In this article, the author explains how FP&A teams can use the FAIR data management framework...

The reality is that we are still just learning to manage data strategically, and probably data volumes grow faster than our data skills. Despite the abundance of dashboards and analytical tools (or because of them), many FP&A teams still struggle with fragmented data, inconsistent definitions, and limited forecasting accuracy.

The latest FP&A Trends webinar, "Mastering Data in FP&A: Turning Analytics into Strategic Advantage," brought together senior leaders from PepsiCo, BILL, and Workday to address this challenge. This report summarises their insights on building data foundations, evolving FP&A workflows, and ensuring analytics actually leads to better decisions.

Building a Solid Data Foundation for FP&A

Angelica Ancira, Global Digital Planning VP FP&A at PepsiCo, spoke passionately about a topic central to her role and close to her heart: building a solid data foundation in FP&A. She explained that, next to people, data should be treated as the most important asset.

Angelica highlighted the barriers many face, including skill gaps, data accessibility issues, and a lack of a strong data culture.

Data enables FP&A teams to support stakeholders and drive performance; we really need to make the pivot and treat data as a critical asset and a true competitive advantage.

Figure 1

At PepsiCo, her team has taken a proactive approach: establishing internal standards, creating validation processes, and implementing a hybrid model where Finance owns the business meaning of data while partners in technology act as the technical stewards.

Angelica underscored that advanced capabilities, such as AI, Machine Learning, and Predictive Analytics, simply won’t work without high-quality, well-structured data. Her call to action was clear:

"Start working on your data now. Don't wait for the perfect moment. Begin by taking a close look at your different data sources across the organisation and start treating your data as an asset, just like any product."

Poll Insight: How Would You Rate Your Organisation’s Current Data Quality?

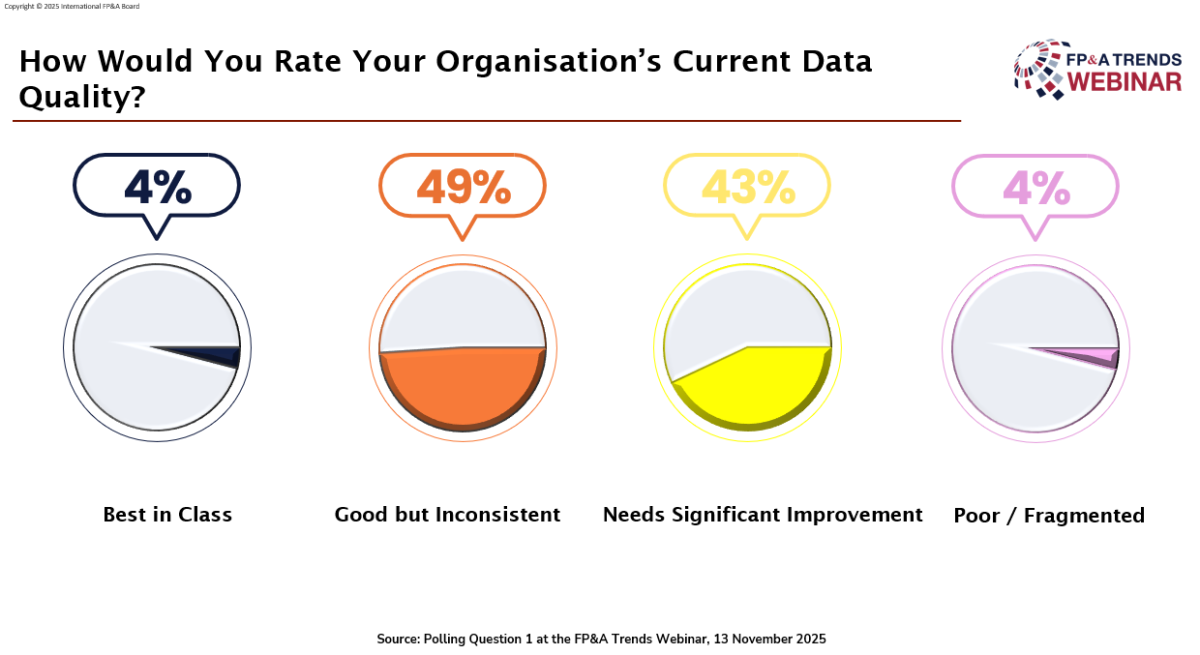

The first poll asked participants to assess their organisation’s current data quality. Nearly half (49%) described it as "good but inconsistent," while 43% said it "needs significant improvement." Only 4% claimed to be "best in class," and another 4% admitted to "poor or fragmented" quality. The bell curve response reinforces a key theme: most companies are mid-journey in their data maturity.

