The budget process still requires a lot of time and effort, which risks creating an outdated...

Undoubtedly, one of the biggest challenges in our work is to reduce uncertainty in the construction of future scenarios, understanding the past, anticipating threats and providing analysed information in time for decision-making.

Let's look at the first challenge, "Building Future Scenarios". Best Estimate, Budget, Forecast, Plan, and many more. There are different names to refer to the same concept. Still, they all share the same problem. It is the same huge, changing and debatable work of building, understanding, assimilating and agreeing on that place where we think we will be in one month, six months or a year or wherever our planning horizon takes us.

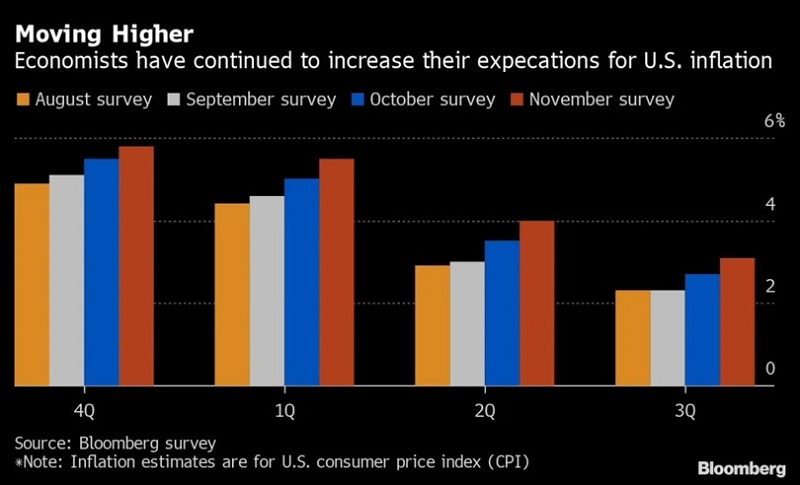

Who among us could anticipate COVID-19? Russia's invasion of Ukraine? The enormous energy challenges facing the world? And one of the biggest consequences of all the above: who could foresee the current inflation levels that we can see in the developed economies?

Understanding the Inflation

Figure 1: Expectations for the US Inflation. Source of the picture: Bloomberg

Inflation is a phenomenon that, if not understood correctly, can lead us to wrong conclusions and, therefore, to wrong decisions. Here are some examples:

- If our sales increase, do they really increase? Or is it just the effect of having raised our prices?

- If our wages increase, do they really increase? Or is it just the effect of maintaining purchasing power in the face of rising prices in the economy?

- Our Operating Profit is higher than in previous years. We should ask ourselves if it increased in constant values.

We could mention several more examples, but the conclusions are the same. The absolute numbers are distorted when inflation begins to be a factor to consider in detail when we come from 1% or 2% per year to levels of 8 or 9% per year. However, there is another thing we cannot control, hyperinflation, which we understand as an 80%, 90% or more than 100% increase per year!

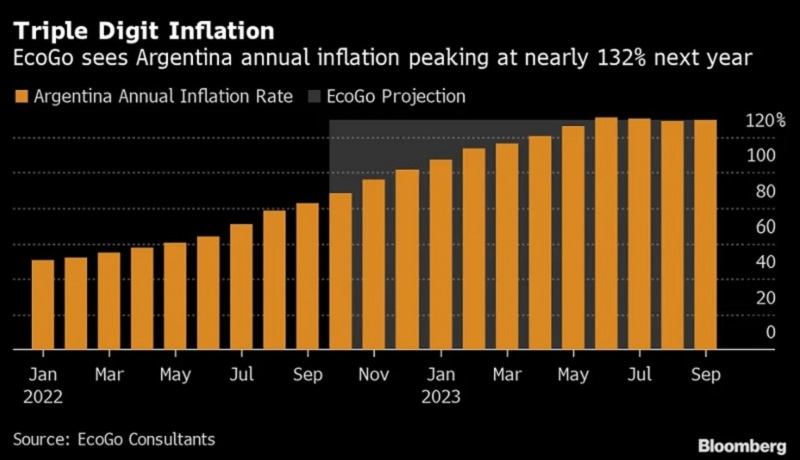

And What about Hyperinflation?

Figure 2: Expected Inflation in Argentina May Become Triple Digit in 2023.

Source of the picture: EcoGo Consultants/Bloomberg

From one year to the other, our sales and salaries have doubled. The numbers lose their absolute meaning, the comparisons are misleading, and it is necessary to incorporate more variables to help us understand what we are talking about.

First, it is necessary to invest time and effort in estimating the Macroeconomic Variables and, very importantly, how we think they will relate to each other.

- What will inflation be in the coming years?

- Given that inflation, how will our prices move towards our customers?

- Will wages be in line with expected inflation?

- What will happen to the devaluation levels of the local currency against the US Dollar?

These variables must be intimately related and thought of as a whole. The prices to our customers, employees' salaries and suppliers' prices will be adjusted following the defined macro variables.

Then we multiply them by the Q's (quantities) and assemble the absolute values. At this point, I don't have good news to give you. The absolute numbers will bear little or no resemblance to the current ones! Inflation will be higher or lower than expected, and then our prices will differ from the estimated ones; therefore, our revenue and wages will not be as anticipated.

But this should not discourage us. In reality, the relative numbers take relevance and should be in line with the current ones. Operating profit as a % of revenue, salaries as a % of revenue, % growth of revenue vs Prior Year (PY) compared to % inflation for the same period, et cetera.

If the macroeconomic variables were developed with coherence between them, respecting their correlation, we would have a good starting point for our current relative numbers to be aligned with the estimates. The Q's will be absolute variations.

It requires "running" N number of scenarios and alternatives with different variables and ranges of variations. It is really inadvisable to do this in Excel when we talk about 100% increments because the variations could be huge.

We Need an FP&A, Don't We?

I have heard on several occasions that if we are sure that our estimates will be quite far from the future actuals, then "Why do we do it?". It is precisely in hyperinflationary scenarios where Financial Planning and Analysis (FP&A) has a critical role to play, as the more uncertain the future scenarios are, the more necessary to understand them.

In these very high inflation scenarios, building Monthly Forecasts becomes a priority, and, month by month, the absolute values will move away from our Plan. We already have X actual months, and we must work on estimated Y months with new variables and months in which those variables will impact our results.

Sorry, but if we close actuals on the 4th or 5th working day and our due date for Forecast is the 7th, then the FP&A will have very complicated days!

Here We Go

We already have our budget; congratulations! What do those numbers look like? Not the desired ones? So, it's time to work on Specific Planning Activities and what we need to do TODAY in order to move from the "Do Nothing Scenario" to the "Best Scenario", but that's another story.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.