The article explores how data-driven FP&A transforms organisations by integrating financial and non-financial metrics to drive...

Introduction

In the fast-paced world of finance, the ability to make informed decisions is paramount. Strategic data harvesting has emerged as a vital component in Financial Planning and Analysis (FP&A), focusing on leveraging data to drive better business outcomes. By analysing various financial and operational data sources, businesses can identify trends, patterns, and correlations that can significantly inform planning and decision-making processes.

Key Aspects of Strategic Data Harvesting

1. Data Collection from Diverse Sources

The first step in strategic data harvesting is the collection of data from a wide array of sources. This includes not only internal financial statements but also operational data and external market trends. Organisations can develop a comprehensive view of their financial health and market standing by gathering information from different departments and external resources. This holistic approach ensures that no critical piece of information is overlooked.

2. Data Cleaning and Organisation

Once the data has been collected, it is crucial to clean and organise it. Inconsistent, incomplete, or irrelevant data can lead to erroneous conclusions and misinformed decisions. Data cleaning involves removing duplicates, correcting errors, and ensuring that the data is formatted correctly. After cleaning, data organisation becomes essential in order to lay the groundwork for effective analysis. Organising data into relevant categories or formats makes identifying patterns and derive insights easier.

3. Data Analysis for Insights and Patterns

The real power of strategic data harvesting lies in analysing the organised data. By employing statistical techniques, data analytics tools, and software, finance professionals can identify trends and correlations that may not be immediately evident. This analysis can reveal insights regarding customer behaviour, operational efficiency, and potential areas of growth or risk. These insights are invaluable in guiding strategic planning.

4. Informing Forecasting, Budgeting, and Scenario Planning

Businesses can improve their forecasting and budgeting processes with the insights drawn from data analysis. Accurate data allows finance teams to create more reliable projections, enhancing the quality of financial models. Additionally, scenario planning becomes more effective when based on real data, allowing organisations to prepare for various potential outcomes and make strategic decisions accordingly.

5. Development of Dashboards and Reports

Communicating data-driven insights to stakeholders is a critical aspect of FP&A. Developing user-friendly dashboards and reports that visually represent the analysed data helps convey complex information in an easily digestible format. By utilising data visualisation techniques, organisations can highlight key metrics and performance indicators, making it simpler for various stakeholders, from executives to department heads, to understand and act upon the insights.

Benefits of Strategic Data Harvesting in FP&A

Strategic data harvesting offers several key benefits that can significantly enhance an organisation’s financial decision-making capabilities:

1. Improved Decision-Making

Access to accurate and relevant data empowers finance teams to make informed decisions. Rather than relying on gut feelings or anecdotal evidence, data-driven insights provide a solid foundation for strategic choices, increasing the likelihood of success.

Consider a financial team at a mid-sized retail company. They have traditionally made decisions based on sales data from the previous year. After implementing a strategic data harvesting system, they began to incorporate real-time market trends, customer feedback, and competitor pricing into their decision-making process.

They discover a growing trend in eco-friendly products by analysing data from social media and customer sentiment analysis tools. This insight leads to an increase in investment in sustainable product lines, resulting in a 20% increase in revenue within the next quarter.

Utilise diverse data sources to enhance decision-making. Transitioning from intuition to data-backed insights can significantly increase the chances of successful outcomes.

2. Enhanced Forecasting Accuracy

A finance team at a manufacturing firm leverages predictive analytics software to analyse production schedules against sales forecasts. They refine their budget forecasting process by integrating historical sales data, seasonal trends, and economic indicators.

The team expects a 10% increase in demand during the holiday season. Using their new system, they identify potential supply chain disruptions early, allowing them to adjust their orders and prevent stock-outs. This proactive approach results in a 15% increase in customer satisfaction and a notable rise in sales.

Accurate forecasting helps in resource allocation and can mitigate risks and seize market opportunities. Invest in technology that provides a comprehensive view of relevant data.

