In this article, the author talks about two of the most prominent applications of AI in...

In the first part of this series, we discussed the typical monthly scenario in a finance team, focusing on the anomalies we detect and how they appear. Now, in Part 2, we explore the key challenges accounting managers face and provide practical recommendations for leveraging AI-aided anomaly detection.

Challenges Accounting Managers Face

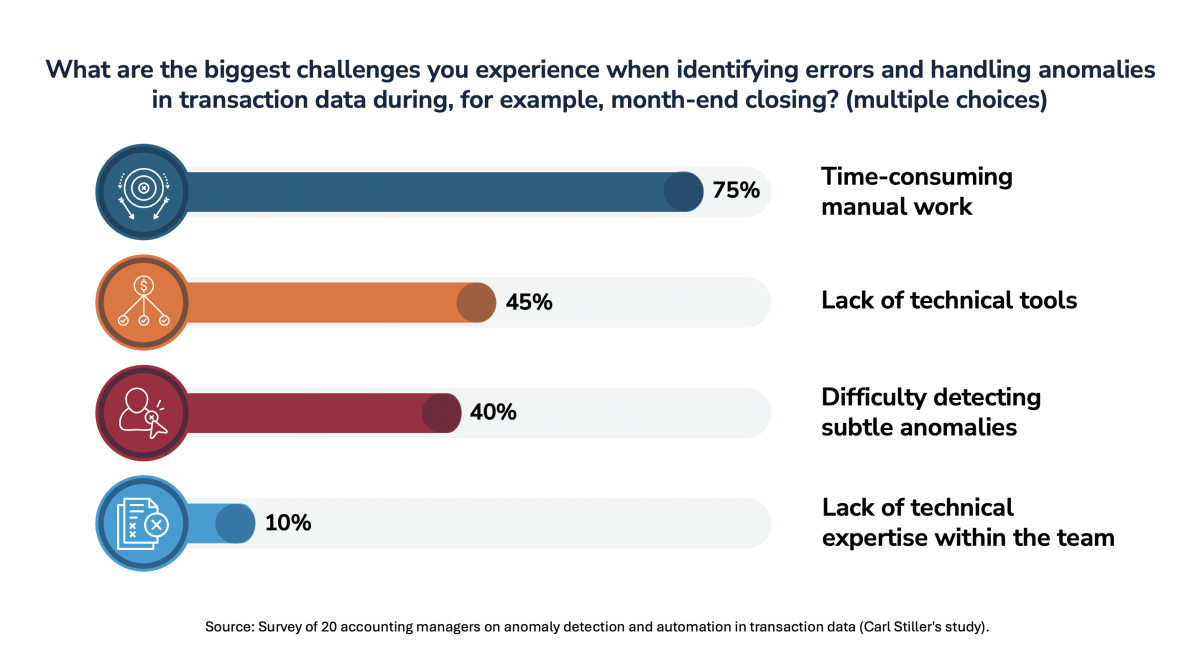

Another study I conducted gathered insights from 20 selected accounting managers to understand how their companies handle anomalies in transaction data and their views on automation and digitisation of such processes.

Accounting managers ensure adherence to financial reports and compliance with regulations and internal processes. They manage balance reconciliations, provisions, and periodisations, where precision and efficiency are crucial for the entire financial close process. The survey responses provide insight into accounting managers’ major challenges: time-consuming manual tasks, lack of technical tools, and the need for automated solutions.

Common Challenges in the Accounting Process

One of the biggest bottlenecks in the accounting process is time-consuming manual tasks, as 75% of respondents in my survey indicate this as a significant challenge. Manual review and reconciliation of transactions requires considerable time and resources, making processes inefficient and prone to human error. Another key challenge noted by 45% of respondents is the lack of advanced technical tools to automate these tasks.

Another issue highlighted by 40% of accounting managers is the difficulty in identifying subtle anomalies in transaction data. With large transaction volumes, manually detecting potential errors is difficult, increasing the risk of inaccuracies in financial reporting.

