xP&A is more than an attempt to ‘fix’ the planning process. It is a complete transformation...

Figure 1: The attendees of the London FP&A Board on the 28th of September, 2022

The International FP&A Board met in London on 28th September 2022 for an insightful and forward-thinking discussion. They explored the challenges faced in the journey from FP&A to Extended Planning and Analysis (xP&A) and examined the impact of xP&A on the various aspects of business today.

The meeting was sponsored by CCH Tagetik, IWG, and Robert Half / Protiviti.

Here you will find some of the case studies and observations shared during this event, including the insights by Saad Siddiqi, Global FP&A Director at Harsco's Environmental Division.

From FP&A to xP&A

The Board explored the topic of the future of FP&A and the move to xP&A, listening to the experiences of those working to improve the process.

Participants had the opportunity to cite their biggest challenge in FP&A right now. The following were among the most significant shared:

- Being agile and responding to the pace of change in the modern world.

- Accounting for macro-economic, for example, high inflation factors, in forecast models and budgets.

- Standardising FP&A practices, methodologies, and cadence across varying businesses and geographies.

- Adopting modern FP&A strategies at companies with legacy systems and traditional mindsets.

- Forecasting at start-ups.

- Analysis paralysis.

- Top-down versus bottom-up.

- Adequately embedding Scenario Planning methodology in FP&A teams.

- Choosing the right tools, i.e., Excel, technology, Monte-Carlo simulation.

- Planning for uncertainty.

- Data and data processes: does anyone have good data?

- FP&A skills and talent. What does the future FP&A workforce look like, and how do we attract and retain them?

Is xP&A Just Another Buzzword?

xP&A is not a new term in finance. Usually, it is called Integrated FP&A or collaborative planning. It is based on the idea that finance professionals need to run scenarios in real-time co-operatively, multi-dimensionally, and at different levels of the organisation.

By embracing xP&A, organisations will see better performance improvements than traditional FP&A processes. It is enabled by combining strategic planning, FP&A, operational planning, and forecasting. It is also about top-down and bottom-up, and cross-functional integration.

How Does It Differ from Integrated Business Planning (IBP)?

Integrated Business Planning is the process of aligning business goals with finance, supply chain, product development, marketing, and other operational functions. xP&A goes further to integrate people, technology, and strategy.

xP&A is a planning approach that takes the best capabilities – like continuous planning, forecasting, advanced analytics, and performance monitoring – and extends them across the business.

It eliminates the traditional barriers between finance and operations and connects strategic, financial, and operational plans in real-time.

How Do We Get There?

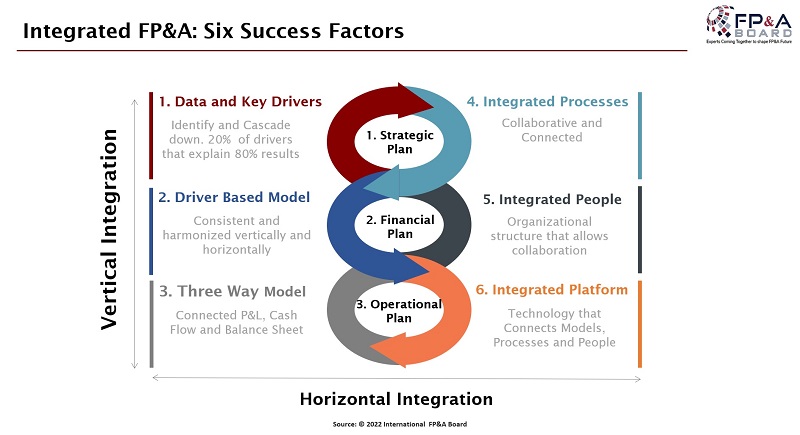

The move from FP&A to xP&A will mean harmonising plans with models and data, adopting flexible processes to adapt to change quickly, and investing in flexible platforms. It is outlined in the FP&A Maturity Model below:

Figure 2: Six Factors Required for Integrated FP&A

How Did Harsco Environmental Division Move to xP&A?

SWOT Analysis

Figure 3: Saad Siddiqi Shares His Insights with the London FP&A Board Members

Keynote speaker Saad Siddiqi shared how performing a SWOT analysis was an essential first step, allowing Harsco to understand the opportunities and challenges they faced on their journey to xP&A. He shared how the company had identified strong regional FP&A expertise with in-depth forecasting experience but a weakness in a lack of driver-based forecasting. The pace of technological change posed a significant threat to the company, and it was identified that there was a great opportunity to improve cross-functional communication.

Harsco built a realistic timeline by assessing itself against the FP&A Trends Group Maturity Model.

They targeted the Intermediate state as their 2020 goal and set their sights on becoming FP&A leaders by 2024.

Moving from Analysis to Analytics

- Hindsight-Descriptive analytics to indicate what has happened.

- Hindsight-Diagnostic analysis to determine why it happened.

- Insight-Predictive analysis to determine what will happen.

- Foresight-Prescriptive Analytics to determine plans of action.

The People Dimension

Critical to moving forward in their goal of achieving the Leading State in 2024 has been an examination of their FP&A team structure, roles, and skill set. Introducing a storyteller who has served as a single point of contact (FP&A SPOC) has been essential.

At Harsco, the SPOC serves as a focal touch point for all FP&A-related tasks and activities for each region/subregion/BU covering key tasks including:

- Working closely with the site Financial/operational team ensuring that forecast accuracy remains credible.

- Leading regional training (supported by the Central FP&A team) for Forecasting systems/applications for the regional finance/FP&A users.

- The SPOC will work closely to identify offshoring opportunities for FP&A tasks and activities.

- Will act as the Storyteller for the data to the Regional/Sub-regional FD and the Central FP&A team.

Harsco's FP&A Data Scientist will take over the offshored activities covering data tasks such as uploads and performing the routine activities within the FP&A function.

The Process Dimension

Harsco examined their processes by defining a process map integrating strategic planning, regional/business planning, and performance management. Including clear performance measures/KPIs has been a critical new activity introduced into their planning process.

The Impact of xP&A Today: Group Work

Figure 4: Group Work Sessions at the London FP&A Board on the 28th of September, 2022

The session ended with the influential FP&A leaders breaking out into discussion groups to examine the impact of XP&A on a range of different business areas.

xP&A and Its Impact on…

Data, Models, and Technology

- There is a need to move beyond Excel and embrace broader technology tools.

- White-box models are key, such as explainable Artificial Intelligence (AI). Translators are vital to taking business and finance on the Machine Learning and Artificial Intelligence journey.

People and Culture

- Improved employee experience driven by modern processes and systems will be critical to attracting and retaining talent.

- Required skills are rapidly evolving due to the pace of change and technological advancements.

Systems and Process

- Collaboration and communication are key.

- Soft skills matter as FP&A is a very political and sensitive space.

- A strong and experienced change partner is critical for success.

Conclusion

The Board agreed that implementing positive change requires time, commitment, and sponsorship. People, talent, and thought leadership are at the heart of a successful FP&A to xP&A journey.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.