In this article, the author talks about two of the most prominent applications of AI in...

What Is an Anomaly?

An anomaly is defined as something that deviates from the normal or established pattern. In natural sciences, an anomaly can be an observation or a result that does not align with expected theories or models.

In statistics or data analysis, an anomaly refers to a data point that deviates significantly from others in a dataset. Generally, an anomaly indicates something unexpected or unusual relative to the context in which it appears.

In accounting, an anomaly can be an incorrect or irregular entry that does not follow standard procedures. For example, if a transaction is significantly larger or smaller than usual, occurs at an unusual time, or is recorded in an uncommon account, it may indicate a mistake or other irregularity.

This article will explore the challenges faced by finance departments today regarding deviations and anomaly detection, particularly during the financial close processes. Drawing on my experiences from various companies, I will discuss how these processes currently function and what works well and what does not.

Through in-depth interviews with finance directors and results from surveys, this article will also analyse how companies can leverage modern technological solutions such as automation and Artificial Intelligence (AI) to improve their anomaly detection and financial reporting. This series of articles will conclude with recommendations on how companies can begin implementing these solutions to reduce workload, increase accuracy, and ensure that their financial close and reports are reliable.

Current Issues in Finance Departments

Finance departments vary depending on the size and industry, but the challenges related to financial closing and accounting are often the same.

Larger companies typically have dedicated accounting teams responsible for reconciling transactions and identifying discrepancies in the accounts. Often, this deviation analysis takes place in the final days before the financial close, causing significant time pressure. It is not uncommon for finance professionals to use Excel models to manually review transaction data and compare it to historical data or budgets.

In smaller companies, resources are more limited, and it is common for finance professionals to assist with accounting work to ensure the financial close is completed on time. This hybrid role can be challenging, as it takes focus away from the business leaders’ core functions and leads to additional stress during the final days of the financial close.

One of the biggest issues is the large volume of transaction data generated each month. As data volumes increase, it becomes increasingly difficult to manually identify errors and deviations, especially with limited tools. This means that many companies need to find more efficient and dynamic solutions to manage this data and improve their financial processes.

Typical Monthly Scenario in a Finance Department

The month-end closing is one of the most intensive and critical periods in a finance department. During this time, transactions must be reviewed and published, and reports must be prepared under a tight deadline. The time pressure and complexity that many finance professionals work under often lead to manual errors and an increased risk of unnoticed anomalies.

Week 1–2: Preparation and Data Collection

The first half of the month primarily focuses on gathering and recording data from sales, purchasing, and payroll departments. It is critical to ensure all data is accurately entered and supported by documentation such as invoices and receipts. These weeks involve preparatory work for the month-end closing.

Week 3: Intensification of Work

During the third week, the workload increases. All transactions must be published and reconciled before reporting can commence. Controllers start analysing preliminary figures and identifying potential discrepancies, but data is rarely complete at this stage. The time pressure means minor errors are often overlooked.

Week 4: Final Push Before Close and Reporting

The last week is characterised by a high pace and long working days. Final reconciliations take place, and any errors must be corrected. Since many systems lack sufficient automation capabilities, large parts of the process remain manual, which increases the risk of undetected errors.

