FP&A people should develop a good understanding of competitiveness. It is not just about the general...

Introduction

Dynamic pricing is a flexible strategy that adjusts prices based on various factors, enabling businesses to optimise revenue in real-time. This series of articles explores dynamic pricing's effectiveness and the challenges caused by fluctuating market conditions. Thompson Sampling (TS) will be introduced as a solution for maximising profits through adaptive selection of demand functions, demonstrating its ability to continuously refine strategies based on observed data. The analysis reveals that TS can effectively navigate market dynamics and achieve substantial profits while providing insights into the complexities of demand management.

At the same time, dynamic pricing is a strategy that adjusts prices according to factors such as customer segments, peak demand periods, or time-sensitive consumption. Unlike static pricing, which applies a uniform price across all situations, dynamic pricing allows businesses to optimise revenue by tailoring prices to reflect changing market conditions. This flexibility enables companies to capture more value in diverse scenarios.

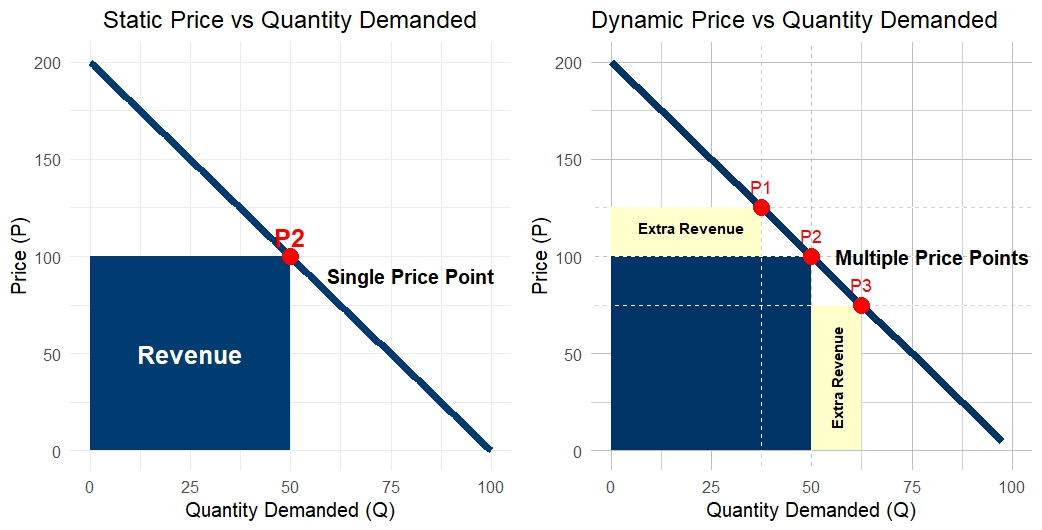

Figure 1: Price vs Quantity Demanded with Single and Multiple Price Points

These figures showcase two distinct pricing approaches, both derived from the same demand function. The first figure represents a fixed-price scenario aimed at maximising revenue through a singular price point called P2. The second figure illustrates a dynamic pricing model, where prices fluctuate from P2 to P1 and P3 in response to factors such as competitor behaviour, inventory levels, supply chain availability, and production costs.

Dynamic pricing is prevalent in industries like e-commerce, travel, and hospitality, where it enhances profitability and balances supply with demand. By employing advanced algorithms and Machine Learning (ML), businesses can analyse data and adjust prices dynamically, ensuring they capture maximum revenue.

Flexibility

Dynamic pricing provides essential flexibility crucial for businesses aiming to remain profitable in rapidly changing markets. This flexibility allows organisations to implement smart pricing strategies, enabling them to respond effectively to fluctuations in demand and competition.

By adopting dynamic pricing, companies can:

- Navigate Market Variability

Businesses can adjust prices based on real-time data, which can help them remain competitive even as market conditions change. For example, during peak seasons or high-demand events, prices can be increased to maximise revenue. In contrast, during other ‘slower’ periods, discounts can stimulate sales. - Explore Diverse Revenue Sources

Dynamic pricing empowers businesses to test various pricing models across different customer segments, thereby identifying new revenue opportunities. This approach can lead to improved customer satisfaction as prices are aligned more closely with perceived value. - Achieve Break-Even During Challenging Times

In times of economic downturn or reduced demand, dynamic pricing allows businesses to lower prices strategically, helping them maintain sales volume and cover fixed costs. This adaptability is vital for sustaining operations and mitigating losses.