Figure 2

Evolving FP&A: Turning Analytics from Insight to Foresight at BILL

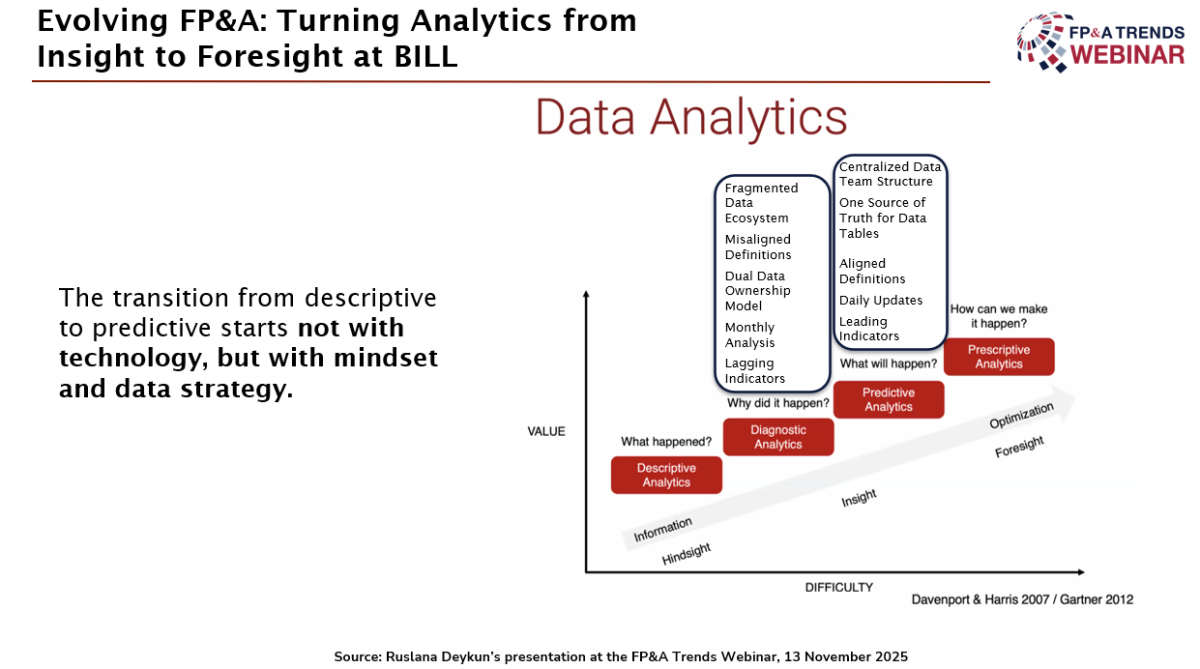

Ruslana Deykun, Director of FP&A at BILL, shared a case study on how BILL transformed its FP&A function from descriptive to predictive analytics. BILL is a fast-growing, intelligent finance platform that supports nearly half a million customers and processes over $345 billion annually. It faced the typical challenges of scale: fragmented data, misaligned metrics, and dual ownership between finance and product teams.

Analytics at BILL was performed, often focusing on lagging indicators. Ruslana highlighted that this setup left little room for predictive insights. To change that, they began by shifting the mindset and data strategy, and centralising the core analytics team under one leader while maintaining embedded analysts across functions.

They brought all stakeholders to the table, agreed on definitions, established a shared data dictionary, and finally created a single source of truth. One major breakthrough was identifying leading indicators that could inform decisions more proactively and earlier. Thus, Bill moved from a monthly to a weekly decision-making cycle, using cleaner, more real-time data.

