This series of articles explores dynamic pricing's effectiveness and the challenges caused by fluctuating market conditions.

Introduction to Demand Function Selection

When attempting to maximise profit through various demand functions, traditional methods typically involve calculating expected profits for each function and selecting the one with the highest value. This approach often overlooks the variability in user behaviours and the dynamic factors influencing demand. In real-world scenarios, market demand rarely aligns with static models, such as the favoured D5 Function Demand mentioned in the previous part. Rapidly changing external factors, including consumer behaviours and market conditions, require companies to react swiftly and adapt their strategies.

Introduction to Thompson Sampling (TS) and Its Application in Demand Function Selection

Thompson Sampling (TS) offers a more flexible, Bayesian-inspired approach to demand function selection. Rather than relying solely on static models, TS updates selection preferences in real-time, using profit observations from different demand functions to adjust its strategy. The adaptive nature of TS strikes a balance between exploration — testing diverse demand functions — and exploitation — leveraging existing knowledge to maximise profit.

TS operates by incrementally favouring demand functions that demonstrate higher profitability. This refinement process guides the system toward those demand functions that best reflect the current market conditions. However, it’s important to note that TS does not aim to directly identify the optimal combination of quantity and price (Q and P) for absolute profit maximisation in a static environment. Instead, it selects demand functions with higher relative success, focusing on maximising the expected average profit rather than guaranteeing the highest possible profit at any given time.

Once TS identifies the most promising demand function, it aids in determining the optimal quantity and price (Q and P) for maximising profit within that specific function. The process starts with assigning an optimal probability to each demand function. These probabilities are then updated iteratively based on performance data, with each iteration involving a random draw from each option's distribution. This allows TS to "serve" the option that it believes is most likely to be optimal, in line with real-time observations.

An essential feature of TS is its ability to adapt its strategy according to the certainty of its estimates. During high uncertainty, TS explores a broader range of demand functions and price points, ensuring that potentially profitable opportunities are not missed. As the model gains more confidence in its predictions, TS narrows its focus to demand functions that more closely align with actual market demand, gradually leading to price selections near the optimal point. This iterative approach allows TS to continuously adjust and optimise pricing in dynamic and unpredictable market environments.

The Concept of Thompson Sampling Is Derived from the “Multi-Armed Bandit”

Figure 4: Multi-Arm Bandit. Image Source: towardsdatascience.com

- Start with Uncertainty

Initially, each "slot machine", representing different demand functions or options, appears equally likely to maximise profit. The algorithm begins to work by testing each function to gather preliminary data on potential profits. - Building Distributions

With each test, the algorithm constructs a probability distribution for each demand function, representing an estimate of each function’s expected “reward”. This enables the model to understand which demand functions may yield higher profits. - Probabilistic Selection

At each round, the algorithm samples from these distributions, probabilistically choosing the demand function with the highest estimated profit. This approach balances exploration when trying less-tested functions and exploitation by focusing on high-reward options. - Updates Based on Results

After testing a chosen demand function, the algorithm updates its probability distribution with the new profit data, refining its profit estimates. - Repeat and Refine

This cycle of testing, updating, and selecting continues repeatedly. In each round, the algorithm improves its understanding of which demand functions consistently generate higher profits. - Final Outcome

As profit estimates become more accurate over time, the algorithm reliably identifies and selects the demand function that yields the truly highest profit, optimising the demand function selection based on the profit observed.

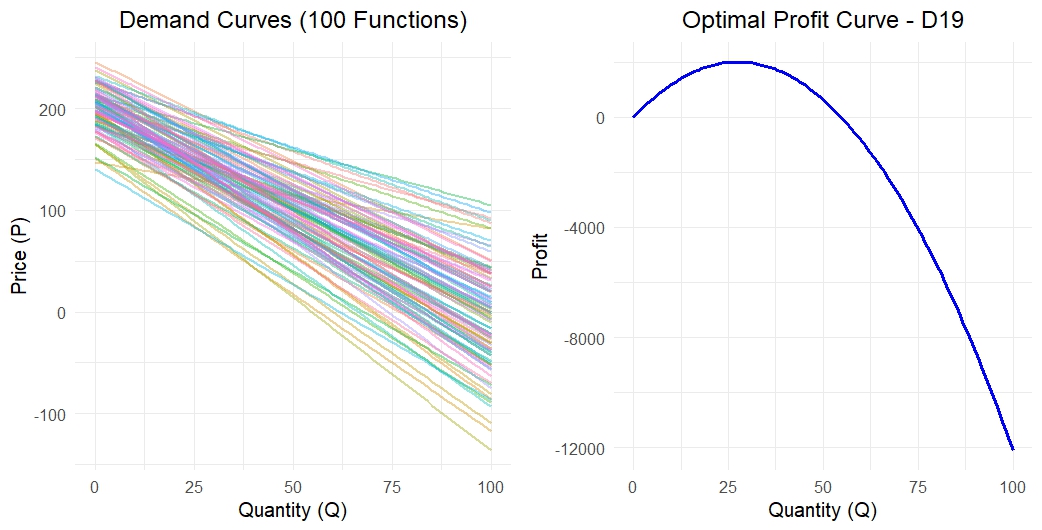

If we consider a highly dynamic market with 100 demand functions, the results from the Thompson Sampling (TS) simulation provide valuable insights into optimising profits across various demand functions. For instance, function D19 in the figures below demonstrates the effectiveness of Thompson Sampling, achieving a maximum profit of approximately 1999.66 and showcasing its adaptability to changing market conditions. The method’s ability to continuously update its understanding of demand functions based on observed data enables ongoing exploration and the strategic exploitation of the most profitable options.