What about Profit?

In the context of dynamic pricing, understanding profit dynamics is crucial for optimising revenue. Consider a scenario where each product unit costs $4, with fixed costs amounting to $20. Given the demand function represented in Figure 1 as:

p(q)=(200-2q)

The revenue can be calculated as:

Revenue=p(q)*q

The Profit equation then becomes as follows:

Ρ=Revenue-Total Costs=p(q)*q-(Fixed Cost+U(c)*q)

Here Fixed Cost encompasses general operational expenses such as insurance, salaries, and rent.

While U(c) is the Unitary Cost per single product.

To maximise profit, we need to identify the optimal quantity q^*. Using the provided data, it can be determined that the optimal quantity for profit maximisation is q^*=49 leading to a maximum profit (Ρ)=4782.

This optimisation problem illustrates that changes in the demand function can significantly influence revenue and profit. Each variation in the demand dynamics necessitates a recalibration of pricing strategies to ensure continuous profitability. In practice, this means that companies must be vigilant and responsive to shifts in market demand, as each adjustment can lead to different profit outcomes.

Complexity

While the previous example simplifies the relationship between pricing and profit, real-world scenarios are far more complex. Markets are dynamic and influenced by a myriad of factors, including competition, product availability, consumer behaviour, and shifting market segments. This variability challenges the notion of a stable demand function, as actual demand fluctuates in response to these diverse influences.

