In times of uncertainty, the failings of systems and measures are brought sharply into focus. Managing...

If you were given the chance to make just one decision to increase your company’s profitability, pricing should be at the top of your list. Nowadays, you must foresee and react to new and fast-changing pricing trends, and Financial Planning and Analysis (FP&A) provides the accurate and quick advice you need. To sustainably grow your profitability, you must plan and model your revenues analytically because bad pricing can drive the best products out of the market, and a good price can keep mediocre ones alive.

Why Is Pricing So Important for Profit?

Pricing is the largest single lever of profitability. For example, a company with a gross profit margin of 80% and fixed costs of 30% of sales can increase their profit by 10% with a 5% price increase while everything else may remain equal. It may require a 10% overall cost reduction, including variable and fixed costs, to achieve the same results through cost cuttings. A volume reduction of the same magnitude for the price increase would still leave the company better off: it could sustain a volume reduction of almost 6% to achieve the same profit as without a price increase.

Similar results apply to any cost structure. A company with a lower gross profit margin would enjoy an even higher profitability increase and could sustain an even higher volume loss. This is intuitive since the lower your profitability, the more you can gain from higher prices and the more volume loss you can afford because that volume was not very profitable to start with.

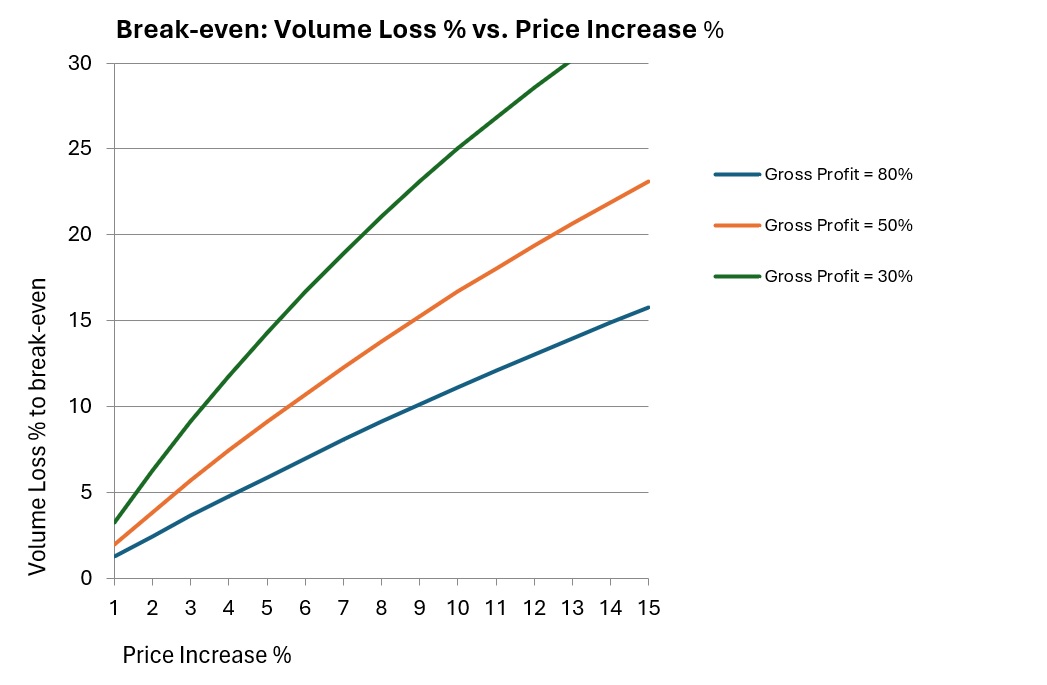

To understand what volume loss you can sustain and still increase your profit, just draw the following chart (Figure 1):

- price increases on the x-axis,

- calculated volume losses that would still generate break-even on the y-axis,

- and do so for each of your products with their respective gross margins.

Figure 1: Sample chart to illustrate the volume loss we can sustain and increase profit

Such a chart shows that when optimising prices, you will need to consider each product separately and take at least a mid-term view to evaluate the consequences for your profitability. An FP&A team helps elaborate scenarios based on demand expectations and products’ elasticity under several price assumptions.

1. What is a good price for sustainable profitability?

It should work for all involved:

- It must be competitive for the end consumers and

- All agents between a company and the end consumers, such as retailers, distributors and so on, must earn a satisfactory margin and

- It must be profitable for you.

Whenever at least one of these three conditions is not satisfied, you will need to fix it sooner or later. There are different options for actions to be taken, depending on which one of the three is not working, for example:

- If it works for end consumers and agents but not for you, you will need to look at your costs to reduce your break-even price;

- If it works for you and agents but not for end consumers, you will need to leverage your marketing efforts to see if your product features can sustain a claim for a higher market price;

- If it works for you and end consumers but not for the agents, you can work on incentive rebates;

- If none of the above works, you will probably have to either abandon it or reap short-term opportunistic benefits and abandon it later.

A relatively simple guideline to approach these issues is to always start with your final customer and then calculate your P&L from there.

- What consumer price is best?

- What gross margin will your intermediaries need based on this consumer price?

- What price do I need in order to satisfy their gross margin objective?

- What profit do I have under these assumptions?

Just by going through this process, you can realise that it is an exercise which involves the whole company, from marketing to sales and finance. Again, FP&A can play a crucial role in coordinating these efforts and all parties involved.

2. What is a good price for maximum profitability?

The law of supply and demand tells us that demand increases as price decreases and vice versa. Suppose you can sell one unit of your product for €10 and need to decrease the price by €0.10 for each unit that you want to sell. Imagine a linear decreasing function with two units for €9.9 each, three units for €9.8 each and so on. For every additional unit sold, you are neglecting €0.10 on each of the units you would have sold before. For example, ten units will result in a turnover of €10x9.1= €91, while 11 units will result in a turnover of €11x9.0=€99. It is as if you sold the last additional unit for €8 instead of €9. Depending on your margins, this last unit may even be unprofitable. The problem is even bigger if you compare prices with the first single unit that you could have sold for €10. Especially when your company is suffering capacity constraints, you should consider what investments you need to increase capacity for selling products with a successively lower marginal profit contribution.

However, there are several methods to increase the number of units sold and their price simultaneously. They require an understanding of your customers’ utility function to determine the maximum price that each individual customer may be willing to pay.

In particular, some of the most popular methods include the following:

- Customise your prices by adopting a non-linear, slower price decline with volume. For example, decrease prices by €0.1 for the first three additional units, by €0.05 for the next five and so on.

- Reduce prices only on additional units and not on the whole volume. This can be achieved through a well-thought-out rebate structure, which is not unusual in distribution contracts.

- Introduce mechanisms that ask customers to pay in order to take advantage of better prices for higher volumes – for example, club memberships.

- Bundle products together with a price advantage.

Conclusion

To conclude, price is one of the first characteristics of a brand that comes to mind: think of any company, and you will immediately position it as (a) cool/uncool and (b) pricey/cheap. Once placed in one of these categories, it is difficult to change it. As far as pricing is concerned, a wrong strategy has severe, lasting consequences on profitability. For this reason, the analysis is a multidisciplinary effort that has to be supported by sound planning and financial tools and not just left to qualitative considerations alone. FP&A is best placed to take a leading role in this respect.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.