Figure 3

Now Ruslana’s team is working on automating and refreshing data pipelines, so they can have the data available in real-time on a daily basis to support a weekly cadence of critical decision-makers who review the data almost in real-time and proactively identify how to react to any changes in trends.

They plan to introduce predictive modelling based on now-cleaned and refined datasets to leverage generative and Machine Learning, which is significant enough. They plan to take these predictive insights into planning. The planning process would start with modelling, connected to Generative AI and Machine Learning.

Poll Insight: Where do You See the Greatest Opportunity to Improve Data-driven Decisions?

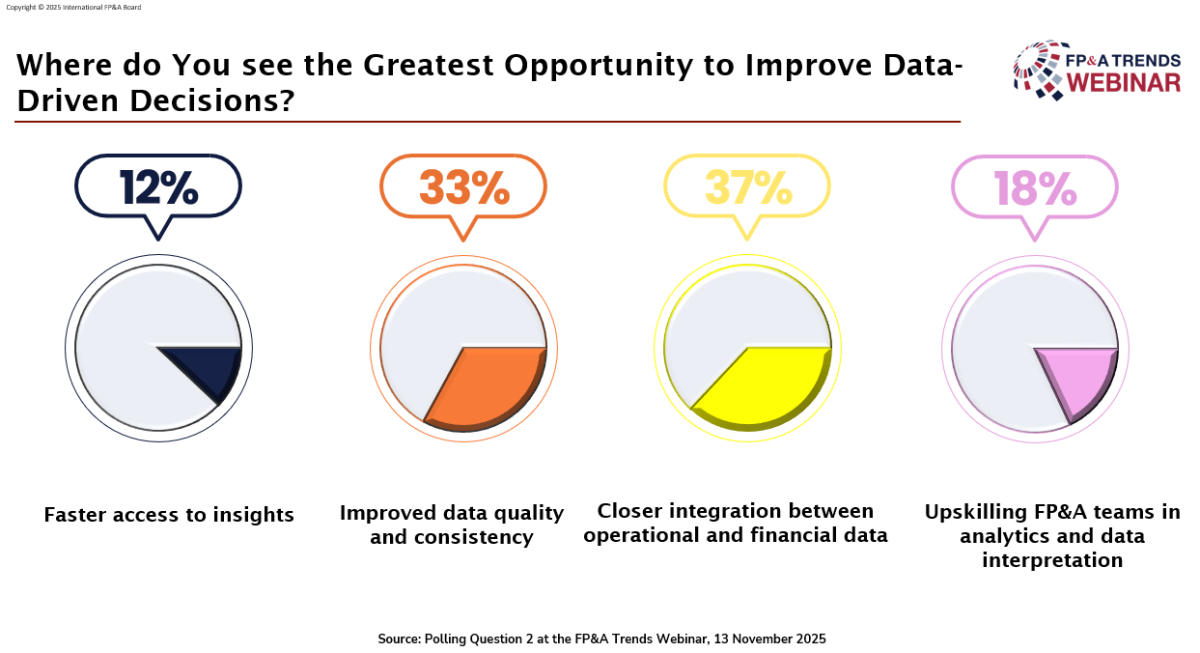

In the second poll, respondents identified their biggest opportunity for improving data-driven decision-making. The top choice, selected by 37%, was closer integration between operational and financial data. This was followed by improved data quality and consistency (33%), upskilling FP&A teams in analytics (18%), and faster access to insights (12%). The results highlight the ongoing challenge of bridging data silos and building end-to-end decision support systems.

Figure 4

How Quality Data Improves Data Insights

Gregory Volpe, Product Director at Workday, focused on the growing pressure CFOs and FP&A teams are facing to generate more analytics, more ongoing forecasts throughout the year, and continue to course correct any kind of business change that takes place during the year, as well as adopt new AI technology that we're all hearing about today.

The challenge, he explained, is that much of this data remains siloed across outdated systems, spreadsheets, or disconnected platforms. As a result, FP&A teams spend more time consolidating data than analysing it. This leaves little room for strategic thinking, making it much harder to respond to business changes.