Common Mistakes Leading to Anomalies

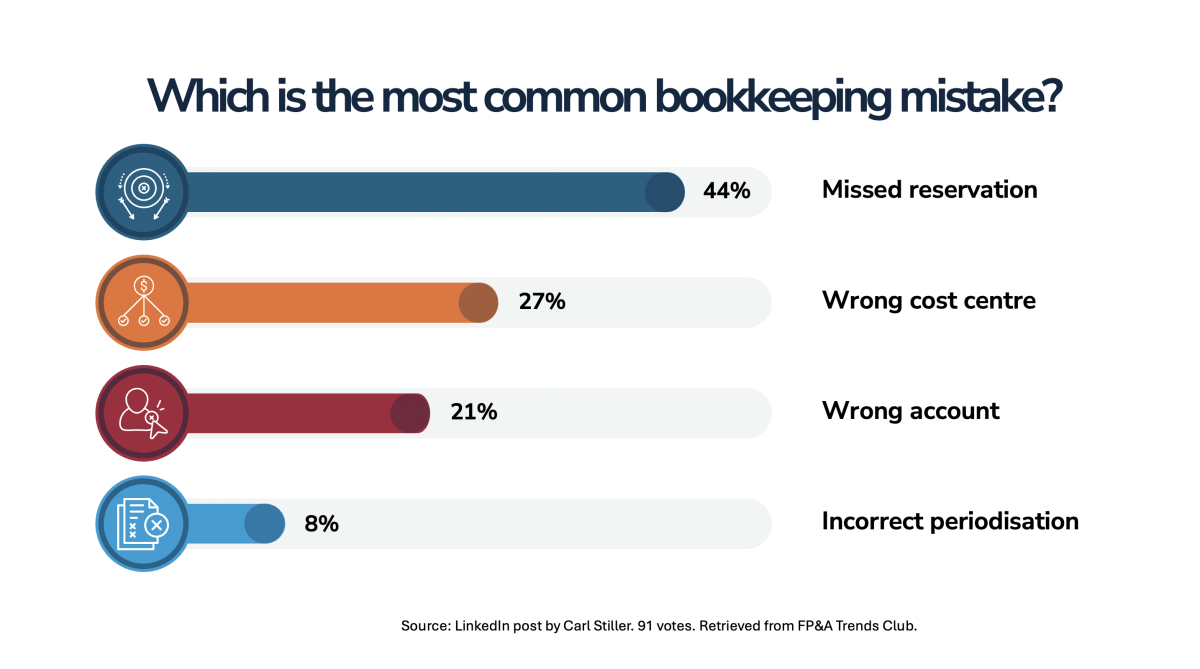

Many mistakes that create anomalies in financial reports are caused due to manual processes and shortcomings in internal procedures. Based on a survey I conducted on the FP&A Trends Club on LinkedIn, the following mistakes are the most common:

- Missed or Incorrect Provisions: Time constraints and unclear internal processes often lead to companies failing to make accurate provisions for doubtful accounts or ongoing expenses. This results in an inaccurate portrayal of their financial position.

- Incorrect Cost Centre or Project Allocation: In companies with many departments and projects, it is common for expenses to be allocated to the wrong cost centre. It complicates the tracking and analysis of individual department performance.

- Incorrect Account Coding: Incorrect accounts are often used due to a lack of clear procedures, especially in complex accounting environments with many accounts. Another common cause is inadequate training on the chart of accounts and regulations or interpreting invoices, often requiring adjustments during the close or audits.

- Incorrect Periodisation: Properly periodising revenues and expenses for long-term projects can be challenging. Incorrect periodisation results in misleading financial results for a given period, affecting decisions regarding dividends and investments.

Other Common Mistakes:

- Forgotten Reversals of Entries: Previously recorded transactions are forgotten to be reversed, impacting the results of the current period.

- Incorrect VAT Handling: Incorrect VAT amounts on purchases or sales that do not match the accounting records may potentially lead to inaccurate reporting to tax authorities.

- Incorrect Elimination of Internal Transactions: Internal transactions between subsidiaries are not correctly eliminated in consolidated financial statements, affecting both profit and balance sheet.

- Missed Reconciliation of Balance Accounts: Insufficient reconciliation of balance sheet accounts, such as receivables and payables, leads to inaccuracies in the balance sheet.

- Missed Depreciation of Fixed Assets: Incorrect or missed depreciation of tangible and intangible assets affects the reported value of assets.

- Incorrect Handling of Lease Agreements: Lease agreements are handled incorrectly, for instance, by not recording costs as assets, resulting in misleading financial results.

- Errors in Accounting for Currency Exchange Differences: Currency gains or losses are recorded incorrectly, impacting financial results.