Figure 1

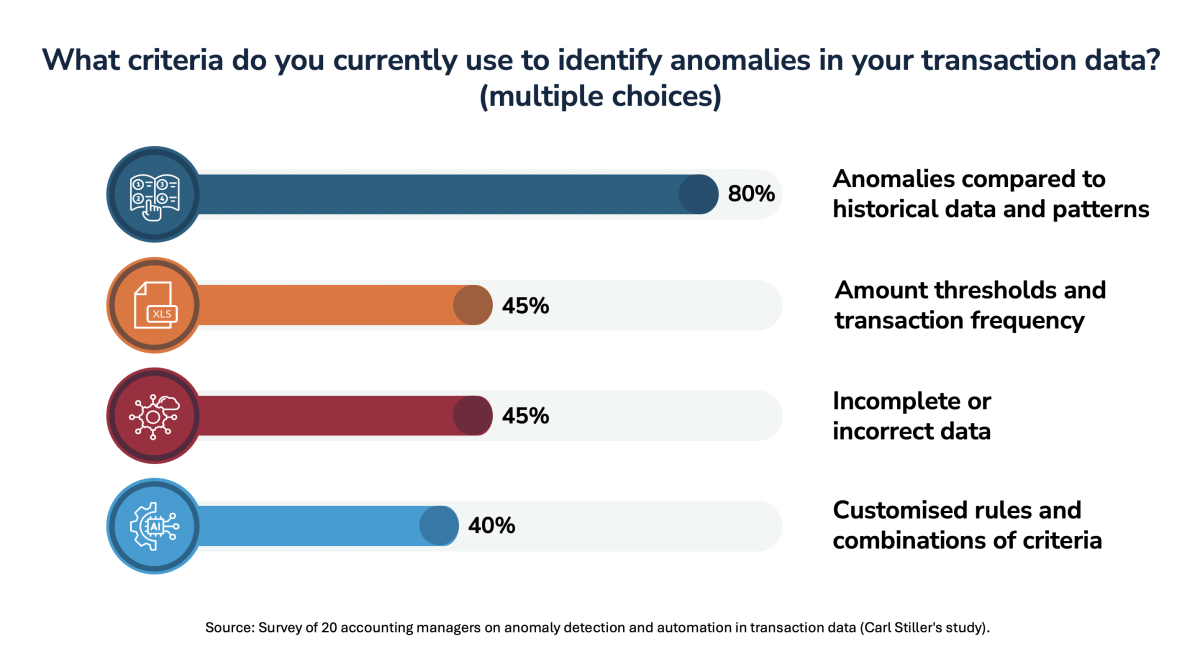

Criteria for Identifying Anomalies

Accounting managers often use a combination of various criteria when they attempt to identify anomalies in transaction data. 80% of respondents reported relying on historical data and transaction patterns to detect discrepancies. This approach can effectively uncover recurring patterns or unusual trends, but it is limited in predicting new types of errors. 45% use amount thresholds and transaction frequency as additional indicators to flag anomalies, while 40% combine multiple criteria and customised rules to gain a more holistic view of potential errors.

