After a 2-year Covid-related break, FP&A Trends resumed a series of live events in the United...

The International FP&A Board met for the first time face-to-face since the pandemic in Paris on 15th November 2022.

38 senior finance practitioners from leading organisations such as GE, Coca-Cola, J&J, Sanofi, Estee Lauder, La Poste Groupe, Carrefour Banque & Assurance, Renault, Univar Solutions and others came together in Paris to discuss key lessons learned from the pandemic from the FP&A perspective.

Figure 1: The Attendees of the Paris FP&A Board on the 15 of November 2022

The forum included:

- a presentation by Larysa Melnychuk on the top lessons learned from the pandemic;

- two case studies presented by two speakers; and

- small group sessions.

After participants were asked to introduce themselves briefly, they had the opportunity to express the biggest lesson learned from the pandemic. The following were among the most significant insights shared:

- Being agile;

- Demonstrating resilience;

- Improving the speed;

- Demonstrating adaptability;

- Adopting automation;

- Embracing technology;

- Working remotely.

Presentations:

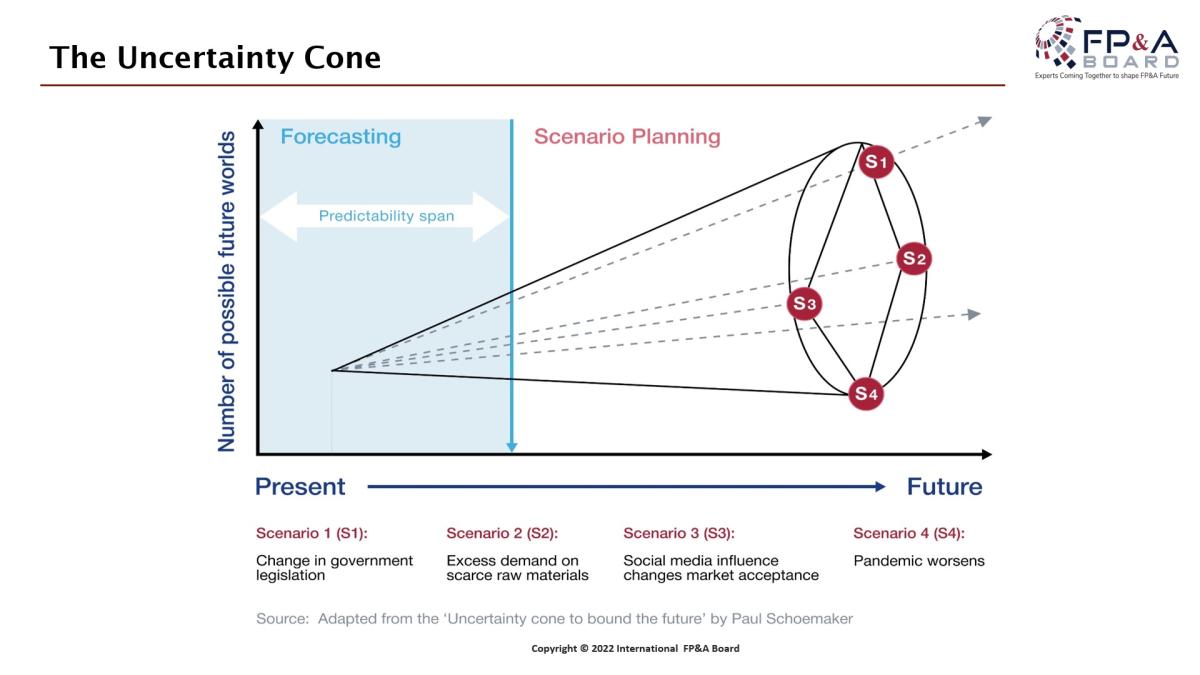

The primary purpose of FP&A is to help manage the company's value by setting models and supporting decision-making through storytelling and communication (according to Gerhard Lohmann, Former CFO at Swiss Re Group). The pandemic has reinforced the trend that traditional budgeting and planning do not work today. It is mainly explained by Paul Shoemaker's Cone of Uncertainty outlined below. The predictability span is shrinking, and the traditional methods only work within this span. The future is uncertain, and there is a need to plan for uncertainty. To address this challenge, we need to adopt the FP&A scenario management, a method that considers alternative futures and their possible effects on the organisation.

Figure 2: The Uncertainty Cone Defining The Shrinking Predictability Span

The implementation of scenario management is done by moving from traditional planning to Extended Planning and Analysis (xP&A). The xP&A is a journey to analytical excellence that involves all the organisation's functions, integrates the strategic and financial plans with the operations, and adopts digital transformation of the processes. The xP&A is implemented through horizontal and vertical integrations of key success factors, among which one can cite the FP&A team roles as outlined below.

Case 1:

Figure 3: Case Studies from Leading Companies Have Been a Hot Topic for Discussion

Alberto de Freitas, Finance Director, Customer Global FP&A at CWT, shared the lessons learned from the pandemic. He stated that CWT decided to shift into survival mode by managing the resources more prudently and protecting cash, anticipating the next steps by redefining the short-, mid- and long-term strategy. They also simplified and optimised the processes and communicated more effectively by maintaining contact with stakeholders. Other actions implemented by the team included putting tasks with little added value on hold and encouraging most employees to take a leave without pay (LWOP). In a nutshell, the team learned that FP&A needs to be agile and adaptable and shift to the modern planning model.

Case 2:

The second case was presented by Diana Groschupp, Vice-President FP&A Europe at TD Synnex. She stated that the challenging conditions of the pandemic force the FP&A team to adopt speed and flexibility more than ever. The FP&A went through 3 phases during the pandemic.

The first phase focused on managing emergencies through quick reactions to new requests and needs, and the second phase settled the activities to the new way of working that they called "Normal of not normal". The third phase stressed the need to build a platform for solid business support, resilience, and agility of the function in the new environment. One of the most important impacts of the pandemic was the acceleration of the FP&A long-term agenda by intensifying business partnering, insightful analytics, speed, agility, and executive support.

Small group discussions:

Figure 4: Group Discussions During the FP&A Board Meeting in Paris on the 15th of November in 2022

The participants could engage in small group exchanges around scenario management, xP&A, and analytical transformation. Below are some key takeaways and conversation points that come up with the discussions:

People:

- The top management has a crucial role in fostering the need for change and supporting the modern FP&A initiative of scenario management.

- Сollaboration of the FP&A team with the organisation and other business departments in scenario planning should increase.

- A team has to be multi-disciplined with functional skills in accounting, finance, analysis, data architecture and data science.

Processes:

- Standardisation, simplifying, and automation of the processes.

- Relying upon an on-demand agile approach.

- Horizontal and vertical integration of processes.

Technology:

- Leverage the technology of analytics and Artificial Intelligence / Machine Learning (AI/ML): identifying internal and external analytical drivers.

- Flexible integrated systems and platforms.

- The importance of real-time transformed data change.

Figure 5: The Participants Enjoyed Working in Small Groups

The end of the event was characterised by a lively networking session, allowing the participants and the organisers to connect and undertake an in-depth discussion of the critical topics of the event.

Conclusion

The International FP&A Board is a valuable learning meeting that brings together the latest financial trends and a group of dedicated FP&A leaders. Scenario management is the planning model of the future. Companies that started to implement it before the pandemic have shown resilience during the Covid crisis and could mitigate the risks and leverage the opportunities that come with it.

The meeting was sponsored by Onestream Software, Michael Page, and IWG plc.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.