- Incorrect Revenue Recognition: Revenue is recorded in the wrong period or inappropriately, particularly in project-based business, distorting financial outcomes.

- Lack of Internal Controls: Insufficient controls mean that errors are not detected in time, impacting the reliability of financial reporting.

- Premature or Delayed Recording of Invoices: Customer and supplier invoices are recorded in the wrong period, affecting results and creating uncertainty around cash flow.

FP&A Teams – Operational Challenges and the Need for Automation

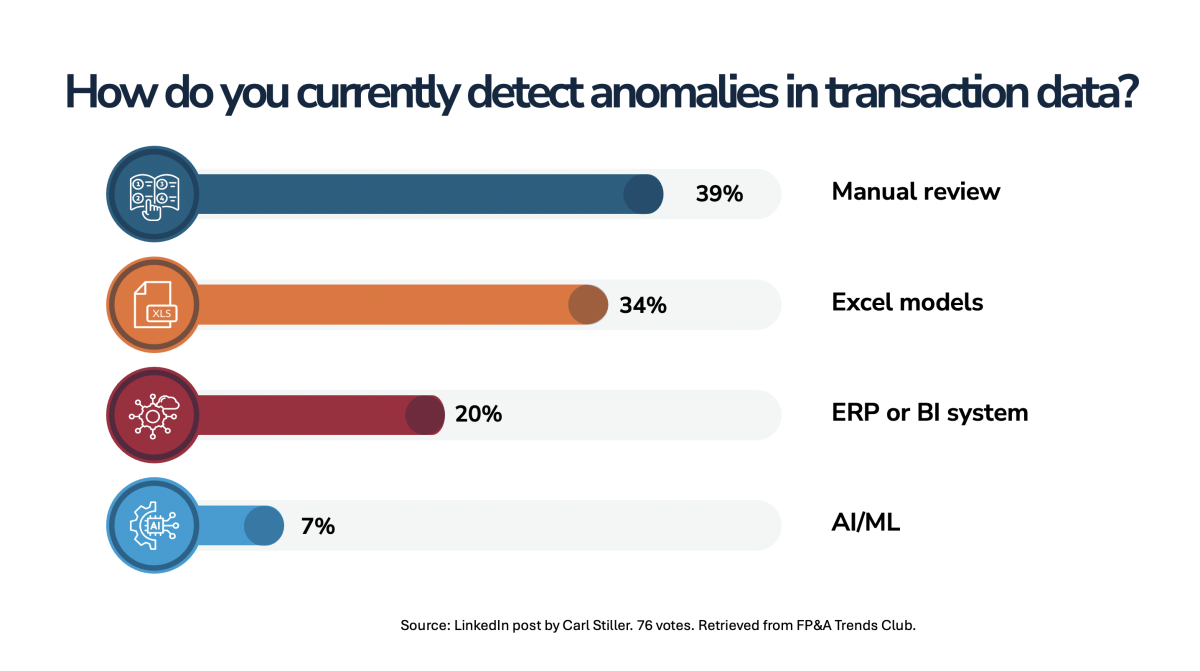

FP&A teams play a central role in ensuring that the month-end close process runs smoothly, and that reporting is accurate. Their daily work involves detailed financial analysis, reconciliations, and anomaly identification, often entailing a significant amount of manual effort. From an initial investigation I conducted, including surveys in the FP&A Trends Club on LinkedIn, several recurring challenges emerged, highlighting the clear need for automated solutions to reduce errors and streamline processes.

Common Accounting Errors During Month-End Close

One of the most common challenges FP&A teams face during the month-end close is incorrect or missed provisions, as noted by 44% of respondents. These errors often stem from inadequate internal procedures or time constraints, leading to inaccurate reports and the need for adjustments during the close or audits. Handling these provisions manually increases the risk of errors, and automation can play a major role in ensuring all provisions are accurately and timely managed.

