if you are familiar with Python. However, if you want to create an automated pipeline and put it into production, you'll need:

- To extract data for financial ERP, you'll need an ETL engineer.

- To train and test diverse models, a data scientist is needed.

- To productionalise, you’ll need a Machine Learning engineer.

There are also AI products in the market that will let you execute quickly without the need for additional resources. Automating Cash Flow forecasting allows FP&A teams to focus on creating business insights rather than the tedious task of business execution.

As we start seeing more AI applications in corporate finance, finance teams need to be equipped with the fundamentals of data science and Machine Learning. Similarly, the incentives need to be aligned to increase efficiency in finance teams.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.

jaintalk

December 2, 2021

You have touched the right chord. My experience of Finance-Order to Cash process improvement too echoes it.

Machine Learning is a blessing for O2C process, especially Accounts Receivables. A successful example is Iron Mountain. The company was able to reduce collection time by 25%-45%.