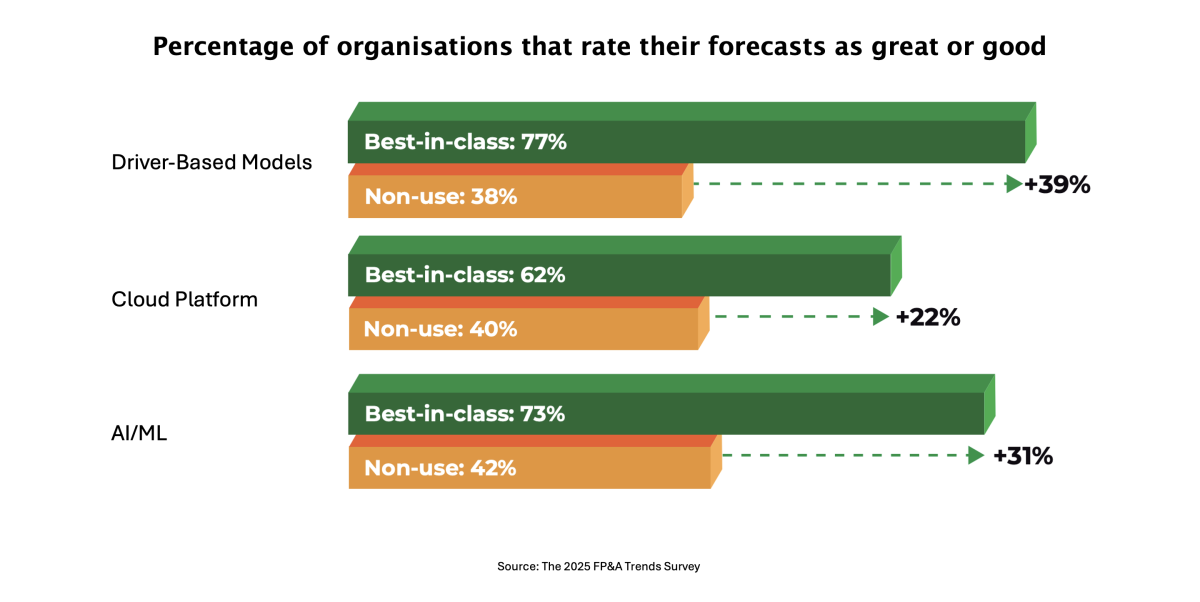

According to the 2025 FP&A Trends Survey, the following technologies have a significant impact on the quality of forecasting, measured by how many organisations rate their forecasts as “great” or “good”:

Driver-Based Models: 77% of organisations using driver-based models rate their forecasts as great or good, compared to just 38% of those that do not employ driver-based models. This represents a 39% variance.

Cloud Platform: 62% of organisations using a cloud platform rate their forecasts as great or good in comparison to 40% that use other applications. This marks a 22% improvement.

Use of Artificial Intelligence/Machine Learning (AI/ML): 73% of organisations that use AI/ML rate their forecasts as great or good, whereas only 42% of those without AI/ML do the same. This reflects a 31% premium generated by AI/ML.

Figure 1: Impact of 'Best-in-Class' Approaches on Forecast Quality

3. Increased Efficiency

An accounting firm faces challenges in gathering and processing financial data for its quarterly reports. Automating the data collection, data entry, and initial analysis processes significantly reduces manual work.

After implementing a cloud-based data management system, the firm cuts report preparation time from weeks to days. This efficiency gain allows team members to focus on analysis and strategy rather than data entry, leading to more insightful reports that clients appreciate.

Automating tedious processes can save finance professionals valuable time, enabling them to contribute more meaningfully to strategic discussions and decision-making.

4. Adaptability and Responsiveness

Imagine a tech startup that develops mobile applications. In the fast-paced tech industry, user preferences can change swiftly. The finance team can access user engagement data and market trends in real-time by implementing a strategic data harvesting system.

In one quarter, the data revealed a sudden decline in user activity for a particular app feature. The finance team immediately informs product development about the trend. They swiftly pivot their strategy, reallocating resources to enhance user experience and reactivate user engagement. Within weeks, app usage rebounds, and a user satisfaction survey shows a 30% increase in positive feedback.

Real-time data insights allow organisations to pivot quickly in response to changing market dynamics. Invest in technologies and processes that enable constant monitoring of performance metrics to maintain agility.

5. Stronger Strategic Alignment

Consider a multinational corporation with various departments (marketing, sales, finance). Traditionally, communication barriers exist, leading to disjointed efforts towards common objectives. By utilising a centralised data dashboard accessible to all departments, the organisation promotes transparency.

After integrating a data analytics platform, all teams gain visibility into real-time financial performance indicators and strategic targets. Monthly strategy meetings transform into collaborative sessions where each department discusses data-driven insights. This shared understanding reduces duplicated efforts and aligns marketing campaigns with financial forecasts, leading to a 25% increase in campaign effectiveness.

A culture of accountability and transparency can be nurtured through shared data insights. Encourage collaboration across departments by utilising a common platform for financial and strategic goals to ensure everyone is working towards the same vision.

By applying these practical insights and examples, organisations can effectively harness the power of strategic data harvesting to enhance adaptability and strengthen alignment, ultimately driving towards their goals more efficiently.