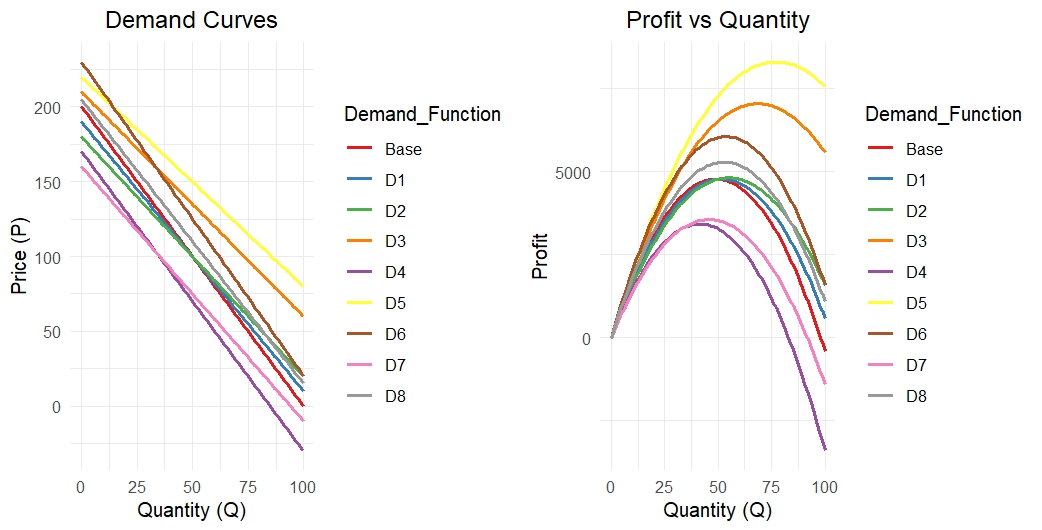

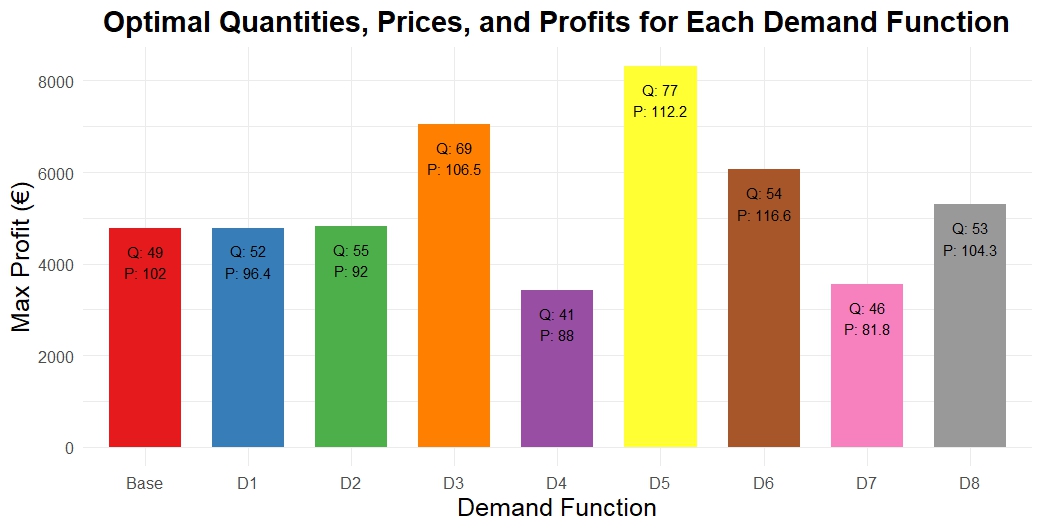

For instance, consider a situation with multiple demand functions, each reflecting different consumer preferences and market conditions. If we analyse eight different demand functions plus the base demand function alongside a constant fixed cost of $20, the optimisation for each will yield different results, as shown in the table below:

| Demand Function | Optimal q | Optimal p | Max Profit |

| Base | 49 | 102 | 4782 |

| D1 | 52 | 96.4 | 4785 |

| D2 | 55 | 92 | 4820 |

| D3 | 65 | 106.5 | 7052 |

| D4 | 41 | 88 | 3424 |

| D5 | 77 | 112.2 | 8311 |

| D6 | 54 | 116.6 | 6060 |

| D7 | 46 | 81.8 | 3559 |

| D8 | 53 | 104.3 | 5296 |

Among these demand functions, D5 emerges as the most profitable, with an optimal quantity of 77 and a price of 112.2, yielding a maximum profit of 8311. However, the complexity lies in the fact that the market is rarely static. Consumer preferences evolve, competitors change their strategies, and external economic conditions fluctuate.

Finding the optimal pricing strategy in such an environment requires continuous data analysis and responsiveness. Gathering comprehensive demand data across various price points often entails significant time investment. This could delay price adjustments, potentially causing businesses to fall behind more agile competitors. Thus, organisations must develop robust mechanisms for real-time data analysis to remain competitive in a dynamic pricing landscape.

As illustrated in the accompanying graph, different representations of the demand function exhibit varying elasticity, leading to distinct optimisation outcomes for each function. However, the reality is not as straightforward as it may seem. The presence of multiple demand functions, shaped by customer preferences, competitor actions, and dynamic market conditions, renders the quest for optimality challenging. Even if a business identifies an optimal pricing strategy, the rapidly changing environment necessitates frequent adjustments. Additionally, internal information can also change swiftly, complicating decision-making further. This underscores the importance of adopting agile data-gathering techniques to ensure that price settings do not inadvertently become excessively high or too low.

Figure 2: Demand Curves and Profit vs Quantity

Figure 3: Optimisation for Different Demand Curves

For a deeper dive into adaptive strategies, Part 2 introduces Thompson Sampling, an AI-driven approach to refine dynamic pricing and maximise profits.

References:

- Price Intel Guru. "Dynamic Pricing - The Key to Profitability in a Competitive Market." Accessed November 26, 2024. https://www.priceintelguru.com/article/dynamic-pricing-in-competitive-market#1-higher-profit-and-sales.

- Leys, Mathias. "Dynamic Pricing in Practice." Medium. Accessed November 26, 2024. https://blog.ml6.eu/dynamic-pricing-in-practice-99fe2216a93d.

- Paddle. "What Is Dynamic Pricing and How to Implement It." Accessed November 26, 2024. https://www.paddle.com/blog/dynamic-pricing-strategy.

- Economics Help. "Dynamic Pricing." Accessed November 26, 2024. https://www.economicshelp.org/blog/148008/economics/dynamic-pricing/.

- Four Week MBA. "Dynamic Pricing." Accessed November 26, 2024. https://fourweekmba.com/dynamic-pricing/

- Flipkart Commerce Cloud. "A Comprehensive Guide on Dynamic Pricing Algorithm." Accessed November 26, 2024. https://www.flipkartcommercecloud.com/dynamic-pricing-algorithm/.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.