Figure 2

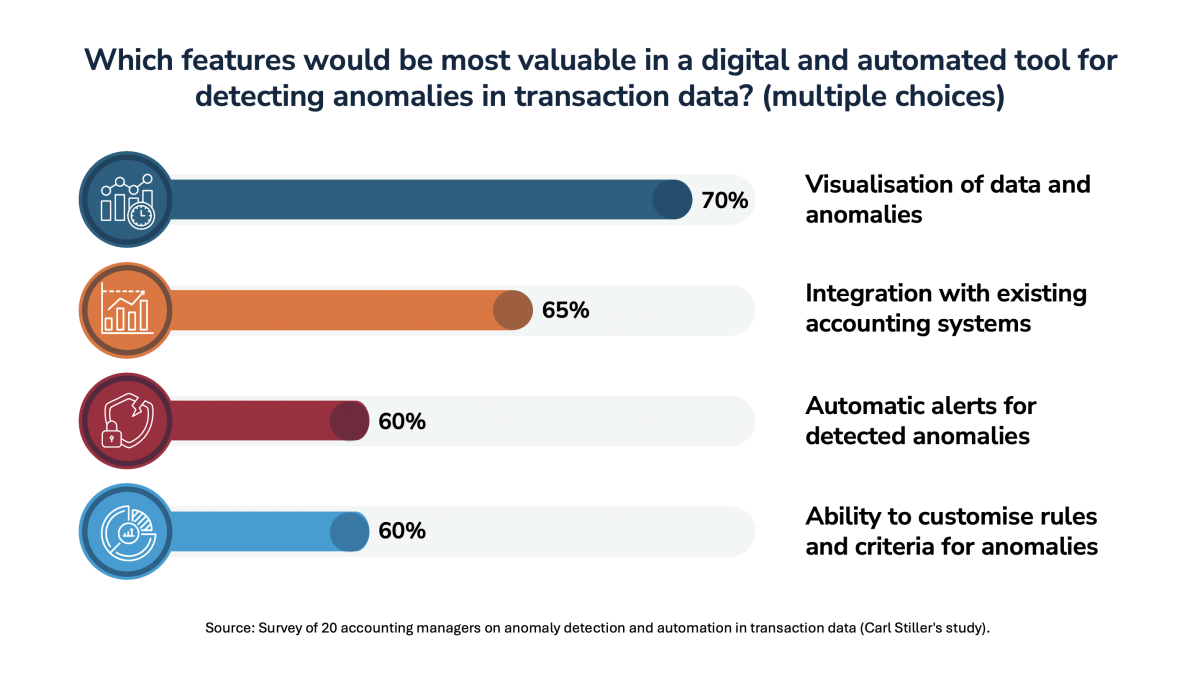

Automated Tools and Visualisation

To help accounting managers handle the growing complexity of accounting processes, implementing automated tools that can analyse large data sets and visualise results is essential. 70% of respondents indicated that data visualisation and anomaly displays are among the most valuable features in an automated anomaly detection system. By clearly visualising anomalies and results, accounting managers can quickly identify where errors have occurred and take quick corrective action.

Automated tools that can generate customisable reports and provide real-time updates are also crucial in streamlining accounting processes. 45% of respondents cited the need for reporting functionality that offers detailed information per transaction and summary monthly reports to facilitate comprehensive analysis.

Figure 3

The Need for Flexible Solutions

40% of respondents indicated that they use a combination of multiple criteria, such as customised rules and various analyses, to identify anomalies more effectively. This highlights the need for flexible systems that can be adapted to specific business requirements rather than relying solely on standardised tools.

Recommendations for Implementing Automation

To fully benefit from automation, it is essential to implement systems capable of handling large volumes of data and identifying errors in real-time. Automated tools should be able to integrate with existing ERP systems and provide user-friendly reporting functionalities. Additionally, these tools must offer data visualisation capabilities that ease understanding of complex anomalies.

By adopting such solutions, accounting managers can reduce their workload during financial closings and period-end reporting and instead focus on enhancing data quality and report accuracy. The survey also revealed that most companies spend up to 10 hours per month reviewing anomalies, suggesting that even a moderate degree of automation could free up sufficient time and resources for more strategic tasks. Automated tools and visual dashboards can support accounting managers in proactively identifying errors and making strategic adjustments in financial management.

Conclusions and Development Opportunities

The survey clearly shows that companies face significant challenges in identifying and managing anomalies in transactional data. Given the frequent errors and time-consuming manual processes, companies need to implement more advanced and automated tools. Today, businesses are looking for solutions that can:

- Integrate seamlessly with existing systems

- Provide automatic alerts when anomalies are detected

- Offer visual dashboards for comprehensive analysis

- Customise rules and criteria according to specific needs

We have examined the challenges in anomaly detection, but how can finance teams effectively implement AI to address them? In Part 3, we will provide a structured, step-by-step approach to integrating AI-driven solutions into financial processes.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.