| Demand Function | Optimal q | Optimal p | Max Profit |

| D19 | 27 | 77.8 | 1999.56 |

Figure 5: Thompson Sampling Selection based on 100 Demand Function

Practical Case Study: AI-Powered Dynamic Pricing in E-Commerce

Due to demand fluctuations, an electronics retailer faced challenges optimising their pricing during the holiday season. The traditional static pricing approach led to missed revenue opportunities and inventory inefficiencies. To address these issues, the retailer implemented a dynamic pricing strategy powered by Artificial Intelligence (AI) using Thompson Sampling (TS) for adaptive decision-making.

AI-Driven Approach

The retailer leveraged AI algorithms to adjust prices in real-time, enabling precise modelling of demand patterns. The system continuously learned from market data, making it highly responsive to shifts in customer preferences, competitor behaviours, and broader market conditions.

Implementation Steps

- Data Analysis: Historical and real-time sales data were analysed to identify trends and competitor’s strategies.

- Dynamic Adjustments: Prices were updated algorithmically across segments and time frames to optimise demand insights.

- Real-Time Optimization: Thompson Sampling enabled continuous fine-tuning of price points for maximum profitability.

The Role of AI

AI-enhanced the retailer's ability to manage complex demand scenarios by:

- Adapting to Market Dynamics: Handling multiple demand patterns effectively.

- Ensuring Real-Time Adjustments: Rapid responses to competitor actions and demand surges.

- Improving Customer Experience: Offering tailored promotions to align pricing with customer expectations.

Wider Adoption in Industries

The same AI-driven dynamic pricing is also used in ridesharing to adjust fares based on demand and in subscription services for tailored discounts. Retail and entertainment industries leverage it to align prices with consumer interest and event-driven demand.

Key Takeaway

This case study shows how AI with TS transforms dynamic pricing, enhancing profitability and agility. It reinforces AI's growing role in modern pricing strategies across industries.

Pros and Cons of Thompson Sampling and Traditional Demand Function Selection

Figure 6

Pros of Traditional Demand Function Selection

- Clear Profit Targeting: Traditional demand function selection targets the highest potential profit in stable markets.

- Simplicity: It’s straightforward and computationally light.

- Static Market Fit: It’s effective in predictable, stable demand scenarios.

Cons of Traditional Demand Function Selection

- Lacks Adaptability: It is limited in responding to real-time market changes.

- Restricted Exploration: It may miss out on potentially profitable demand functions.

- Assumes Stability: It is less suitable for volatile markets with shifting demand.

Figure 7

Pros of Thompson Sampling (TS)

- Real-Time Adaptability: TS adjusts dynamically to fluctuating demand.

- Balancing Exploration and Exploitation: It finds profitable opportunities even in uncertain markets.

- Market Responsiveness: Suited to dynamic environments with ongoing demand variability.

Cons of Thompson Sampling (TS)

- High Data and Computational Needs: TS requires substantial data and more processing power.

- Complex Implementation: Thompson Sampling is more intricate to set up and monitor in resource-limited contexts.

- Less Direct Profit Targeting: It prioritises adaptability over guaranteed maximum profit.

Implications for FP&A

Thompson Sampling (TS) significantly enhances short-term forecasting and Scenario Planning by utilising real-time data insights. This dynamic, adaptive approach helps FP&A teams quickly respond to fluctuations in demand, ensuring that resources are allocated efficiently to meet immediate priorities. However, adopting TS requires shifting from traditional static models to more responsive methods, integrating real-time analytics into financial planning processes.

Conclusion

When deciding between Thompson Sampling (TS) and traditional demand function selection, businesses need to balance adaptability with simplicity. TS is particularly advantageous in uncertain and fast-changing markets, as it uses AI-driven techniques to adjust pricing dynamically and maximise profit. However, this approach may not be ideal for environments where demand is predictable, or resources are constrained. Traditional methods, while simpler, remain effective in stable markets with well-understood demand patterns. However, the choice between these two strategies ultimately depends on market dynamics and available computational resources.

References:

- Price Intel Guru. "Dynamic Pricing - The Key to Profitability in a Competitive Market." Accessed November 26, 2024. https://www.priceintelguru.com/article/dynamic-pricing-in-competitive-market#1-higher-profit-and-sales.

- Leys, Mathias. "Dynamic Pricing in Practice." Medium. Accessed November 26, 2024. https://blog.ml6.eu/dynamic-pricing-in-practice-99fe2216a93d.

- Paddle. "What Is Dynamic Pricing and How to Implement It." Accessed November 26, 2024. https://www.paddle.com/blog/dynamic-pricing-strategy.

- Economics Help. "Dynamic Pricing." Accessed November 26, 2024. https://www.economicshelp.org/blog/148008/economics/dynamic-pricing/.

- Four Week MBA. "Dynamic Pricing." Accessed November 26, 2024. https://fourweekmba.com/dynamic-pricing/

- Flipkart Commerce Cloud. "A Comprehensive Guide on Dynamic Pricing Algorithm." Accessed November 26, 2024. https://www.flipkartcommercecloud.com/dynamic-pricing-algorithm/.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.