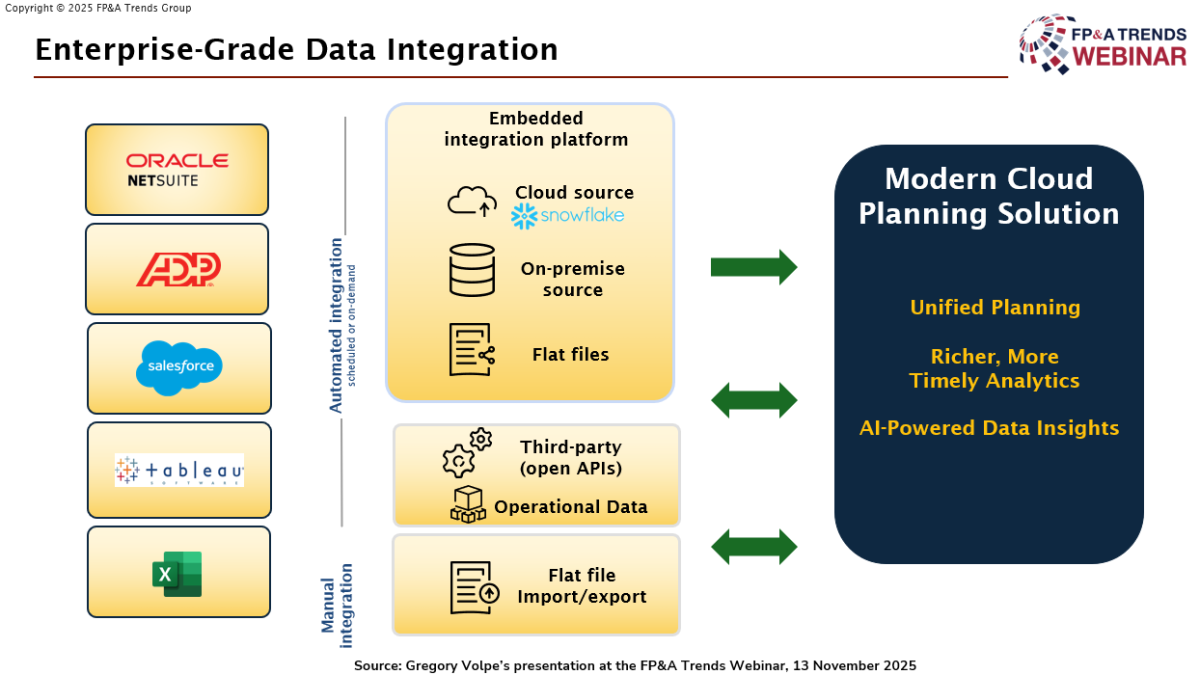

Greg argued that the solution lies in adopting a unified, modern planning platform — one that integrates financial and operational data, processes it in real-time, and embeds AI capabilities such as predictive forecasting and anomaly detection. Such platforms offer a “single version of the truth,” driving faster and more accurate insights across the business.

Figure 5

Even with a modern planning technology solution, there's so much data that it's almost virtually impossible for any human to make sense of patterns, trends, anomalies, or similar information. And this is where AI comes in, making it very compelling.

However, he emphasised that none of this is effective without high-quality data. AI and advanced analytics are only as effective as the data that fuels them. As he put it:

“AI doesn’t matter if your data quality isn’t there.”

Data remains the essential foundation for any modern FP&A strategy.

Conclusion

If there is one message FP&A professionals should take from this discussion, it is this: start working on your data quality now. There is no time to wait. Without a robust data foundation, none of the tools or technologies we rely on, such as basic analytics, predictive models, Machine Learning, and AI agents, can deliver value. Whatever you hope to build must stand on strong, reliable data.

But this doesn’t mean striving for perfection in every dataset across the enterprise.

Instead, work backwards:

identify the key data drivers behind critical decisions

set clear priorities

focus your efforts accordingly

As the statistician George Box once said, “All models are wrong, but some are useful.” In FP&A, you rarely need 100% accuracy to make a meaningful impact. What you do need is clarity on which data matters most.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.