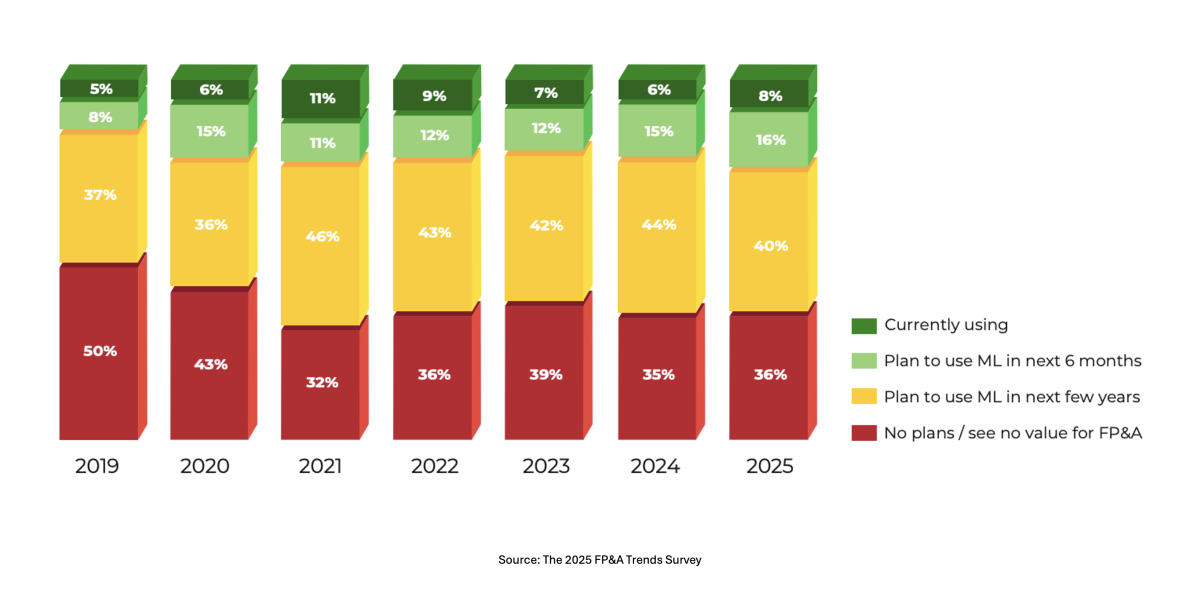

Adoption of AI/ML in FP&A

According to the 2025 FP&A Trends Survey, the adoption of AI/ML in FP&A has followed a nuanced trajectory over recent years. Initially, in 2021, interest surged, and the percentage of organisations using AI/ML climbed to 11%. Since then, however, enthusiasm has waivered, and the percentage has reduced annually, 9% in 2022, 7% in 2023, and 6% in 2024. In 2025, there was a modest uptick to 8%. The fluctuation may reflect the challenges organisations experience with AI/ML adoption, such as integration complexities and an existing skills gap in finance.

Despite the dip, future prospects look positive. There is an increasing trend in respondents planning to adopt AI/ML: 16% intend to do so within the next six months, up from 15% in 2024 and 12% in 2023. Additionally, 40% are anticipating integration in the longer term. Nonetheless, disappointingly, one-third of organisations still see no immediate value in deploying AI/ML within their FP&A processes, which indicates a persistent scepticism about the practical benefits.

Figure 2: The Use of AI/ML in Forecasting

Predictive analytics and scenario modelling will play a pivotal role in this evolution, enabling FP&A experts to derive deeper insights from data. With AI, professionals can generate more accurate forecasts and assess various scenarios, leading to better decision-making. This shift will necessitate that FP&A teams evolve into business experts proficient in data utilisation, ensuring that their analytical insights align closely with organisational goals.

Moreover, managing and building data lakes will become increasingly important, as these repositories provide the necessary foundation for leveraging advanced analytics and Business Intelligence (BI) solutions. As the reliance on data-driven decision-making grows, the importance of strategic data harvesting will be paramount, setting the stage for a future where FP&A professionals are at the forefront of organisational success.

Conclusion

In summary, Strategic Data Harvesting stands as a pivotal force in enhancing decision-making within FP&A. By systematically collecting and analysing data from diverse sources, businesses can uncover critical insights and trends that drive strategic initiatives.

The benefits of strategic data harvesting enhance financial performance and foster a culture of data-driven decision-making across the organisation.

Incorporating AI into this process provides significant benefits, including improved accuracy, faster processing times, and enhanced predictive analytics. AI technologies enable FP&A professionals to automate routine tasks, allowing them to focus on more strategic analysis and scenario modelling, ultimately leading to better-informed decisions. As organisations continue to leverage these advanced capabilities, the synergy between data harvesting and AI will empower finance teams to act as strategic partners in navigating today's complex business landscape, fostering growth and adaptability for the future.

References:

Here are some web sources that can provide valuable insights and research on Strategic Data Harvesting in FP&A and its implications for business decisions:

- The 2025 FP&A Trends Survey: https://fpa-trends.com/fp-research/fpa-trends-survey-2025-ambition-execution-how-leading-fpa-teams-turn-insights-impact

- Building a Data-Driven Culture in FP&A: Strategies for Success: https://fpa-trends.com/

- Transforming Data Presentation to Compete with Artificial Intelligence: https://fpa-trends.com/

- Harvard Business Review

- Website: [Harvard Business Review] (https://hbr.org/)

- Description: Articles on transforming data into intelligence with the right data solutions

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.