Figure 1

AI Solution to Reduce Month-End Close Errors

An AI system can automatically monitor and perform real-time checks to detect and correct missed provisions before the close, reducing manual errors and saving time. These systems can also continuously match cost centre allocations against predetermined criteria, ensuring accurate data management and reducing the risk of discrepancies. To implement AI solutions for minimising accounting errors, companies can start by using AI-powered tools that automatically validate all provisions and flag potential errors before the close. These systems can be seamlessly integrated into existing ERP solutions and ensure accurate cost allocation by comparing historical transaction patterns.

Anomaly Detection – Current Methods and Future Solutions

The survey indicates that most FP&A teams today use manual review (39%) to identify erroneous entries or anomalies in transaction data. This is a resource-intensive process that not only consumes time but also increases the risk of errors going unnoticed. While some rely on Excel models (34%) to support their analysis, these tools still depend on manual input and are prone to human errors.

Only 7% of respondents mentioned using AI or Machine Learning (ML)-based solutions for anomaly detection, highlighting significant room for improvement. AI and automation can be used to create systems that learn from past mistakes and continuously improve their ability to detect discrepancies. For example, an AI model can automatically flag transactions that deviate from historical patterns, allowing FP&A teams to quickly identify and correct errors before they impact reporting.

Other common errors include incorrect cost centre allocations (21%) and periodisations (8%). When expenses or revenues are allocated to the wrong cost centre, it affects not only reporting but also the analysis of departmental performance. Implementing automated systems for cost centre allocation and periodisation can help minimise these issues, contributing to a more accurate and efficient month-end close process.

Figure 2

Automation Replacing Manual Anomaly Reviews

By integrating AI-based anomaly detection systems, companies can replace manual reviews with automated processes that identify complex anomalies more quickly and accurately than humans. AI systems can also analyse historical data and detect subtle patterns that Excel models cannot handle, providing more proactive insights into potential anomalies. AI systems can be introduced by building a module that analyses all transactions in real-time and automatically identifies anomalies, eliminating the need for manual review processes. Companies can start by running these AI tools in parallel with Excel models to validate their accuracy before a full transition.

Drivers for Innovation and Technological Investments

FP&A teams see growing transaction volumes (31%) and the demand for real-time analysis (39%) as the primary drivers for investing in new anomaly detection systems. This highlights the need for modern tools that can handle large data volumes and quickly identify errors in real-time. Integrating automated systems with existing ERP and accounting solutions would not only streamline workflows but also ensure data is managed more consistently and accurately.

Figure 3

AI for Real-Time Analysis and Managing Growing Transaction Volumes

AI solutions for real-time analysis enable continuous monitoring of transaction flows, allowing anomalies to be identified and corrected immediately without delays in reporting. As transaction volumes increase, AI systems can be scaled to manage large data sets without requiring additional manual intervention, thus optimising workflow. The implementation of real-time analysis can be achieved by integrating AI with existing data warehouses, enabling continuous transaction monitoring without straining systems. To manage growing transaction volumes, companies can implement AI systems that automatically scale as needed, reducing manual workload and improving efficiency.

Recommendations for Implementing Automation

To fully benefit from automation and AI, organisations should invest in systems that can automate manual reconciliations and periodisations and detect errors in transaction data in real-time. User-friendly tools that require minimal training are essential for FP&A teams to quickly adapt to new workflows.

These tools should not only detect errors but also provide insights that enhance Financial Planning and Analysis. By leveraging AI, FP&A leaders can focus more on strategic decision-making and less on manual tasks.

Findings from the 2024 FP&A Trends Survey indicate a clear need to automate anomaly detection. While manual review and reactive analysis still dominate, the need for real-time solutions and handling large transaction volumes is driving the development of more advanced AI and ERP-based systems. Such investments would streamline the closing process and reduce errors.

Although only 6% currently use AI, this figure will rise in the coming years. Companies should start investing in technology that can reduce manual work and free up time for more value-added activities, such as analysis and strategic advisory for management.

In the next part of the article series, we will discuss the challenges faced by accounting managers and my conclusions and recommendations.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.